Condensing Unit Market Outlook:

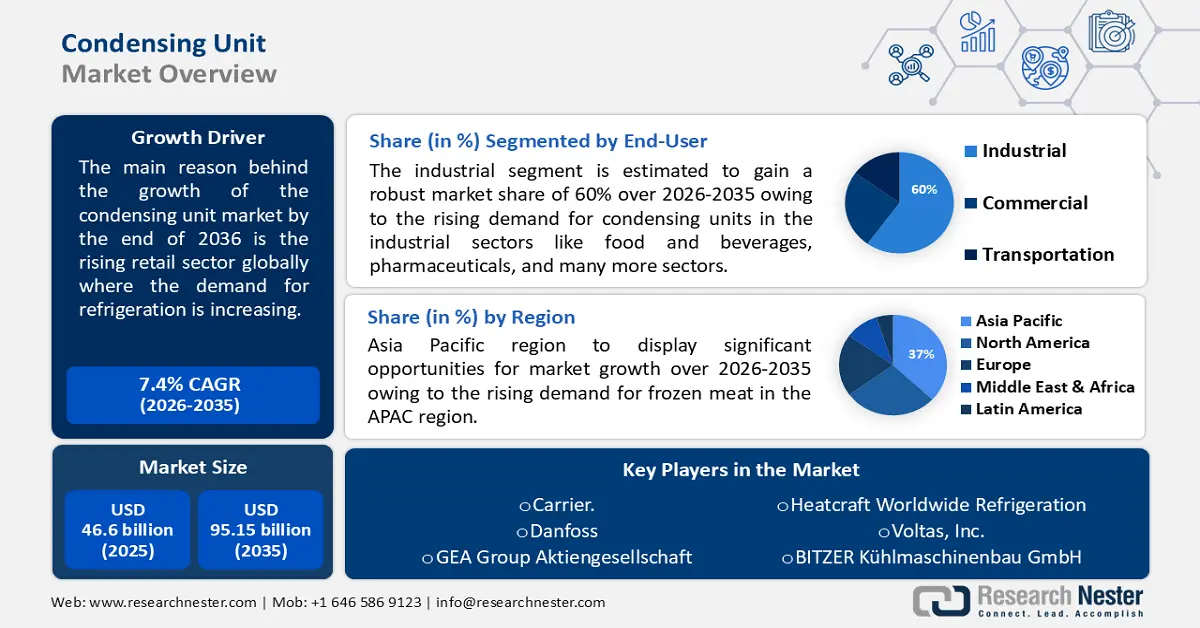

Condensing Unit Market size was over USD 46.6 billion in 2025 and is poised to exceed USD 95.15 billion by 2035, growing at over 7.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of condensing unit is estimated at USD 49.7 billion.

The reason behind the growth is the rising retail sector globally where the appeal for refrigeration is increasing. In line with the UK Parliament Research released on 24 May 2024, the UK's retail industry generated USD 143 billion in economic activity in 2023, up 2.4% from 2022 and accounting for 4.9% of the country's overall economic output.

Key Condensing Unit Market Insights Summary:

Regional Highlights:

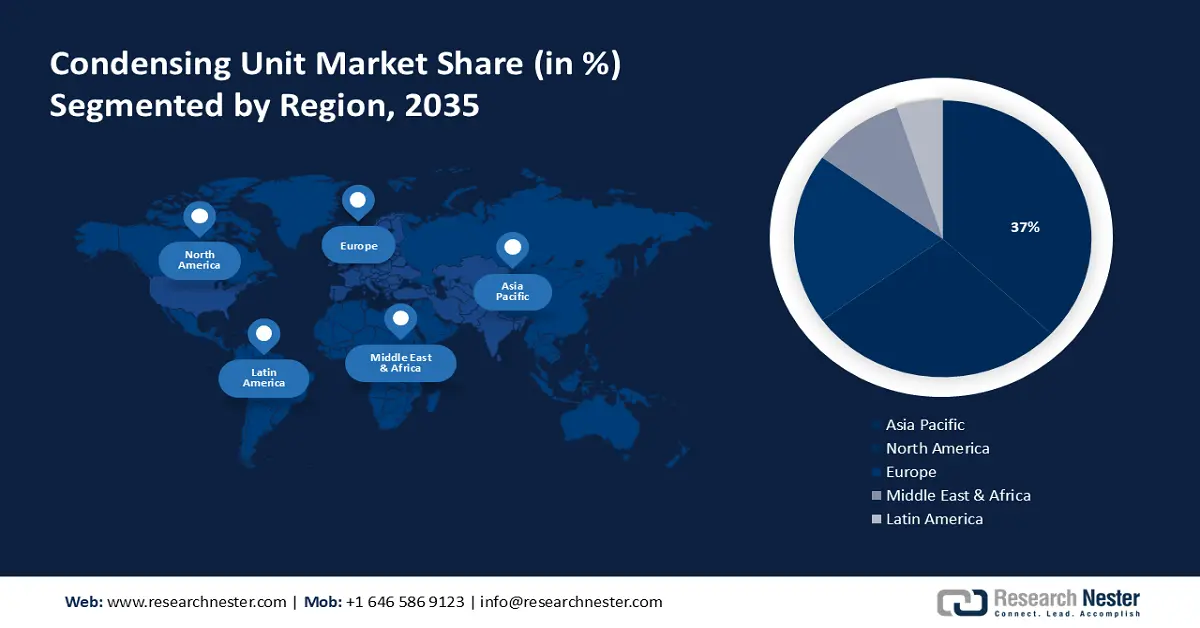

- Asia Pacific condensing unit market is anticipated to capture 37% share by 2035, driven by the rising demand for frozen meat and industrial refrigeration.

Segment Insights:

- The air conditioning segment in the condensing unit market is expected to experience substantial growth till 2035, fueled by increasing consumption of air conditioning systems due to rising temperatures and demand for cooling.

- The industrial segment in the condensing unit market is expected to capture a 60% share by 2035, attributed to the rising demand for condensing units in various industrial sectors such as food & beverages and pharmaceuticals.

Key Growth Trends:

- Rising demand for air conditioning and refrigeration systems globally

- Rising demand for energy-efficient condensing units

Major Challenges:

- Rising cost of energy-efficient condensing

- Higher cost of raw materials

Key Players: Emerson Electric Co., Carrier, Danfoss, GEA Group Aktiengesellschaft, Heatcraft Worldwide Refrigeration, Voltas, BITZER Kühlmaschinenbau GmbH, Baltimore Aircoil.

Global Condensing Unit Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 46.6 billion

- 2026 Market Size: USD 49.7 billion

- Projected Market Size: USD 95.15 billion by 2035

- Growth Forecasts: 7.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 17 September, 2025

Condensing Unit Market Growth Drivers and Challenges:

Growth Drivers

-

Rising demand for air conditioning and refrigeration systems globally - Over the coming decades, surface temperatures will rise worldwide due to human-induced climate change. According to climate projections, the mean surface temperature of the planet might rise by more than 2 °C by 2050 compared to preindustrial times, with considerably more variations occurring at the regional level. Therefore, the demand for refrigeration systems, and air conditions will increase and concurrently the demand for condensing units will also increase.

Moreover, according to IRENA (2023), by 2050, electricity should make up 27% of all industrial final energy use. In buildings, electricity would supply 73% of the total demand by 2050, up from 34% currently, according to IRENA's 1.5°C Scenario. By 2050, 793 million heat pump units—a 14-fold increase from the 58 million ones in use today—will need to be operational. - The rising population increasing the residential buildings -Developing countries are focusing on the infrastructural development of their residential areas. As the population is constantly growing, the demand for residential development is also increasing. In addition, people are implementing radiant heating and cooling systems in their residences

For instance, while the number of housing units expanded by 21.5% between 2000 and 2020, the population of the United States increased by 17.8%. The United States' urban land area grew by 14% between 2000 and 2020.

- Rising demand for energy-efficient condensing units - Governments are enacting laws to encourage the use of energy-efficient appliances, most notably by establishing minimum energy performance requirements.

The IEA (2021) report described that the energy demand for space cooling has increased at an average annual rate of 4% since 2000, twice as fast as that of lighting or water heating. Additionally, the number of units in use has more than doubled since the year 2000, reaching over 2.2 billion units in 2021. Therefore, the demand for energy-efficient condensing units is increasing.

Challenges

- Rising cost of energy-efficient condensing - As the demand for energy conservation grows globally, condensing systems' energy use has come under closer examination. Technological innovation is required to increase condensing unit efficiency without appreciably raising prices in order to achieve these goals. This is a problem as more efficiency necessitates the use of sophisticated parts and materials, which drive up costs and restrict market growth.

- Higher cost of raw materials - Due to a confluence of factors brought about by the COVID-19 epidemic, the cost of HVAC components and equipment is higher than typical during this season. The epidemic has decreased raw material availability and led to a manpower shortage in the industries that produce the necessary parts and equipment.

Condensing Unit Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.4% |

|

Base Year Market Size (2025) |

USD 46.6 billion |

|

Forecast Year Market Size (2035) |

USD 95.15 billion |

|

Regional Scope |

|

Condensing Unit Market Segmentation:

Type Segment Analysis

Air-cooled segment is projected to account for condensing unit market share of around 56% by 2035. This segment growth can be impelled by the rising demand for air-cooled condensing units in air conditions and refrigeration.

According to the International Energy Association (IEA, 2018), almost 20% of the power used in buildings worldwide is used by people using electric fans and air conditioners to remain cool. In many nations, the growing need for space cooling is simultaneously severely taxing the electrical grid and increasing emissions.

AC usage is expected to skyrocket over the next thirty years, ranking among the main factors driving the world's need for electricity. According to recent research, new guidelines can assist the globe to avoid experiencing a similar "cold crunch" by promoting efficiency while maintaining temperature.

Function Segment Analysis

In condensing unit market, air conditioning segment is estimated to account for revenue share of more than 60% by the end of 2035.

The air conditioning segment is set to garner a notable revenue share of around 60% in the coming years. This expansion will be noticed due to the increasing consumption of air conditioning by the people.

In line with IEA (2018), in comparison to the Reference Scenario, the Efficient Cooling Scenario demonstrates how smart policies may cut cooling energy consumption by 45% and double the average AC efficiency.

End-User Segment Analysis

By 2035, industrial segment is likely to dominate condensing unit market share of over 60%. There has been a rising demand for condensing units in the industrial sectors for example food and beverages, pharmaceuticals, and many more sectors.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

|

Function |

|

|

Refrigerant Type |

|

|

Technology |

|

|

End-User |

|

|

Compressor Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Condensing Unit Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is set to hold largest revenue share of 37% by 2035. The rising demand for frozen meat in the APAC region will drive the market of condensing units in this region. According to the United States Department of Agriculture Foreign Agricultural Service (USDA) published in April 2024, Asia's imports of poultry, pork, and beef are expected to be 3 million metric tons less in 2024 than they were in 2020. It is anticipated that Asia's proportion of the world's exports of beef, pig, and poultry will drop from 25% at their peak in 2020 to just 17% overall.

Condensing units are especially in actual demand in China, driven by the rising industrialization and demand for industrial refrigeration in this region. According to Oxford Academics released in 2019, Chinese manufacturing has expanded at a pace of more than 9 % per year for almost a century.

In Japan, condensing units will encounter massive growth because of the rising pharmaceutical manufacturing sector. According to ITA published in November 2022, Japan is a vital export market for medicines made in the United States and the third-largest pharmaceutical market in the world.

The condensing units sector will also be huge in Korea due to the rising urbanization in this country. In fact, South Korea's proportion of the population living in cities, at 81.43 percent in 2022, was essentially stable.

North American Market Insights

North America condensing unit market is anticipated to witness substantial growth rate till 2035. This growth will be noticed mainly due to the rising demand for cooling agents for instance ACs and refrigerators in commercial sectors. According to the Department of Energy released in September 2019, by 2030, building energy use in North America could be cut by more than 20% using technologies known to be cost-effective recently and by more than 35% if research goals are met.

The market for condensing units has expanded in the U.S. as a result of the presence of the dominant key players in this region. For instance, February 27, 2024, Emerson Electric Co., a multinational technology and software company known for its innovation leadership, is set to revolutionize industrial manufacturing with Boundless Automation, a next-generation automation architecture that will liberate data, eliminate data silos, and unleash the potential of software.

The Canadian condensing unit sector will grow mainly due to the rising demand for packaged food, and refrigerating it for a longer period. According to the Government of Canada, at current pricing, packaged food retail sales in Canada reached a total of USD 77.6 billion in 2023.

Condensing Unit Market Players:

- Emerson Electric Co.

- Carrier.

- Danfoss

- GEA Group Aktiengesellschaft

- Heatcraft Worldwide Refrigeration

- Voltas, Inc.

- BITZER Kühlmaschinenbau GmbH

- Baltimore Aircoil Company

- Dorin S.p.A.

- PanasonicCorporation

To keep a competitive advantage, the major competitors in the condensing unit market are continuously involved in strategic efforts. Among the major participants in the industry are:

Recent Developments

- Emerson Electric Co., has been selected by Norwegian energy producer Equinor to supply cutting-edge well-completion monitoring equipment for the development of the Rosebank oil and gas field offshore in the United Kingdom.

- Emerson Electric Co. created the new BransonTM GLX-1 Laser Welder which allows customers flexibility to satisfy the increased need for combining tiny, intricate, or fragile plastic components and assemblies, was introduced on May 30, 2024. It may be used in ISO-8 cleanroom conditions due to its compact size and modular construction, and its integrated automation controller makes installation easier and allows it to link with production robotics.

- Report ID: 6211

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Condensing Unit Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.