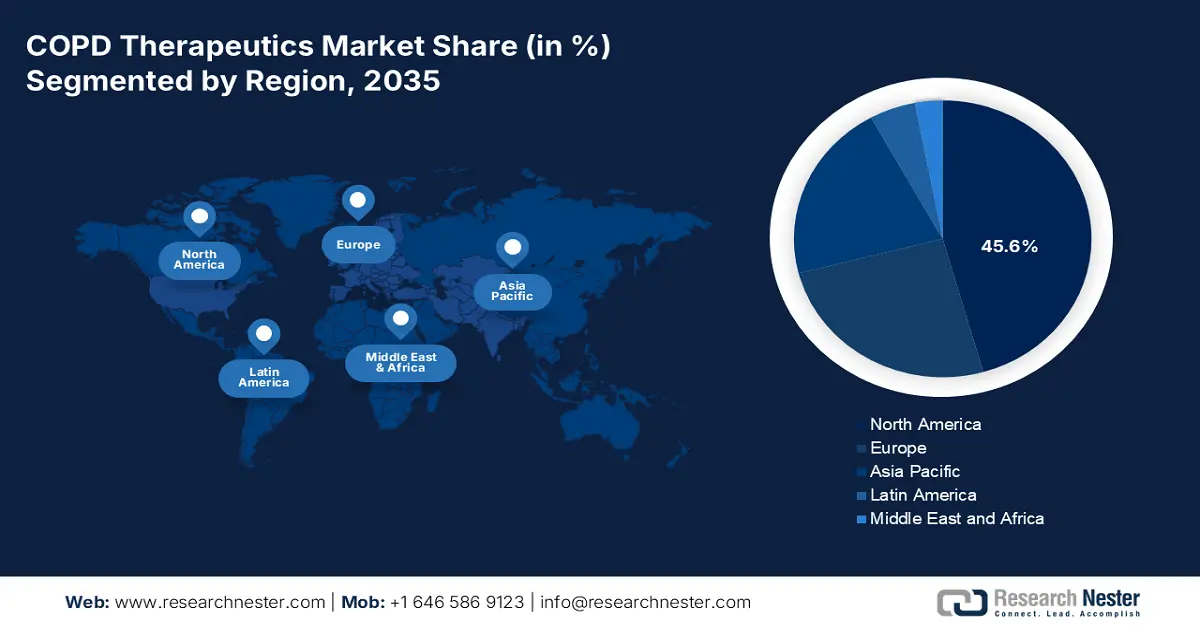

COPD Therapeutics Market - Regional Analysis

North America Market Insights

North America market is dominating and is projected to hold a share of 45.6% by 2035. The market is driven by the rising disease prevalence and advanced healthcare infrastructure. The key growth drivers of the region are the rising aging population and strong diagnostic rates, and fast adoption of high-efficiency triple therapy inhalers and biologics. According to the CDC report in June 2024, COPD affects over 15 million COPD affects over 15 million of people in the U.S., highlighting the substantial patient base. The market is also driven by the key players in the pharmaceutical sector and robust R&D pipelines focusing on targeted therapies.

The U.S. is dominating the North America COPD therapeutics market and is driven by the rising disease prevalence and advanced healthcare infrastructure. As per the CDC data in June 2024, nearly 165,248 people were hospitalized due to COPD as the first-listed diagnosis. Moreover, these patient risk factor depends on the patient's history. The American Lung Association data states that COPD is the fourth leading cause of death, demanding urgent treatment. The CDC June 2024 report states that 1 of the top 10 causes of death in the U.S. is COPD. The market is also defined by significant biologic drug development targeting specific inflammatory pathways and rising emphasis on value-based care and digital tools for patient monitoring.

In Canada, the market is driven by the public healthcare system and strategic efforts to enhance disease management. A major trend involves the implementation of national strategies and standardized care pathways to minimize the hospital admissions, which are the major cost driver. In Canada, 80% to 90% of the COPD registered cases is due to smoking, as per the Government of Canada report in July 2025. The market is witnessing a significant adoption of cost-effective, newer therapies to address the cost related challenges in new drugs.

Rising COPD Patient Pool

|

|

Male |

Female |

||

|

Number |

Rate |

Number |

Rate |

|

|

2019 |

4,927,122 |

4.1% |

6,642,209 |

5.1% |

|

2020 |

5,245,330 |

4.3% |

7,298,981 |

5.6% |

|

2021 |

4,829,624 |

4.0% |

6,870,437 |

5.3% |

|

2022 |

5,093,988 |

4.1% |

6,589,874 |

5.0% |

Source: American Lung Association 2025

APAC Market Insights

The Asia Pacific is the fastest-growing region in the COPD therapeutics market and is expected to grow at a CAGR of 6.5% during the forecast period 2026-2025. The market is driven by the massive and aging population, rising air pollution levels and prevalence of smoking habits in key countries. The region significantly improves the healthcare infrastructure and health insurance which is expanding the access to modern treatment and diagnosis. Further, the region is witnessing a surge in the production and adoption of cost-effective generic drugs, mainly from India, which drives the market volume.

China is the largest market in APAC and is driven by its massive patient base, and high rates of smoking habits. The market size is expanding rapidly as the diagnostic rates improve the beyond major metropolitan hubs. As per the NLM study in June 2022, China’s COPD cases is nearly 25% of the global COPD cases. This rise is mainly due to the change in economic shifts, sociodemographic development, and lifestyle. Further, the nationwide volume-based procurement policies are actively reducing the cost for both generic and originator drugs, hence fueling the drug access.

India’s market is driven due to the vast and underdiagnosed population with extreme price sensitivity. The demand is heavily linked with indoor air pollution from biomass fuels and tobacco use. The market size is currently dominated by low-cost generic drugs, though branded generics and innovative therapies are gaining a foothold in private healthcare. In November 2023, Lupin launched the world’s first fixed combination of triple-dose drug, Vilfuro-G which is used for COPD management in India. This launch reflects the landscape towards patient-centric therapies aided by private and public sectors.

Hospitalization Costs of COPD Cases

|

Factors |

Cost ($) |

Percentage (%) |

Median (IQR) |

|

Hospitalization costs |

5,419,011 |

|

1952(2031) |

|

Out-of-pocket fess |

2,381,475 |

43.95 |

938(956) |

|

Health insurance fees |

3,037,536 |

56.05 |

984(1529) |

|

Hospitalization costs |

|

|

|

|

Service fees |

775,742 |

14.32 |

266(335) |

|

Diagnostic fees |

1,329,255 |

24.53 |

599(468) |

|

Treatment fees |

513,202 |

9.47 |

91(237) |

|

Medication fees |

2,054,026 |

37.90 |

743(987) |

|

Other fees |

746,786 |

13.78 |

134(214) |

Source: NLM July 2023

Europe Market Insights

The COPD therapeutics market in Europe is steadily growing and defined by universal healthcare systems, a rising elderly population, and robust regulatory policies by the European Medicines Agency. The key driver dominating the market is the high disease prevalence associated with historical smoking rates and aging demographics, mainly in Western Europe. A significant trend is the change from dual to triple inhaler therapies, which is the standard care for patients with moderate to severe COPD that is driven by the clinical guidelines supporting the exacerbation reduction.

The UK market is fueled by a well-established, centralized healthcare system in providing standardized treatment protocols. The market is large and requires strict cost-effectiveness for new treatments. The most important trend is the move towards value-based healthcare and integrated care systems, which seek to decrease hospitalizations for respiratory disease. According to the Asthma and Lung UK statistics in May 2025, almost 1.7 million people in the UK suffer from COPD, highlighting the demand continues to drive therapeutic spending.

Germany’s COPD therapeutics market is driven by its large aging population and favourable pricing environment that provides a rapid adoption of premium-priced innovative therapies post EMA approvals. The government of the nation aims to focus on enhancing the health insurance system to reduce the healthcare out of pocket costs. Government's focus, via organizations suh as the G-BA, is on early benefit assessment rather than initial price negotiation, facilitating market entry.