Continuous Integration Tools Market Outlook:

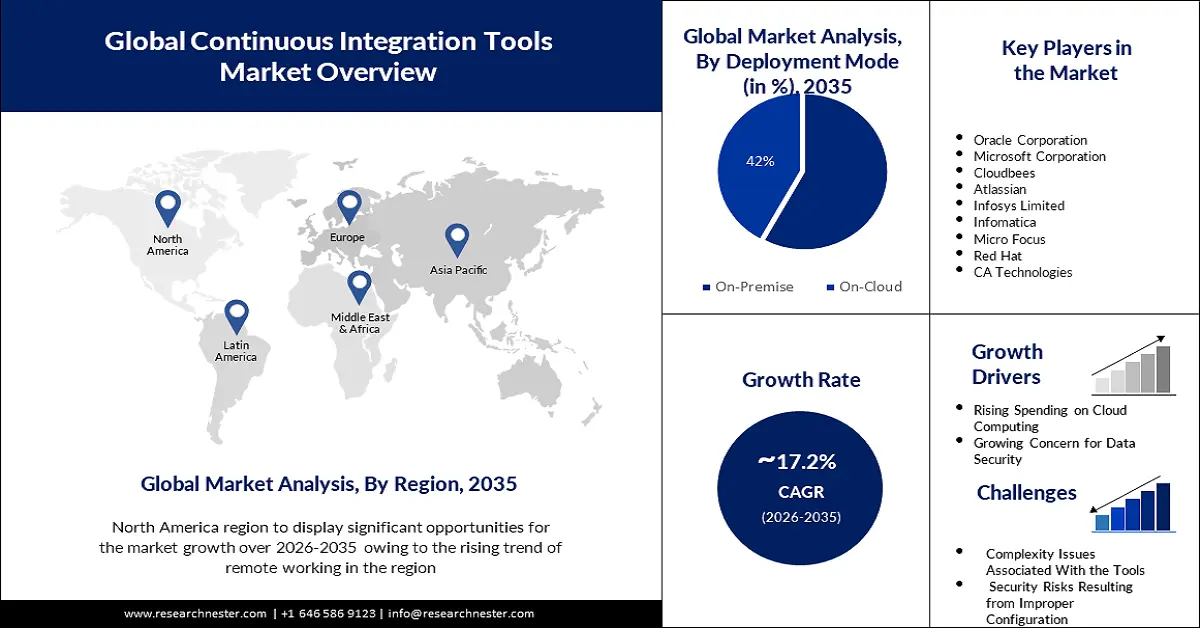

Continuous Integration Tools Market size was over USD 8.82 billion in 2025 and is anticipated to cross USD 43.13 billion by 2035, witnessing more than 17.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of continuous integration tools is assessed at USD 10.19 billion.

The reason behind the growth is impelled by the rising adoption of DevOps. Continuous integration is a best practice for DevOps and agile development and is also considered a subset of DevOps where developers regularly merge their code modifications into a common repository.

For instance, in 2021, more than 20% of software development teams used the DevOps approach to source code management, and it was found in recent research that over 80% of DevOps leaders frequently test their infrastructure for continuous integration/continuous delivery (CI/CD) in software development.

The shift towards microservices architecture are believed to fuel the market growth. In the fast-changing world of software development, continuous integration/continuous deployment microservices architecture enables to acceleration of the process of building, deploying, and testing applications and makes it easier for teams to change code and manage the complexities of multi-microservices.

Key Continuous Integration Tools Market Insights Summary:

Regional Highlights:

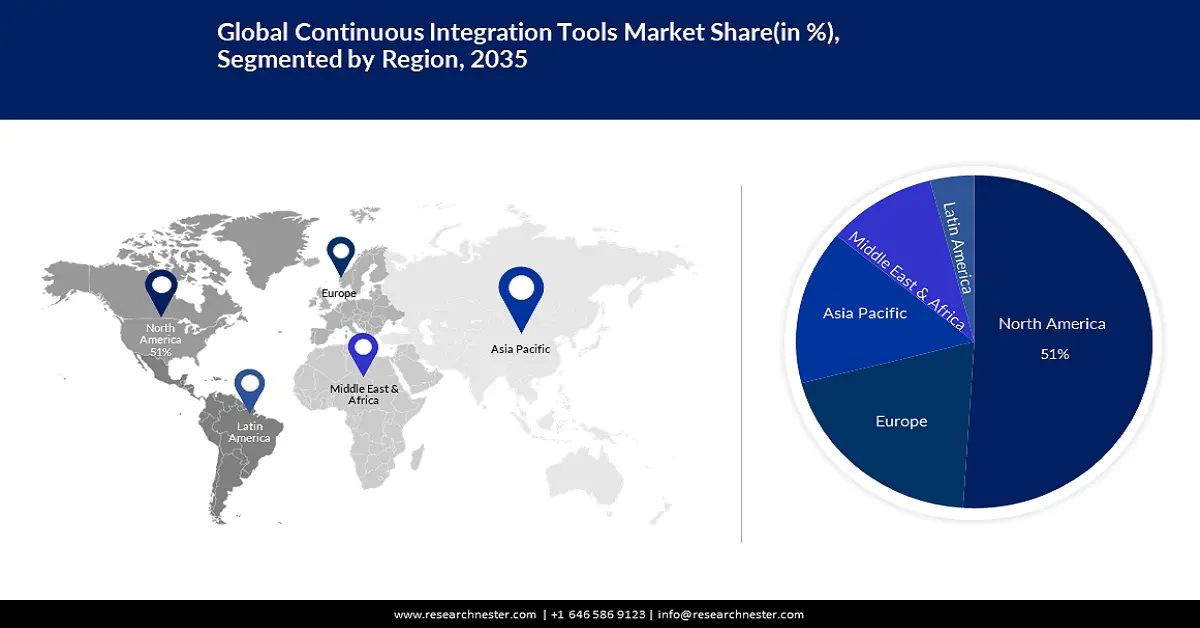

- The North America continuous integration tools market is poised to secure a 51% share by 2035, fueled by the rising trend of remote working.

- The Asia Pacific market is expected to achieve a significant revenue share by 2035, driven by a growing number of startups.

Segment Insights:

- The on-premise segment in the continuous integration tools market is anticipated to capture a 58% share by 2035, driven by the preference for customizable, lower-cost CI systems hosted onsite.

Key Growth Trends:

- Rising Spending on Cloud Computing

- Growing Concern for Data Security

Major Challenges:

- Complexity Issues Associated With the Tools

- Security Risks Resulting from Improper Configuration

Key Players: Oracle Corporation, Microsoft Corporation, Cloudbees, Atlassian, Infosys Limited, Infomatica, Micro Focus, Red Hat, CA Technologies.

Global Continuous Integration Tools Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.82 billion

- 2026 Market Size: USD 10.19 billion

- Projected Market Size: USD 43.13 billion by 2035

- Growth Forecasts: 17.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (51% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, India, Germany, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Singapore

Last updated on : 11 September, 2025

Continuous Integration Tools Market Growth Drivers and Challenges:

Growth Drivers

-

Rising Spending on Cloud Computing – Continuous integration can enable cloud services, which are frequently used in cloud-native development to automate the software development process and aid in the release and deployment of software changes across cloud providers and in SaaS enterprise applications. In 2023, global user spending on public cloud solutions exceeded USD 550 billion.

-

Growing Concern for Data Security- Continuous integration tools including Jenkins, Bamboo, GitLab, and Codeship serve as a repository for sensitive data such as platform authentications, keys, IDs, and passwords.

Challenges

-

Complexity Issues Associated With the Tools – It often gets challenging to integrate continuous integration tools with an existing software development eco-system, especially in large enterprises with legal systems. Besides this, when continuous integration pipelines consume more secrets, complexity arises, which makes it challenging to ensure a seamless transition.

-

Security Risks Resulting from Improper Configuration

-

High Setup and Maintenance Costs of Continuous Integration Infrastructure

Continuous Integration Tools Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

17.2% |

|

Base Year Market Size (2025) |

USD 8.82 billion |

|

Forecast Year Market Size (2035) |

USD 43.13 billion |

|

Regional Scope |

|

Continuous Integration Tools Market Segmentation:

Deployment Mode Segment Analysis

The on-premise segment in the continuous integration tools market is estimated to gain a robust revenue share of 58% in the coming years. On-premises continuous integrated solutions have fewer setup constraints and are preferred by the majority of continuous integration as they can be hosted on machines in data center. They can be bent and extended to meet the needs of the firm and also can be customized to perform a specific function. Furthermore, on-premise CI systems support testing frameworks with potentially lower costs as compared to on-cloud. For instance, installing platforms including Jenkins a continuous integration program that includes over 9000 plugins on on-premises servers can help in utilizing those solutions to handle the development, testing, staging, and deployment of the apps.

End-User Segment Analysis

Continuous integration tools market from the retail & e-commerce segment is set to garner a notable share shortly. Continuous integration benefits the retail industry by increasing the continuous delivery pace, ensuring that end customers in the retail sector can test as many different types of codes as they desire.

Our in-depth analysis of the global market includes the following segments:

|

Deployment Mode |

|

|

End-User |

|

|

Organization Size |

|

|

Component |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Continuous Integration Tools Market Regional Analysis:

North American Market Insights

Continuous Integration Tools market in North America is predicted to account for the largest share of 51% by 2035 impelled by the rising trend of remote working. Since the pandemic, remote work has increased around sixfold in the United States, with over 4% of Americans working remotely. This has significantly increased the importance of continuous integration tools in the region as these tools allow developers to collaborate without any requirement of physical location and help in providing immediate feedback to resolve issues quickly.

According to estimates, by 2025, more than 32 million Americans will be working remotely.

European Market Insights

The Europe continuous integration tools market is estimated to be the second largest, during the forecast timeframe led by growing software development. One of the fastest-growing industries in Europe is software development owing to reasons such as rising demand for software goods and services, and the advent of new technologies. As a result, the demand for continuous integration tools is expected to rise to optimize the software development process improve overall business operations, and allow software engineers in the region to integrate their changes in a source repository, construct the resulting software, and test its functionality.

APAC Market Insights

Also, the market in the Asia Pacific, is poised to hold significant share by the end of 2035 driven by growing number of startups. Lately, India has the world's third-largest startup environment, owing to the presence of a vibrant entrepreneurial spirit, a growing economy, and favorable government policies. Moreover, startups can benefit more from cloud-based CI/CD solutions as they include the fundamental needed functionality for a limited number of users at minimal or no cost and can produce high-quality software faster and more efficiently than ever before. This may drive the market growth in the region.

For instance, as of 2023, India had emerged as the world's third-largest startup ecosystem, with over 98,000 DPIIT-recognized startups spread across more than 650 districts.

Continuous Integration Tools Market Players:

- IBM Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Oracle Corporation

- Microsoft Corporation

- Cloudbees

- Atlassian

- Infosys Limited

- Infomatica

- Micro Focus

- Red Hat

- CA Technologies

Recent Developments

- Oracle Corporation announced to increase developer connectivity with CI/CD tools for automating software continuous integration, and allow programmers to rely on the Oracle cloud for all steps between creation and deployment. Furthermore, the company wishes to encourage developers to rely on the platform for a large portion of the security and governance of operating apps offer accounts to all members, and give them the freedom to delegate build control.

- Infosys Limited teamed up with ABN AMRO to speed up its cloud and DevOps transformation, and enable ABN AMRO Bank to fulfill its business and operational and move corporate processes to a single public cloud to increase agility and cost efficiency.

- Report ID: 5128

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Continuous Integration Tools Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.