Corneal Ulcer Treatment Market Outlook:

Corneal Ulcer Treatment Market size was valued at USD 1.1 billion in 2025 and is set to exceed USD 1.97 billion by 2035, registering over 6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of corneal ulcer treatment is estimated at USD 1.16 billion.

The increasing incidence of pink eye, particularly among contact lens users and individuals with underlying health conditions such as diabetes, is driving the demand for robust eye ulcer care. In May 2024, the CDC reported that the prevalence of ocular issues is rising in America, where 90 million people over 40 suffer from vision issues. It further estimated the prevalence of diabetic retinopathy to rise by 72% in 2050 without successful therapies. Additionally, the global aging population is more susceptible to such diseases, boosting the need for state-of-the-art solutions. These factors are significantly contributing to the enhancement of the market, as patients seek timely, specialized solutions to manage and treat their conditions effectively.

Additionally, increased awareness about ocular ulcer and their potential complications has led to better patient understanding and early detection, contributing significantly to the market. As of a February 2024 NLM report, the annual incidence of corneal wounds in the U.S. ranged between 30,000 and 75,000, with 12.2% of corneal transplants addressing infections of keratitis. Educational campaigns focused on proper ophthalmic care and hygiene, especially for contact lens users, have also improved patient compliance with medication protocols. This awareness encourages individuals to seek medical help sooner, reducing the risk of severe outcomes and promoting timely interventions, ultimately driving the need for potent and cutting-edge medications.

Key Corneal Ulcer Treatment Market Insights Summary:

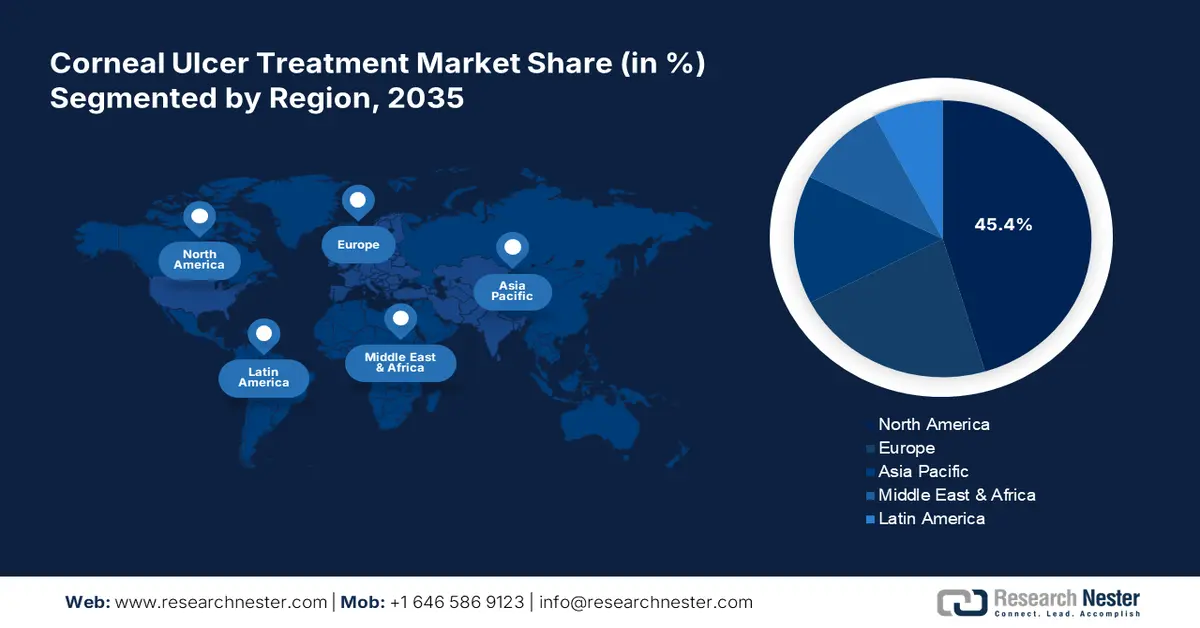

Regional Highlights:

- North America leads the corneal ulcer treatment market with a 45.4% share, fueled by the rising prevalence of eye infections and a well-established healthcare system, supporting robust growth through 2035.

- Asia Pacific’s corneal ulcer treatment market is set for rapid growth through 2026–2035, attributed to significant investments in healthcare infrastructure and government health programs.

Segment Insights:

- The Hospital Pharmacy segment is projected to capture over 54.5% market share by 2035, fueled by the rise in severe cases needing immediate care and hospitals' ability to stock specialized treatments.

- Medication segment is projected to hold the majority share by 2035, driven by the rising prevalence of ocular infections requiring potent pharmacological intervention.

Key Growth Trends:

- Enhanced healthcare Infrastructure

- Cutting-edge innovations

Major Challenges:

- Side effects and risks associated with treatments

- Antibiotic resistance

- Key Players: Aurobindo Pharma, Lupin, AbbVie Inc..

Global Corneal Ulcer Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.1 billion

- 2026 Market Size: USD 1.16 billion

- Projected Market Size: USD 1.97 billion by 2035

- Growth Forecasts: 6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.4% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

Corneal Ulcer Treatment Market Growth Drivers and Challenges:

Growth Drivers

- Enhanced healthcare Infrastructure: Augmented reach to healthcare services, especially in emerging markets, has significantly improved ophthalmic care, driving corneal ulcer treatment market proliferation. Government initiatives and investments in ocular care programs have further boosted awareness and admissibility. The November 2023 Eye Health Investment Study by IAPB revealed that investment in ocular health generates a return on investment (ROI) of 36 to 1. As a result, patients receive prompt responses, reducing complications and increasing the appeal for therapies, ultimately fostering an upsurge in the market.

- Cutting-edge innovations: The development of novel therapies, including regenerative therapies, gene therapies, and innovative diagnostic tools, is significantly driving expansion in the corneal ulcer treatment market. Regenerative therapies, such as stem cell medications have the potential to restore damaged corneal tissue, providing long-term solutions. Gene therapies target the root causes of corneal erosion, enhancing detection capability to enable early and timely mediation and reduce complications. These innovations enhance patient outcomes and expand solution accessibility, fueling market escalation.

Challenges

- Side effects and risks associated with treatments: Certain procedures for corneal lesions, such as corticosteroids and surgical modifications, come with significant risks, including corneal thinning, scarring, and even vision loss. These complications make both patients and healthcare providers cautious about opting for aggressive medication approaches. Concerns over side effects and long-term outcomes may lead to delays in treatment or the preference for less efficient alternatives. This hesitancy can impact the overall effectiveness of ulcer management and slow market adoption of refined therapies.

- Antibiotic resistance: The rising prevalence of antibiotic-resistant bacterial strains poses a significant challenge to keratitis ulcer management, as standard antibiotic therapies are becoming less beneficial. This resistance complicates medication protocols, leading to prolonged infections and increased risks of severe complications, including vision loss. As a result, there is a growing need for the development of new antimicrobial drugs. Moreover, creating these drugs requires extensive research, significant financial investment, and rigorous clinical trials, which can slow down their availability and adoption.

Corneal Ulcer Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6% |

|

Base Year Market Size (2025) |

USD 1.1 billion |

|

Forecast Year Market Size (2035) |

USD 1.97 billion |

|

Regional Scope |

|

Corneal Ulcer Treatment Market Segmentation:

Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Online Pharmacy)

By distribution channel, the hospital pharmacy segment is predicted to dominate corneal ulcer treatment market share of over 54.5% by 2035. The segment’s application is due to the increasing number of severe cases requiring immediate medical assistance. Hospitals provide specialized care, ensuring timely opportunities to cut medications, including antibiotic and antifungal oculus drops. Additionally, hospital pharmacies stock a wider range of prescription therapeutics, including compounded formulations for complex infections. The rise in ophthalmic procedures and improved healthcare infrastructure further boosts the requisition for hospital-based pharmaceutical services for ocular lesion medication.

Treatment (Medication, Surgery)

Based on treatment, the medication segment is poised to garner the majority of corneal ulcer treatment market share over the forecast period. The segment’s progress is attributed to the increasing prevalence of bacterial, fungal, and viral ocular infections, which require potent pharmacological interference. Advances in antibiotic, antifungal, and antiviral orb drops provide targeted therapy, reducing complications and improving recovery rates. For instance, in September 2023, Viatris and Ocuphire Pharma’s FDA-approved RYZUMVI for mydriasis remedy was added to the medication segment, expanding options for ophthalmic therapies, including ocular ulcer medication. Further, the increasing antibiotic discoveries and awareness drive a global upsurge in the corneal lesions medication segment.

Our in-depth analysis of the global market includes the following segments:

|

Distribution Channel |

|

|

Treatment |

|

|

Diagnosis |

|

|

Symptoms |

|

|

Dosage |

|

|

Route of Administration |

|

|

End Users |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Corneal Ulcer Treatment Market Regional Analysis:

North America Market Statistics

North America corneal ulcer treatment market is predicted to account for revenue share of around 45.4% by 2035. The rising prevalence of eye infections, especially among contact lens users and individuals with underlying health conditions, has significantly driven the consumption of effective corneal erosion procedures. Coupled with the region’s well-established healthcare system, which ensures better reach to advanced rehabilitation options, this has led to earlier diagnoses and intercessions. This improved accessibility and timely care are crucial in reducing complications, encouraging patients to seek medication, and contributing to the ongoing surge of the market.

The widespread use of contact lenses, along with an increase in underlying health conditions such as diabetes, has heightened the risk of ocular infections, driving the market need for keratitis ulcer procedures in the U.S. Additionally, the aging population has led to a rise in age-related optic diseases, including corneal erosion. In May 2024, the CDC estimated that 12 million Americans aged 40 and older suffer from visual impairment. This demographic shift, combined with the increased prevalence of ocular diseases, creates a growing need for more targeted, innovative assistance options, further fueling the expansion of the market.

The growing use of contact lenses and the rising prevalence of health conditions such as diabetes have led to an increase in ocular infection and corneal wounds, driving demand for efficient remedies in Canada. As per NLM in March 2023, diabetic retinopathy (DR) was the leading cause of blindness, affecting 25% of diabetics in Canada. Additionally, the robust healthcare system in Canada ensures a widespread approach to specialized oculus care services and pioneering solutions. This accessibility supports early diagnosis and timely intervention, contributing significantly to the escalation of the market by improving patient outcomes and expanding medication opportunities.

Asia Pacific Market Analysis

In APAC, the corneal ulcer treatment market is established to garner the fastest CAGR, over the forecast period. Developing countries are investing significantly in healthcare infrastructure, improving reach to advanced ophthalmic care and rehabilitation, which facilitate early diagnosis and better outcomes for keratitis ulcers. Additionally, governments in countries such as India and China are prioritizing optic health programs and supporting regulatory approvals for new approaches. These efforts are enhancing the availability and adoption of innovative therapies, ultimately driving the progression of the market by ensuring wider availability of advanced care and timely engagement.

Continuous investments in healthcare infrastructure in China, particularly in ophthalmic care, are enhancing connection to advanced support, leading to earlier diagnosis and better intervention for ocular ulcers. Additionally, the government of China focuses on improving healthcare and supporting innovative eye care solutions, including regulatory approvals and funding for new medications, which is driving the escalation of the corneal ulcer treatment market. These efforts ensure that cutting-edge therapies are more accessible to patients, facilitating better outcomes and boosting market expansion.

The growing population in India, high rates of eye diseases, especially among contact lens users and diabetics, and a large rural demographic are driving the demand for ocular wound procedures. The investments in healthcare infrastructure in India, particularly in rural areas, are improving the reach of specialized optic care services. According to IBEF's January 2025 report, the hospital sector in India, which makes up 80% of the country's healthcare system overall, accounted for USD 132 billion by 2023. This enhances early diagnosis and intervention, leading to better patient outcomes and fueling the surge of the market in India.

Key Corneal Ulcer Treatment Market Players:

- Bayer AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Pfizer Inc.

- GlaxoSmithKline plc

- Sanofi

- Novartis AG

- Allergan

- Merck & Co., Inc.

- Mylan N.V.

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Ltd.

- Aurobindo Pharma

- Lupin

- AbbVie Inc.

- Cumberland Pharmaceuticals Inc.

- Melinta Therapeutics LLC

- Eli Lilly and Company

- Cipla Inc.

- Aurion Biotech

- AstraZeneca

- Johnson & Johnson Private Limited

Key companies in the corneal ulcer treatment market are developing progressive therapies such as regenerative cell therapies, novel antimicrobial agents, and gene therapies. These innovations focus on enhancing healing rates, improving patient outcomes, and minimizing complications. Additionally, companies are investing in cutting-edge drug delivery systems and personalized medicine approaches, allowing for more targeted and effective medications. This continuous research and development push towards enhanced, non-invasive, and long-term solutions is driving the proliferation of the market. These key players are:

Recent Developments

- In May 2024, Merck acquired EyeBio strengthening its ophthalmology portfolio, enhancing research and development for innovative solutions, and contributing to the escalation of the ocular ulcer management industry.

- In June 2023, Novartis's agreement to divest ophthalmology assets including Xidra and SAF312 to Bausch + Lomb, boosts optic ulcer therapies by advancing dry eye and ocular surface pain therapies, supporting market improvement.

- Report ID: 7123

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Corneal Ulcer Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.