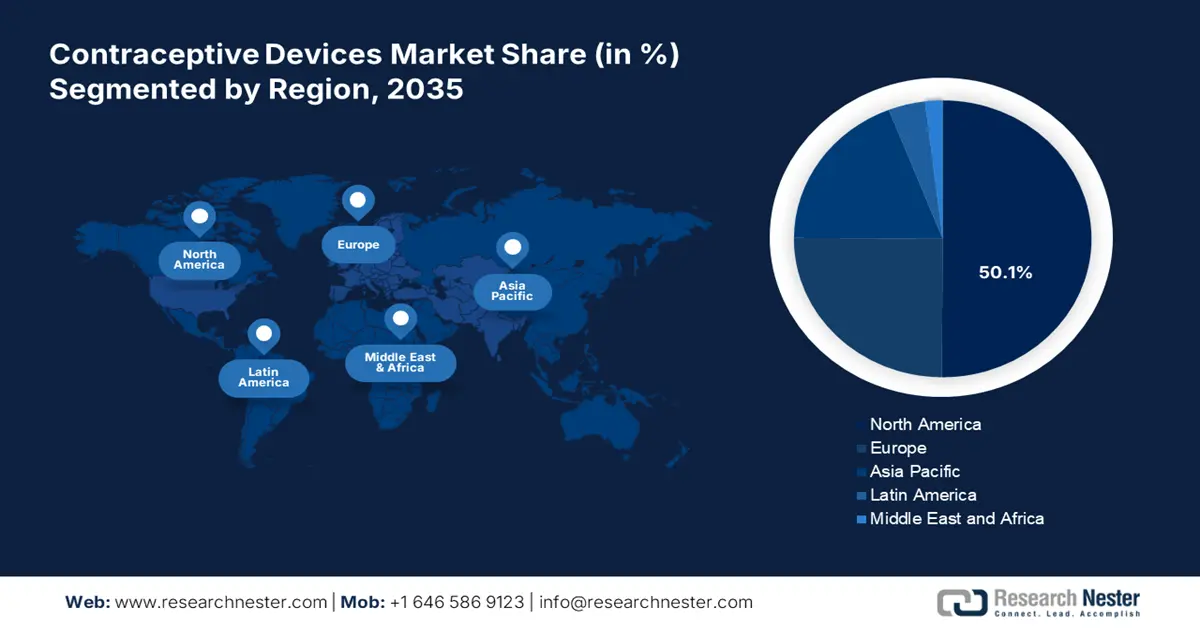

Contraceptive Devices Market - Regional Analysis

North America Market Insights

The North America contraceptive devices market is estimated to account for the leading share of 50.1% over the analyzed tenure. The region’s dominance is primarily attributed to the presence of a strong healthcare infrastructure, high levels of awareness, and supportive government policies. Besides, MedTech advancements and a rise in the use of modern contraceptive methods are also playing an influential role in this landscape, which is accompanied by robust investments in innovation and product development. Further, the rising concerns about unintended pregnancies and growing demand for long-acting reversible contraceptives (LARCs) are solidifying the region’s forefront position in this sector.

The U.S. is one of the world’s biggest consumer bases and innovation hubs in the market. Evidencing the same, the OEC reported that the country ranked among the top 5 importers of sheath contraceptives in 2023, accounting for USD 58.1 million. On the other hand, testifying to the enlarging demography, a 2024 study from an international reproductive health journal unveiled that around 66.6% women in the U.S. use contraception. It also mentioned that almost 45% of the total annual 2.5 million pregnancies nationwide were classified as unintended during the same timeline.

The Canada contraceptive devices market is following the upward trajectory of growth, owing to federal and provincial healthcare initiatives that emphasize reproductive and women’s health. As evidence, from 2021 to 2027, a total of USD 81 million was allocated to strengthen the healthcare system and related supports for the underserved community through the Sexual and Reproductive Health Fund (SRHF). Further, in February 2025, the Ministry of Health in Canada again dedicated USD 1.7 million in funding to support projects aimed at improving access to sexual and reproductive health services.

APAC Market Insights

Asia Pacific is poised to become the fastest-growing region in the global market by the end of 2035. The region's pace of progress in this category is accelerated by the enlarging population and government-led promotional activities for family planning, where highly populated countries, such as India and China, are taking an active part. On the other hand, rapid urbanization and evolving social attitudes toward birth control translate to greater uptake rates and improved access to healthcare services.

The dominance of China over both global and local manufacturing capacity is a major advantage for its domestic contraceptive devices market. Specifically, the country’s ability to offer cost-effective products is creating a favorable environment for the merchandise. Additionally, the government-backed relaxation from the one-child policy and growing emphasis on modern contraception methods are collectively securing a progressive future for the country in this sector. Moreover, with one of the largest populations in the world, China is making remarkable progress in this sector.

In 2023, India won the status as the world’s most populous country by surpassing 1.4 billion, followed by the downfall in China after 2022, as per a report from the United Nations (UN). Another finding from the PIB established that the proportion of people aged 15-64 crossed 68% in 2024, where more than 78% of women aged 15-49 were using modern methods of contraception in 2022. These figures indicate a lucrative opportunity to cultivate a strong foundation for suppliers and manufacturers in this field. Besides, the ongoing government initiatives, Mission Parivar Vikas (MPV) and Scheme for Home Delivery of Contraceptives, are also amplifying adoption.

Country-wise Trade Values of Sheath Contraceptives (2023)

|

Country |

Export Value (in USD) |

Import Value (in USD) |

|

China |

75.7 million |

134.9 million |

|

India |

90.9 million |

2.9 million |

|

Japan |

35.9 million |

12.5 million |

|

Malaysia |

80.9 million |

9.9 million |

|

Australia |

1.2 million |

9.0 million |

|

Thailand |

250.6 million |

7.5 million |

|

Indonesia |

263.9 thousand |

10.2 million |

|

Philippines |

739.0 thousand |

3.8 million |

|

Korea Rep. |

1.0 million |

7.3 million |

Source: WITS

Europe Market Insights

Europe is expected to hold a strong position in revenue generation from the contraceptive devices market during the timeline between 2026 and 2035. With the supportive government policies, a rise in public awareness, and advancements in the MedTech industry, the region consolidated its significance in this sector. As evidence, in April 2024, Aspivix, in alliance with Bayer, shared its plans for widespread access to its Carevix across Switzerland as a modern and gentler alternative to a cervical tenaculum. The UK, Germany, and France are augmenting this cohort of development, owing to their strong healthcare systems and proactive reproductive health programs.

Massive grant allocation to public welfare is a major growth driver for the UK market. This also helps the country enable widespread provision of a variety of services offered through the National Health Service (NHS), which ensures sufficient resource supply to people in need. Furthermore, the country's commitment to sexual and reproductive wellness shines through its policies and innovations. Natural Cycles in January 2025 announced the launch of a Reproductive UK Women’s Health Initiative to help them make informed decisions.

The dedication of governing authorities in Germany to funding research and innovation in the contraceptive devices market plays a pivotal role in fostering a profitable business environment for both domestic and foreign players in this field. Specifically, government allocations to sexual health programs are securing a consistent capital influx in this sector, encouraging more companies to invest and participate. As evidence, in September 2023, Bayer invested USD 294.4 million in a new manufacturing facility in Finland to improve public access to modern contraception methods and resources.

Country-wise Trade Values of Sheath Contraceptives (2023)

|

Country |

Export Value (in USD) |

Import Value (in USD) |

|

Germany |

23.6 million |

17.7 million |

|

Hungary |

14.4 million |

15.4 million |

|

Poland |

12.8 million |

23.1 million |

|

Spain |

10.5 million |

19.2 million |

|

Belgium |

9.1 million |

7.2 million |

|

Netherlands |

8.4 million |

9.0 million |

|

UK |

8.1 million |

12.6 million |

|

France |

5.3 million |

20.0 million |

|

Sweden |

4.6 million |

2.4 million |

|

Romania |

3.3 million |

3.1 million |

|

Greece |

2.5 million |

6.5 million |

|

Italy |

973.8 thousand |

18.4 million |

|

Turkey |

1.0 million |

14.2 million |

|

Austria |

1.2 million |

6.4 million |

Source: WITS