Construction Generator Sets Market Outlook:

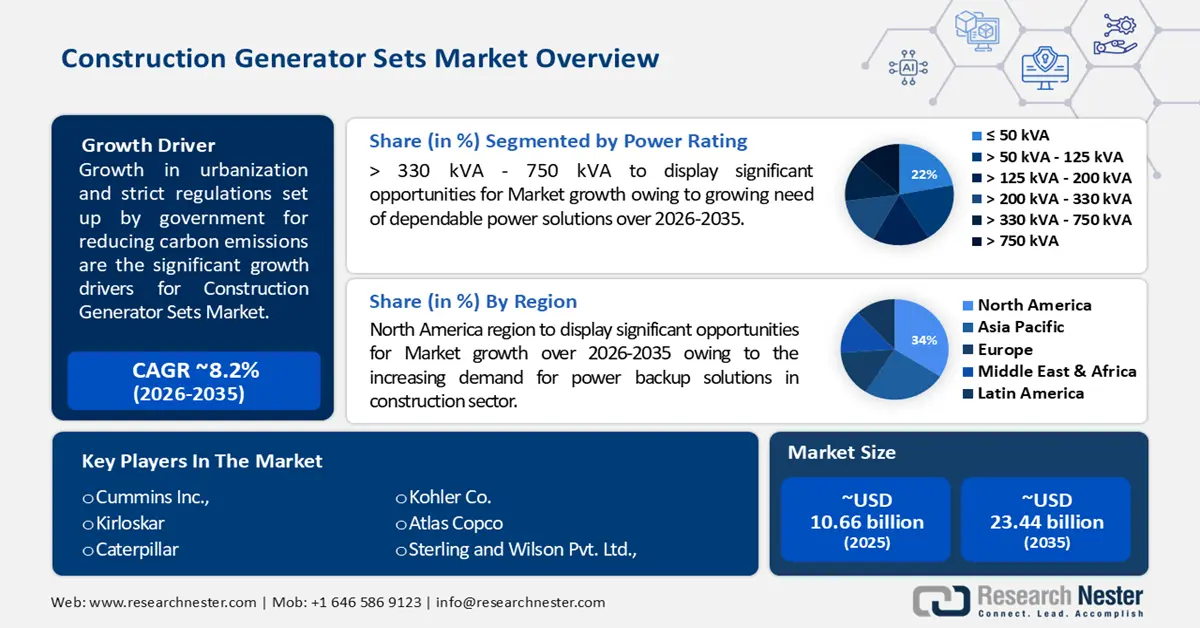

Construction Generator Sets Market size was over USD 10.66 billion in 2025 and is anticipated to cross USD 23.44 billion by 2035, witnessing more than 8.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of construction generator sets is assessed at USD 11.45 billion.

Growth in investments made in the real estate sector is fueling the market growth. As per the latest report, domestic investors' shares increased to an estimated value of 35% in 2023 from 14% in 2022. The total amount of commercial real estate shares was 1.4 trillion USD in 2022.

The main advantage of construction generator sets is their reliability and flexibility, which have a significant positive impact on the market growth. These systems can work on different ranges of fuels such as diesel, natural gas, and propane, which makes them fit for a wide range of industries and scenarios. It’s also used as a backup power, majorly for remote construction sites.

Key Construction Generator Sets Market Insights Summary:

Regional Highlights:

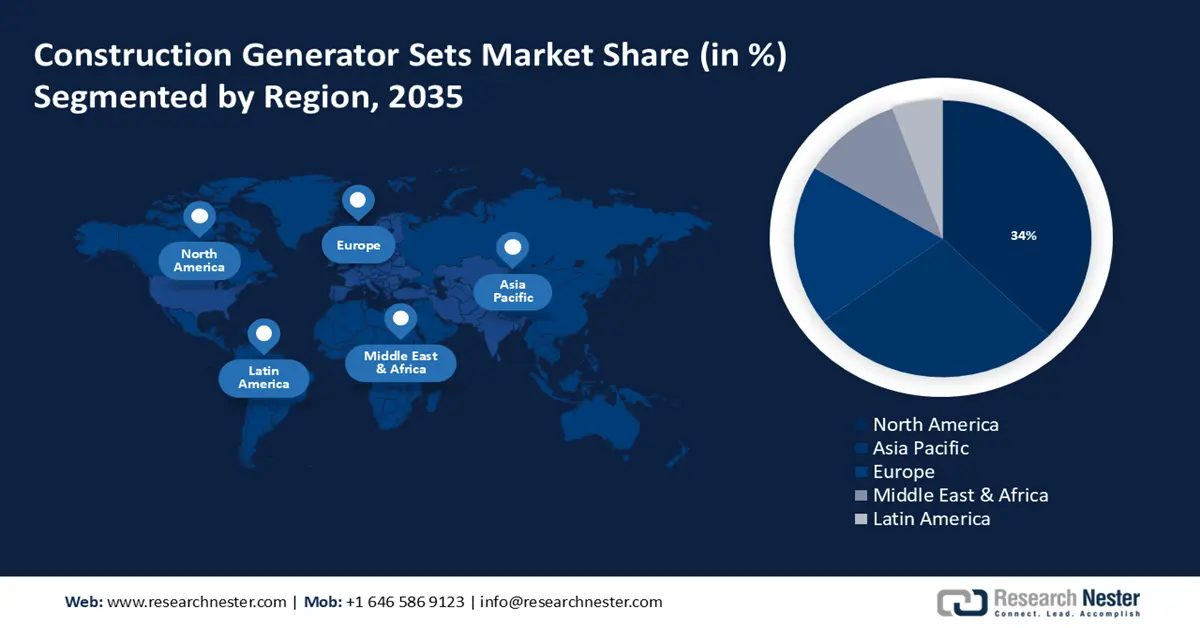

- North America construction generator sets market will hold more than 34% share by 2035, driven by increasing demand for power backup solutions in the construction sector, supported by technological advancements for cleaner and more efficient generator sets.

- Asia Pacific market will achieve a 25% share by 2035, fueled by rapid growth in infrastructural development, particularly in China and India, increasing demand for construction generator sets.

Segment Insights:

- The gas generated segment in the construction generator sets market is expected to capture a 55% share by 2035, attributed to the rising demand for energy efficiency and clean energy solutions in remote locations.

- The >330 kva - 750 kva segment in the construction generator sets market is projected to achieve a 22% share by 2035, influenced by the increasing need for dependable power solutions due to the growing number of construction projects.

Key Growth Trends:

- Strict Regulations to Lower Carbon Emission

- Growth in Urbanization and Population Density

Major Challenges:

- Strict Regulations to Lower Carbon Emission

- Growth in Urbanization and Population Density

Key Players: Deere & Company, Cummins Inc., Kirloskar, Caterpillar, Kohler Co., Atlas Copco, Powerica Limited, Sterling and Wilson Pvt. Ltd., Rapid Power Generation Ltd., Yamaha Motors Co., Ltd..

Global Construction Generator Sets Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.66 billion

- 2026 Market Size: USD 11.45 billion

- Projected Market Size: USD 23.44 billion by 2035

- Growth Forecasts: 8.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 16 September, 2025

Construction Generator Sets Market Growth Drivers and Challenges:

Growth Drivers

- Strict Regulations to Lower Carbon Emission-The government has laid strict policies whose main focus is to limit the production of carbon emissions as the demand for portable gen-sets is increasing progressively resulting in the construction generator sets market growth of construction generator sets. These systems act as a significant part in ensuring a well-grounded and compatible power supply in construction environments, which contributes to the productivity and efficiency of several infrastructural projects. According to a recent report published in 2022, the annual carbon emissions from both diesel and PMS-operated electricity generators were estimated. These emissions were recorded to be around 1500 tons of CO2 per annum with the institution’s diesel generators accounting for 59%.

- Growth in Urbanization and Population Density-As the population is growing gradually, combined with the expansion of commercial and retail spaces will fuel the construction generator sets market growth of construction generator sets. Generators are very important for backup power during electrical failure and to make sure that the operations run smoothly without any interruptions. Moreover, the boost in the hospital industry and increasing focus on the production of green buildings are anticipated to further contribute to the growing momentum in this sector. As per the recent report published by the World Bank, more than 5o% of the population lives in urban areas globally and it will increase by 1.5 times to 6 billion by 2045. The adoption of generator sets by the urban population is rising to meet their growing needs.

Challenges

- High Maintenance of Generator Sets- The operation and maintenance of construction generator sets need more technical expertise, which can act as a challenge in areas having limited access to skilled personnel. Ensuring the safe and efficient operation of these systems requires huge investments in training programs and local capacity building.

- Diesel-operated generator sets harm the surroundings badly, the environmental impact related to the generator sets is a high rate of carbon production from diesel-powered generators. These gensets contribute to air pollution and change in climatic conditions.

Construction Generator Sets Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.2% |

|

Base Year Market Size (2025) |

USD 10.66 billion |

|

Forecast Year Market Size (2035) |

USD 23.44 billion |

|

Regional Scope |

|

Construction Generator Sets Market Segmentation:

Power Rating Segment Analysis

The > 330 kVA - 750 kVA segment is predicted to account for 22% share of the global construction generator sets market by 2035. The segment growth can be attributed to the growing need for dependable power solutions, incorporated with an increasing number of construction sites and projects on infrastructural development. As per the recent report, heavy-duty generators are usually operated in construction activities which provides power output in the range from 200KW TO 2500 KW.

Fuel Segment Analysis

The gas generated segment is predicted to account for 55% share of the global construction generator sets market by 2035. The segment growth can be attributed to the growing focus on energy efficiency and pocket-friendly is shifting consumers towards a clean energy solution. Moreover, decentralized power generation is getting popular mainly in remote locations is a key factor fueling the construction generator set market. The natural gas-operated generators offer a range from 995 KWe to 2000 KWe.

Our in-depth analysis of the global market includes the following segments:

|

Power Rating |

|

|

Fuel |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Construction Generator Sets Market Regional Analysis:

North America Market Insights

North America industry is poised to account for largest revenue share of 34% by 2035. The market growth in the region is also expected on account of increasing demand for power backup solutions in the construction sector and harsh environments, which can be operated in extreme weather conditions such as hurricanes and winter storms. These generator sets are set to create an environment that has positive impacts on the business. Moreover, technological advancements will contribute to the market growth as the rising adoption of cleaner and more efficient power sets is growing. According to a recent report published in 2022, the construction sector has remained fairly steady at 4.1% in the US and 7.4% in Canada. The healthcare sector is witnessing rapid growth in the adoption of these generator sets focusing on lower emissions, cost-effectiveness and continuous availability of sets is propelling the deployment of construction generator set units.

APAC Market Insights

The Asia Pacific market is estimated to be the second largest, registering a share of about 25% by the end of 2035. The market’s expansion can be attributed majorly to the rapid growth in infrastructural development. China is the leading producer of generator sets market in the Asia-Pacific region. As per the recent report published in January 2019, road-related construction projects in Asia-Pacific are growing with a total value of USD 2 trillion. Out of this amount, around USD 800 billion is in the execution stage and USD 300 billion is in the planning stage. China accounts for the highest value with USD 632 billion, followed by India with projects valuing USD 218 billion. As the infrastructural projects are growing with expansion in power demand-supply gap across the country resulting in demand for construction generator sets. Moreover, generators operated by using diesel as a fuel are benefitting the country as they are cost-effective and the living standard is improving leading to the demand for power backup devices.

Construction Generator Sets Market Players:

- Deere & Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cummins Inc.,

- Kirloskar

- Caterpillar

- Kohler Co.

- Atlas Copco

- Powerica Limited

- Sterling and Wilson Pvt. Ltd.

- Rapid Power Generation Ltd.

- Yamaha Motors Co., Ltd.

Recent Developments

- Yamaha Motor Co., Ltd. has announced today that the company has produced a total of three-million of the Yamaha Performance Damper*, which is an anti-vibration damper used in automobiles and its manufacturing was started in 2004. It is a device which was designed to control and absorb minute distortions and vibrations produced which contributed in improving stability and comfort in different variety of vehicle types. After the development of basic concept in 2000, it was firstly adopted as a mass-produced product in April 2004, and the total number has now reached is three million.

- Kirloskar Oil Engines, leading producer of power generators has announced the official launch of its gas-powered generator range. It has always been focused on sustainable development and solutions as per customer’s requirement. As the concern for sustainability and availability of gas has grown, industry segments were looking to them as leaders of backup power solutions providers to create alternative fuel-based Genset options. These IoT-enabled gas generators run very efficiently in extreme cold conditions on PNG and they also offered feature of digital monitoring system that gives users to remotely monitor the generator’s performance and important parameters in real-time from any location.

- Report ID: 5951

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Construction Generator Sets Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.