Contract Mining Services Market Outlook:

Contract Mining Services Market size was over USD 18.56 billion in 2025 and is anticipated to cross USD 29.66 billion by 2035, growing at more than 4.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of contract mining services is assessed at USD 19.36 billion.

The contract mining services market is expanding due to rising energy consumption, urbanization, and infrastructure development. Mining businesses are pressurized to boost production and capacity while prioritizing safety and efficiency. According to the International Energy Agency (IEA), electricity demand worldwide increased from 2.5% in 2023 to 4% in 2024. As economies grow and evolve, the demand for raw materials and essential components for the construction of highways, skyscrapers, bridges, and other critical infrastructure has markedly increased. This elevated demand prompts more intensive and extensive mining operations, thereby enhancing the necessity for specialized contract mining services. Additionally, the need for contract mining services is interwoven with industries like mining, construction, and oil and gas, which depend significantly on robust labor forces, specialized equipment, and expert knowledge.

Key Contract Mining Services Market Insights Summary:

Regional Highlights:

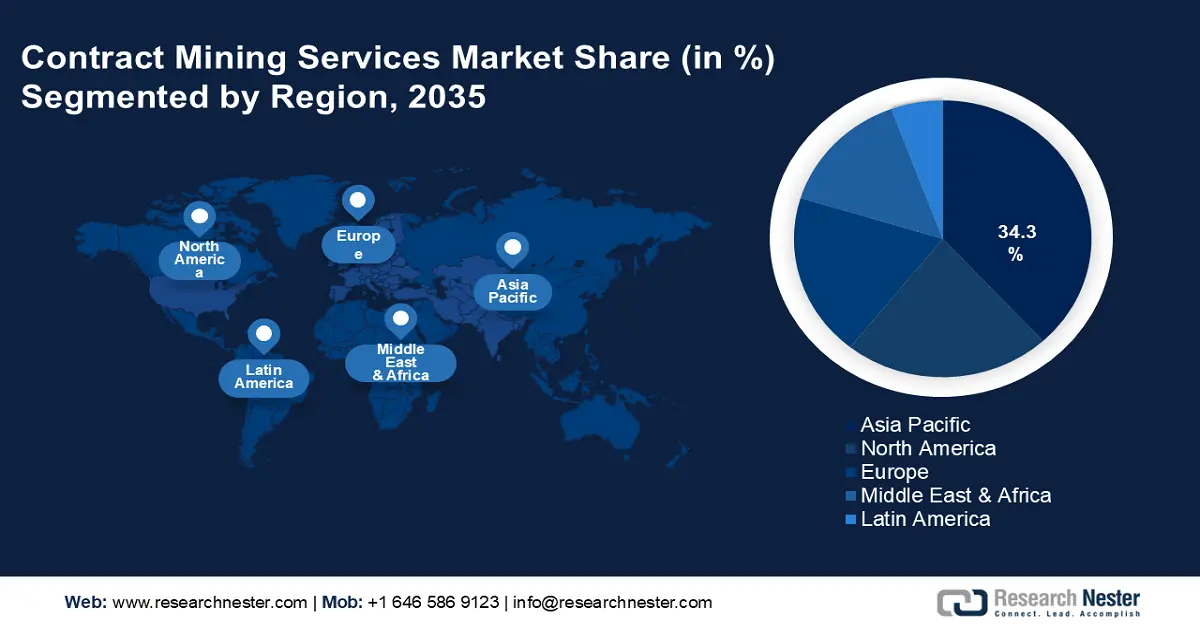

- Asia Pacific contract mining services market will account for 34.30% share by 2035, attributed to the increased need for minerals in China, India, and Australia, supported by government backing and innovative mining methods.

- North America market will account for 20.60% share by 2035, driven by sophisticated mining processes, vital resource deposits, and adoption of advanced technologies.

Segment Insights:

- The full-service contract segment in the contract mining services market is projected to achieve a 58.80% share by 2035, fueled by full-service contracts covering every mining process, offering efficiency, innovation, and tailored value-added services.

- The civil construction contracts segment in the contract mining services market is expected to achieve a 25.40% share by 2035, fueled by the essential role of civil construction in building infrastructure for mining operations.

Key Growth Trends:

- Increased focus on corporate social responsibility (CSR)

- Increased shift towards sustainability

Major Challenges:

- Varied employment terms

- Volatile commodity prices

Key Players: Barminco, Byrnecut, CIMIC Group Limited, Downer Group, Macmahon Holdings Limited, Master Drilling, Moolmans, Murray & Roberts Holdings Ltd., Orica Limited, PT Petrosea Tbk.

Global Contract Mining Services Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 18.56 billion

- 2026 Market Size: USD 19.36 billion

- Projected Market Size: USD 29.66 billion by 2035

- Growth Forecasts: 4.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (34.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Australia, Canada, United States, China, Chile

- Emerging Countries: China, India, Indonesia, Thailand, Brazil

Last updated on : 18 September, 2025

Contract Mining Services Market Growth Drivers and Challenges:

Growth Drivers

- Increased focus on corporate social responsibility (CSR): Mining firms are focusing on the effects of their operations on the environment, local communities, and their employees. Companies have adopted CSR activities to improve their public reputation, control risks, and cultivate enduring partnerships with local communities. As a result of this development, there is an increasing need for contract mining services that may complement and strengthen existing CSR programs. Services providers are setting themselves apart by providing services that include social initiatives and sustainable mining methods for the benefit of nearby communities. These programs are acknowledged as important forces behind long-term revenue development in addition to being a reaction to public and regulatory constraints.

- Increased shift towards sustainability: The industry has grown due to the increased hiring of professional mining service providers by the shift towards sustainable mining methods. This transition can be attributed to the growing focus on minimizing the environmental footprint, enhancing social responsibility, and improving economic viability. Professional mining service providers implement best practices, by optimizing operations and ensuring compliance with regulations.

Various government policies & initiatives to attract foreign investments in the mining sector and initiate sustainable practices are other factors driving the contract mining services market growth. For instance, India's National Mineral Policy 2019 seeks to guarantee environmentally sustainable mining with the involvement of stakeholders; transfer mining benefits to areas and individuals affected by mining; preserve a high degree of trust among all stakeholders; create a regulatory environment that facilitates business in the sector; and establish clear, straightforward, and time-bound processes for obtaining mining clearances. Also, in China, The Circular On Several Measures on Expanding the Opening to and Active Use of Foreign Investment in Manufacturing and Mining Sectors was released by the State Council in January 2017.

- Technological advancements in the mining industry: The sector is progressively embracing automation and digital technology, particularly AI-driven machinery, remote monitoring, and data analytics, to improve operational efficiency and lessen worker dependence. By utilizing their specialized expertise, contractors are spearheading the adoption of these cutting-edge technologies, giving mining companies a competitive edge without incurring significant internal costs.

Moreover, major companies are launching favorable advanced technologies for mining industries. For instance, in September 2024, Hexagon, the global pioneer in digital reality solutions, launched its AI-powered 3D blast movement solution, Hexagon Blast Movement Intelligence (BMI), designed for mining environments. It increases blasting efficiency while offering great insight into ore dilution for educated ore and waste delineation post-blast, resulting in a safe block model of the muck pile and, ultimately, maximum yield.

Challenges

- Varied employment terms: Contractors often lack the benefits afforded to permanent employees, frequently sign incomplete contracts, and are consequently viewed as easily replaceable. Accepting these less favorable terms and lower pay can cast permanent workers negatively, especially when they make what may be perceived as unnecessary or difficult demands. This factor may lead to a shortage of labor which may hamper the contract mining services market. Recent trends indicate that employers are increasingly advocating for fair treatment of employees from contracted operators, particularly for essential mining services and their impact on production and throughput.

- Volatile commodity prices: The contract mining services market faces a significant challenge from changes in commodity prices. These price fluctuations affect mining businesses' decisions to seek outside services and their profitability. This price volatility is highlighted in a recent World Bank research that projects a 5% drop in metal prices for 2023 after a remarkable 12% increase in 2022.

Contract Mining Services Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.8% |

|

Base Year Market Size (2025) |

USD 18.56 billion |

|

Forecast Year Market Size (2035) |

USD 29.66 billion |

|

Regional Scope |

|

Contract Mining Services Market Segmentation:

Service Coverage Segment Analysis

Full-service contract segment is expected to hold over 58.8% contract mining services market share by the end of 2035. The segment is growing as full-service contracts cover every mining process, from mineral discovery to post-mining cleanup, mining companies are increasingly choosing them. These contracts' suppliers contribute specialized mining knowledge, cutting-edge equipment, and flexibility in response to changes in the sector. Full-service contract drives segment growth by fostering efficiency, innovation, and value-added services tailored to client needs.

Providing everything from exploration to mine closure reduces client effort and ensures consistency. This positions the provider as a one-stop shop, making it attractive to potential clients. Tailoring services to meet specific operational or geographical requirements differentiates the provider in the competitive contract mining services market.

Service Type Segment Analysis

By 2035, civil construction contracts segment is projected to dominate over 25.4% contract mining services market share. Civil construction contracts are crucial to the contract mining services sector as the foundation for the infrastructure necessary for mining projects. These contracts, which cover foundation laying, tunnel excavation, and road construction, are essential for setting up and running mining operations. The demand for specialized contractors in this field is still high due to mining operations demanding civil engineering requirements.

Building high-quality roads facilitates the transportation of heavy equipment, raw materials, and extracted minerals, reducing logistical bottlenecks. Clearing, leveling, and grading mining sites ensure smooth deployment of machinery and operations.

Our in-depth analysis of the global contract mining services market includes the following segments:

|

Service Type |

|

|

Service Coverage |

|

|

Service Provider |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Contract Mining Services Market Regional Analysis:

APAC Market Insights

Asia Pacific in contract mining services market is expected to dominate around 34.3% revenue share by the end of 2035. The market growth can be attributed to the increased need for minerals in China, India, and Australia. These nations require more mining as they expand their infrastructure and businesses. Mining corporations frequently recruit outside experts to complete the work to reduce expenses and improve operations. Additionally, the region receives government backing and uses innovative mining methods.

With its abundant mineral resources and dominant position in coal production and rare earth metals, China dominates the contract mining services market. The businesses use new technologies to provide full services at reduced prices. Also, the local government encourages domestic mining and foreign investment, particularly in Latin America and Africa. The Africa Policy Research Institute reported that trade between the US and African nations tripled in 2022, with China-Africa trade approaching USD 300 billion. Numerous lithium projects in countries like Namibia, Zimbabwe, and Mali have been fueled by Chinese mining and battery corporations, which have recently invested USD 4.5 billion in lithium mines.

In India, the mining industry is undergoing a digital revolution due to businesses such as Tata Steel utilizing cutting-edge technology like automation, AI, and IoT to improve productivity and safety regulations. Incorporating digital solutions and leveraging contract mining services enhances competitiveness in the global market and streamlines operations. The growing demand for coal, which accounts for 55% of India's electrical generation, is driven by industrialization, urbanization, and rural electrification.

North America Market Insights

By the end of 2035, North America contract mining services market is poised to capture around 20.6% share. A substantial proportion of the GDP in North American countries is derived from the mining industry. According to the U.S. Geological Survey, in 2021, mining commodities generated USD 3.3 trillion in products and services, or almost 15% of the country's total GDP. In addition to supplying essential minerals, metals, and raw materials that underpin the economy, the mining sector provides employment opportunities for numerous individuals.

The contract mining services market is expanding in the U.S. due to its sophisticated mining processes, substantial deposits of vital resources like coal and metals, and emphasis on new technologies. The mining corporations frequently employ specialized contractors to adhere to stringent environmental regulations and operate effectively. The nation's strong position is aided by its extensive mining operations, particularly in the coal and metal industries.

Canada's mining sector is constantly innovating and implementing cutting-edge technologies to boost productivity, lessen its environmental impact, and enhance safety. Furthermore, initiatives such as the Prospectors and Developers Association of Canada's e3 Plus framework for responsible exploration and the Mining Association of Canada's Towards Sustainable Mining initiative can support the minerals industry in upholding its status as a significant economic driver in Canada while also preserving the environment and upholding social responsibility. Therefore, altogether these factors are contributing to the expansion of the contract mining services market in the nation.

Contract Mining Services Market Players:

- Barminco

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Byrnecut

- CIMIC Group Limited

- Downer Group

- Macmahon Holdings Limited

- Master Drilling

- Moolmans

- Murray & Roberts Holdings Ltd.

- Orica Limited

- PT Petrosea Tbk

The major players in the contract mining services market concentrate on growing their R&D expenditures, manufacturing facilities, infrastructure, and chances for value chain integration. Using these tactics, contract mining service providers may meet growing demand, maintain competitiveness, create cutting-edge goods and technologies, lower production costs, and enlarge their clientele.

Recent Developments

- In June 2024, PT Petrosea Tbk signed a mining services agreement term sheet with PT Global Bara Mandiri worth about USD 230 million. The contract is for 8 years and has the potential to be extended for the life of the mine. The job scope comprises stripping, removing overburden, and conveying coal at a mine in Central Kapuas District, Kapuas Regency, Central Kalimantan Province.

- In May 2024, Byrnecut, a leading contract miner, announced that it would collaborate with Sandvik to create new diesel-electric mining equipment aimed at increasing underground sustainability, efficiency, and productivity.

- Report ID: 6809

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Contract Mining Services Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.