Cooking Robot Market Outlook:

Cooking Robot Market size was valued at USD 3.2 billion in 2025 and is projected to reach USD 11.6 billion by the end of 2035, rising at a CAGR of 15.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of cooking robot is estimated at USD 3.6 billion.

The global cooking robot market is poised for extensive growth in the upcoming years since commercial kitchens, food manufacturers, and institutional foodservice operators increase their adoption of automated meal-preparation systems to address labor shortages and production scalability. In this regard, the article published by NIH in March 2023 observed how software-controlled cooking driven by 3D food printing and laser-based heating is advancing toward high-precision, customizable meal preparation. The study also stated that additive manufacturing can assemble and selectively cook multi-ingredient foods with millimeter-level control, enabling suitable nutrient composition, reduced handling, and improved food safety. In addition, the combination of precise deposition with laser-based heating, researchers successfully fabricated a seven-ingredient cake entirely relying on software, showcasing how digital cooking could emerge as a practical tool for both home and industrial food production.

This strengthens the innovations in terms of AI-enabled robots and flexible food manipulation systems. Furthermore, based on the Miso Robotics offering memorandum, which was disclosed in January 2025, the cooking robot market also benefits from considerable financial investment, wherein Miso has raised more than USD 77 million through various equity offerings as of early 2025. The primary driving factor was the urgent need to solve the growing labor crisis in the quick-service restaurant sector, a problem accelerated by rising minimum wages, such as California's USD 20 per hour mandate. Besides the core value proposition for products such as Flippy is the projected gross positive margin impact of USD 50,000 to USD 250,000 on a yearly basis per location by reducing labor, oil, and food waste costs while increasing revenue through faster service, thereby positively impacting market growth.

Key Cooking Robot Market Insights Summary:

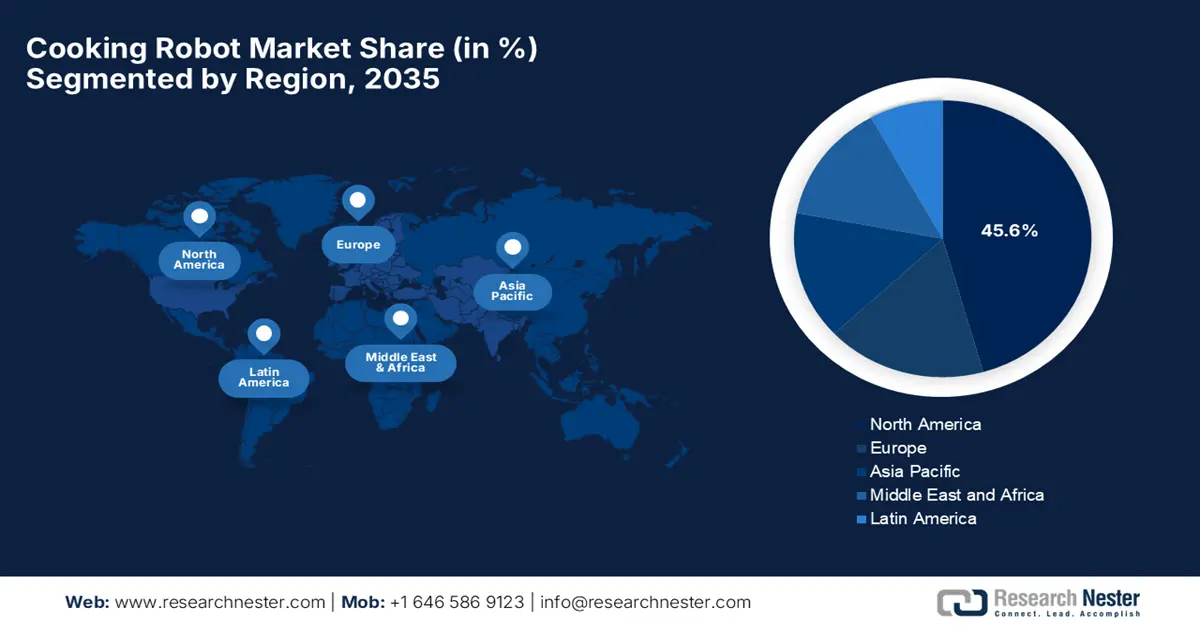

Regional Insights:

- North America is set to command a 45.6% share by 2035 in the cooking robot market , strengthened by rapid AI-led innovation in automated food-service systems.

- The Asia Pacific region is anticipated to expand at the fastest pace through 2035, spurred by rising urbanization, growing disposable incomes, and acute shortages of skilled kitchen labor.

Segment Insights:

- The low payload segment is projected to secure a 65.4% share by 2035 in the cooking robot market, supported by its compact design, cost efficiency, and compatibility with common kitchen operations.

- The quick service restaurant segment is anticipated to command a notable revenue share by 2035, fueled by rising labor costs, staffing shortages, and the accelerating adoption of AI-enabled robotic cooking systems.

Key Growth Trends:

- Labor shortages in foodservice & manufacturing

- Investment support for food robotics

Major Challenges:

- Technical and operational factors

- Financial and adoption barriers

Key Players: Miso Robotics (U.S.), Moley Robotics Ltd. (UK), Dexai Robotics (U.S.), Karakuri Studios Ltd. (UK), Zimplistic Pte. Ltd. (Singapore), Creator, Inc. (U.S.), Cafe X Technologies (U.S.), Bear Robotics (U.S.), Sony Semiconductor Solutions Corporation (Japan), Samsung Bot (South Korea), Panasonic Corporation (Japan), Wilkinson Baking Company (U.S.), Suzumo Machinery (Japan), ABB Robotics (Switzerland), Robot Coupe (France)

Global Cooking Robot Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.2 billion

- 2026 Market Size: USD 3.6 billion

- Projected Market Size: USD 11.6 billion by 2035

- Growth Forecasts: 15.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Singapore, UAE, Australia, Brazil

Last updated on : 26 November, 2025

Cooking Robot Market - Growth Drivers and Challenges

Growth Drivers

- Labor shortages in foodservice & manufacturing: This is the primary growth driver for the cooking robot market since the food industry is facing a shortage of labor, in which these robotics offer a way to automate these operations, reducing dependence on human labor. As per an article published by the U.K. government in May 2024, its response to the Shropshire Review emphasizes addressing labor shortages in the food supply chain with a highly coordinated approach, which includes recruitment, retention, skills development, and automation. The article also stated that this initiative aims to reduce reliance on migrant labor by extending support for domestic workforce training to ensure short-term supply. Furthermore, investments in automation are intended to increase productivity and reduce reliance on human labor, thereby fueling market growth.

- Investment support for food robotics: Public and private institutions such are funding foundational research in robotics that can be extended into food production and kitchen automation, thoroughly driving business in the cooking robot market. In this regard, the article published by Invest Korea in July 2024 disclosed that the company is seeking an investment of USD 8 million through equity investment or M&A and has several patent applications pending for devices, which include ingredient dispensers, automatic cooking systems, and conveyor ovens. Its 2023 sales totaled USD 0.50 million, reflecting early-stage commercialization. This growth was efficiently driven by rising wages, kitchen labor shortages, and the need for consistent food quality. Therefore, these factors will drive consistent progress in the industry, attracting more players to make investments in this field.

- Food Safety and sanitation requirements: Since there is consistent progress in the hygiene standards, the consumers are also demanding safer food handling, cooking robots, especially those certified for food contact. This can be testified from the Chef Robotics announcement in June 2025, which reported that its AI-enabled meal assembly robot called C-001748 is now NSF-certified, meeting strict food safety and cleanability standards. In this regard, this certification assures customers that the robot can safely handle ingredients and maintain hygiene throughout process of production thereby strengthening trust and adoption in the food manufacturing industry. The company also underscored that with over 50 million servings already produced using its robots, it continues to scale flexible meal assembly automation, leveraging its AI platform to increase production efficiency and support the cooking robot market.

Challenges

- Technical and operational factors: The cooking robot market faces considerable technical and operational challenges that are negatively impacting both adoption and performance. In this regard, handling a wide variety of ingredients with different sorts of textures, viscosities, and moisture content demands accurate deposition and heating mechanisms, which increases system complexity. On the other hand, robots must operate in environments which has high temperatures, humidity, and constant cleaning cycles, by maintaining food safety and sanitation standards to prevent any contamination. In addition, the integration of these robots with existing kitchen workflows presents more challenges, since robots must navigate non-standard layouts and coordinate with human staff efficiently, making it extremely complex and restrictive.

- Financial and adoption barriers: The aspect of high capital investments is a constant restraint for the cooking robot market. In this regard, the equipment costs, maintenance, and software updates can be prohibitive for small and medium-scale operators, causing an obstacle to widespread deployment. On the other hand, limited space in kitchens, staff training, and integrational procedures exacerbate the costs of operations. In terms of residential user affordability is also affected by recurring costs such as proprietary ingredient cartridges or subscription-based recipe systems. In addition, consumer acceptance also poses a major challenge, influenced by long-term durability and trust in automated food handling. Therefore, early adopters may be limited to high-end or experimental environments, making scale-up and return on investment severely uncertain.

Cooking Robot Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

15.4% |

|

Base Year Market Size (2025) |

USD 3.2 billion |

|

Forecast Year Market Size (2035) |

USD 11.6 billion |

|

Regional Scope |

|

Cooking Robot Market Segmentation:

Pay Load Segment Analysis

The low payload segment is expected to garner the largest revenue share of 65.4% in the cooking robot market during the forecasted duration. Their suitability for most common kitchen tasks, handling tools such as spatulas, whisks, as well as manipulating individual food items, is the key factor behind this leadership. Also, their lower cost, smaller footprint, and faster cycle times align properly with the needs of high-speed commercial kitchens, positioning the subtype at the forefront of revenue generation in this sector. In addition, the low payload cooking robots are particularly popular in quick-service restaurants as well as small to medium-sized kitchens where space and efficiency are highly essential. Furthermore, their ease of integration with existing kitchen workflows and minimal maintenance requirements further boost their adoption and market revenue potential.

End user Segment Analysis

By the conclusion of 2035, in the end-user segment, the quick service restaurant segment is expected to attain a significant revenue share in the cooking robot market. The rising minimum wages, making automation a financial imperative, are continuously driving growth in this segment. Also, most operators report insufficient staffing, creating a pressing need for robotic solutions in high-volume, repetitive tasks like frying. Furthermore, the heightened demand for consistent food quality and faster service times in quick-service restaurants strengthens the pace of adoption of cooking robots. Integration of AI-driven robotics also allows operators to optimize kitchen workflows, thereby reducing human error and enhancing overall operational efficiency. Hence, the presence of all of these factors creates an optimistic market opportunity for both national and international pioneers in this field.

Application Segment Analysis

The frying & cooking application segment is leading in the cooking robot market, owing to its critical role in QSR menus such as fries, wings, and nuggets. It also offers operational advantages, whereas the prominent organizations are emphasizing consistent cooking as the key to food safety, where robots ensure precise time-temperature control, directly reducing food safety risks. In January 2025, Miso announced the launch of the flippy fry station, which is an AI-powered robot that automates fry station tasks with unmatched precision, speed, and reliability, backed by over 25 patents and collaborations with Ecolab, NVIDIA, and leading QSR brands. Besides, the new flippy is half the size, twice as fast, installs in existing kitchens overnight, and reduces labor costs, thereby enhancing safety, allowing younger employees to operate it under federal guidelines. The system has no upfront costs and a measurable ROI through labor redeployment, faster service. It is being deployed into major chains such as White Castle and Jack in the Box in 2025.

Our in-depth analysis of the cooking robot market includes the following segments:

|

Segment |

Subsegments |

|

Pay Load |

|

|

End user |

|

|

Application |

|

|

Type |

|

|

System Type |

|

|

Type of Robot |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cooking Robot Market - Regional Analysis

North America Market Insights

The cooking robot market in North America is expected to lead the entire global dynamics, capturing the largest stake of 45.6% by the end of 2035. The region’s focus on technological innovation and AI integration in food service operations has propelled it to gain a dominant position in this field. In January 2023, Nala Robotics, with Ovention, Inc. and Hatco Corporation, announced that it had unveiled a compact, fully autonomous robotic pizza-making system at NAFEM 2023, which is designed for convenience stores, QSRs, as well as ghost kitchens. It also stated that this AI-powered system automates dough pressing, sauce and topping application, cooking, slicing, boxing, and storage in Hatco’s Pizza Locker, all within a 10' x 10' footprint. Hence, this integrated solution enhances operational efficiency and allows operators to increase revenue by providing consumers with convenient, customizable pizza options.

The U.S. has captured the commanding position in the regional cooking robot market owing to a combination of factors such as increased adoption in commercial kitchens, as well as the need for operational scalability in large restaurant chains. In November 2024, Serve Robotics announced that it had acquired Vebu Inc., which is the developer of the Autocado robotic system, to expand its automation offerings beyond delivery into back-of-house restaurant operations. In this regard, the Autocado automates avocado processing, allowing staff to focus on other tasks, and is currently piloting at Chipotle in Huntington Beach, California. Hence, this acquisition strengthens Serve’s partnerships with major restaurant chains, broadens market opportunities, and integrates Vebu’s expertise in kitchen automation into Serve’s operations, making it suitable for overall market growth.

Canada is reaping advantages in the cooking robot market, wherein the foodservice operators are turning to automation to maintain consistent food quality by optimizing kitchen workflow and reducing operational risks. The country’s strong emphasis on workplace safety, along with compliance with stringent hygiene standards, is also readily encouraging the deployment of NSF-certified robots. In July 2022, Compass Group Canada and SJW Robotics announced that they had entered into an exclusive partnership to pilot the RoWok, which is a 24/7 autonomous kitchen robot, in select locations in the country. Moreover, the initiative targets gaps in around-the-clock meal availability by offering hot, fresh, and customizable meals for healthcare workers, students, and office staff outside the normal kitchen hours. The company also underscored that RoWok combines robotics, AI, machine learning, and cloud analytics to deliver more than 60 meals per hour while occupying just 100 square feet, hence enabling innovative service in spaces without a full kitchen.

APAC Market Insights

The cooking robot market in the Asia Pacific is considered to be the fastest-growing region during the forecast period. This rapid growth is effectively propelled by factors such as rising urbanization, increasing disposable income, and an expanding foodservice industry. Simultaneously, countries across the region are facing acute shortages of skilled kitchen labor, encouraging restaurants and hotels to integrate robotics. In March 2024, SoftBank Robotics announced that it would take over the distribution of Yo-Kai Express’s autonomous cooking robot called CHEFFY in Japan, thereby aiming to expand usage and enhance service quality. Besides, this partnership builds on existing deployments of Yo-Kai’s ramen-preparing robots across offices, commercial spaces, and major transit hubs. Furthermore, the company also stated that it's planning to drive further innovation and broaden the reach of autonomous food-service technology.

China has gained huge exposure in the regional cooking robot market since it has a massive foodservice sector and the ever-increasing popularity of smart kitchens. The surging labor costs are encouraging both small eateries as well as large restaurant chains to adopt these robotic cooking systems. For instance, in June 2025, DOBOT announced the launch of its mass production and delivery of its humanoid robot, DOBOT Atom, marking a major milestone in embodied intelligent robotics. The company also stated that Atom features DOBOT’s proprietary neuro-driven system for coordinated motion and industrial-grade precision, enabling tasks from soldering to delicate cherry picking. In this context, the debut reflects the company’s achievements and advances its mission to make next-generation robotics widely accessible, hence making it suitable for overall market growth.

India also holds a strong position in the regional cooking robot market, effectively attributable to the heightened demand for hygienic fast food preparation. Food operators in the country are opting for these robots to perform multiple functions such as automating frying, griddling, and food assembly operations, especially in metro cities with high footfall. Simultaneously, the country also hosts burgeoning startups that are readily fueling innovation in affordable, modular cooking robots that are suitable for domestic cuisines. Government initiatives promoting smart kitchens, Make in India manufacturing, along with AI adoption, are also encouraging market expansion. Furthermore, the rising awareness among consumers about food safety, consistency, and quick service is encouraging operators to deploy robots, particularly in QSRs, hotels, and catering segments, hence fueling adoption across the country.

Europe Market Insights

Europe has acquired the most prominent position in the regional cooking robot market, positively influenced by factors such as stringent labor laws and high wages. Automation is increasingly being implemented in commercial kitchens, hospitals, and institutional food services to reduce dependency on human labor. In December 2024, Circus SE announced that it had entered the European nursing and elderly care sector with its fully autonomous AI-powered CA-1 food-service robot, which delivers personalized, hygienic meals by easing staff workloads. The robot uses AI and machine learning, and it tailors menus to individual dietary needs, supporting care facilities that are facing rising demand. Furthermore, it also stated that with over 30 million people in need of care across the region, the company positions itself as a key innovator in a rapidly growing, multi-billion-euro sector.

Germany has gained enhanced momentum in the cooking robot market, facilitated by its advanced automation ecosystem and strong focus on workforce efficiency. Manufacturers in the country are readily making investments in robots that have high precision, energy efficiency, and compliance with strict food safety standards. In June 2023, dnata reported that it showcased an AI-powered cooking robot developed by Moley Robotics at the 2023 World Travel Catering & Onboard Services Expo, reflecting the future of automated culinary operations. It also stated that the robot replicates chef-made dishes utilizing sensors and machine learning, thereby highlighting the company’s crucial role in boosting quality and efficiency through advanced technologies. Therefore, such instances are expected to boost the country’s market at a rapid pace, positioning it as a key growth engine in the regional landscape.

The U.K.’s cooking robot market is growing owing to the rising operational costs and increased adoption of technology in foodservice operations. The country’s market also benefits from the growing trend of contactless service, along with digital ordering has created demand for scalable, AI-driven robotic systems that can handle repetitive tasks consistently while enhancing overall kitchen productivity. In January 2024, Moley Robotics announced that it had inaugurated the first ever world’s first luxury robot kitchen showroom in London, which is offering an immersive look at automated gourmet cooking powered by advanced robotic arms and AI. It also stated that the space showcases premium kitchen designs and live demonstrations of Moley’s Chef’s Table, X-Air, and A-Air systems, which can recreate recipes from world-renowned chefs, hence denoting a positive market outlook.

Key Cooking Robot Market Players:

- Miso Robotics (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Moley Robotics Ltd. (UK)

- Dexai Robotics (U.S.)

- Karakuri Studios Ltd. (UK)

- Zimplistic Pte. Ltd. (Singapore)

- Creator, Inc. (U.S.)

- Cafe X Technologies (U.S.)

- Bear Robotics (U.S.)

- Sony Semiconductor Solutions Corporation (Japan)

- Samsung Bot (South Korea)

- Panasonic Corporation (Japan)

- Wilkinson Baking Company (U.S.)

- Suzumo Machinery (Japan)

- ABB Robotics (Switzerland)

- Robot Coupe (France)

- Miso Robotics has emerged as the major player in the cooking robot industry due to its flagship Flippy robotic fry station, which uses computer vision and AI to automate frying tasks. The company has partnered with major foodservice brands as well as quick-service restaurants to scale its business, leveraging the Robotics-as-a-Service business model, reducing the upfront investment required from its customers. Miso’s strategy also includes launching a more compact, second-generation robot built for higher throughput and flexibility.

- Moley Robotics Ltd. is pioneering the fully automated home kitchen with its bionic chef arms that replicate human cooking motions. The company’s solution targets affluent consumer segments as well as the premium commercial kitchens. On the other hand, innovations in terms of robotics hardware, haptics, and recipe digitization are building a library of cloud-based, cookable recipes that its robotic arms can execute exactly, hence gaining the interest of a wider audience group.

- Dexai Robotics offers Alfred, which is a multi-axis robotic arm designed to integrate into existing kitchen environments without requiring custom cabinets. The company’s core differentiation lies in intelligence and modularity, wherein the Alfred can perform multiple functions such as scoop, stir, pour, and plate a wide range of ingredients using vision and force control. Furthermore, they emphasize low disruption during deployment, competitive TCO, and continuous learning through data-driven software upgrades, which allow each unit to improve over time.

- Karakuri Studios Ltd is also a prominent player in this field, which builds highly flexible food‑assembly robots, sometimes referred to as food printers, which are capable of constructing complex dishes in high-mix, low-volume environments. Their business model is centered around working directly with food brands and catering operators to prototype, customize, and co-develop robot stations that prepare brand-specific meals. Karakuri also invests heavily in design and modularity, enabling quick changes in recipe without retooling. Their long-term strategy emphasizes scalability, both geographically and by menu, offering robotic appliances that can adapt to customer needs while reducing labor overhead.

- Zimplistic Pte. Ltd., the company behind Rotimatic, is best known for its automated roti-making machine built for homes. While not a traditional “robot chef, Rotimatic represents a unique facet of cooking automation. Zimplistic’s corporate strategy has focused first on perfecting its hardware and ingredient handling, then on building a subscription model for its smart dough cartridges. They are also working on expanding the machine’s capabilities and leveraging their existing customer base to bring next-gen home cooking robots to market. Their deep understanding of geographic markets gives them a competitive edge in scaling regionally.

Below is the list of some prominent players operating in the global market:

The cooking robot market is highly competitive, wherein Miso Robotics is pivoting toward compact, high-throughput systems for restaurants. Meanwhile, companies such as Creator and Cafe X are focusing on modular meal assembly and automated coffee-on-demand deployments. In addition, the established electronics firms such as Sony and Samsung leverage their sensor and robotics expertise to push into kitchen robotics. In January 2025, Daiwa Seiko announced that it had acquired the kitchen equipment business from Kubota Corporation, taking complete responsibility for development, quality assurance, and manufacturing, whereas MIK Corporation will continue handling sales. Their product line includes the rice robot for fully automated rice cooking, the senmai robot for precise rice washing, and the shari robot for consistent rice and vinegar mixing, all designed to improve efficiency and taste in commercial kitchens. Hence, this denotes a positive market outlook.

Corporate Landscape of the Cooking Robot Market:

Recent Developments

- In May 2025, Posha announced a USD 8 million Series A funding round led by Accel, stating that the investment will accelerate its mission to bring an AI-powered private-chef-style cooking robot into home kitchens.

- In March 2025, Chef Robotics announced a substantial USD 43.1 million Series A funding round, which is a mix of equity and equipment financing aimed at accelerating the deployment of its AI-enabled food robotics systems. The company stated that the capital will fuel the advancement of its embodied-AI platform ChefOS, expand customer deployments.

- Report ID: 2617

- Published Date: Nov 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cooking Robot Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.