Construction Equipment Rental Market Outlook:

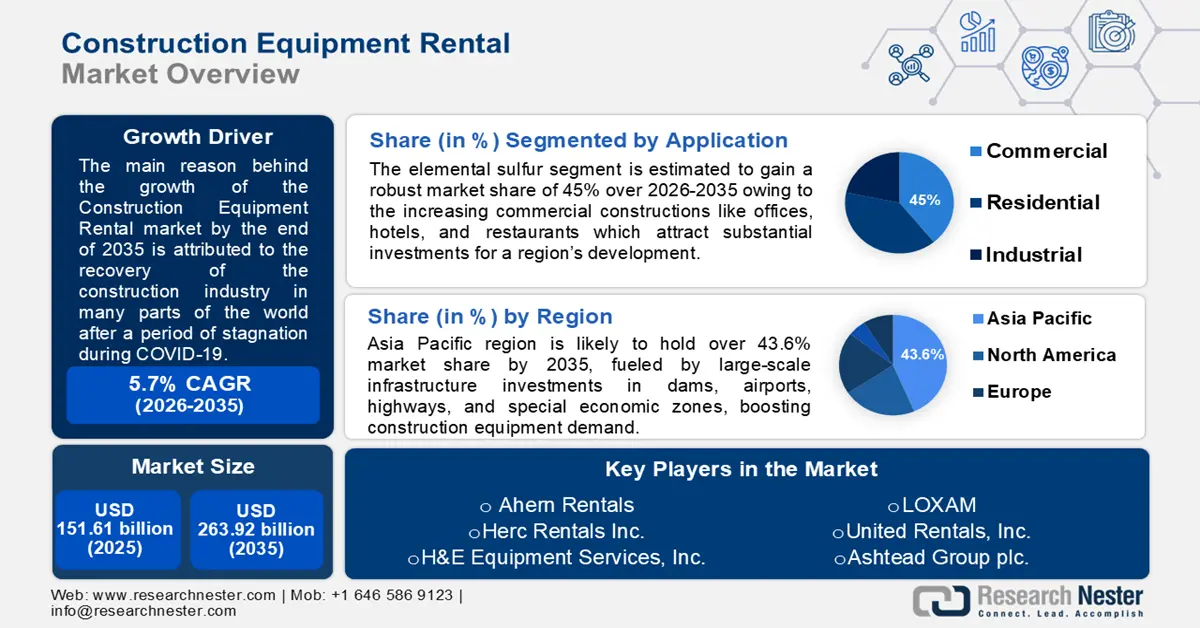

Construction Equipment Rental Market size was over USD 151.61 billion in 2025 and is projected to reach USD 263.92 billion by 2035, witnessing around 5.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of construction equipment rental is evaluated at USD 159.39 billion.

The growth of the market can be attributed to the recovery of the construction industry in many parts of the world after a period of stagnation during COVID-19. For instance, construction activities in Latin America have been predicted to show an average growth of about 4% from 2020-2023. Further, the South and South-East Asian regions have been projected to show remarkable growth in the construction industry by the end of 2023.

Another factor that is expected to lead to market growth is the increasing rental penetration in some parts of the world. For instance, the share of the construction equipment in India which was rented constituted only about 48% in 2010. In 2020, this proportion of machines had risen to 68%. However, the rental business penetration was still very locally-focused in 2020. It is estimated that more than 44,999 units of the machine were sold in the rental business in India in 2021. Similarly, the regions with low or marginal rental penetration compared to others indicate opportunities for further growth of the market.

Key Construction Equipment Rental Market Insights Summary:

Regional Highlights:

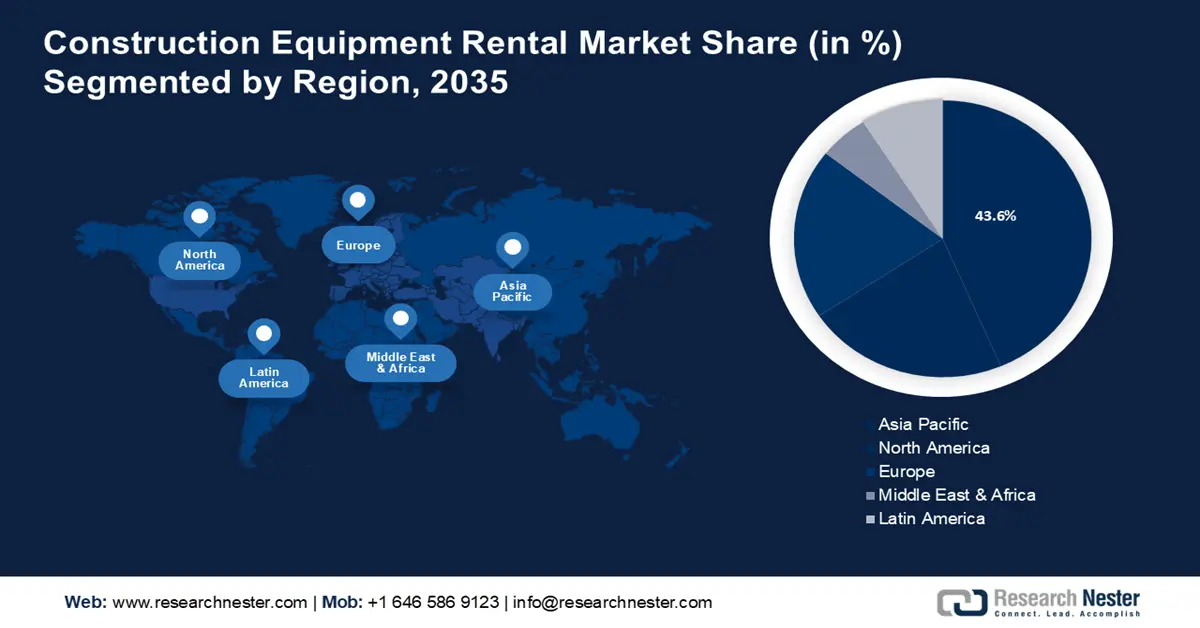

- Asia Pacific construction equipment rental market is predicted to capture 43.6% share by 2035, fueled by large-scale infrastructure investments in dams, airports, highways, and special economic zones, boosting construction equipment demand.

- North America market will exhibit remarkable growth during the forecast timeline, attributed to extensive construction activities in Canada, housing development, and increased use of specialized mining and construction equipment.

Segment Insights:

- The earth moving machinery segment in the construction equipment rental market is projected to hold a 56% share by 2035, attributed to government infrastructure projects and increased urbanization and industrialization.

- The commercial segment in the construction equipment rental market is forecasted to capture a significant share by 2035, driven by growing commercial construction needs like offices, hotels, and shops.

Key Growth Trends:

- High Infrastructure Development Investments

- Large-scale Implementation of Infrastructure Development Programs

Major Challenges:

- Adverse Effects of Economic Recession on the Construction Industry

- Shortage of Labor Who are Skilled to Use the Equipment

Key Players: Ahern Rentals, Herc Rentals Inc., H&E Equipment Services, Inc., LOXAM, United Rentals, Inc., Ashtead Group plc., Caterpillar, Sumitomo Corporation., Hitachi Construction Machinery Co., Ltd., Liebherr-IT Services GmbH.

Global Construction Equipment Rental Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 151.61 billion

- 2026 Market Size: USD 159.39 billion

- Projected Market Size: USD 263.92 billion by 2035

- Growth Forecasts: 5.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (43.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 10 September, 2025

Construction Equipment Rental Market Growth Drivers and Challenges:

Growth Drivers

- High Infrastructure Development Investments - Infrastructure development helps a nation in multiple ways. It helps enhance the manufacturing competitiveness of the nation. High manufacturing competitiveness is expected to bring in more investment, create more jobs, and thus boost growth in several sectors, which are the building blocks of the country's economy. For instance, the government of India announced a raise in capital expenditure for infrastructure development in 2023-24 to an amount equivalent to USD 122 billion in its Union Budget 2023. This raise also included the highest to date outlay for railroads, which amounts to USD 29 billion

- Large-scale Implementation of Infrastructure Development Programs - The large-scale implementation of infrastructure programs aims to connect different parts of the world, open new trade routes, and simplify international trade. One such initiative is the Belt and Road Initiative by China. This initiative aims to accelerate economic growth across central and eastern Europe, Asia Pacific, and Africa by addressing the infrastructure gap between these regions. As of July 2022, up to 150 countries had officially agreed to join the Belt and Road Initiative (BRI) by China. Further, as per predictions by experts, China should spend up to USD 9 trillion over the life of the BRI.

-

Growth of Residential Construction Projects in Developed Nations - The market for rental construction equipment is expected to witness growth as a result of the flourishing of residential construction activities in the United States (U.S.) and Europe. For instance, the university town of Tucson in Arizona boasted the construction of over 1499 conventional apartments in 2021. Similarly, about 2,486 square feet was the average size of a house built for sale for a single-family in the United States (U.S.) in 2021.

-

Growth of the Mining Industry in Developing Nations in MEA and Latin America - It is estimated that Africa should have more than 210 mining and infrastructure projects in the energy and power sector by 2030. Equally worth mentioning is the presence of Chile and Peru, two of the world's largest producers of copper in the Latin American region. It is estimated that Chile alone held 29% of copper produced globally in 2020.

Challenges

- Adverse Effects of Economic Recession on the Construction Industry - Construction, just similar to many other industries, is one of the most badly hit during an economic slowdown. With the safety protocols during the pandemic, the construction industry struggled poorly, with a shortage in financing, labor, and supply of raw materials. For instance, construction products in the European Union (EU) faced an unprecedented decline of about -26% during March and April of 2020.

- Shortage of Labor Who are Skilled to Use the Equipment

- Fewer Opportunities for Market Growth as a Result of High Rental Penetration

Construction Equipment Rental Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.7% |

|

Base Year Market Size (2025) |

USD 151.61 billion |

|

Forecast Year Market Size (2035) |

USD 263.92 billion |

|

Regional Scope |

|

Construction Equipment Rental Market Segmentation:

Application Segment Analysis

The commercial segment is expected to garner a significant share by the end of 2035. Commercial construction, such as offices, hotels, and restaurants is a great means to attract substantial investments for a region's development. It is estimated that globally, the floor space of commercial buildings should grow to 125 billion square feet by 2050. The figure reflects the growth of up to 36% from that of 2021. The rising interest rates for single-family buildings are thought to indirectly contribute to the surge in the number of construction activities involving commercial property. There is also a great demand for building space for offices and shops in many parts of the world. This requirement for buildings and space for commercial purposes is also expected to lead to a high demand for construction equipment for rent.

Product Type Segment Analysis

The earth moving machinery segment is estimated to gain the largest construction equipment rental market share of 56% over the projected time frame. The increased undertaking of commercial and residential construction projects by various governments is expected to encourage contractors and firms to lease earthmoving equipment. As the increase in construction projects are the result of the growing industrialization and urbanization of a region, these aspects are expected to contribute to market growth indirectly. According to the World Bank, the urban population comprised 56% of the total world population in 2019. Quarrying and mining activities are expected to make use of earthmoving equipment the most. Some mostly used earthmoving equipment include backhoe loaders, mini excavators, crawler excavators, and skid-steer loaders.

Our in-depth analysis of the global market includes the following segments:

|

By Product Type |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Construction Equipment Rental Market Regional Analysis:

APAC Market Insights

Asia Pacific region is likely to hold over 43.6% market share by 2035, fueled by large-scale infrastructure investments in dams, airports, highways, and special economic zones, boosting construction equipment demand. Further, a substantial portion of this sum is to be spent on the region's new greenfield airports. This initiative mainly intend to improve the overall economy of the region by boosting trade and connectivity. However, these extensive initiatives are expected to attract the leaders in the construction equipment rental business to set up their company or invest in the expansion of their company to this region, thus leading to regional market growth.

North American Market Insights

North America is another region that should exhibit remarkable growth in the construction equipment rental market by 2035. One of the major reasons for the growth of the regional market growth is the extensive construction activities that are undertaken by Canada. The number of immigrants to Canada has increased considerably in recent years. The increase in the number of immigrants is attracting significant investment from the regional government for the development of construction infrastructure to address the changing demands of both the immigrants and the citizens. Further, emphasis is being laid on the use of specialized equipment to optimize the mining and construction activities in the region, and this is expected to create opportunities for market growth.

Europe Market Insights

Europe is also expected to hold a significant share of the global market by the end of 2035. The demand for residential buildings in Europe region is climbing. The climbing demand is, in turn, helping the recovery of the construction industry in the region. Further, many initiatives are being undertaken by the regional governments to improve the infrastructure. All these are encouraging businesses in the construction industry to enter into partnerships with service enterprises in consulting firms, design, and equipment rental. Such partnerships should contribute to the growth of the regional market for construction equipment rental during the forecast period considerably.

Construction Equipment Rental Market Players:

- Ahern Rentals

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Herc Rentals Inc.

- H&E Equipment Services, Inc.

- LOXAM

- United Rentals, Inc.

- Ashtead Group plc..

- Caterpillar

- Sumitomo Corporation.

- Hitachi Construction Machinery Co., Ltd.

- Liebherr-IT Services GmbH

Recent Developments

-

LOXAM announced acquiring HR – ALUGUER DE EQUIPAMENTOS S.A. The company added that through the acquisition, it aims to consolidate its presence in the equipment rental market in Portuguese. With the latest acquisition, Loxam has completed its network of 6 branches in Portuguese. HR operated 3 branches with about 40 employees in the country.

-

H&E Equipment Services, Inc announced completing the acquisition of Rental Inc., an equipment rental company focusing on non-residential construction. With the acquisition, H&E expected to expand its business in Western Georgia, Alabama, and Florida.

- Report ID: 4731

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.