Converged Data Center Infrastructure Market Outlook:

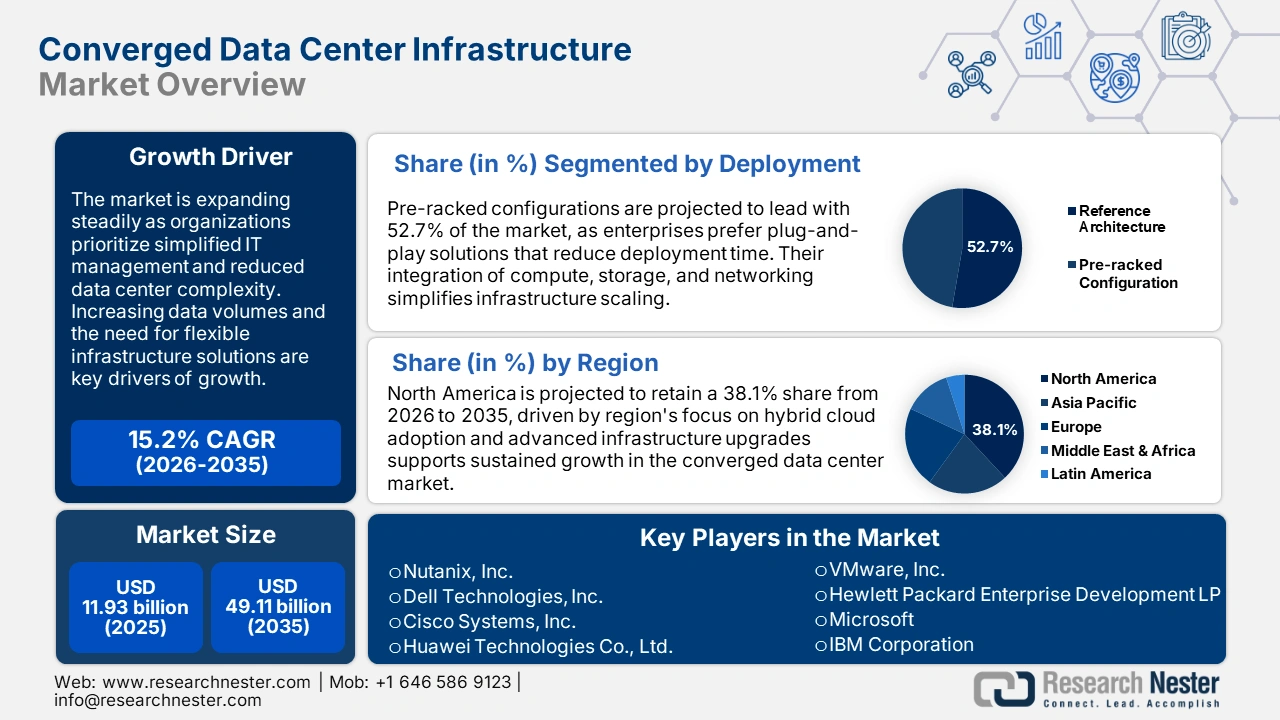

Converged Data Center Infrastructure Market size was over USD 11.93 billion in 2025 and is anticipated to cross USD 49.11 billion by 2035, growing at more than 15.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of converged data center infrastructure is assessed at USD 13.56 billion.

The converged data center infrastructure market is rapidly growing due to the increasing need for flexible and efficient infrastructure solutions. With the advancement of hybrid and multi-cloud systems, the requirement for integrated data storage, computing, and networking solutions has become more important. Organizations are spending on the latest infrastructure required for data-centric workloads, especially for AI, big data, and IoT. In May 2024, NetApp launched a new AI-optimized data storage infrastructure that addresses hybrid cloud and on-premises needs to meet the growing need for converged systems in the digital environment.

Several government policies are driving the growth of the converged data center infrastructure market, and sustainability and energy efficiency are the key factors among them. Energy efficiency and utilization of renewable energy sources are now driving the changes in data center design and management. This focus guarantees the long-term integrity of infrastructure and its conformity to contemporary ecological requirements. Companies are embracing these approaches to prepare their structures for the future and cut expenses in operations. Consequently, the public and private sectors are working together to advance new and sustainable data center solutions and investments.

Key Converged Data Center Infrastructure Market Insights Summary:

Regional Highlights:

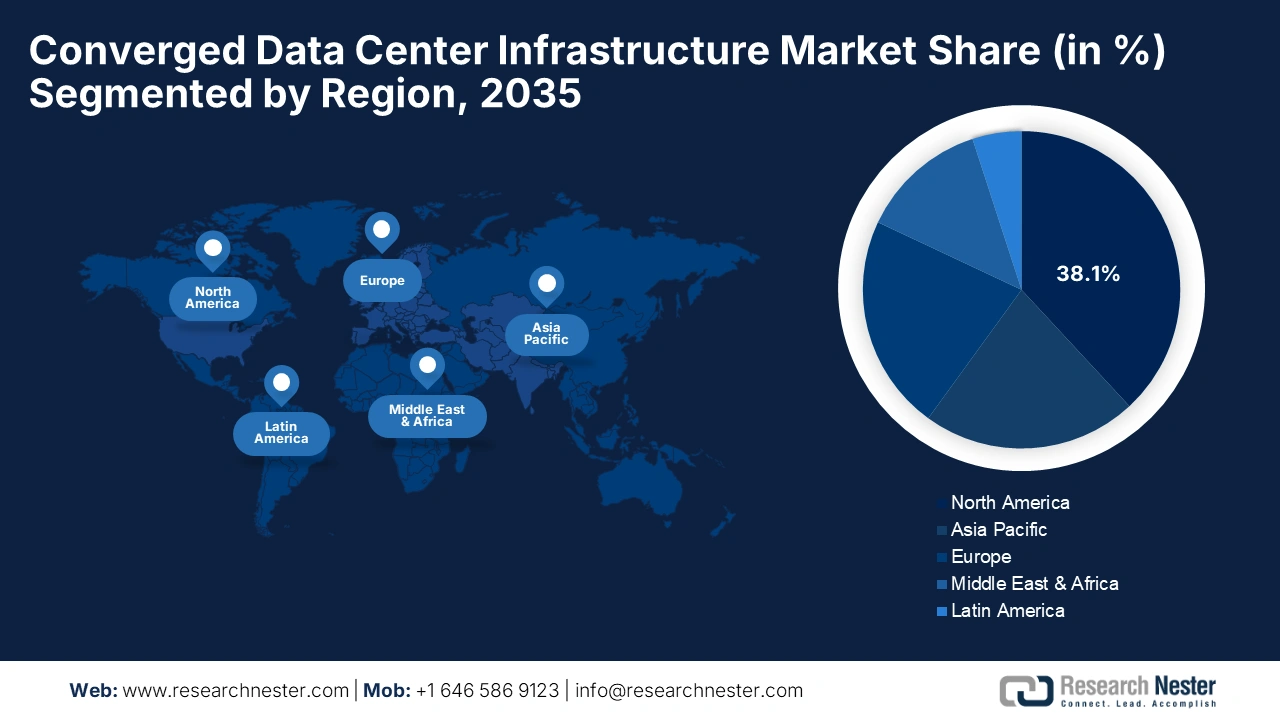

- North America converged data center infrastructure market will account for 38.10% share by 2035, fueled by cloud computing and digital services development.

- Asia Pacific market will register significant growth during the forecast period 2026-2035, attributed to rising internet usage and digital business strategies.

Segment Insights:

- The pre-racked configuration segment in the converged data center infrastructure market is anticipated to capture a 52.70% share by 2035, fueled by the effectiveness and installation convenience of pre-racked systems.

- The networking devices segment in the converged data center infrastructure market is anticipated to secure a 47% share by 2035, driven by demand for high-speed data transfer and connectivity.

Key Growth Trends:

- Rising demand for hybrid and multi-cloud deployments

- AI and big data expansion

Major Challenges:

- Data security and compliance risks

- Infrastructure integration complexity

Key Players: Nutanix, Inc., Dell Technologies, Inc., Cisco Systems, Inc., Huawei Technologies Co., Ltd., VMware, Inc., Hewlett Packard Enterprise Development LP, Microsoft, IBM Corporation, DataCore Software, Pivot3, Inc., NetApp, Inc., Hitachi Vantara LLC, Scale Computing.

Global Converged Data Center Infrastructure Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.93 billion

- 2026 Market Size: USD 13.56 billion

- Projected Market Size: USD 49.11 billion by 2035

- Growth Forecasts: 15.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 18 September, 2025

Converged Data Center Infrastructure Market Growth Drivers and Challenges:

Growth Drivers

- Rising demand for hybrid and multi-cloud deployments: The advancements in the use of hybrid and multi-cloud solutions are on the rise and this has increased the need for converged data center infrastructure to help with workload management and flexibility. Organizations are implementing these solutions in order to simplify management and enhance flexibility in the face of dispersed system architectures. In April of 2024, Nutanix extended its Cloud Clusters to Microsoft Azure, enabling seamless workloads between on-premise and the cloud. This development aligns with the current trend of flexible data distribution that enables organizations to better manage their resources and gain better results.

- AI and big data expansion: The increasing use of artificial intelligence, machine learning, and big data is creating the demand for efficient converged infrastructure for processing large datasets. Converged systems are being deployed by organizations to handle AI applications, increase productivity, and gain real-time information. DataStax launched its hyper-converged data platform in May 2024 that incorporated generative AI for data management for AI workloads. This demonstrates how the growth of AI is changing the data center architecture and infrastructure and encouraging further investment in new technologies that will underpin the next phase of digital transformation.

- Sustainability and energy efficiency initiatives: Sustainability is gaining momentum as the converged data center infrastructure market imperative as businesses focus on energy-saving solutions to achieve global carbon reduction goals. The governments are encouraging low-carbon data centers and supporting green technology. In May 2024, Cloverleaf Infrastructure undertook the construction of the next-generation low-carb data centers to support the change towards green operations. This trend is in line with the general market strategies to reduce environmental effects as well as enhance energy use. Those companies that have adopted sustainable measures are gaining competitive advantage and meeting the social responsibilities of corporations.

Challenges

- Data security and compliance risks: With the increasing adoption of converged data centers, securing the environment in a multi-domain fashion is a new challenge. The interconnection of different systems enhances the chances of cybercrimes that are a major threat to business activities. Organizations need to use encryption, zero trust, and real-time monitoring to secure their data. Compliance becomes an additional challenge since organizations need to meet the current and frequently changing security standards.

- Infrastructure integration complexity: The integration of the converged data center infrastructure with the existing systems is still a problem for many organizations. Interoperability problems, outdated hardware, and system outages can hinder deployments and reduce the extent to which they can be expanded. Companies need to be strategic when it comes to changes not to create performance issues and to properly integrate into the current operations. This tends to require significant resources for the training of personnel and the procurement of new hardware and software. To achieve the objectives of digital transformation and reap the benefits of converged infrastructure, it is crucial to address the integration issues and ensure the continuity of operations.

Converged Data Center Infrastructure Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

15.2% |

|

Base Year Market Size (2025) |

USD 11.93 billion |

|

Forecast Year Market Size (2035) |

USD 49.11 billion |

|

Regional Scope |

|

Converged Data Center Infrastructure Market Segmentation:

Deployment Segment Analysis

By 2035, Pre-racked configurations segment is expected to capture over 52.7% converged data center infrastructure market share due to their effectiveness and installation convenience. These solutions are shipped as complete systems, helping to speed deployment and minimize the impact on enterprise operations as they expand their data center footprints. The self-contained pre-racked systems are easily configurable and flexible to changing business requirements since they do not require additional setup. These configurations are preferred by companies for their capacity to provide a flexible approach to infrastructure scaling without compromising on performance. Due to the increased adoption of scalable and efficient solutions, pre-racked options are likely to continue leading the market.

Component Segment Analysis

In converged data center infrastructure market, networking devices segment is poised to hold more than 47% revenue share by 2035 due to the increased demand for high-speed data transfer and connectivity. The use of data centers in cloud computing, the Internet of Things, and artificial intelligence is on the rise, and this means that companies need to have reliable networking to support their needs. In September 2024, Dynacons Systems secured a ₹143 crore order for the supply of converged networking solutions for the Bank of Maharashtra, which shows the increasing use of sophisticated networking equipment in large-scale modernization programs. This trend can be attributed to the growing need for high-speed and low-delay networks to support data center applications.

Our in-depth analysis of the global converged data center infrastructure market includes the following segments:

|

Deployment |

|

|

Component |

|

|

Facility |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Converged Data Center Infrastructure Market Regional Analysis:

North America Market Insights

By 2035, North America converged data center infrastructure market is set to hold more than 38.1% revenue share. This growth is mainly attributed to the development of technologies such as cloud computing and digital services that are crucial for companies that want to boost their operational effectiveness and expand in the market. The U.S. captured about 65.4% of the North America market, underpinning its importance in the regional data center market. The U.S. has over 5,389 data centers, which is considerably more than other countries, such as the UK, which has 512 data centers. In addition, giant companies such as Amazon Web Services (AWS) invested USD 35 billion in Virginia from 2006 to 2023, which proves the market potential of the sector related to increasing technological needs.

The growth of the U.S. converged data center infrastructure market can be attributed to the growing demand for cloud services and the increasing need for better data processing in industries such as IT and telecommunications, which generated 31.4% of the market’s revenue in 2022. Also, the U.S. market is projected to have an IT load of 14.81 thousand MW by 2024 and 24.11 thousand MW by 2029, which can be seen as a large increase in the capacity to meet the increasing data demand arising from the use of technologies like 5G and increased mobile usage5. The colocation revenue is also expected to rise from USD 37,501 million in 2024 to USD 95,232 million in 2029, meaning that data centers will continue to be critical for business.

The converged data center infrastructure market in Canada is also on the rise as the other markets. The Canadian segment is expected to grow due to investment in digital infrastructure and cloud services as companies look to update their operations and communications. As illustrated in this report, market growth corresponds to trends seen in the North America region, where there is an increasing focus on developing better data management solutions due to technological advancements. As a result, companies are in a position to minimize the time and money spent on the management of multiple systems through the use of converged infrastructure solutions.

Asia Pacific Market Insights

Asia Pacific region is expected to register significant growth till 2035. The market outlook is characterized by high growth in urbanization, internet usage, and digital business strategies in different industries. Thus, APAC countries are improving their data center infrastructure to satisfy increasing consumer demand for digital services due to these trends. The APAC converged data center infrastructure market is expected to experience investments in the construction of new facilities or expansion of the existing ones in order to address the increasing workloads stemming from cloud computing and big data analytics. The various economic structures within the region offer a number of challenges and opportunities for service providers as more organizations turn to converged systems that combine storage, networking, and computing resources.

India converged data center infrastructure market is rising at a considerable pace as the country moves toward becoming a key player in IT services. Studies show that India data center power consumption ranges from 1700 MW to 1800 MW, and it may increase by 900 MW in 2025. This impressive growth reflects India’s significance as one of the leading players in the global converged data center infrastructure market of IT services. The adoption of cloud solutions by businesses is making companies invest in modern data centers that are integrated with AI and ML. Consequently, the uptake of converged infrastructure solutions is expected to rise as organizations look for more flexibility and agility in their operations.

China is among the largest consumers of the converged data center infrastructure market in Asia Pacific. The government has adopted a strong policy on digitalization, especially in cloud computing and other technologies. Furthermore, China data center market is anticipated to rise owing to the growing use of the internet and smart devices in cities. This focus not only meets domestic needs but also makes China an important participant in the global technology supply chain. Moreover, the use of green energy solutions in data centers is in line with sustainable development goals to support the reduction of adverse effects of energy consumption from conventional sources on large-scale operations.

Converged Data Center Infrastructure Market Players:

- Nutanix, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Dell Technologies, Inc.

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- VMware, Inc.

- Hewlett Packard Enterprise Development LP

- Microsoft

- IBM Corporation

- DataCore Software

- Pivot3, Inc.

- NetApp, Inc.

- Hitachi Vantara LLC

- Scale Computing

The converged data center infrastructure market is considerably competitive, and the major players in this market continue to develop new offerings in order to help address the requirements of today’s enterprise. The major players in the converged data center infrastructure market are Nutanix, Cisco, Dell Technologies, and NetApp, which provide integrated systems for hybrid and multi-cloud environments. These players are working on increasing scalability, automation, and security to foster market growth. Strategic alliances and acquisitions also enhance their converged data center infrastructure market presence and help them in quicker adoption of new technologies.

In November 2024, Versa Networks introduced VersaONE, a SASE platform that provides security for WAN, LAN, and cloud networks due to the increasing need for data protection. This is a further indication of the ongoing race to provide end-to-end, efficient infrastructure, which fits into the wider trend of the industry to move towards hyper-converged solutions to simplify and improve the performance of enterprise networks. The emphasis on secure and agile connectivity indicates that network and security are becoming more and more integrated within the data center.

Here are some leading players in the converged data center infrastructure market:

Recent Developments

- In June 2024, OVHcloud introduced a Local Zone Edge Cloud Service in Spain and Belgium, focusing on low-latency workloads and distributed data center infrastructure. The service is designed to support AI applications, IoT, and gaming industries by offering faster data processing closer to end users. This move aligns with OVHcloud’s strategy to expand its edge computing presence across Europe.

- In May 2024, DataStax launched its Hyper-Converged Data Platform, providing enterprises with a comprehensive data center suite tailored for AI workloads. The platform integrates real-time data processing, multi-cloud support, and Kubernetes-based architecture, simplifying the deployment of AI in production environments. This launch underscores DataStax’s commitment to converged data center solutions, addressing the increasing demand for AI-driven infrastructure.

- In April 2024, Converge ICT announced a P5 billion investment to develop new data centers in the Philippines, expanding its digital infrastructure footprint. This initiative supports the company’s growth in cloud services, edge computing, and disaster recovery solutions. The investment will boost local digital transformation efforts, enhancing Converge ICT’s role in converged data center markets.

- Report ID: 6926

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Converged Data Center Infrastructure Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.