Continuous Variable Transmission Market Outlook:

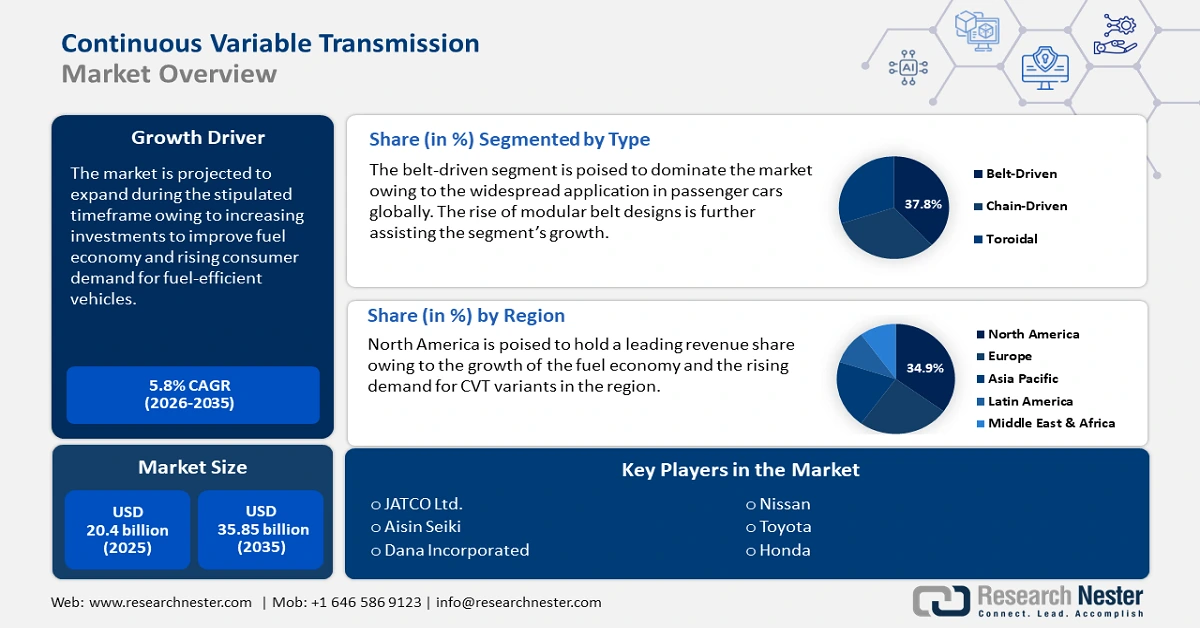

Continuous Variable Transmission Market size was valued at USD 20.4 billion in 2025 and is set to exceed USD 35.85 billion by 2035, expanding at over 5.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of continuous variable transmission is estimated at USD 21.46 billion.

The automotive industry has pursued fuel efficiency in a bid to bolster the global fuel economy. The trend assists the growth of the continuous variable transmission market due to the ability of CBTs to optimize engine performance. The earlier concerns regarding wear and tear of CVT components are largely being mitigated with the advancements in material science. Furthermore, a major proponent of CVT adoption is the enforcement of stricter emission norms worldwide with the looming decarbonization goals by 2050. The table below highlights key features of the U.S. fuel economy which is a major driver of continuous variable transmission solutions.

50th Annual Automotive Trends Report by EPA

|

Particular |

Details |

|

Fuel economy increase in 2023 |

1.1 mpg increase and reaching a record high of 27.1 miles mpg. |

|

Co2 emissions decrease in 2023 |

CO2 emissions decreased to a record low of 319 grams per mile. |

|

Co2 emissions decrease rate from 2004 to 2023 |

31%, or 142 g/mi |

|

Fuel economy increase rate from 2004 to 2023 |

40%, or 7.8 mpg |

Source: The U.S. Environmental Protection Agency (EPA)

The trends highlighting the increase in fuel economy of the U.S. bode well for the sustained growth of the continuous variable transmission market. Moreover, the success in the U.S. market bolsters the continuous variable transmission market in other regions by encouraging integration rates. Technological innovation has been a key factor in the market’s expansion with advanced belt-drive and chain-drive mechanisms improving power transmission efficiency. Macroeconomic trends that have impacted the market favorably include the adoption of automation to optimize production cycles and rising investments in electric and hybrid vehicle production.

A major feature of the continuous variable transmission market is the evolving consumer demand for sustainable solutions. Eco-conscious consumer bases have grown worldwide, and the rising disposable income to spend on sustainable choices has spurred demand for lightweight vehicles with lower emission rates. For instance, a Google Trends analysis of the keyword electric vehicles (EVs) highlights steady growth from February 2020 to February 2025. In May 2024, the International Journal of Application on Economics and Business published a study that eco-friendly features and concerns played a significant role in the decision to purchase automobiles in Jakarta, Indonesia. With green vehicle mandates on the rise, similar trends are expected to be reflected globally, ensuring a sustained growth of the continuous variable transmission market.

Key Continuous Variable Transmission Market Insights Summary:

Regional Highlights:

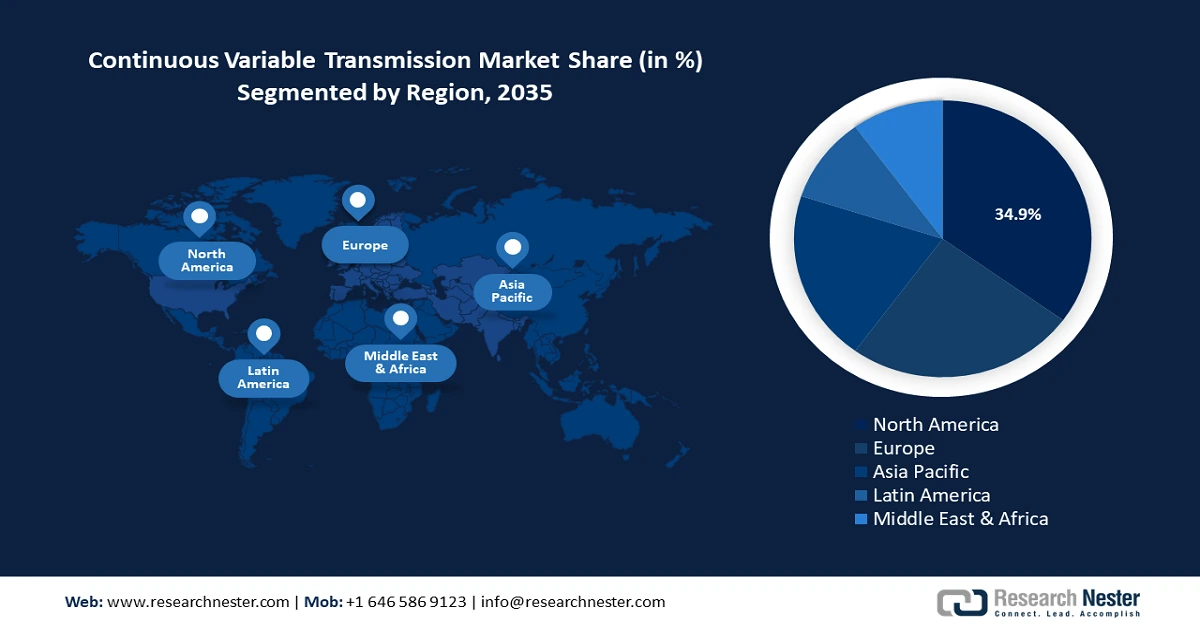

- North America's 34.9% share in the continuous variable transmission market is fueled by the push to improve fuel economy amidst heightened calls to curb emissions, positioning it for significant growth through 2035.

- Europe's Continuous Variable Transmission Market is forecasted for rapid growth by 2035, fueled by the transition towards carbon neutrality and fuel-efficient transmission solutions.

Segment Insights:

- The Chain-Driven Type segment is projected to hold the second-largest revenue share by 2035, fueled by its high torque capacity and durability, with rising demand for off-road vehicles.

- The Belt-driven Type segment is projected to hold over 37.8% share by 2035, fueled by its cost-effectiveness and application in fuel-efficient passenger vehicles.

Key Growth Trends:

- Rising regulatory mandates to curb emissions

- Integration with next-generation hybrid and PHEV powertrains

Major Challenges:

- Durability constraints in high-torque applications

- Higher dependence on regular maintenance and fluid quality

- Key Players: JATCO Ltd., Aisin Seiki, Honda, Toyota, ZF Friedrichshafen, BorgWarner, Hyundai Transys, Subaru, Schaeffler, Exedy Corporation, Nissan, Chery, Dana Incorporated, Panasonic.

Global Continuous Variable Transmission Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 20.4 billion

- 2026 Market Size: USD 21.46 billion

- Projected Market Size: USD 35.85 billion by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34.9% Share by 2035)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: United States, Japan, China, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Mexico

Last updated on : 13 August, 2025

Continuous Variable Transmission Market Growth Drivers and Challenges:

Growth Drivers

- Rising regulatory mandates to curb emissions: Stricter emission standards have prompted automakers to adopt CVTs as key enablers of fuel efficiency. The table below highlights regulatory mandates for fuel efficiency and to curb emissions for three key economies in APAC, North America, and Europe.

Emission Regulations

|

Particular |

Details |

|

APAC |

India proposed fuel consumption standards (FCS) for all vehicles that are manufactured or imported to India for sale in the domestic market, and the norms were implemented in April 2023. |

|

North America |

In the U.S., the final CAFÉ standards increase at a 2% rate per year for passenger cars in Mys 2027-2031 and 2% per year for light trucks in the model years of 2029-31. |

|

Europe |

Similarly, in 2020, the UK set the average emissions target of 95g CO2/km applied to new passenger cars, and a target of 147g CO2/km was established for light commercial vehicles. |

Moreover, the subsidies for low-emission vehicles in markets such as Japan’s Green Innovation Fund and China’s New Energy Vehicle credit system incentivize automakers to integrate CVT.

- Integration with next-generation hybrid and PHEV powertrains: The trends highlight CVTs being increasingly paired with hybrid and plug-in hybrid electric vehicle systems. Furthermore, the increasing production of hybrid and electric vehicles worldwide has ensured a parallel growth of the continuous variable transmission market. The table below highlights the sales and registration details of EVs and PHEVs, and an increase in sales within lucrative markets is poised to benefit the sustained growth of the CVT sector.

EVs and PHEVs Sales

|

Particulars (Global) |

Details |

|

New EV registrations in 2023 |

14 million |

|

EVs on the road in 2023 |

40 million |

|

EV sales increase percentage |

35% year-on-year increase in 2023 in comparison to 2022 |

|

PHEV sales |

4.2 million in 2023 |

|

PHEV sales among EV sales |

29.6% of EV sales in 2023 |

Source: International Energy Agency (IEA)

- Consumer preference for smoother driving experience boosting sales: Consumer awareness has heightened over the years regarding vehicle purchases. Automobiles are tangible depreciating assets where consumers engage in research from various mediums to reach the bottom of the funnel. In a competitive industry, automakers offering smoother driving experiences are expected to have an advantage in expanding their market shares. The recent increase in sales of CVT variants of the most popular car models is expected to ensure the growth of the market. The table below highlights the sales figures of popular CVT variants in India:

CVT Variant Automobile Sales in India

|

Particular |

Details |

|

Hyundai Creta |

54,003 units sold in January 2025 |

|

Maruti Suzuki Baleno |

2,02,901 units sold in FY 2023, up from 1,48,187 units sold in FY 2022 |

|

Nissan Magnite |

Announced third consecutive year of 30,000 plus sales |

|

Hyundai Venue |

1,28,897 units sold in FY 2024 |

Apart from Hyundai Creta all other variants have experienced steady growth in sales highlighting the user comfort of CVT models and the burgeoning demand. The trends make it lucrative for industry stakeholders to bolster investments in continuous variable transmission.

Challenges

- Durability constraints in high-torque applications: CVTs can face limitations in high-torque environments which limits the use case for off-road vehicles. The wear and tear on belts and pulleys in high-stress conditions present a challenge for the market’s growth. The challenge is evident in the North America continuous variable transmission market where there is a larger demand for light trucks and SUVs. Ford’s decision to avoid CVTs in its F-150 lineup over reliability concerns is indicative of the effects of the challenge.

- Higher dependence on regular maintenance and fluid quality: CVTs rely on specific transmission fluids to maintain proper belt friction, cooling, and hydraulic pressure. CVTs are highly sensitive to fluid degradation, and if not replaced on time, then it can lead to transmission failure. Moreover, CVT repairs can be more expensive owing to the specialized component required.

Continuous Variable Transmission Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 20.4 billion |

|

Forecast Year Market Size (2035) |

USD 35.85 billion |

|

Regional Scope |

|

Continuous Variable Transmission Market Segmentation:

Type (Belt-Driven, Chain-Driven, Toroidal)

Belt-driven segment is projected to dominate over 37.8% continuous variable transmission market share by 2035. The segment’s profitable expansion is attributed to the widespread application in passenger vehicles. Automotive manufacturers are rapidly adopting belt-driven CVTs to meet fuel economy standards. Moreover, the cost-effectiveness of belt-driven systems makes them a preferred choice in compact and mid-sized vehicles. Additionally, the rise of modular belt designs compatible with multiple vehicle platforms has bolstered adoption in different markets. A recent market movement highlighting companies introducing new durable belts to improve CVT performance indicates opportunities within the segment. For instance, in August 2023, Gates announced the launch of the new G-Force Workhorse CVT belt for off-road vehicles.

The chain-driven segment is poised to hold the second-largest revenue share in the market. The segment’s growth is due to the design offering torque capacity and durability compared to belt-driven counterparts. The higher power transmission demand is evident for recreational activities such as off-roading. With the rising demand for all-terrain vehicles (ATVs), the chain-driven segment is expected to find continued opportunities in domestic markets with the burgeoning culture of recreational activities.

Transmission Design (Hydraulic, Mechanical, Electromechanical)

The hydraulic segment is projected to account for a significant revenue share in the continuous variable transmission market during the forecast period. Hydraulic CVTs utilize hydrostatic design facilitating the precise control of power output, making them suitable for heavy-duty applications in agricultural machinery and construction equipment. Manufacturers are leveraging the heightened demand from the increasing construction activities in emerging economies, especially in APAC, bolstered by the rapid rate of urbanization. In August 2023, RICS reported construction activities to exhibit growth in India, Singapore, Hong Kong, Australia, and Malaysia. Furthermore, businesses are launching powerful CVT vehicles for the utility tractor segment in the agriculture industry. For instance, in October 2024, the 340hp 6340 Terrus CVT by STEYR was launched in the backdrop of farms in Europe seeking compact tractors capable of performing in lowland and mountainous terrains.

Our in-depth analysis of the global continuous variable transmission market includes the following segments:

|

Type |

|

|

Transmission |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Continuous Variable Transmission Market Regional Analysis:

North America Market Forecast

North America continuous variable transmission market is anticipated to capture revenue share of over 34.9% by 2035. A major factor propelling the market in North America is the continued push to improve the fuel economy amidst heightened calls to curb emissions. Furthermore, the well-established automotive industry in North America, characterized by the rising consumer demand for EVs has bolstered CVT manufacturers. The positive sales figures in the U.S. reported by the Nissan Group highlight opportunities. In the fourth quarter of 2024, Nissan reported 222,484 units sold, marking a 10.3% increase from the previous quarter. The sales of Versa, a popular CVT variant, were up by 71.7% for the calendar year.

The U.S. continuous variable transmission market is projected to expand its leading revenue share in North America. Automakers in the U.S. are increasingly incorporating CVTs into a variety of vehicle models, ranging from compact passenger cars to SUVs to keep pace with the rising demand for efficient transmission systems that can improve vehicle performance. The fuel economy of the U.S. has improved between 2004 and 2023, as per the EPA, which is a key trend incentivizing automaker to ramp up production of CVT models to ensure the continued growth of the fuel economy. Recent advancements within the market include the advent of the infinitely variable transmission (EMIVT) system by Dana Incorporated ensuring seamless shifting from engine-only, hybrid, and battery-only modes has potential for heightened commercial applications. Additionally, supportive federal initiatives include the U.S. Environmental Protection Agency (EPA) grants for heavy-duty ZEVs and associated infrastructure.

The Canada continuous variable transmission market is poised to exhibit growth by the end of 2035. The rising adoption of hybrid and electric vehicles in Canada, which has historically been a market characterized by favorable consumer sentiments for eco-friendly solutions, has created opportunities for manufacturers. Furthermore, supportive policies and incentives for eco-friendly vehicles are encouraging the integration of CVTs. For instance, the Zero-Emission Vehicles (iZEV) Program which was launched in 2019 incentivizes the transition to zero-emission vehicles. The strong manufacturing supply chain with five global OEMs assembling more than a million vehicles at manufacturing plants located in the country benefits the production capabilities of CVT variants in Canada.

Europe Market Forecast

The Europe continuous variable transmission market is expected to account for the fastest growth after North America. A significant feature of the Europe market is the aggressive push for carbon neutrality amidst advancements in automotive technology led by Germany. Stringent European Union (EU) regulations such as the Euro 6 and upcoming Euro 7 standards encourage automakers to adopt fuel-efficient transmission solutions such as CVTs to reduce carbon footprints. Additionally, the trends indicate Europe’s transition towards achieving electrification in automobile solutions, highlighting the opportunities for ECT manufacturers to improve transmission efficiency.

The Germany continuous variable transmission market is expected to register robust growth throughout the forecast period. The country’s domestic market is characterized by a well-established automotive industry and a heightened focus on emission reduction as investments are underway to ensure Germany is carbon-neutral by 2045. In 2023, the EU and the German government announced an agreement that will allow the 2035 zero-emissions deadline for vehicles to enter law, and as per the proposal, cars running on e-fuels mandated within the Euro 6 vehicle type will be approved. The trends forecast a heightened production of CVT variants in Germany to mitigate emissions and stay on track with the Euro 6 and Euro 7 standards.

The France continuous variable transmission market is poised to expand during the stipulated timeframe. The electrification of transportation and commitment to sustainable mobility are driving the market of France. The government has actively promoted low-emission vehicles, while consumer trends highlight a rising demand for fuel-efficient low-emission vehicles. The demand for fuel efficiency is a major factor in the growth of opportunities within the France continuous variable transmission market with lucrative segments to invest. Recent trends within the France automobile market highlight growth in hybrid and used cars. Investments in continuous variable transmission aftermarket services in France have the potential to leverage the growth exhibited by the used cars and hybrid cars segments.

Key Continuous Variable Transmission Market Players:

- JATCO Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Aisin Seiki

- Honda

- Toyota

- ZF Friedrichshafen

- BorgWarner

- Hyundai Transys

- Subaru

- Schaeffler

- Exedy Corporation

- Nissan

- Chery

- Dana Incorporated

- Panasonic

The continuous variable transmission market is exhibiting robust growth throughout the forecasted period of market analysis. The competitive market has the presence of several key players who have established significant market shares through innovation and strategic partnerships. Moreover, leading companies have been at the forefront of developing advanced CVT systems, catering to the increasing demand for fuel-efficient vehicles and smooth driving experience.

Here are some key players in the continuous variable transmission market:

Recent Developments

- In January 2025, Punch Powertrain announced a major project with a leading OEM from China for their continuously variable transmissions. The start of production is scheduled for 2025, and demand is forecasted for over 100,000 transmissions.

- In June 2024, Honda announced that the Fourth Generation Honda City had achieved a sales volume of over 0.25 million units, making it the best-selling City ever from Honda in India. The model has an all-new i-DTEC diesel engine and a new-generation CVT transmission technology.

- Report ID: 7171

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.