Cosmetic Oil Market Outlook:

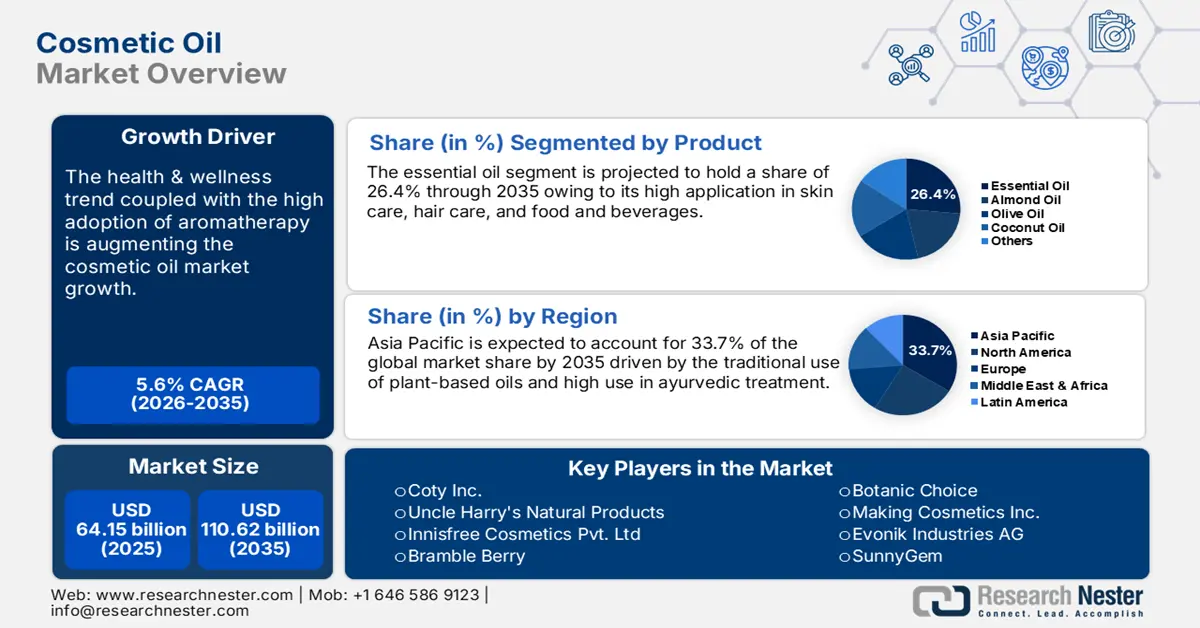

Cosmetic Oil Market size was over USD 64.15 billion in 2025 and is anticipated to cross USD 110.62 billion by 2035, witnessing more than 5.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cosmetic oil is assessed at USD 67.38 billion.

The health and wellness trends are major growth drivers augmenting the sales of various types of cosmetic oils. Consumers are becoming aware of what goes in their products, which is boosting the consumption of organically produced cosmetic oil. Even being premium, natural oils such as olive, almond, jojoba, avocado, and rosehip are gaining traction. The effective results of these oils are a prime contributor to their sales growth.

For instance, in July 2024, the analysis by the U.S. Bureau of Labor Statistics estimated that the export price index of essential oils and resinoids accounted for 146.7 in June of the same year. Furthermore, the USDA Foreign Agriculture Service reveals that around 1.12 million metric tons of almonds were produced in the U.S., in 2024. The country accounts for 70% of the global almond production, while Australia captures 11%. The high production of almonds in these economies directly influences their essential oil sales. The abundance of raw materials appeals to several key market players to grab high-earning niche opportunities.

In October 2024, Coty, Inc., a leading beauty & cosmetic product company revealed the estimated FY25 adjusted EBITDA outlook for +9-11% YoY growth. The company calculates a high EBITDA margin in the financial year 2025. The fragrance category of the company is outperforming both in volume and price/mix, further augmenting its revenue growth.

Key Cosmetic Oil Market Insights Summary:

Regional Highlights:

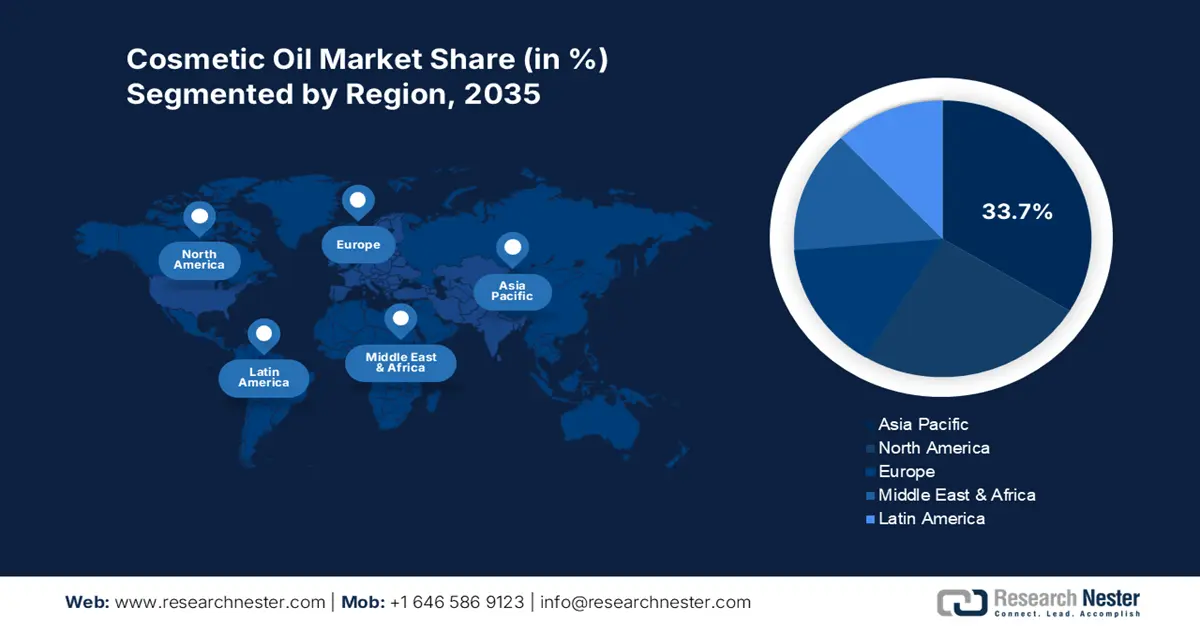

- Asia Pacific's 33.7% share in the Cosmetic Oil Market is propelled by the widespread use of essential oils, cementing its lead through growing demand for holistic treatments and wellness centers in 2026–2035.

- North America is expected to grow at the fastest rate in the Cosmetic Oil Market from 2026 to 2035, driven by the increasing use of essential oils in food & beverages, and a strong client base spending on premium personal care products.

Segment Insights:

- The Essential Oil segment is projected to achieve a 26.4% market share by 2035, fueled by growing mental health awareness and increasing use in aromatherapies for conditions like insomnia, depression, and anxiety.

- The Hair Care segment is set to maintain a dominating position over 2026-2035, driven by rising focus on scalp health and the popularity of cosmetic oils like jojoba and tea tree for treating hair issues.

Key Growth Trends:

- DIY trend

- Collaborations with spa and wellness centers

Major Challenges:

- High prices of premium cosmetic oils

- Lab-made alternatives driving competition

- Key Players: Coty Inc., Uncle Harry's Natural Products, Innisfree Cosmetics Pvt. Ltd, and Bramble Berry.

Global Cosmetic Oil Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 64.15 billion

- 2026 Market Size: USD 67.38 billion

- Projected Market Size: USD 110.62 billion by 2035

- Growth Forecasts: 5.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (33.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, United States, South Korea, Germany

- Emerging Countries: China, India, Japan, South Korea, Malaysia

Last updated on : 13 August, 2025

Cosmetic Oil Market Growth Drivers and Challenges:

Growth Drivers

- DIY trend: The Do-it-Yourself (DIY) trend is driving interest among consumers in personalized skincare routines. To customize their beauty oils, consumers often buy multiple carrier oils, creating a profitable opportunity for manufacturers. Furthermore, considering the rising popularity of DIY beauty oil formulations, manufacturers are producing and commercializing cosmetic oils in small-volume batches.

For instance, in January 2024, Evonik Industries AG introduced a sustainable baobab oil for natural cosmetic formulations, certified by the FairWild Foundation. The oil is sourced from Sahel, Ghana, and is commercialized under the Ecohance name. This oil is used to make cosmetic formulations such as hair conditioners and body creams. In cooperation with the United Nations Convention to Combat Desertification (UNCCD), the company supports the Great Green Wall Initiative that ensures the sustainability of baobab oil. - Collaborations with spa and wellness centers: The wellness and spa centers being major consumers of cosmetic oils are consistent sources of revenue growth for key players. To create high brand exposure, cosmetic oil manufacturers are collaborating with spa service providers. This move is boosting the oil application in professional treatments such as facial, massage, and hair treatments. For instance, the global spa services market was valued at USD 147 billion in 2023 and is estimated to grow over 65.0% by 2032. The swiftly increasing spa services such as massages, beauty treatment, grooming, and fitness are set to significantly augment cosmetic oil sales in the coming years.

Challenges

- High prices of premium cosmetic oils: Premium quality cosmetic oils such as argan, almond, olive, and marula are often associated with high prices owing to their superior purity. The extraction process of premium cosmetic oils is complex and labor intensive, which drives up its sellable costs. These factors majorly limit premium cosmetic oil sales in price-sensitive markets or among budget-conscious consumers.

- Lab-made alternatives driving competition: The chemically produced cosmetic oils majorly challenge the sales of organic or natural counterparts. The lab-made alternatives perfectly mimic the benefits of natural oil, creating a competitive environment. Also, these alternatives are cost-effective and easily available, which hampers the growth of the cosmetic oil market.

Cosmetic Oil Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.6% |

|

Base Year Market Size (2025) |

USD 64.15 billion |

|

Forecast Year Market Size (2035) |

USD 110.62 billion |

|

Regional Scope |

|

Cosmetic Oil Market Segmentation:

Product (Almond Oil, Olive Oil, Coconut Oil, Essential Oil, Others)

The essential oil segment is poised to dominate around 26.4% cosmetic oil market share by the end of 2035. The rising mental health awareness trend is augmenting the use of essential oils in aromatherapies. Aromatherapy service providers are major consumers of several types of essential oils as they effectively aid in treating insomnia, depression, and anxiety. A study by the National Institutes for Health (NIH), reveals that the prevalence rate of insomnia is around 10% to 30%, globally. This underscores that the adoption of aromatherapy for insomnia treatment has a strong potential to fuel essential oil consumption. Also, the rising home wellness trend is accelerating the use of essential oils in daily routines. Europe is estimated to hold the largest share of the essential oil market while Asia Pacific and North America are tying for the second position. Furthermore, in 2023, the U.S. totaled USD 20.09 billion and the U.K. calculated USD 7.6 billion in essential oil imports.

Application (Hair Care, Skin Care, Lip Care, and Others)

The hair care segment in cosmetic oil market is anticipated to hold a dominating position throughout the projected period. The rising focus on scalp health coupled with home care remedies is fueling the adoption of cosmetic oils such as jojoba, olive, and tea tree. The antibiotic and anti-inflammatory properties of these oils are driving their consumption in haircare routines. Apart from this home hair care use, many pharma companies are formulating medicated shampoos, conditioners, and hair oils using cosmetic oils as a base. These cosmetic oil-based hair care products effectively aids in treating issues such as dandruff, hair loss, and even psoriasis. For instance, the Repositório da Produção USP report reveals that 5% use of tea tree oil in shampoo can effectively reduce dandruff.

Our in-depth analysis of the global cosmetic oil market includes the following segments:

|

Product |

|

|

Nature |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cosmetic Oil Market Regional Analysis:

Asia Pacific Market Forecast

In cosmetic oil market, Asia Pacific region is expected to hold more than 33.7% revenue share by 2035. The widespread use of essential oils, strong adoption of holistic treatment approaches such as aromatherapy, and high demand for wellness and spa centers are pushing the sales of cosmetic oils in the region.

In India, celebrity endorsement strategies are aiding the key players to boost their sales and revenue growth. The traditional Ayurvedic influence is positively augmenting the consumption of cosmetic oil in the country. For instance, the report by the India Brand Equity Foundation reveals that the country exported around USD 1.24 billion of Ayush and herbal products between 2021 and 2023. This highlights that India is a high-potential marketplace for cosmetic oil market.

Similar to India, the strong use of natural and plant-based solutions for face, hair, and body care is making China a profitable marketplace for cosmetic oil producers. The expansion of essential oil use in cooking and bakery is further opening potential doors for leading companies to earn high profits. For instance, the import value of essential oils and resinoids in the country was calculated at USD 17.6 billion, in 2023.

North America Market Statistics

The North America cosmetic oil market is poised to increase at the fastest pace from 2025 to 2035. The growing use of essential oils in food & beverages, the strong presence of a client base that spends on premium personal care products, and the existence of industry giants are fueling the regional cosmetic oil market growth.

In the U.S., the organic trend particularly for skin care is increasing the consumption of essential oil-based products. The demand for herbal oils such as tea tree, jojoba, and rosehip is widely used for hydration and antiaging skin care. For instance, the Observatory for Economic Complexity estimates that the essential oil export was calculated at USD 693 million in 2022.

In Canada, the clean beauty trend coupled with holistic health and wellness approaches is fueling the focus of individuals on natural beauty products including various cosmetic oils. The strong presence of Asian and Middle Eastern immigrants in the country is also contributing to the cosmetic oil market growth. The country held USD 4.9 million of essential oil export value in 2022, reveals the Observatory for Economic Complexity report.

Key Cosmetic Oil Market Players:

- Coty Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Uncle Harry's Natural Products

- Innisfree Cosmetics Pvt. Ltd

- Bramble Berry

- L’Oreal Group

- Unilever

- FARSÁLI

- Sophim Iberia S.L

- Botanic Choice

- Making Cosmetics Inc.

- Evonik Industries AG

- SunnyGem

- Cupid Limited

- Johnson & Johnson

- Himalaya Holdings Ltd.

Leading companies in the cosmetic oil market are implementing strategies such as innovations in formulations, new product launches, strategic collaborations & partnerships, digital marketing, sustainability, and regional expansion to earn high profits. New oil blends and formulations enable companies to cater to a broader consumer base. Targeted marketing and rise in the e-commerce activities are positively fueling the sales of cosmetic oil products. Cosmetic oil manufacturers are directly entering the e-commerce space by introducing their platforms to interact with consumers in a B2C manner.

The high-profile celebrity endorsement and collaborations are an all-time win-win strategy for cosmetic oil manufacturers. The majority of consumers' mindset to follow what celebrities or influencers use augments the demand for endorsed cosmetic oil solutions, boosting both revenue growth and brand visibility. Furthermore, regional expansion tactics aid them in grabbing high-profit opportunities from untapped markets.

Some of the key players are in cosmetic oil market:

Recent Developments

- In September 2024, Cupid Limited announced its plan to launch almond hair oil and massage oil made of Jasmine & Loban, Lavender & Loban. Through this move, the company is expanding its operations in the cosmetic oil industry.

- In July 2023, SunnyGem announced the expansion of its almond oil product to Hy-Vee Stores. The 100% virgin and cold-pressed Sunny Gem Almond oil is initially commercialized in 500ml packs to analyze its sales.

- Report ID: 6803

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cosmetic Oil Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.