Cordierite Market Outlook:

Cordierite Market size was over USD 2.89 billion in 2025 and is poised to exceed USD 4.71 billion by 2035, witnessing over 5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cordierite is estimated at USD 3.02 billion.

The rise in urban migration in both developed and developing regions is rapidly propelling the construction and infrastructure development activities. The increasing demand for both residential and commercial structures is fueling the applications of cordierite-based components. High-performance ceramics and advanced materials are gaining traction in the construction sector. Furthermore, cordierite use in the production of fire-resistant tiles, roofing materials, and insulating products is booming due to their high demand, particularly in emerging economies. For instance, the U.S. Census Bureau revealed that around 1,483,000 residential structures were allowed permits in January 2025.

|

New Residential Construction, January 2025 |

|

|

Building Permits |

1,483,000 |

|

Housing Starts |

1,366,000 |

|

Housing Completions |

1,651,000 |

Source: U.S. Census Bureau

The biggest infra-development projects across the world are also positively influencing the sales of cordierite products. HS2, NEOM the city of tomorrow, Grand Paris Express, the Regional Environmental Sewer Conveyance Upgrade Program (RESCU), and Brenner Base Tunnel (Austria-Italy) are some of the major development happenings around the globe. Singapore and South Korea are leading the smart city initiatives, uplifting the Asia Pacific position in the global landscape.

Key Cordierite Market Insights Summary:

Regional Highlights:

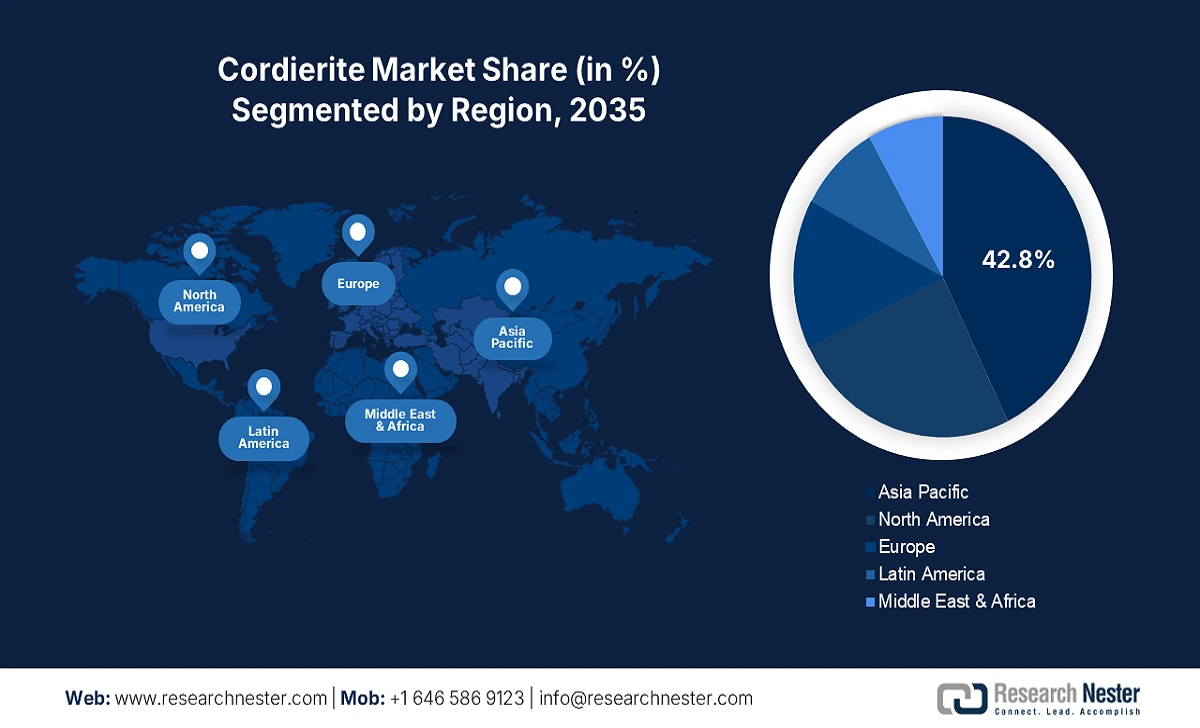

- Asia Pacific dominates the Cordierite Market with a 42.8% share, supported by supportive policies for mining and the vast presence of active mines enabling a consistent supply chain of raw materials, ensuring growth through 2035.

- North America is projected to achieve the fastest CAGR in the Cordierite Market from 2026 to 2035, driven by ongoing and planned construction and infra-development projects offering high growth opportunities for cordierite manufacturers.

Segment Insights:

- The Cordierite Ceramics Product segment is forecasted to achieve over 33.6% market share by 2035, propelled by rising demand for sustainable vehicles and continuous advancements in electronics driving the need for cordierite ceramics in catalytic converters.

- Kiln Furniture Application segment is expected to hold around a 32.9% share by 2035, driven by growing demand for cordierite’s thermal shock resistance and high-temperature stability.

Key Growth Trends:

- Automotive an opportunistic marketspace

- Cordierite companies finding profitable scope in consumer electronics

Major Challenges:

- Competition from alternative materials

- Mining restrictions and supply chain disruptions

- Key Players: Blasch Precision Ceramics, Inc., Corning Inc., Vesuvius Plc, and Elementis Plc.

Global Cordierite Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.89 billion

- 2026 Market Size: USD 3.02 billion

- Projected Market Size: USD 4.71 billion by 2035

- Growth Forecasts: 5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, United States, Germany, South Korea

- Emerging Countries: China, Japan, South Korea, India, Brazil

Last updated on : 13 August, 2025

Cordierite Market Growth Drivers and Challenges:

Growth Drivers

- Automotive an opportunistic marketspace: The growing applications of cordierite in the automotive sector are opening lucrative doors for key market players. Cordierite is particularly used in the manufacturing of catalytic converters owing to its superior thermal stability and resistance to thermal shock. The growth in lightweight and fuel-efficient vehicles is boosting cordierite sales. Electric and internal combustion engine automobile sales are anticipated to uplift the demand for cordierite products in the coming years. For instance, as per the International Energy Agency (IEA) analysis, the stock of EVs excluding 2 and 3-wheelers is estimated to reach 525.0 million in 2035 up from 45.0 million in 2023. By the end of 2035, over one in four automobiles are anticipated to be of electric engines, registering a growth of 23.0%.

- Cordierite companies finding profitable scope in consumer electronics: Continuous technological innovations are projected to amplify the sales of advanced cordierite solutions. These solutions are further anticipated to ding wide applications in aerospace, energy, and electronics sectors. The growth in demand for smart devices and semiconductor technologies is driving a healthy trade for cordierite. Dielectric properties of cordierite are further increasing its use in the fabrication of electronic components such as insulators and substrates.

Challenges

- Competition from alternative materials: The sales of cordierite are primarily hindered by the availability of alternative materials such as composites. Cordierite is often replaced by composites, silicon carbide, and alternative ceramics in certain applications owing to their similar to superior properties. They are also preferred in specific high-temperature and high-performance applications, limiting the cordierite market shares manufacturers. Continuous investments in research and development activities are poised to expand the applications of cordierite in the coming years.

- Mining restrictions and supply chain disruptions: The restrictions on mining in some regions can act as a barrier to the overall cordierite market growth. Limited mining activities as well as scarcity can disrupt the supply chain leading to a rise in final product costs. The challenges in pricing strategies and profitability issues further hamper the pockets of cordierite producers. Integration of advanced technologies such as artificial intelligence, predictive analysis, and machine learning aids in real-time prediction and decision-making, leading to effective production and supply of cordierite.

Cordierite Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5% |

|

Base Year Market Size (2025) |

USD 2.89 billion |

|

Forecast Year Market Size (2035) |

USD 4.71 billion |

|

Regional Scope |

|

Cordierite Market Segmentation:

Product Type (Raw Cordierite, Cordierite Ceramics, Cordierite Refractories, Cordierite Honeycomb Monoliths, Others)

Cordierite ceramics segment is set to hold over 33.6% cordierite market share by the end of 2035. Cordierite ceramics are majorly used in the production of catalytic converters in the automotive sector. The rising demand for sustainable vehicles is a significant driver for the cordierite ceramic sales growth. Continuous advancements in the electronics sector such as the miniature trend and high demand for superior semiconductors, capacitors, and resistors are augmenting the trade of cordierite ceramics. Furthermore, the rapidly expanding construction sector is poised to amplify the market shares of cordierite ceramic manufacturers in the coming years.

Application (Kiln Furniture, Refractory Bricks, Catalytic Converters, Foundry, Electrical Insulators, Cookware and Bakeware, Thermal Insulation, Others)

By the end of 2035, Kiln furniture segment is estimated to capture around 32.9% cordierite market share. The excellent thermal shock resistance, high-temperature stability, and chemical resistance are prime factors fueling the use of cordierite in Kiln furniture production. Shelves, supports, and setters are some Kiln furniture products that need to endure high temperatures during the firing process, and cordierite is one of the advanced materials with superior qualities to meet the required demands. The growing furniture demand is estimated to directly propel the application of cordierite.

Our in-depth analysis of the global cordierite market includes the following segments:

|

Product Type |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cordierite Market Regional Analysis:

Asia Pacific Market Forecast

Asia Pacific in cordierite market is set to capture over 42.8% revenue share by 2035. The supportive policies for mining and the vast presence of active mines are enabling a consistent supply chain of raw materials. The growth in urban and industrial activities is amplifying the sales of cordierite products. The strong presence of the construction, consumer electronics, automotive, glass, and cookware sectors is poised to propel the consumption of cordierite in the coming years. China, India, South Korea, and Japan are the most profitable marketplaces for cordierite manufacturers.

China being the hub for semiconductor production is projected to propel the demand for cordierite market during the foreseeable period. The Observatory of Economic Complexity (OEC) study revealed that in 2023 China totaled semiconductor device export trade worth USD 62.3 billion. Semiconductor devices were the 7th most traded product in the country, with Cooper Lighting Solutions, Costco Wholesale, and Ledvance leading the shipping trade. Hong Kong (USD 9.16 billion), Germany (USD 5.3 billion), Brazil (USD 4.15 billion), India (USD 3.83 billion), and the Netherlands (USD 2.94 billion) are some of the top importers of Chinese semiconductor devices. This highlights the booming production of semiconductor devices are anticipated to propel the applications of cordierite.

The robust construction and infrastructure development activities in India are anticipated to push the sales of cordierite products. For instance, the India Brand Equity Foundation (IBEF) study states that the capex outlay for infrastructure in the interim 2024-25 budget crossed USD 133.8 billion to 11.1%, accounting for around 3.4% of the country’s GDP. By the end of 2025, India’s rapidly expanding infrastructure industry is poised to exceed USD 1.4 trillion. This sector is expected to drive India to become a USD 26000 billion economy. Overall, investing in India is set to double the returns in the years ahead.

North America Market Statistics

The North America cordierite market is expected to increase at the fastest CAGR between 2025 to 2035. The ongoing and planned construction and infra-development projects are offering high growth opportunities for cordierite manufacturers. The increasing demand for innovative chemicals and materials in the automotive, construction, electronics, and glass sectors is propelling the sales of cordierite products. The EV and smart home trends are further uplifting the demand for cordierite components in both the U.S. and Canada.

The swiftly expanding U.S. automotive sector is increasing the applications of cordierite in automobile manufacturing. Consumers in the country are heavily investing in fuel-efficient vehicles such as EVs, which is creating a lucrative pool for cordierite manufacturers. The U.S Energy Information Administration (EIA) states that the country recorded a high share of electric and hybrid vehicle sales in Q3’24. The combined sales of new light-duty battery electric vehicles, plug-in hybrid electric vehicles, and hybrid vehicles expanded from 19.1% in Q2’24 to 21.2% in the third quarter of 2024.

Canada is witnessing a rise in building and construction actions, leading to high sales of cordierite products. Increasing migration activities in search of jobs, education, and a better standard of living are uplifting the country’s construction sector. According to Statistique Canada, in December 2024, the total investment in building and construction reached USD 15.34 billion (Canadian 21.8 billion dollars). The smart home trends are fueling the demand for advanced devices with superior semiconductors, which is directly augmenting the use of cordierite.

Key Cordierite Market Players:

- Blasch Precision Ceramics, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Corning Inc.

- Vesuvius Plc

- Elementis Plc

- CoorsTek

- Unifrax

- CeramTec

- Saint-Gobain S.A.

- Mantec Technical Ceramics Ltd.

- Morgan Advanced Materials Plc

- Nextgen Advanced Materials, Inc.

The revenue growth of the companies in the cordierite market is majorly influenced by the growth in the building & construction, electronics, and automotive sectors. To maximize reach and market shares, leading companies are investing heavily in organic and inorganic strategies such as technological innovations, new product launches, mergers & acquisitions, partnerships & collaborations, and regional expansions. Organic marketing strategies are estimated to offer high sales and revenue growth in the coming years. Considering the healthy growth, many new companies are also set to enter the cordierite market during the study period.

Some of the key players include:

Recent Developments

- In January 2025, researchers from the Queen Mary University of London uncovered new insights into high-performance and anisotropic materials and their thermal behaviors. The research demonstrates that the anomalous thermal expansion of cordierite originates from a surprising interplay between atomic vibrations and elasticity.

- In April 2023, Kyocera Corporation revealed that it entered into an acquisition agreement for about 37 acres of land. The company aims to build a new smart factory on this land, particularly Minami Isahaya Industrial Park in Isahaya City, Nagasaki Prefecture for the production of fine ceramic components used in semiconductor-related applications as well as semiconductor packages.

- Report ID: 7223

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cordierite Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.