Continuous Glucose Monitoring Devices Market Outlook:

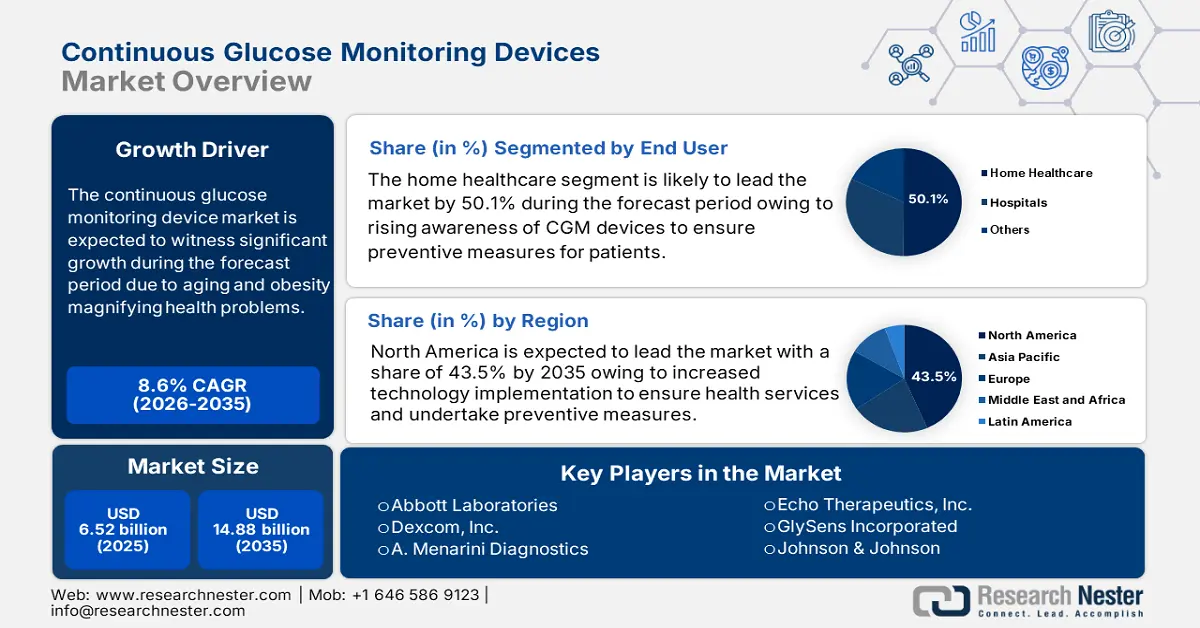

Continuous Glucose Monitoring Devices Market size was over USD 6.52 billion in 2025 and is projected to reach USD 14.88 billion by 2035, witnessing around 8.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of continuous glucose monitoring devices is evaluated at USD 7.02 billion.

Globally, the market is driven by the distressing increase in the occurrence of diabetes resulting in treatment and preventive measures requirement. According to the 2025 WHO report, nearly 830 million of the world's population suffer from diabetes, out of which the prevalence is higher among low-and middle-income nations. Another 2025 WHO report stated that over 95% of people with this disorder have type 2 diabetes, which is extremely common in adults. To combat this, early diagnosis is necessary, and blood tests and regular check-ups in consultation with healthcare personnel are probable solutions that patients can undertake, thus enhancing market growth.

Moreover, self-monitoring of blood glucose (SMBG) is another useful devices for the management of diabetes mellitus, and patients suffering from this disorder often evaluate their blood glucose to identify hypoglycemia. To make this devices affordable, the American Diabetes Association conducted a payer’s pricing analysis in June 2024 to reduce the expense of both CGM and SMBG devices. The study included the case scenario of T1D pregnancy in association with cost guidelines, NICU admission, and regular glucose finger sticks. After a thorough evaluation, the per-person cost of CGM devices was USD 12,116 and SMBG devices were USD 12,468, eventually reducing the NICU admission rates, thus driving the market growth.

CGM versus SMBG Cost for T1D Pregnancy

|

Analysis Type |

Cost Component |

Cost |

|

|

CGM |

SMBG |

||

|

Base case analysis |

CGM devices |

397,517 |

N.A. |

|

Finger stick test strips |

230,618 |

230,618 |

|

|

NICU admission |

838,068 |

1,082,043 |

|

|

Total cost per person |

USD 14,662 |

USD 13,127 |

|

|

Scenario analysis |

CGM devices |

274,702 |

N.A. |

|

Finger stick test strips |

98,836 |

164,727 |

|

|

NICU admission |

838,068 |

1,082,043 |

|

|

Total cost per person |

USD 12,116 |

USD 12,468 |

|

Source: American Diabetes Association 2024

Key Continuous Glucose Monitoring Devices Market Insights Summary:

Regional Highlights:

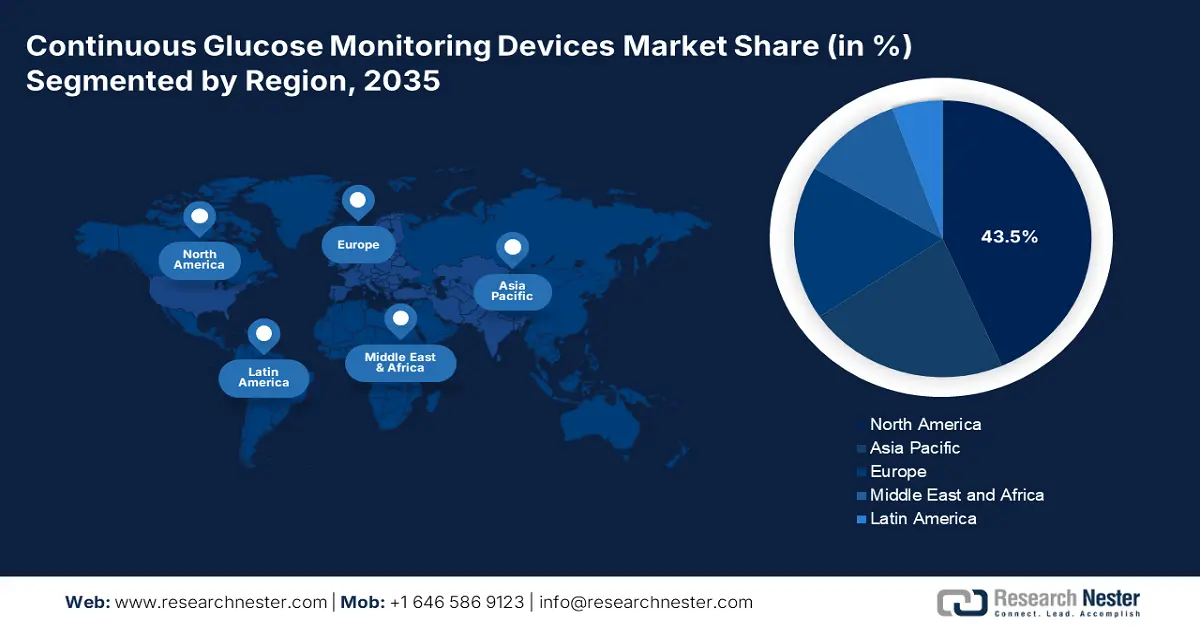

- North America holds a 43.5% share in the Continuous Glucose Monitoring Devices Market, driven by high healthcare spending, technology adoption, and obesity management, fostering growth through 2035.

- Asia Pacific's continuous glucose monitoring devices market is set for the fastest growth by 2035, fueled by WHO initiatives and diabetes treatment awareness.

Segment Insights:

- The home healthcare segment is forecasted to hold a 50.1% share by 2035 in the continuous glucose monitoring devices market, driven by rising health consciousness and hospital-at-home initiatives.

- The Sensors segment of the Continuous Glucose Monitoring Devices Market is expected to hold a 44.7% share by 2035, propelled by novel sensor technologies with high sensitivity and advanced biomedical applications.

Key Growth Trends:

- Increase in the geriatric population

- Development of healthcare services

Major Challenges:

- Overpricing of devices

- Limited reimbursement policies

- Key Players: Abbott Laboratories, Ascensia Diabetes Care, Echo Therapeutics, Inc., GlySens Incorporated, Johnson & Johns.

Global Continuous Glucose Monitoring Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.52 billion

- 2026 Market Size: USD 7.02 billion

- Projected Market Size: USD 14.88 billion by 2035

- Growth Forecasts: 8.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 13 August, 2025

Continuous Glucose Monitoring Devices Market Growth Drivers and Challenges:

Growth Drivers

-

Increase in the geriatric population: At present, the world is aging rapidly, and there has been an enhancement in the elderly population of 65 years from 5.5% to 10.3% , as reported in the 2025 UNFPA report. However, this is poised to double to 20.7% by 2074, during which the 80-year-old category people are expected to triple. Therefore, the adoption of CGM devices for this type of population caters to vigorous sharing of glucose readings with caregivers, reduction in the requirement of capillary tests, and deliberating technologic awareness of hypoglycemia, thus driving the growth of the market.

-

Development of healthcare services: Partnerships between private, public, and non-profit organizations can help countries achieve their health goals. For instance, in September 2024, WHO partnered with Multilateral Development Banks to provide €1.5 billion (USD 1.6 million) funding for the establishment of a primary health financing platform to expand health facilities in vulnerable communities to shape flexibility against pandemic threats. Hence, an optimistic growth factor for boosting the continuous glucose monitoring (CGM) devices market across all nations globally.

Challenges

- Overpricing of devices: The high annual cost of CGM devices is a huge barrier to the growth of the continuous glucose monitoring devices market since these devices are designed to be frequently updated and ensure a continuous supply of ancillary product components, as stated in the October 2021 Clinton Health Access Organization report. In addition, increased markups along the supply chain further contribute to the products’ high prices. The total yearly cost of SMBG systems in LMICs is cost-prohibitive for many, especially given the desire to utilize the devices alongside lifelong diabetes treatment, hence a barrier to market upliftment.

- Limited reimbursement policies: The coverage for therapeutic-based CGM devices is restricted, wherein patients make use of durable medical equipment (DME) to get access to glucose data. But in case patients use non-DME devices such as smartphones or tablets as the display devices, either discretely or in combination with the dedicated receiver classified as DME, the non-DME devices is non-covered. Such restrictions result in poor health scrutiny, negatively impacting reimbursement policies. Also, medicare professionals fail to cover the devices while billing, thus a restraint in the growth of the continuous glucose monitoring (CGM) devices market.

Continuous Glucose Monitoring Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.6% |

|

Base Year Market Size (2025) |

USD 6.52 billion |

|

Forecast Year Market Size (2035) |

USD 14.88 billion |

|

Regional Scope |

|

Continuous Glucose Monitoring Devices Market Segmentation:

End User (Home Healthcare, Hospitals)

Home healthcare segment is likely to dominate continuous glucose monitoring devices market share of around 50.1% by the end of 2035. An escalation in health consciousness and preventive measures are essential factors impacting the segment of the market. According to The Commonwealth Fund Organization 2025 report, hospital-at-home initiatives that allow patients to obtain critical care at home have proven operative in reducing difficulties while cutting the cost of care by more than 30%, leading to entrepreneurial efforts to endorse their use. These are conventional in England, Canada, and Israel where payment policies provide health care services in less costly venues, thus driving the market growth.

Component (Sensors, Transmitters, Receivers, Integrated Insulin Pumps)

In continuous glucose monitoring devices market, sensors segment is poised to account for revenue share of more than 44.7% by the end of 2035. As per a study conducted by Biosensors and Bioelectronics in June 2024, a novel non-enzymatic sensor has been developed for continuous glucose measurement in physiological body fluids by implementing a step-wise and amperometric method. It displays high sensitivity (13.8 μA mM−1.mm−2) and a low limit of detection (11.3 μM) in neutral pH (7.4). Also, the use of biocompatible and user-friendly quince seed mucilage as a reinforcing layer enhances its potential for biomedical applications, hence an effective contribution to market upliftment.

Our in-depth analysis of the global market includes the following segments:

|

End User |

|

|

Component |

|

|

Demographics |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Continuous Glucose Monitoring Devices Market Regional Analysis:

North America Market Analysis

North America continuous glucose monitoring devices market is likely to dominate revenue share of over 43.5% by 2035. Factors including increased disposable income, the adoption rate of the latest technologies, healthcare expenditure, and disposable income are responsible for the market growth in the region. In August 2024, Abbott declared its global partnership with Medtronic to cooperate on a united continuous glucose monitoring devices based on Abbott's most unconventional FreeStyle Libre technology that will connect with Medtronic's automated insulin delivery (AID) and smart insulin pen systems. Therefore, with such an agreement, the demand for CGM devices in the region is amplifying the market.

The U.S. continuous glucose monitoring devices market is gaining traction due to the dominance of obesity among individuals. As reported in the 2024 CDC report, this chronic disease is present in over 2 in 5 adults in the country. In addition, 58% of the adult population with the disorder suffer from high blood pressure and heart disease, and 23% are diabetic. To overcome this, in March 2024, the U.S. FDA approved the Stelo Glucose Biosensor System, a wearable sensor paired with a user’s smartphone, to continuously measure, record, analyze, and display glucose values, thereby an optimistic development of the market.

The market in Canada is witnessing significant growth since there are regional guidelines and policies to prevent cases of both high and low blood sugar levels. According to a modeling study conducted on 180,000 people in Canada by NLM in July 2022, nearly 7,400 people are prone to live with diabetic complications with the use of CGM devices, resulting in the reduction of deaths by 11,500 approximately. Likewise, over 3,400 are devoid of type 1 diabetes with a diminished death rate of 4,600. Moreover, based on the cost-effective interventions, the traditional pricing of CGM devices is USD 35,239.8 (CAD 50,000/QALY) which is expected to amplify the market growth.

APAC Market Statistics

The continuous glucose monitoring devices market in APAC is the fastest-growing region and is poised to witness lucrative growth during the forecast timeline. As per the 2025 WHO report, approximately 250 million in Southeast Asia aged over 30 years are prone to suffer from diabetes, and over half of the population is unaware of the condition. Besides, an estimated 68 million people with the condition receive treatment, and around 48,000 deaths take place in the country due to this disease. However, to overcome this, the 76th session of the WHO Regional Committee for South-East Asia endorsed the SEAHEARTS to ensure rapid CVD risk reduction and provide protocol-based management for 100 million of the population by 2025.

The market in India is expecting substantial growth since these devices provide a continuous and non-invasive way to detect glucose levels, making it an appropriate option for patients with diabetes. As per the November 2024 NLM report, the prevalence rate of diabetes in tribal India is 19.8%, out of which only 9.2% of the population regularly ensures the evaluation of their blood sugar levels. To overcome this, the successful implementation of CGM devices depends upon infrastructural, educational, policy-related, and cultural aspects, thereby an effective initiative to hinder the growth of the market in the tribal region of the country.

The continuous glucose monitoring devices market in China is gaining exposure owing to heightened mindfulness and acceptance of CGM technology, strong government support, and policy initiatives. The national regulator of medical devices and IVDs is the National Medical Product Administration of China to revise its prime medical devices legislation, as stated in the October 2021 Health Action International Organization report. Besides, in a cross-sectional study conducted on 83 head nurses by NLM in February 2023, 60.2% of patients were unaware of CGM devices which can be overcomed by effective promotions through insurance coverage, training sessions, and development of a standardized management system.

Key Continuous Glucose Monitoring Devices Market Players:

- Abbott Laboratories

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ascensia Diabetes Care

- Echo Therapeutics, Inc.

- GlySens Incorporated

- Johnson & Johnson

- Medtronic plc

- Senseonics Holdings, Inc.

- F. Hoffmann-La Roche Ltd

- Nemaura Medical, Inc.

- Ypsomed

Companies dominating the market are gaining rapid exposure due to the growing need for point-of-care treatments, technological advancements, and an increase in the adoption of wearable devices. All these factors assist in the continuous assessment of blood glucose levels. For instance, in August 2023, Nemaura Medical, Inc. revealed the SFDA approval of sugarBEAT®, its non-invasive wearable glucose sensor. Additionally, the organization has launched a beta trial of Miboko, using a non-invasive glucose sensor and an AI mobile application to evaluate lifestyle habits, thus a positive outlook for market development.

Recent Developments

- In October 2024, Ascensia Diabetes Care proclaimed the launch of the Eversense® 365 continuous glucose monitoring system for patients with diabetes in the U.S. This devices has been developed by Senseonics Holdings, Inc. that provides a year of precise monitoring with nominal interruptions, allowing assured decisions, long-term peace of mind, and improved quality of life.

- In August 2024, Medtronic plc reported the U.S. FDA approval of its Simplera™ continuous glucose monitor, the organization's first disposable, all-in-one CGM that's half the size of previous Medtronic CGMs. The devices is a simplified one with discreet insertion and wear experience that diminishes the requirement for overtape.

- Report ID: 7195

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Continuous Glucose Monitoring Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.