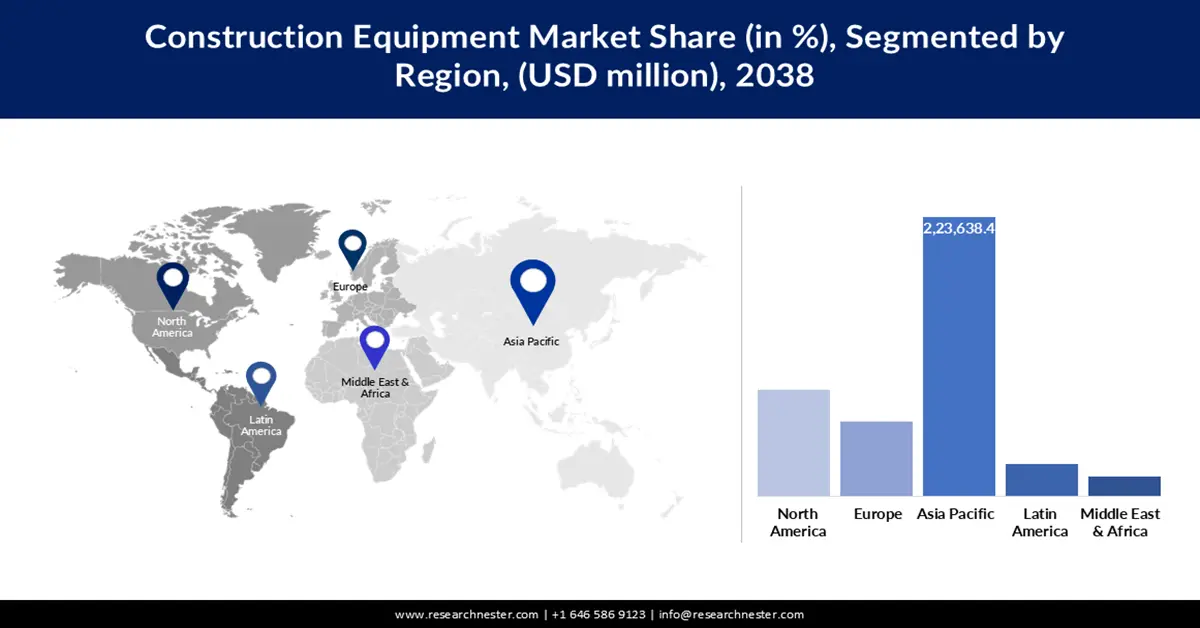

Construction Equipment Market - Regional Analysis

APAC Market Insights

The APAC construction equipment industry is anticipated to account for a 43.2% share in the global market during the forecast period as a result of increasing urbanization, infrastructure investment, and manufacturing expansion. In April 2025, Komatsu reported that it will increase Asia, Europe, and North America crawler excavator production, increasing capacity as regional demand grows. The market is also benefiting from green construction-friendly government policies and the adoption of electric and autonomous equipment. Technology partnerships and local production are supporting low-cost, high-performance equipment solutions.

China market is evolving rapidly, and there is strong demand for green, efficient, and high-technology machinery. BYD partnered with XCMG in December 2024 to develop next-generation battery systems for construction equipment, driving the electrification proposition. Chinese manufacturers are investing in the high-volume production and export of electric and hybrid models, and state policy is encouraging the adoption of low-emission machinery in urban projects. The market's emphasis on innovation and sustainability is driving growth and international competitiveness.

India construction equipment market is in a growth phase, driven by urbanization, infrastructure development, and green initiatives. Tata Hitachi launched the electric EX 210LC excavator in March 2025, further accelerating the country's move towards green urbanization. The government's focus on affordable housing, smart cities, and emission reductions is driving demand for electric, compact, and modular machines. Local manufacturers are ramping up production and R&D to meet evolving needs, making India a significant regional market player.

North America Market Insights

North America is set to rise at a CAGR of 4.4% during the forecast period, with infrastructure spending, equipment rental expansion, and manufacturing expansion. United Rentals reported an 8% year-over-year growth in rental revenue in April 2025, fueled by strong demand in commercial buildings. The U.S. Department of the Interior's June 2025 expenditure of over USD 13 million on mine land reclamation grants is also driving demand for equipment used in mining projects. Furthermore, JCB and other manufacturers are doubling factory capacity in Texas to address localized demand, while Canadian firms are investing in modular and green equipment for urban development.

The U.S. market is seeing a demand boom for electrified and autonomous machinery, driven by infrastructure investment and sustainability needs. In April of 2024, Caterpillar invested in Lithos Energy in an effort to accelerate the development of battery systems for construction equipment to drive low-emission fleets. The market is also seeing growth in off-site and modular building, with NREL's April 2025 modular home project showing the need for specialized equipment. These trends are solidifying the U.S. as a construction equipment innovation and adoption leader.

Canada construction equipment market is expanding steadily, with a focus on sustainability and city infrastructure. Sany Heavy Industry opened its first Indonesian factory in April 2025, but domestic production is being augmented as well by Canadian firms to meet demand for efficient, eco-friendly equipment. Government subsidies on green building and modular housing are driving the use of electric and hybrid equipment. The market is also fueled by investment in resource and mining initiatives, with a growing emphasis on operator safety and digitalization.

Europe Market Insights

Europe is anticipated to expand at a robust pace between 2026 and 2038, driven by urbanization, emissions control, and digitalization, pushing demand. Oslo's June 2023 win of the E-Visionary Award recognized the city as a pioneer of electric construction equipment. European governments are mandating zero-emission equipment for government projects, driving demand for electric and hybrid. Spending on smart cities and infrastructure replacement is also driving the market, with contractors adding more digital capability to enhance productivity and compliance.

Germany market is expanding with a focus on high-level automation, safety, and sustainability. In November 2024, Kawasaki Heavy Industries introduced an autonomous excavator system, employing 3D design data and LiDAR for precision and reduced dependence on labor. German manufacturers are investing in digital cab upgrades and emissions-technology engines, and government projects increasingly specify environmentally friendly equipment. The market's focus on quality, innovation, and regulatory compliance is fueling consistent growth and global competitiveness.

The UK construction sector is seeing strong demand for off-site and modular construction, as seen in December 2022 when Volumetric Building Companies delivered a 10-storey modular hotel in London. The trend is driving demand for heavy-duty lifting and assembly gear. The UK government's affordable housing and city regeneration plans are driving investment in electric, autonomous, and compact machines. Manufacturers are responding with next-generation digital controls and safety technologies, making the UK the top in adoption and innovation in construction equipment.