Connected IoT Devices Market Outlook:

Connected IoT Devices Market size was over USD 23.68 billion in 2025 and is projected to reach USD 139.45 billion by 2035, witnessing around 19.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of connected IoT devices is assessed at USD 27.81 billion.

The connected IoT devices market’s growth is owed to the large-scale proliferation of Internet of Things (IoT) devices. Additionally, the rapid expansion of 5G technology has led to faster data transmission and lower latency, benefiting the sector’s growth. The National Institute of Standards and Technology (NIST) stated that IoT-connected devices stand to revolutionize the U.S. economy. In September 2024, the NIST industrial wireless team published a report on the conditions required for Orthogonal Frequency-Division Multiple Access (OFDMA) uplink trigger frames sent by commercial access points (APs), and the OFDMA uplink activation stands to significantly reduce latency, boosting faster response time for IoT devices. Furthermore, the connected IoT devices market is set to find profitable opportunities from a growing number of smart homes, connected healthcare devices, and industrial automation.

The industry 4.0 initiatives globally to create an integrated digital ecosystem is projected to be a major driver for the market’s growth. Key players in the sector offering IoT hardware development solutions, cloud, and edge computing services are set to expand their revenue share owing to significant opportunities provided by industry 4.0 initiatives. The connected IoT devices market is poised to maintain its profitable growth curve by the end of the forecast period by leveraging multiple sectors embracing digitization, and new revenue streams emerging in middle-to-low-income countries.

Key Connected IoT Devices Market Insights Summary:

Regional Highlights:

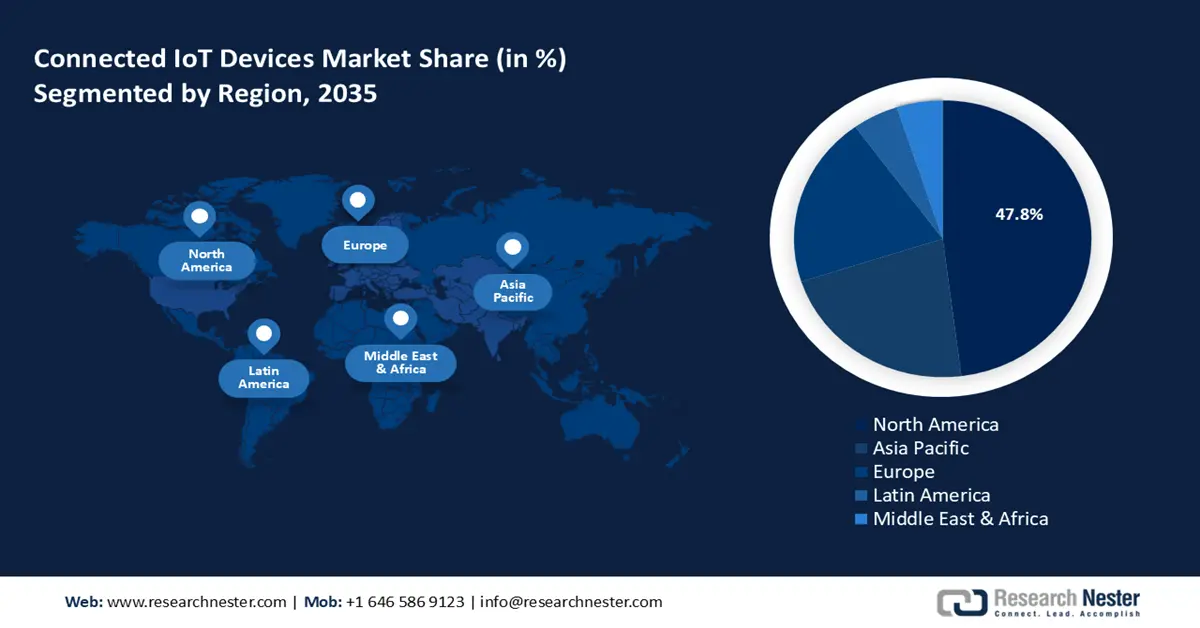

- North America dominates the Connected IoT Devices Market with a 47.80% share, driven by advanced infrastructure and widespread adoption of automation and AI in the region, ensuring strong growth through 2035.

Segment Insights:

- The Public segment is projected to capture more than 64.9% market share by 2035, driven by large-scale investments in public cloud and smart infrastructure.

- The Solution segment is anticipated to achieve a significant revenue share from 2026-2035, driven by demand for industry-specific platforms and secure IoT solutions.

Key Growth Trends:

- Advancements in wireless communication

- Rising AI integration and adoption of edge computing

Major Challenges:

- Interoperability & standardization constraints

- Environmental concerns due to the rise in e-waste

- Key Players: Oracle Corporation, Cisco, Johnson Controls, PTC Inc., LG Corporation, KORE, Apple Inc., Samsara, IBM, GE Digital, Telit, Softeq Development Corporation, HTC Corporation.

Global Connected IoT Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 23.68 billion

- 2026 Market Size: USD 27.81 billion

- Projected Market Size: USD 139.45 billion by 2035

- Growth Forecasts: 19.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (47.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, UAE

Last updated on : 14 August, 2025

Connected IoT Devices Market Growth Drivers and Challenges:

Growth Drivers

- Advancements in wireless communication: Rapid advancements in wireless communication technologies have boosted the capabilities of connected IoT devices by reducing latency. Improved performance of IoT devices benefits adoption across various sectors. Smart stadiums have integrated connected IoT devices to expand revenue streams by providing real-time data analytics and personalized fan experiences. For instance, in May 2023, JIG-SAW partnered with the San Diego Padres to build a smart stadium using connected IoT devices.

Additionally, the rapid proliferation of 5G devices has led to wider coverage, boosting the proliferation of IoT devices worldwide. For instance, in June 2023, 5g Americas reported that global 5G connections had reached a whopping 1.2 billion and are set to reach 6.8 billion by the end of 2027. - Rising AI integration and adoption of edge computing: Integration of IoT with edge computing and artificial intelligence (AI) enables faster data processing and intelligent decision-making at the device level. These technologies reduce dependence on cloud computing and open possibilities in sectors such as smart agriculture and autonomous vehicles. Additionally, processing data locally minimizes the risk of data breaches. For instance, key market players offer smart home devices integrated with AI that improve end user experience and boost sales. Citing an instance of a key player leveraging the market opportunities, in August 2024, LG launched the LG ThinQ ON AI home hub featuring affectionate intelligence and is poised to provide an elevated connected home living experience.

- Increasing digital transformation of the healthcare sector: The connected IoT devices market analysis indicates that the healthcare sector is a significant beneficiary of connected IoT devices. The advent of remote patient monitoring, wearable health trackers, and telemedicine solutions offer multiple segments for the connected IoT devices sector. Improvement in patient outcomes due to connected IoT devices in healthcare settings augurs well for the market’s expansion. Furthermore, opportunities are positioned to arise from large-scale investments to improve healthcare infrastructure in emerging economies for businesses to supply IoT devices. For instance, in July 2024, Prisma Health invested USD 41 million in smart beds across its hospital system.

Challenges

- Interoperability & standardization constraints: Lack of standardized protocols and frameworks among IoT devices can create challenges in seamless integration. Incompatible technologies from different manufacturers can result in fragmented ecosystems that can stifle scalability. Additionally, unsupported IoT devices can cause cyber troubles.

- Environmental concerns due to the rise in e-waste: The growing number of IoT devices causes the issue of e-waste. In October 2024, the World Health Organization estimated e-waste as one of the fastest-growing solid waste in the world. Additionally, the energy consumption of IoT devices contributes to environmental impact pushing businesses to adopt energy-efficient solutions.

Connected IoT Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

19.4% |

|

Base Year Market Size (2025) |

USD 23.68 billion |

|

Forecast Year Market Size (2035) |

USD 139.45 billion |

|

Regional Scope |

|

Connected IoT Devices Market Segmentation:

Deployment (Public, Private)

In connected IoT devices market, public segment is set to account for revenue share of more than 64.9% by the end of 2035. The segment’s growth is attributed to large-scale investments by developed countries in building public cloud infrastructure. Rising investments in smart city development and intelligent traffic monitoring systems position the segment for rapid growth. Furthermore, public sector IoT deployment offers revenue streams in disaster management and water resource monitoring by creating opportunities for technology service providers and the government to collaborate. For instance, in October 2024, Actelis Network announced a new order from a major municipality in Germany for the modernization of secure critical IoT infrastructure through the expansion of its hybrid-fiber networking technology.

The private segment of the connected IoT devices market is emerging during the forecast period and is estimated to increase its revenue share. Rising adoption across retail, logistics, and healthcare is a major driver for the segment’s growth. IoT-enabled wearables and automation devices are reshaping consumer lifestyles and demands, creating profitable opportunities for industry stakeholders. Additionally, the proliferation of data-driven decision-making is expected to create steady revenue streams in the market.

Component (Solution, Service)

The solution segment of the connected IoT devices market by component is poised to hold a significant revenue share during the forecast period. Industry-specific solutions catering to verticals such as agriculture, manufacturing, healthcare, etc., boost end use of solutions. Growing reliance on cloud and edge computing provides opportunities for hybrid platform solutions. Additionally, rising security threats create opportunities to provide end-to-end security services. For instance, in August 2024, Nozomi Networks collaborated with Mandiant to provide security solutions for IoT threat detection & response via the Nozomi TI expansion pack.

Our in-depth analysis of the global connected IoT devices market includes the following segments:

|

Deployment |

|

|

Component |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Connected IoT Devices Market Regional Analysis:

North America Market Forecast

By the end of 2035, North America connected IoT devices market is predicted to dominate around 47.8% revenue share. The market is driven by the advanced infrastructure and widespread adoption of automation and AI in the region. The presence of leading IoT technology providers in the region acts as a key catalyst in the region’s growth. With rising investments in IoT to improve public services in the region, the sector is expected to maintain its profitable growth. For instance, in November 2024, Opsys collaborated with Curiosity Lab and the city of Peachtree Corners to launch solid-state LiDAR technology marking the company’s first deployment in the U.S.

The U.S. accounts for the lion’s share of revenue in the connected IoT devices market of North America. The rapid IoT adoption in the country is intertwined with the country’s goal of industrial automation. Investments in smart factories and IoT-integrated supply chains are beneficial to the sector’s growth in the U.S. Furthermore, the rising demand for IoT-enabled services in smart homes is poised to fuel the market’s continued growth while reshaping consumer preferences.

With strong collaboration between businesses, academic institutions, and government bodies, the sector is poised to witness advancements in IoT. For instance, in February 2024, Medical Guardian and KORE collaborated to launch the first eSIM-powered medical alert device, and the technology is projected to overcome cell signal challenges and fulfil healthcare access disparities.

Canada is poised to increase its revenue share in the connected IoT devices market of North America. The robust telecommunications sector and expanding 5G networks are key drivers of the adoption of IoT devices. Furthermore, government programs such as the Pan-Canadian Artificial Intelligence Strategy to drive the adoption of AI across the economy and society of Canada incentivize market players to forward innovative IoT devices catering to various industries. For instance, in September 2024, TELUS launched SmartEnergy to enable customers to reduce their environmental footprint and save money on their energy bills by connecting compatible smart devices like thermostats and plugs to the TELUS intuitive SmartHome+ app.

APAC Market Forecast

The connected IoT devices market in APAC is estimated to register the fastest revenue growth during the forecast period. The growth of the market in APAC is due to extensive digital transformation efforts across multiple countries. China, India, Japan, South Korea, and Australia are leading the market share in APAC. Furthermore, APAC has positioned itself as a hub for manufacturing in the global supply chain bolstering the adoption of IoT devices, and robust growth in the consumer electronics sector is poised to drive demand for IoT-enabled wearable devices. For instance, in July 2024, mCare Digital and KORE launched a smartwatch, i.e., mCareWatch 241, for virtual patient monitoring.

China holds a dominant share in the connected IoT devices market in APAC. The country has made major strides in integrating IoT across various industries while the presence of major players such as Alibaba and Tencent, are at the forefront of developing IoT ecosystems in China. For instance, in September 2024, the Ministry of Industry and Information Technology launched a plan to boost the development of IoT with mobile IoT terminal connections expected to exceed 3.6 billion by 2027.

India is projected to increase its revenue share in the connected IoT devices market in APAC owing to a surging push by the government to promote digitization across the countries and large-scale proliferation of the 5G network. Furthermore, the integration of IoT devices for public services has boosted service delivery. The Digital India initiative is positioned to create profitable opportunities in the domestic market during the forecast period. In May 2024, Mindgrove launched the first indigenously designed commercial high-performance SoC (system on chip) and is poised to benefit domestic players by offering a cost-effective solution.

Key Connected IoT Devices Market Players:

- Oracle Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cisco

- Johnson Controls

- PTC Inc.

- LG Corporation

- KORE

- Apple Inc.

- Samsara

- IBM

- GE Digital

- Telit

- Softeq Development Corporation

- HTC Corporation

Key players in the market are investing in improving IoT-based solutions and providing value-added services such as remote support to stand out in a competitive market and expand revenue shares. Furthermore, investments to build strong cybersecurity measures are essential for customer retention. Strategic collaborations and acquisitions can help key market players in expanding to untapped markets, and improve the distribution networks. Here are some key players in the connected IoT devices market:

Recent Developments

- In October 2024, Thoughtworks and Swann announced a collaboration to develop SwannShield. The innovative AI-powered home security assistant will be compatible with video doorbells, cameras, etc.

- In October 2024, Sleep Number introduced the Climate Cool smart bed. The smart bed actively cools and adjusts to both sleepers and is ideal for couples with different sleep preferences.

- Report ID: 6772

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Connected IoT Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.