Controlled Environment Agriculture Market Outlook:

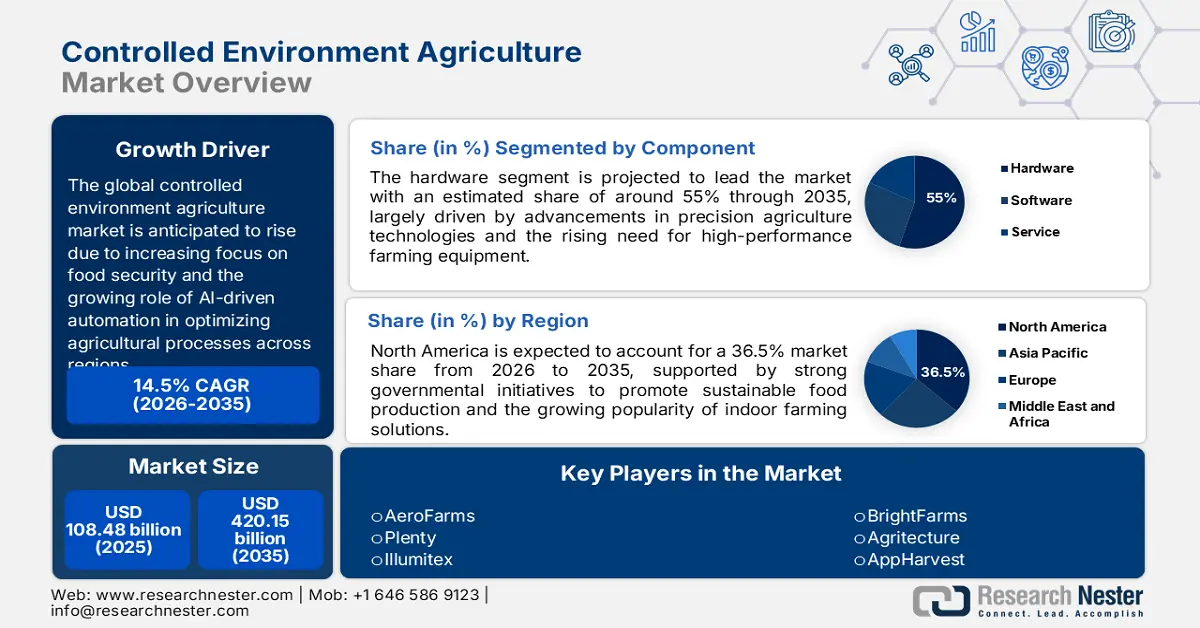

Controlled Environment Agriculture Market size was valued at USD 108.48 billion in 2025 and is likely to cross USD 420.15 billion by 2035, expanding at more than 14.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of controlled environment agriculture is estimated at USD 122.64 billion.

The market is expanding at a rapid pace as food security has become a global priority. This growth has been further driven by increasing demand for sustainable and high-yield agricultural solutions that are independent of seasonal changes in weather. One of the recent developments in this sector includes the launch of CEAg World by Meister Media Worldwide in March 2024. This launch targets controlled environmental food production, with most initiatives currently focused on vertical farms and greenhouses, representing increased specialization and scale in the industry. Various incentives and initiatives for ensuring all-year-round fresh produce supplies, reducing food miles, and enhancing food security are promoted by governments all over the world.

Government initiatives are focused especially on education and infrastructural development of controlled environment agriculture. For instance, Richmond Hill High School partnered with New York Sun Works in April 2024 to develop a Hydroponics Lab, an educative environment integrating advanced technology in agriculture. Such initiatives emphasize the importance of current developments, ensuring that companies can cope with the technologies of urban farming and be able to serve during times when food production in urban areas becomes an even bigger issue. Furthermore, the rising investments in sustainable farming technologies by governments are likely to open lucrative opportunities for players in the market.

Key Controlled Environment Agriculture Market Insights Summary:

Regional Highlights:

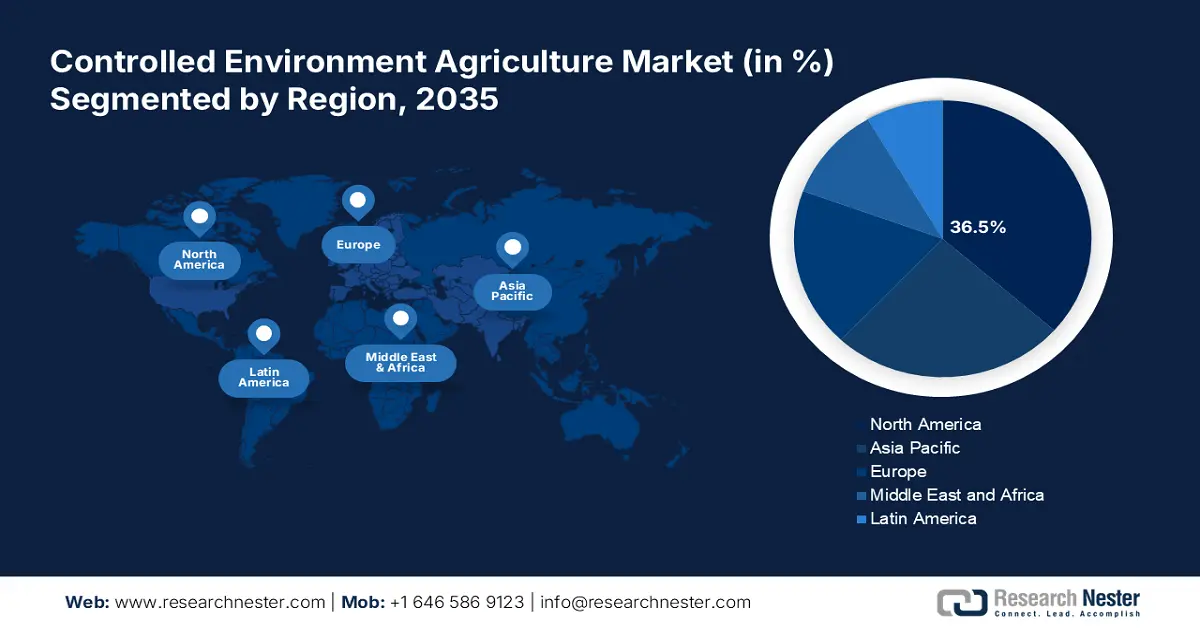

- North America dominates the Controlled Environment Agriculture Market with a 36.5% share, driven by technological advancements enabling large-scale, efficient operations through 2026–2035.

- The Controlled Environment Agriculture Market in Asia Pacific is set for lucrative growth through 2026–2035, driven by technological innovations and supportive government policies.

Segment Insights:

- The Hydroponics segment is anticipated to achieve a 43% share by 2035, driven by the efficiency of hydroponic systems in resource utilization and high crop yields in urban farming.

- The Hardware segment is expected to hold 55% market share by 2035, fueled by increased adoption of advanced farming systems like specialty LED lighting and climate control.

Key Growth Trends:

- Increased focus on sustainable agriculture

- Technological advances and R&D

Major Challenges:

- Regulatory and policy challenges

- Limited Accessibility to Economical Technologies

- Key Players: AeroFarms, Bowery Farming, Plenty, Illumitex, BrightFarms, Agritecture, AppHarvest, Gotham GreensHeliospectra, and Freight Farms.

Global Controlled Environment Agriculture Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 108.48 billion

- 2026 Market Size: USD 122.64 billion

- Projected Market Size: USD 420.15 billion by 2035

- Growth Forecasts: 14.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Netherlands, China, Japan, Canada

- Emerging Countries: China, India, Brazil, Mexico, Singapore

Last updated on : 14 August, 2025

Controlled Environment Agriculture Market Growth Drivers and Challenges:

Growth Drivers

- Increased focus on sustainable agriculture: The rising demand for sustainable farming practices is driving growth in the controlled environment agriculture market. Governments and organizations are promoting CEA solutions to minimize environmental impact, conserve water, and reduce pesticide use. This focus on sustainability has accelerated investments in advanced CEA technologies, leading to improved crop yields, resource efficiency, and a more resilient agricultural supply chain.

- Technological advances and R&D: Artificial intelligence, machine learning, and robotics are the broad areas of integration that help make the CEA operations seamless. Various companies are partnering to integrate advanced technologies to boost their production output. For example, in February 2023, AeroFarms and the International Center for Biosaline Agriculture collaborated to foster further R&D on AI-controlled agriculture with robotics. Such innovations raise levels of efficiency and productivity, hence making CEA a solution to scale up food production.

- Expansion into Urban and Regional Markets: Another major growth factor is the expansion of CEA facilities based on local and regional demands. In October 2023, Gotham Greens launched a new greenhouse in Monroe, Georgia, that put the company in a better position to provide more fresh produce to the southeastern U.S. market. This move also aligns with the increasing trend in consumer preference for more locally grown and sustainably produced fresh produce, giving further impetus to the market.

Challenges

- Regulatory and policy challenges: The controlled environment agriculture (CEA) sector faces significant hurdles due to complex and inconsistent regulatory frameworks across different regions. These challenges can delay project approvals, increase compliance costs, and create uncertainty for investors. In some areas, outdated agricultural policies do not adequately address the unique aspects of CEA, leading to legal ambiguities. Additionally, the lack of standardized guidelines for CEA operations complicates adherence to best practices.

- Limited Accessibility to Economical Technologies: The cost of access to and the sustainability of advanced CEA technologies remains particularly high, particularly in developing regions. Most small-scale farmers and startups are often unable to afford the basic infrastructure that includes climate control systems and LED lighting. These financial burdens restrict the adoption of CEA practices despite potential benefits related to resource efficiency and yield improvement.

Controlled Environment Agriculture Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14.5% |

|

Base Year Market Size (2025) |

USD 108.48 billion |

|

Forecast Year Market Size (2035) |

USD 420.15 billion |

|

Regional Scope |

|

Controlled Environment Agriculture Market Segmentation:

Component (Hardware, Software, Services)

Hardware segment is anticipated to account for more than 55% controlled environment agriculture market share by the end of 2035. This segment dominance is due to the increased adoption of advanced farming systems, including specialty LED lighting and climate control hardware for maintaining optimal growth conditions within crops. For example, in July 2023, Fifth Season, a vertical farming company, opened a research and development center in Pittsburgh, Pennsylvania. This new center focuses on advancing technology and innovation in the vertical farming sector.

Technology (Hydroponics, Aeroponics, Aquaponics)

By 2035, hydroponics segment is projected to hold more than 43% controlled environment agriculture market share. The demand for hydroponics is rising since it uses minimal water with high yield percentages of crops, which can be used in urban farming. For example, Plenty Unlimited Inc. opened Plenty Compton Farm in California in December 2023. The company will supply Walmart stores using hydroponic techniques. This development represents how the efficiency of resource utilization, along with the reliability of hydroponic systems, keeps it continuously in favor of large-scale retail supply.

Our in-depth analysis of the global market includes the following segments:

|

Component |

|

|

Technology |

|

|

Crop |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Controlled Environment Agriculture Market Regional Analysis:

North America Market Analysis

North America industry is poised to hold largest revenue share of 36.5% by 2035. The presence of large-scale operations in the region contributes to this leading position, along with technological advancements regarding vertical and hydroponic farming. Governmental support, like the new crop insurance program that the United States Department of Agriculture (USDA) introduced in October 2023, further enables the growth and stability of CEA operations through financial security for producers in controlled environments.

The U.S. remains a leading market in North America driven by the presence of several key players boosting their production with new facilities. For instance, Bowery Farming's latest facility opened in September 2023 in Arlington, Texas. The facility was designed to supply the Dallas-Fort Worth area to meet the growing demand for fresh produce on a continual basis. Such developments reflect the ongoing efforts to enhance food security and sustainability within the country.

The market is also witnessing growth in Canada, mainly due to the expansion of greenhouses and new projects focused on sustainability enhancement. The significant importance of regional solutions and sustainability in agriculture, particularly greenhouse produce, drives the market growth. Additionally, advancements in agricultural technologies and increased government initiatives supporting eco-friendly practices further propel this sector.

Asia Pacific Market Analysis

Asia Pacific controlled environment agriculture market is projected to witness steady growth over the forecast period, largely driven by technological innovations and supportive government policies. Rapid urbanization and the need for sustainable food production have made CEA an attractive option for many countries in the region. Additionally, increasing investments in vertical farming and advancements in automation are further enhancing productivity.

China is also growing as a considerable player in Asia Pacific CEA market. In February 2023, AeroFarms partnered with the Public Investment Fund of Saudi Arabia to set up one of the largest vertical farms in China. It is estimated to produce 1.1 million kilograms of crops per year. Such moves underline the ambitions of China to reach productivity and food security through technology while attempting to meet urban food needs.

Growth in the India CEA market is driven both by public and private companies' efforts to improve agricultural yields. For example, the Krishi 24/7 initiative by the government of India in November 2023 stresses the integration of technology into agriculture, becoming an ideal way to increase crops and overcome the problem of food insecurity. This showcases the proactive outlook of India toward integrating advanced technology in controlled agriculture and enhancing the overall food production capabilities of the country.

Key Controlled Environment Agriculture Market Players:

- AeroFarms

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Plenty

- Illumitex

- BrightFarms

- Agritecture

- AppHarvest

- Gotham Greens

- Bowery Farming

- Heliospectra

- Freight Farms

Competition in the controlled environment agriculture market is getting very fierce, and a number of leading companies set the pace for innovation and expansion. Some of the leading players are AeroFarms, Bowery Farming, Plenty, AppHarvest, Gotham Greens, and Freight Farms. These companies are scaling up operations and heavily investing in R&D to achieve optimal levels of crop yields, resource use, and overall sustainability in controlled environment settings. The competition lies in technological advances, efficient use and deployment of resources, and increased geographical presence to address local requirements.

One recent development that further reflects the move by players to gain a competitive advantage includes Kalera's announcement in June 2023 about a merger with Agrico Acquisition Corp. This merger made Kalera a publicly traded company trading under the ticker KAL. Furthermore, the deal brings increased visibility to Kalera while also providing more financial resources to take over a greater market share in the domestic CEA footprint. This strategic shift by players is an indication that they are positioning themselves to maximize the increased demand for sustainable and scalable food production systems.

Here are some leading players in the controlled environment agriculture market:

Recent Developments

- In July 2024, Skytree launched the Stratus Pioneer Program, designed to promote sustainable practices in controlled environment agriculture (CEA) by optimizing key operational processes. The program offers uptime assurance, energy analysis, and CO2 performance analytics to enhance efficiency. With the ability to generate up to 1,250 kg of CO2 per day, it is particularly suited for large greenhouses and vertical farms.

- In March 2024, Cox Enterprises established Cox Farms, positioning it as one of the largest greenhouse growers in North America with a focus on sustainability. Cox Farms aims to revolutionize traditional agriculture by expanding indoor farming practices and incorporating advanced technology. This move ensures a reliable, sustainable food supply that is independent of seasonal or weather constraints.

- Report ID: 6650

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Controlled Environment Agriculture Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.