Conductive Polymer Capacitor Market Outlook:

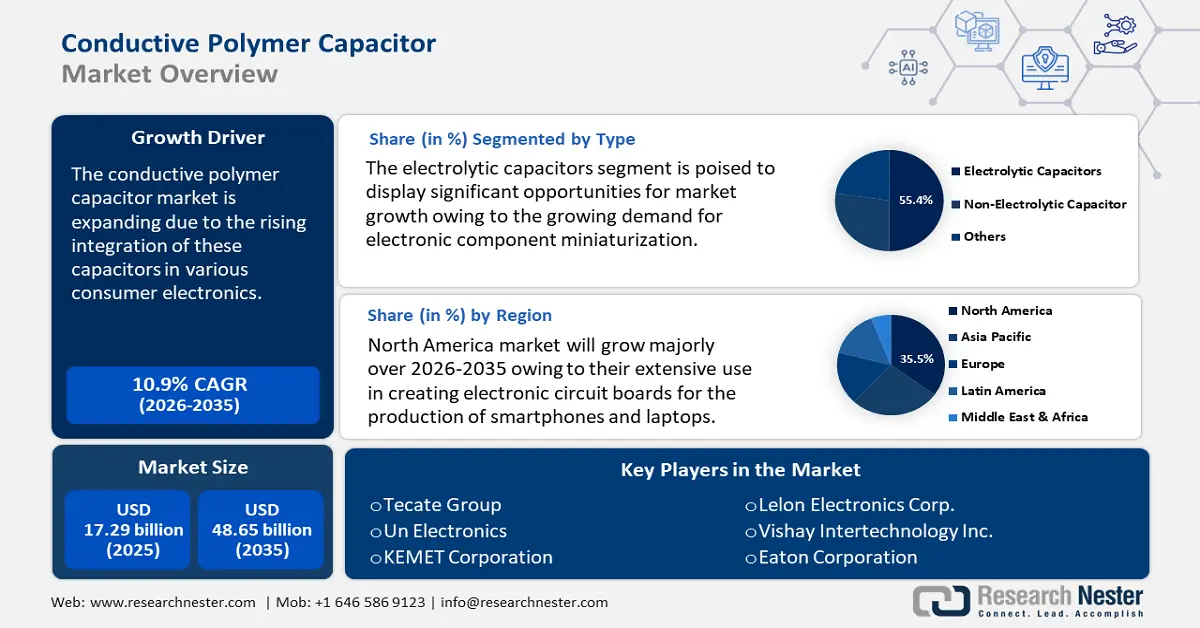

Conductive Polymer Capacitor Market size was over USD 17.29 billion in 2025 and is poised to exceed USD 48.65 billion by 2035, witnessing over 10.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of conductive polymer capacitor is estimated at USD 18.99 billion.

The global conductive polymer capacitor market is poised to expand owing to their rising integration into consumer electronics such as smartphones, laptops, and tablets for power management and noise filtering. One of the main forces behind innovation in recent years has been the miniaturization of consumer electronics. The need for smaller parts that can slide into confined spaces has grown enormously along with the size and compactness of electronics. Capacitors made of conductive polymers have become one of the best options as a result of their portability and compact size.

Conductive polymer capacitors, in contrast to conventional ceramic and electrolytic capacitors, can be produced in small sizes without impacting functionality. Due to this characteristic, they are highly desirable for usage in various portable devices, including wearable technology, smartphones, tablets, and other consumer electronics.

With each new generation of smartphones and tablets, manufacturers strive to produce increasingly lighter and thinner devices. This objective necessitates the miniaturization of internal components to optimize available space. Conductive polymer capacitors, which occupy minimal space on the circuit board, have facilitated the development of exceptionally slim and lightweight gadgets. Their high energy density and compact size allow for greater capacitance to be accommodated within limited areas of small devices. Consequently, their application in circuits for audio, power management, and other contexts requiring precise capacitance in constrained environments has substantially increased. Moreover, the ongoing trend toward miniaturization is prompting smartphone and tablet manufacturers to transition from traditional bulkier capacitors to ultra-thin conductive polymer capacitors.

Furthermore, the global trade of smartphones is a major driver of the conductive polymer capacitor market due to the increasing demand for high-performance, compact, and energy-efficient electronic components. The Observatory of Economic Complexity revealed that with a USD 316 billion overall trade in 2023, smartphones ranked as the fifth most traded product globally. Smartphone exports increased 8.36% between 2022 and 2023, from USD 292 billion to USD 316 billion. Smartphone trade accounts for 1.4% of global trade.

|

Country |

Export Value of Smartphones (USD billion) |

Country |

Import Value of Smartphones (USD billion) |

|

China |

186 |

U.S. |

58 |

|

Vietnam |

36.2 |

Hong Kong |

34.9 |

|

UAE |

17.1 |

UAE |

28.5 |

|

India |

16 |

Japan |

15.4 |

|

Netherlands |

8.96 |

Germany |

12.4 |

Source: OEC

Key Conductive Polymer Capacitor Market Insights Summary:

Regional Highlights:

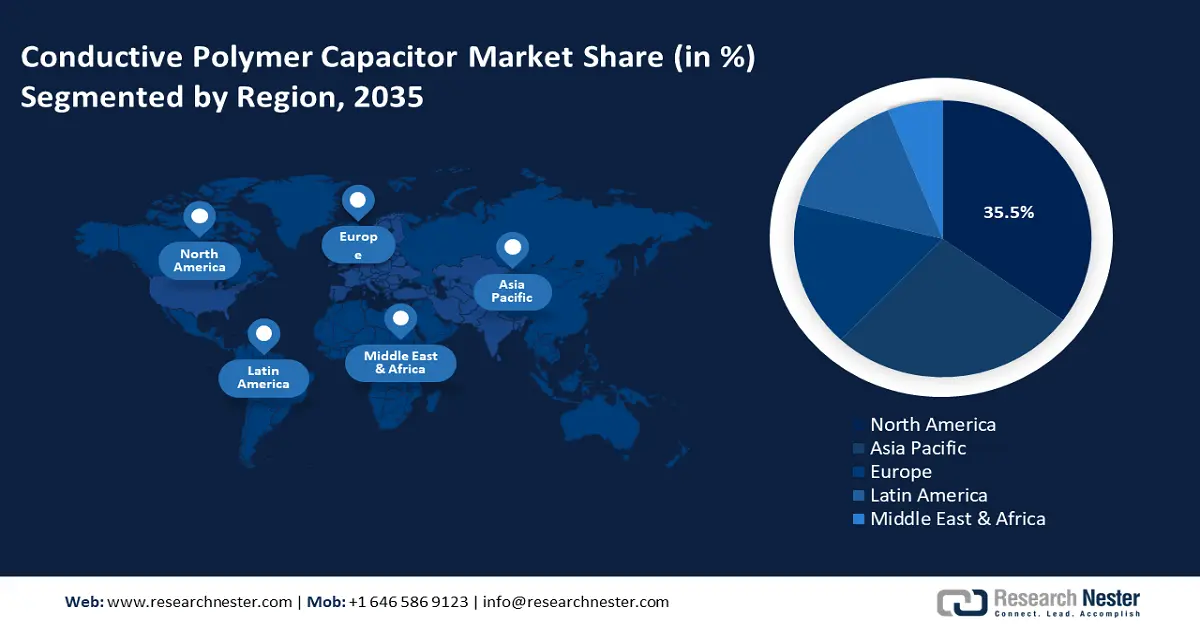

- North America holds a 35.5% share in the Conductive Polymer Capacitor Market, bolstered by a strong semiconductor industry and 5G/EV infrastructure expansion, ensuring sustained growth through 2035.

- The conductive polymer capacitor market in Asia Pacific is achieving significant growth by 2035, attributed to rising EV adoption, smart grid initiatives, and electronics manufacturing.

Segment Insights:

- Conductive Polymer Capacitors segment are projected to hold a 55.40% share by 2035, driven by miniaturization in electronics and demand for ultra-compact capacitors.

Key Growth Trends:

- Rise of the Internet of Things (IoT)

- Expansion of manufacturing capabilities

Major Challenges:

- High manufacturing costs

- Intricate integration in modern electronics

- Key Players: Tecate Group, Sun Electronics, KEMET Corporation, Lelon Electronics Corp., Vishay Intertechnology Inc., Eaton Corporation, CDE (Cornell Dubilier Electronics), Aihua Group, Panasonic Co., Ltd., NICHICON CORPORATION.

Global Conductive Polymer Capacitor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 17.29 billion

- 2026 Market Size: USD 18.99 billion

- Projected Market Size: USD 48.65 billion by 2035

- Growth Forecasts: 10.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Japan, China, United States, South Korea, Germany

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 13 August, 2025

Conductive Polymer Capacitor Market Growth Drivers and Challenges:

Growth Drivers

- Rise of the Internet of Things (IoT): The conductive polymer capacitor market presents significant opportunities due to the growth of the Internet of Things (IoT) sector. The increasing integration of electronic components capable of supporting high operating frequencies, compact form factors, and resilience in demanding environments is essential for IoT connectivity across various applications, including wearable technology, smart home devices, connected vehicles, and industrial automation. For instance, with approximately 1.8 billion connections in 2023, broadband IoT (4G/5G) is predicted to remain the technology that connects the majority of cellular IoT devices through 2029. Conductive polymer capacitors are well-suited to meet these requirements due to their compact size, lightweight design, flexibility, high current handling capabilities, and wide operating temperature range.

Manufacturers are developing application-specific conductive polymer capacitors to address the diverse needs of IoT devices and sensor nodes in areas such as power management, signal coupling, and energy storage. As the adoption of IoT-driven technologies continues to proliferate across multiple industries, a substantial increase in demand for conductive polymer capacitors is anticipated in the coming years. Furthermore, original equipment manufacturers and IoT platform providers are collaborating with capacitor suppliers to deliver innovative solutions and advance commercialization within this sector. - Expansion of manufacturing capabilities: Leading companies are improving their production capacities to meet the escalating demand from sectors such as automotive, consumer electronics, and telecommunications. For instance, in February 2024, Panasonic Industry Co., Ltd. began the commercial production of its ZL series conductive polymer hybrid aluminum electrolytic capacitors. These capacitors were designed for use in electronic control units (ECUs) for electric cars, including hybrids.

Similarly, in May 2024, NICHICON CORPORATION expanded the rated capacitance of the PCW series of chip-type conductive polymer aluminum solid electrolytic capacitors with a guaranteed superimposed ripple current at high temperatures, to meet the increasing demand in the automotive and telecommunications fields. The PCW series is the industry’s first conductive polymer aluminum solid electrolytic capacitor with a guaranteed superimposed ripple current. These strategic enhancements in production are meeting the rising demands and driving innovation, leading to more efficient and compact electronic components across end use industries.

Challenges

- High manufacturing costs: As a result of the strict purity and consistency requirements, producing high-quality conductive polymer materials is an expensive operation. High capital and operating costs are also a result of the thin-film deposition, patterning, and multilayer stacking processes used in the production of conductive polymer capacitor chips. Costs are further increased by ensuring high yields and low defect rates. In certain production stages, technological and financial obstacles prevent automation and mass production scalability. Manufacturers are under additional cost pressure due to the electronics industry's growing performance standards and demands for product downsizing. To address this, participants need to concentrate on supply chain management, economies of scale, and technological advancements to mitigate the effects of high costs and attain long-term profitability.

- Intricate integration in modern electronics: Research teams are testing polyaniline variants that can operate steadily above 60V since some energy storage modules operating at extremely high voltages or extremely fast switching frequencies require more specialized polymer formulations. Automotive engineers creating inverters for performance EVs have seen capacitor stress events during sudden load transitions, where 4 out of 25 prototypes showed ESR fluctuations that compromised circuit reliability. Also, accurately depositing conductive polymers on production lines requires complex machinery, and even small misalignments can impair the performance of thousands of capacitors in a batch. Furthermore, several circuit prototyping teams have highlighted the necessity of advanced field testing, stating that before final qualification, each new polymer variant must undergo at least six distinct stress scenarios under real-time settings. Therefore, these technical issues are hindering the conductive polymer capacitor market.

Conductive Polymer Capacitor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.9% |

|

Base Year Market Size (2025) |

USD 17.29 billion |

|

Forecast Year Market Size (2035) |

USD 48.65 billion |

|

Regional Scope |

|

Conductive Polymer Capacitor Market Segmentation:

Type (Electrolytic Capacitors, Non-Electrolytic Capacitors)

By 2035, electrolytic capacitors segment is estimated to capture over 55.4% conductive polymer capacitor market share. The growing demand for electronic component miniaturization, particularly from industries such as consumer electronics and automotive, has positioned electrolytic capacitors as a significant component within the market. Unlike traditional aluminum electrolytic capacitors, conductive polymer capacitors can be manufactured in considerably smaller quantities while maintaining capacitance levels. This characteristic enables their application across a diverse array of space-constrained environments in various sectors. As devices continue to shrink in size and integrate increasingly complex circuitry and functionalities, ultra-compact capacitors have become essential. The reduced footprints of conductive polymer electrolytic capacitors present an effective solution to address this emerging requirement.

Application (Consumer Electronics, Automotive, Industrial Equipment, Telecommunications)

The consumer electronics segment in conductive polymer capacitor market is poised to garner a significant share during the assessed period. The growth of the segment can be attributed to the dynamic characteristics of the consumer electronics sector, which is characterized by rapid replacement cycles and continuous product innovation. Increasing consumer demand for portable smart devices with extended battery lives has led to greater utilization of conductive polymers, particularly in capacitors. Major companies in the consumer electronics industry are consistently developing advanced devices that require compact power sources with high capacitance densities. Conductive polymer capacitors primarily satisfy this requirement. Their compact form factor enhances the energy and power densities of batteries, while simultaneously providing ample space for additional components within constrained environments. As long as there remains a strong global market for innovative consumer electronics, the adoption of conductive polymer capacitors is expected to increase.

Our in-depth analysis of the global conductive polymer capacitor market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Conductive Polymer Capacitor Market Regional Analysis:

North America Market Statistics

North America conductive polymer capacitor market is likely to account for revenue share of around 35.5% by 2035. One of the most economically significant and technologically sophisticated countries in the region is the U.S. The existence of major IT and semiconductor manufacturing giants has raised the need for conductive polymers due to their extensive use in creating electronic circuit boards for the production of smartphones, laptops, and televisions. North America is expected to dominate the conductive polymer capacitor market owing to its robust electronics and semiconductor industries, access to state-of-the-art technology, and R&D facilities. In the U.S., the electronics sector is rebounding.

Also, in the U.S., the rapid expansion of EVs and 5G infrastructure is driving the demand for these capacitors, as these industries require compact, energy-efficient, and durable components. Additionally, rising investments in semiconductor manufacturing and government initiatives supporting domestic electronics production contribute to the market expansion. For instance, over USD 30 billion in planned private sector investments under CHIPS have been announced by the U.S. Department of Commerce so far, including 23 projects across 15 states. Over 115,000 manufacturing and construction jobs are anticipated to be created nationwide by these projects, which include 16 new semiconductor manufacturing plants. By the end of 2024, Commerce distributed all of the remaining cash to CHIPS recipients.

In Canada, the conductive polymer capacitor market is expanding since these capacitors offer advantages such as high conductivity, low equivalent series resistance (ESR), and improved reliability, making them ideal for advanced electronic applications, including EVs and 5G technology. Telefonaktiebolaget LM Ericsson, a multinational networking and telecommunications company, reported that only 17% of Canadians wanted to subscribe to a 5G plan in 2024. Of these, 4% already have a 5G phone, and 13% need to purchase one. Additionally, Canada’s push for greener energy solutions and the increasing adoption of renewable energy systems are driving the need for efficient energy storage components. Government incentives for technology innovation and the expanding electronics manufacturing sector further fuel the conductive polymer capacitor market growth.

APAC Market Analysis

Asia Pacific conductive polymer capacitor market is expected to grow at a significant rate during the projected period. The region's robust supply chains, high-tech manufacturing capabilities, and quick growth in consumer electronics are driving the industry. Also, leading suppliers, such as South Korea's Samsung Electro-Mechanics and Japan's Nippon Chemi-Con, focus their R&D activities in Asia, supporting ongoing developments in polymer capacitor technology.

Furthermore, as China positions itself as a global hub for consumer electronics, smartphones, and automotive electronics, manufacturers are turning to conductive polymer capacitors due to their superior performance, reliability, and efficiency compared to traditional electrolytic capacitors. The push for electric vehicles and renewable energy solutions has also fueled demand for conductive polymer capacitors in the nation. For instance, early in 2023, new regulations were implemented to encourage the growth of the solar business on underutilized and current construction land in response to a slowdown in the real estate market. China increased its solar capacity by an anticipated 200 gigawatts (GW) by the end of the year, more than twice the 2022 record of 87 GW.

In India, the rise in EV adoption, coupled with government initiatives promoting renewable energy and smart grid infrastructure, is driving the need for high-performance capacitors. The India Smart Grid Forum reported that in 2015, the National Smart Grid Mission was established to address major smart grid initiatives nationwide and improve the responsiveness, affordability, and dependability of India's power infrastructure. A 20-year plan has been developed for the nation's overall integrated intra-state, inter-regional, and inter-state transmission network.

Additionally, the expansion of the electronics manufacturing sector under initiatives such as Make in India and increased investments in semiconductor fabrication and PCB production are further propelling the conductive polymer capacitor market growth. Rising consumer demand for compact, energy-efficient, and durable electronic components also contributes to the increasing adoption of these capacitors in India.

Key Conductive Polymer Capacitor Market Players:

- Tecate Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sun Electronics

- KEMET Corporation

- Lelon Electronics Corp.

- Vishay Intertechnology Inc.

- Eaton Corporation

- CDE (Cornell Dubilier Electronics)

- Aihua Group

- Panasonic Co., Ltd.

- NICHICON CORPORATION

The presence of well-established firms, growing startups, and material science firms define the competitive environment of the conductive polymer capacitor market. To improve their market position and meet the rising demand for dependable and high-performance capacitors, major industry players are concentrating on technological developments, product innovation, and strategic alliances. To improve conductive polymer capacitor market position and satisfy the changing needs of diverse end-use industries, these businesses are actively involved in R&D, product portfolio expansion, and strategic partnerships.

Recent Developments

- In May 2024, NICHICON CORPORATION introduced the GXC line of aluminum electrolytic capacitors with superior heat resistance and conductive polymer hybrid technology. The GXC series offers exceptional high ripple current and low ESR performance. These characteristics are becoming important in the automobile and telecommunications industries.

- In October 2020, KEMET entered the aluminum hybrid electrolytic capacitors space with the launch of capacitors that will offer many benefits to the modern designer. This launch was made possible with recent advancements in the materials and construction of e-caps, which have yielded a new family of devices called aluminum hybrid polymer capacitors.

- Report ID: 7260

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Conductive Polymer Capacitor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.