Consumer Genomics Market Outlook:

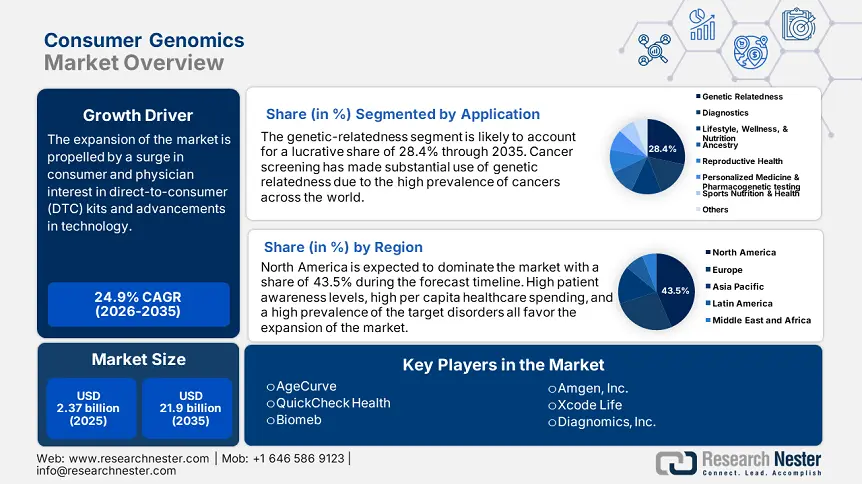

Consumer Genomics Market size was over USD 2.37 billion in 2025 and is poised to exceed USD 21.9 billion by 2035, witnessing over 24.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of consumer genomics is estimated at USD 2.9 billion.

The market is developing through ushering due to a major revolution in personal healthcare spending and awareness and the maximization of well-being. For instance, in December 2024, the Centers for Medicare & Medicaid Services unveiled the data representing an increase of 7.5% in NHE (USD 4.9 trillion) in 2023, or USD 14,570 per person accounting for 17.6% of the U.S. GDP. In addition, spending on Medicare increased by 8.1% to USD 1,029.8 billion in 2023, or 21% of the entire NHE. Moreover, spending on Medicaid increased 7.9% to USD 871.7 billion in 2023, or 18% of total NHE. In 2023, private health insurance spending increased by 11.5% to USD 1,464.6 billion, or 30% of total NHE.

Furthermore, customers are increasingly drawn to genomic test services for information about inherited traits, disease susceptibility, and treatment response. For instance, in April 2023, it was stated by the National Library of Medicine that as of November 2022, a total of 129,624 genetic tests including updated versions of pre-existing tests had been made available and submitted to the genetic testing registry in the United States and 197,779 worldwide. This transformation is attributed to the cost that is coming down and the availability increasing due to emerging technologies in sequencing hardware and bioinformatics.

The growing awareness of the potential of personalized medicine, in which treatment is tailored based on a patient's genetic composition to improve efficacy and outcomes, is another factor propelling this movement. Furthermore, artificial intelligence within genomic analysis allows for better interpretation of data, providing enhanced, more useful health information. In addition, the emergence of direct-to-consumer testing businesses is turning the tide, inviting an activated model of medical care, and raising ethical concerns about data protection and genetic discrimination. Hence, the market will experience a shift in how preventive health plans are being designed, so people can master their health journey through their genetics.

Key Consumer Genomics Market Insights Summary:

Regional Highlights:

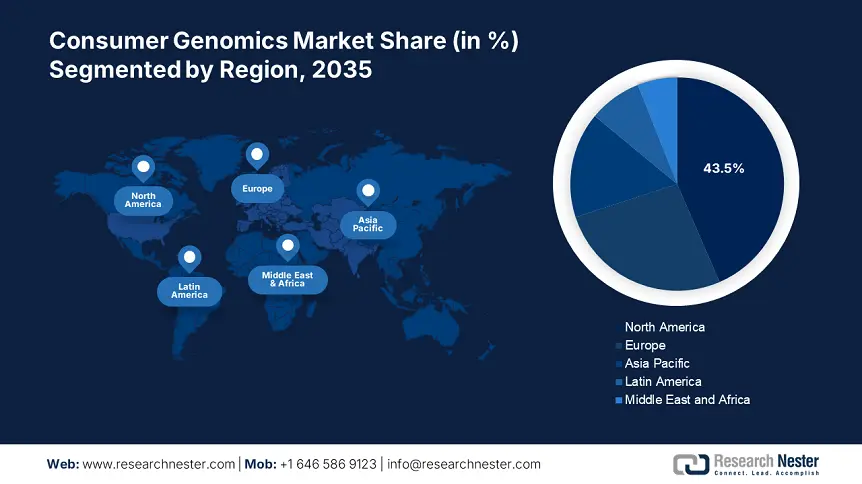

- North America leads the Consumer Genomics Market with a 43.5% share, propelled by increased global investment in biotechnology proving clinical and analytical validity and utility, solidifying its dominance through 2026–2035.

Segment Insights:

- The Genetic Relatedness segment is forecasted to achieve over 28.4% market share by 2035, driven by the expansion of direct-to-consumer genetic tests providing ancestral and familial insights.

Key Growth Trends:

- Expansion of digital health ecosystem

- Breakthroughs in genomic technologies

Major Challenges:

- Market saturation and competition

- Consumer understanding and misinterpretation

- Key Players: Toolbox Genomics, SomaLogic, Inc., Inui Health (formerly Scanadu), AgeCurve, QuickCheck Health, Biomeb, and more.

Global Consumer Genomics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.37 billion

- 2026 Market Size: USD 2.9 billion

- Projected Market Size: USD 21.9 billion by 2035

- Growth Forecasts: 24.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43.5% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, Canada, United Kingdom, Germany, Japan

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 12 August, 2025

Consumer Genomics Market Growth Drivers and Challenges:

Growth Drivers

- Expansion of digital health ecosystem: The growth of the digital health ecosystem in the consumer genomics market is largely fueled by combining genomic information with next-generation digital health technologies, offering a more comprehensive style of managing personal health. For instance, in September 2024, Neuberg Diagnostics introduced ‘Geniee - Decode your DNA’, a new personalized genomics platform. Through Geniee company entered the genetic testing and personalized medicine space with this initiative. With the real-time integration of health data and genomic data, the digital health platform empowers individuals to be aided by informed life choices and self-participation in their wellness path.

- Breakthroughs in genomic technologies: The innovations in genomic technologies have impacted the market vastly, especially via the introduction of next-generation sequencing (NGS) and substantial lowering of cost and timelines involving the genomic assessment. For instance, in January 2025, Tempus AI, Inc. revealed that it created xH, the first whole-genome sequencing test. This test included whole-genome sequencing (WGS) as a platform that helped physicians identify all variants that are clinically relevant and will advance personalized therapy, particularly in hematological oncology.

Challenges

- Market saturation and competition: The consumer-to-direct business in the consumer genomics market is experiencing huge saturation and heightened competition, spurted out predominantly by the boom of DTC genetic testing firms into the marketplace. It becomes more challenging to compete with multiple operators vying for market share, which forces businesses to constantly develop their customer service and engagement. To better convey the value proposition of products and to impose pressure on price methods, businesses are forced to invest in advertising and training in this type of competitive market. Therefore, an organization's capacity to innovate and adjust to the requirements of its customers is essential to sustain competition in this fast-paced world.

- Consumer understanding and misinterpretation: In the consumer genomics market, the issue of consumer interpretation and misinterpretation of genetic information is most pressing due to the inherent nature of genomic data complexity and health implications. Consumers lack the basic knowledge to properly interpret the results of genetic tests, potentially causing health status and risk misinterpretation. This lack of information can increase fear or cause uninformed health choices, ultimately diminishing the value of the genomic information desired. The industry, thus has a compelling imperative to create plain, simple-to-read educational materials and full genetic counseling services to empower consumers.

Consumer Genomics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

24.9% |

|

Base Year Market Size (2025) |

USD 2.37 billion |

|

Forecast Year Market Size (2035) |

USD 21.9 billion |

|

Regional Scope |

|

Consumer Genomics Market Segmentation:

Application (Genetic Relatedness, Diagnostics, Lifestyle, Wellness, & Nutrition, Ancestry, Reproductive Health, Personalized Medicine & Pharmacogenetic testing, Sports Nutrition & Health)

The genetic-relatedness segment is anticipated to dominate consumer genomics market share of over 28.4% by 2035. The expansion of direct-to-consumer genetic tests that provide information on ancestral origins and ethnic composition brought massive numbers of people who made them discover their ancestry and link with distant relatives. For instance, in November 2023, Myriad Genetics, Inc. and Personalis, Inc. announced a non-exclusive partnership. Through this strategic partnership, Myriad made the MyRisk Hereditary Cancer Test, BRACAnalysis CDx, and MyChoice CDx Cancer Test easily available for people to access. Focus on genetic interrelatedness, therefore, is a compelling marketplace in grounding consumer interest and creating demand for gene-driven information that respects individual and family heritages.

Our in-depth analysis of the global market includes the following segments:

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Consumer Genomics Market Regional Analysis:

North America Market Statistics

North America consumer genomics market is expected to dominate revenue share of around 43.5% by the end of 2035. It is one of the significant examples of non-traditional and medical applications that have replaced more personal utility-focused healthcare applications. Consequently, it leads to an increased global investment in the biotechnology sector as it is essential for proving clinical and analytical validity and utility.

The U.S. market is growing exponentially owing to the strategic collaborations between companies to emerge as prominent healthcare solution providers using expertise in genomic health. For instance, in March 2024, Nucleus Genomics and Illumina collaborated to expand their goal of using WGS to create a more proactive healthcare system that gives people more agency. Following an exponential decline in genome sequencing costs, this initiative advanced its efforts to make WGS broadly accessible to the general public.

The Canada market is likely to witness substantial growth during the forecast period supported by the robust regulatory framework and its financial assistance. For instance, in February 2025, the Parliamentary Secretary to the Minister of Health and Member of Parliament for Ottawa Centre unveiled the Canadian Genomics Strategy. This strategy is supported by a USD 175.1 million federal investment spread over seven years, beginning in 2024–2025. This investment will make it easier for Canada to turn genomics research into practical uses in the advancement of personalized medicine, cutting-edge diagnostics, and innovative treatments.

Asia Pacific Market Analysis

The Asia Pacific consumer genomics market is predominantly driven by the growing knowledge of DTC genetics along with the planning and execution of research projects. This region shows significant growth potential attributable to the arrival of new competitors. Furthermore, governmental bodies, other medical agencies, and systems are actively involved in educating medical professionals to stay well-informed of the swift developments in molecular genetics. Hence, the market is likely to flourish in the stipulated timeframe within the growing economies of the region.

The market in India is witnessing lucrative growth opportunities owing to the facilities and services expansion to deliver state-of-the-art healthcare solutions in the genomics segment. For instance, in September 2024, Illumina announced the creation of a Global Capability Center in Bengaluru at the Illumina India Genomics Summit. This aimed to assist India in improving healthcare and halting the effects of climate change that leads to an increase the burden of genomics diseases. Additionally, this helped the country to cater to public health diorders with the implementation of genomics, thus a positive contribution for the market growth.

The consumer genomics market in China is experiencing fast-paced growth and receiving accreditations for its revolutionary contributions to genomic sectors. For instance, in July 2023, at the 44th Telly Awards, the Oscars of the American TV industry, "China Next: The Future Seen from the Greater Bay Area" won the coveted gold award in the TV category. Lewis Lusuwi, a BGI Genomics automation engineer, demonstrated how genetic testing technology advances precision medicine in this gripping documentary to educate and support the future of precision medicine.

Key Consumer Genomics Market Players:

- Color Genomics, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ancestry

- Gene By Gene, Ltd.

- 23andMe, Inc.

- Myriad Genetics, Inc.

- Mapmygenome

- Positive Biosciences, Ltd.

- Futura Genetics

- Helix OpCo LLC

- MyHeritage Ltd.

- Pathway Genomics

- Amgen, Inc.

- Xcode Life

- Diagnomics, Inc.

- Toolbox Genomics

- SomaLogic, Inc.

- Inui Health (formerly Scanadu)

- AgeCurve

- QuickCheck Health

- Biomeb

The competitive landscape in the consumer genomics market is controlled by a broad array of players, ranging from incumbent biotech firms to new entrants, which vie for a share of the increasing interest in genetic testing services. In addition, acquisitions between these companies inspire rapid innovation and technological advancement to fulfill customer demands for accuracy, anonymity, and visibility in the field of genomic testing. For instance, in July 2024, Fluent BioSciences was acquired by Illumina, Inc. The integration of Fluent BioSciences into Illumina aimed to enhance the multiomics growth strategy and offer its clients important new capabilities in a critical genomic growth area.

Here's the list of some key players:

Recent Developments

- In May 2024, SOPHiA GENETICS announced a collaboration with Microsoft and NVIDIA, leveraging their technologies and expertise in genomics. It offered medical institutions affordable and user-friendly whole genome sequencing (WGS) screening solutions.

- In November 2022, Arima Genomics, Inc. announced a new partnership with Basepair to provide researchers with new options for bioinformatic analysis of 3D genomic data.

- Report ID: 7278

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Consumer Genomics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.