Contract Lifecycle Management Market Outlook:

Contract Lifecycle Management Market size was over USD 1.32 billion in 2025 and is anticipated to cross USD 4.17 billion by 2035, witnessing more than 12.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of contract lifecycle management is assessed at USD 1.46 billion.

The reason behind this growth is the never-ending accessibility of the internet all over the world along with several technological advancements which include 5G, cloud services, Internet of things (IoT), Artificial Intelligence (AI), and blockchain. For instance, as of January 2024, there were more than 5.3 billion active users worldwide, which is estimated to be 66% of the global population.

Furthermore, the CLM software is being highly used by lawyers, especially for retrieving contracts from the library for their reference purposes, as this reduces their time to review and this enables the organizations to identify loopholes in their systems. About 44% of the corporate legal departments were using CLM systems in 2018 and in 2021, approximately 55% of corporate legal departments were using CLM.

Key Contract Lifecycle Management Market Insights Summary:

Regional Highlights:

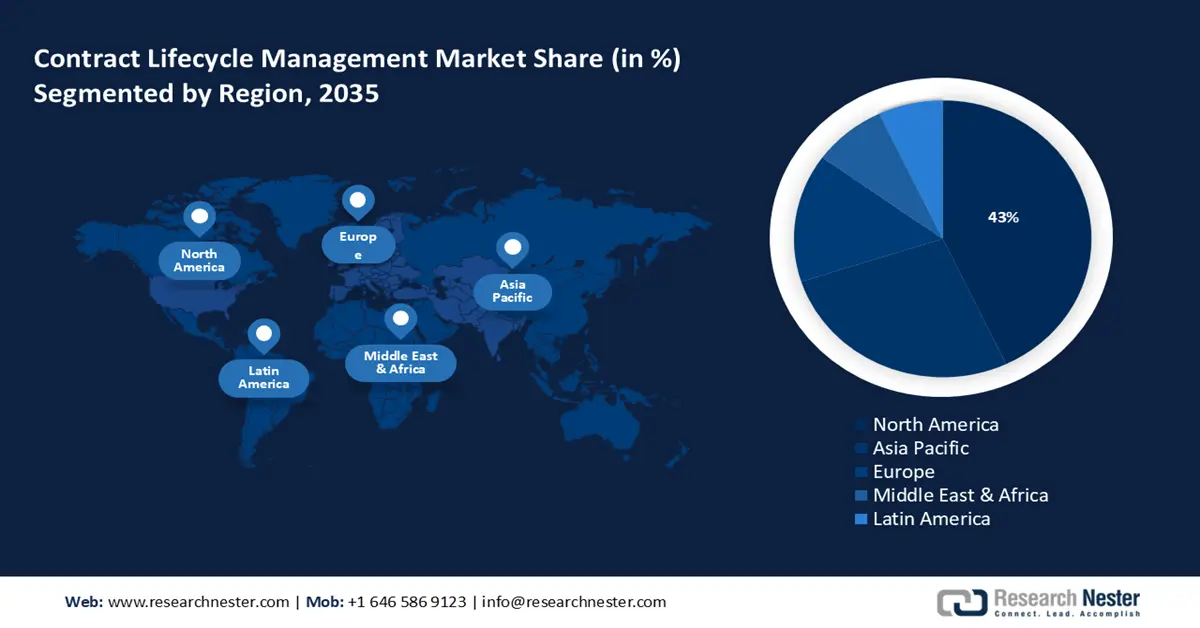

- The North America contract lifecycle management (CLM) market is poised to capture 43% share, expected to grow by 2035, driven by the presence of major players investing in R&D for CLM technologies.

- The Asia Pacific market will achieve significant revenue share, forecasted to expand by 2035, fueled by high adoption of cloud-based CLM solutions across SMEs.

Segment Insights:

- The software segment in the contract lifecycle management market is expected to capture a 58% share by 2035, attributed to improved automation facilitating various processes.

- The sme segment in the contract lifecycle management market is anticipated to hold a noteworthy share by 2035, driven by the digitalization and adoption of technology by SMEs.

Key Growth Trends:

- Growing population of gig workers

- Importance of contract work

Major Challenges:

- Growing population of gig workers

- Importance of contract work

Key Players: Coupa Software Inc. (Exari), Infor, Newgen Software Technologies Limited, SAP SE, Infosys Limited, Information Services Group, Inc., Model N, Inc., Synertrade (Econocom Group), Corcentric, Ivalua Inc., Agiloft Inc., Apttusand.

Global Contract Lifecycle Management Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.32 billion

- 2026 Market Size: USD 1.46 billion

- Projected Market Size: USD 4.17 billion by 2035

- Growth Forecasts: 12.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, China, India

- Emerging Countries: China, India, Brazil, Mexico, Singapore

Last updated on : 9 September, 2025

Contract Lifecycle Management Market Growth Drivers and Challenges:

Growth Drivers

-

Growing population of gig workers - There is an increase in the demand in the gig economy due to the expansion of the contract Lifecycle management (CLM) market, as the population is opting for a short-term contract and freelance opportunities, instead of a full-time employment. According to a NITI Aayog 2022 report on the gig economy, the gig workforce has the potential to increase to 2.35 crore by 2030.

-

Importance of contract work - The growing importance given to the contract work, especially for skilled professionals, is driving the market for contract Lifecycle management.

- Demand for flexible work arrangements - The growing demand for a flexible work arrangements and high work-life balance has increased the demand for support mechanisms, such as contract Lifecycle management, which provides several services and support for those who are working on contract or freelance bases.

- Importance of contract-based benefits - Along with the importance of contract Lifecycle management for tracking contract work, the demand for contract-based benefits and services, such as insurance, reimbursements, and other related benefits is also increasing.

- Importance of self-employment - The increasing surge of self-employment as a form of job and the source of income, has increased the demand for a proper management of finances and several other related aspects.

Challenges

-

Complexities of contracting - The contract lifecycle is highly complicated while involving several parties and stakeholders, such as clients, employers, employees, insurance providers, and tax authorities, which offers several challenges to the management for contractual obligations.

-

Confusing regulations and laws - Several regulations and laws which are related to contractual work can be extremely complex and confusing, especially in several regions. This can act as a barrier in the proper implementation and administration of contract Lifecycle management.

- Lack of tools and solutions - The available tools and solutions, for the contract Lifecycle management may be limited and might not be able to cater to the growing need and complexity of the contracting and freelancing environment.

- Difficulty in integration - The integration of contract Lifecycle management solutions and existing systems and processes can pose a big challenge and cause problems with communication, coordination, and data flow between different departments and teams. This can hinder the effectiveness and the return on investment from the management of contractual activities.

Contract Lifecycle Management Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.2% |

|

Base Year Market Size (2025) |

USD 1.32 billion |

|

Forecast Year Market Size (2035) |

USD 4.17 billion |

|

Regional Scope |

|

Contract Lifecycle Management Market Segmentation:

Component Segment Analysis

Software segment is poised to capture contract lifecycle management market share of around 58% by the end of 2035, owing to the improved automation as this facilitates the automation of various processes and activities, such as contract and workflow generation, tracking, administration, finance and accounting, and risk management as 76% of businesses use automation for standardizing or automating daily workflows; 58% use automation for data/reporting for planning, and 36% use it for regulation or compliance. Furthermore, software can also facilitate improved customer service, where relevant information about contract activities, such as benefits, payments, and regulations, can be provided quickly and easily to contractors. Moreover, the software component can create an integrated and centralized database of contract-related data that can be easily accessed and analyzed, to gain insight into different contract activities and performance. This can help in making informed and data-driven decisions and policies for contract Lifecycle management.

Deployment Segment Analysis

cloud-based segment is poised to account for substantial revenue share by the end of 2035, due to the growing number of contractors and the complexity of their work. The platform can be easily scaled up or down to meet the changing needs of its users, due to which it’s easy for clients and contractors can access the software platform. Moreover, the segments can provide a greater degree of mobility and remote access to the platform which allows easy access to the platform from anywhere through their devices, providing them with the flexibility of working from anywhere.

Enterprises Segment Analysis

The SME segment is estimated to hold a noteworthy share as the digitalization and adoption of technology by SMEs are rapidly increasing. The growing demand for contract-based work, which can provide a source of flexible income and cost-effectiveness for businesses, is driving the growth of this segment. Moreover, the increasing competitiveness in various business industries makes it crucial for SMEs to improve their level of efficiency and effectiveness.

Our in-depth analysis of the global market includes the following segments:

|

Component |

|

|

Deployment |

|

|

Enterprise |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Contract Lifecycle Management Market Regional Analysis:

North American Market Insights

In contract lifecycle management (CLM) market, North America region is estimated to account for revenue share of more than 43% by the end of 2035, impelled by the presence of several major industrial participants such as Coupa, Icertis, Zycuz, SAP SE who are investing heavily in the research and development while they are being included in cutting-edge technological features to improve their customer experience and products. According to the National Centre for Science and Engineering Statistics, the investment in Research and development has increased from about 2.7% in 2016, 2.9% in 2018 to 3.1% in 2019, to about 3.4% in 2020.

APAC Market Insights

In contract lifecycle management (CLM) market, Asia Pacific region is estimated to hold significant share by the end of 2035, driven by higher adoption of contract lifecycle management solutions across China, India, and Japan, as SMEs in these countries have shown their highest growth in the deployment of their cloud-based solutions, mainly to improve their contract processes and to reduce the business complexity.

Contract Lifecycle Management Market Players:

- Contract Logix, LLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Coupa Software Inc. (Exari)

- Infor

- Newgen Software Technologies Limited

- SAP SE

- Infosys Limited

- Information Services Group, Inc.

- Model N, Inc.

- Synertrade (Econocom Group)

- Corcentric

- Ivalua Inc.

- Agiloft Inc.

- Apttus

Recent Developments

- Icertis, introduced Contract Intelligence Solution, is majorly dedicated to the banking and capital market’s needs with a suite of associated documents, attributes, clauses, obligation management, templates, and reporting.

- Nexa3D, launched Icertis Matter Management, built on the Icertis Contract Intelligence (ICI) Platform.

- Aventa, has developed a set of Smart Marketing tools comprising target-focused and innovative measures.

- Report ID: 3633

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.