Concrete Repair System Market Outlook:

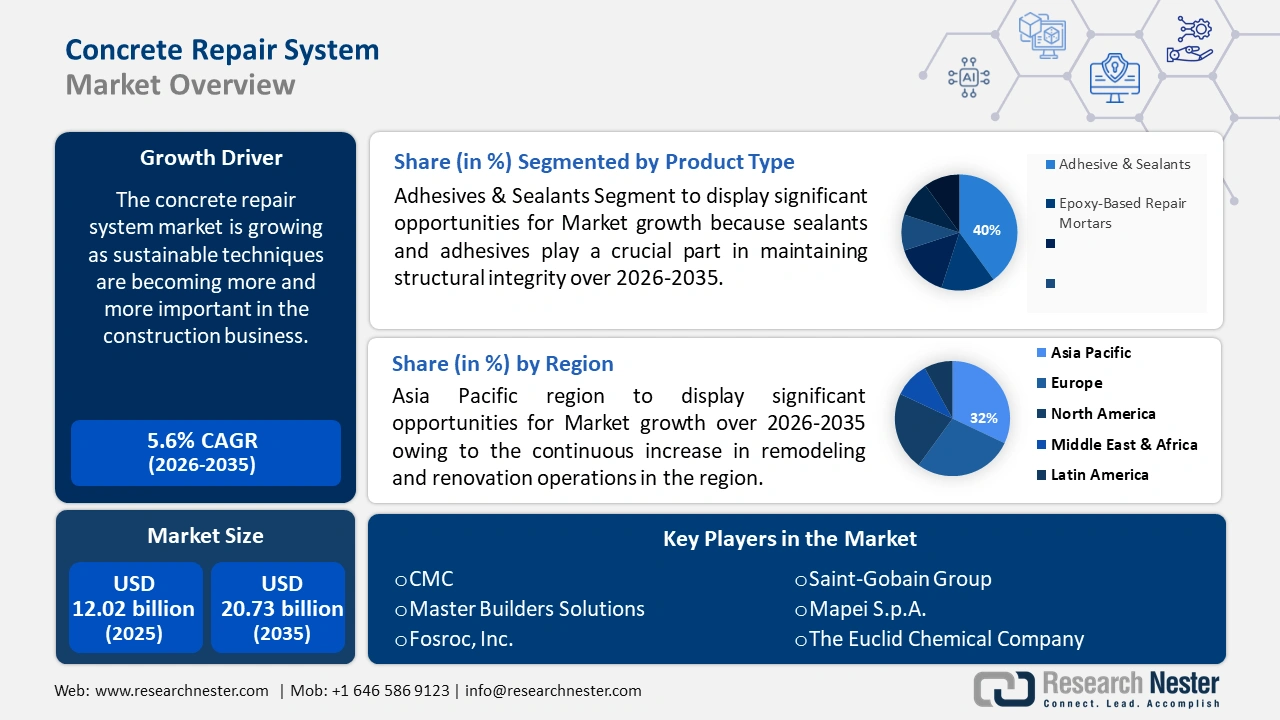

Concrete Repair System Market size was valued at USD 12.02 billion in 2025 and is likely to cross USD 20.73 billion by 2035, registering more than 5.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of concrete repair system is assessed at USD 12.63 billion.

The concrete repair system market is growing as sustainable techniques are becoming more and more important in the construction business. By prolonging the life of structures, lowering the need for demolition and reconstruction, and eliminating waste generation, concrete repair technologies provide environmentally responsible solutions. The industry for sustainable building materials is expected to generate USD 425.4 billion revenue by 2027.

Key Concrete Repair System Market Insights Summary:

Regional Highlights:

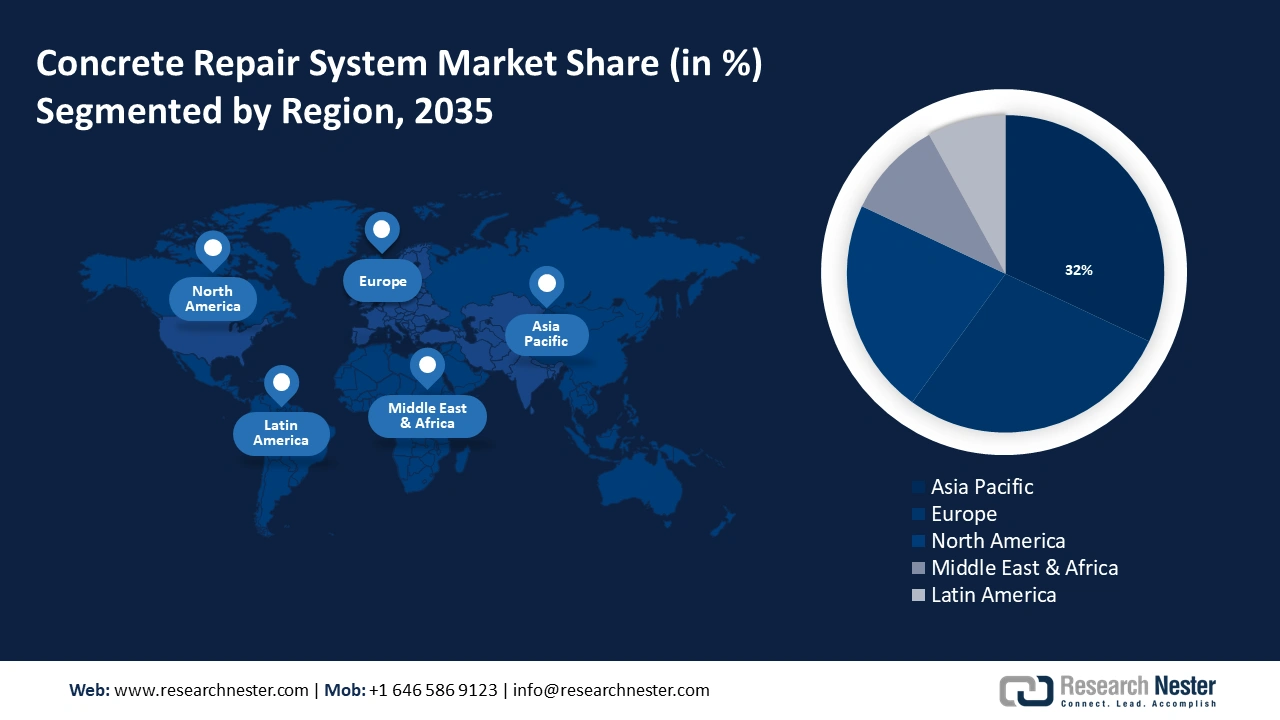

- Asia Pacific concrete repair system market will dominate around 32% share by 2035, driven by rapid urbanization and population expansion placing a heavy burden on infrastructure.

- Europe market will secure the second largest share by 2035, fueled by strict laws supporting environmentally friendly building materials and a focus on green buildings.

Segment Insights:

- The adhesive & sealants segment in the concrete repair system market is expected to achieve significant growth till 2035, driven by the critical role of sealants in maintaining concrete structural integrity.

- The buildings segment in the concrete repair system market is projected to witness lucrative growth till 2035, driven by increasing global construction and restoration activities.

Key Growth Trends:

- Requirement to preserve and expand infrastructure life

- Growing demand for risk mitigation and structural safety

Major Challenges:

- Requirement to preserve and expand infrastructure life

- Growing demand for risk mitigation and structural safety

Key Players: Commercial Metals Company, Master Builders Solutions, Fosroc International Ltd., Saint-Gobain Weber, Mapei S.p.A., Euclid Chemical Company, The Quikrete Companies, Inc., RPM International Inc., PPG Industries, Inc..

Global Concrete Repair System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 12.02 billion

- 2026 Market Size: USD 12.63 billion

- Projected Market Size: USD 20.73 billion by 2035

- Growth Forecasts: 5.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (32% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Brazil, Mexico, Indonesia

Last updated on : 17 September, 2025

Concrete Repair System Market Growth Drivers and Challenges:

Growth Drivers

-

Requirement to preserve and expand infrastructure life - One of the primary motivations for implementing an effective concrete repair system is to ensure the longevity and maintenance of essential infrastructure. For the purposes of commerce, public safety, and transportation, concrete structures such as roads and dams are essential.

However, with time, these constructions' exposure to harsh environmental factors, heavy traffic, and other stressors causes concrete to disintegrate. By putting in place a well-thought-out concrete repair system, authorities can promptly handle problems like cracks, spalling, and structural defects.

Furthermore, prompt repair keeps minor defects from growing into larger problems, protecting the integrity of the infrastructure. 38% of American bridges require maintenance, with over 47,000 of them being deemed to be in urgent need of repair. - Growing demand for risk mitigation and structural safety - When concrete structures are not maintained properly, there can be major safety risks for both the general public and the people who utilize these facilities. Implementing a concrete repair system is essential for risk reduction as it facilitates the identification and prompt resolution of potential hazards.

By carrying out regular inspections and repairs, the responsible parties can proactively control the risks associated with concrete deterioration and create a safer environment for everyone who interacts with the structures. Ten percent of the 250,000 workers in the concrete manufacturing industry have sustained injuries. - Growing need for concrete repairs mortar - Repair mortars are specialist materials used in the concrete repair system to repair concrete surfaces that have deteriorated or been damaged, restoring their structural integrity, bonding, and protection. Repair mortars are used in a variety of concrete repair applications.

Moreover, they can be used on concrete components for minor fixes like filling in cracks and spalls as well as major structural restoration. Superior repair mortars are engineered to provide outstanding functionality and longevity in the long run. When utilized correctly, they can endure freeze-thaw cycles, chemical attacks, climatic variations, and other pressures that lead to concrete degradation. With an anticipated 4.8% annual growth rate, the worldwide residential building industry is projected to reach USD 8.3 trillion by 2032.

Challenges

-

Inadequate schedule for preventive maintenance - It is necessary to perform proper infrastructure maintenance in order to keep the area safe for frequent use. Not only does this ongoing procedure involve preventive maintenance, but it also involves fast fault correction. Periodic upkeep and specialized repairs are included in preventive maintenance. The aging of the infrastructure causes various structural and service components to deteriorate. It becomes necessary to replace components and perform extensive repairs. It becomes essential to prevent more damage and extreme wear and tear from occurring to the structure and to restore it to as near its original condition as feasible. Hence, all these factors are impeding the concrete repair system market growth.

-

Lack of manpower & expertise - Skilled work is necessary for applying concrete repair system correctly, and a manpower shortage may prevent these materials from being widely used. For efficient application, certain repair circumstances need for specific expertise and methods, which can present difficulties for contractors and other building industry specialists.

Concrete Repair System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.6% |

|

Base Year Market Size (2025) |

USD 12.02 billion |

|

Forecast Year Market Size (2035) |

USD 20.73 billion |

|

Regional Scope |

|

Concrete Repair System Market Segmentation:

Product Type Segment Analysis

Adhesive & Sealants segment is set to dominate over 40% concrete repair system market share by 2035. The segment growth can be accredited to the because sealants and adhesives play a crucial part in maintaining structural integrity, sealing and bonding concrete surfaces, and stopping water ingress and corrosion. These items are frequently utilized in many different construction and maintenance applications.

Furthermore, sealants are also used to weatherproof joints and cracks and stop water intrusion. Excellent adhesion, flexibility, and weather resistance are provided by silicone-based sealants. Moreover, polyurethane sealants are ideal for dynamic joints due to their exceptional elasticity and endurance.

Because acrylic sealants are easy to apply and paintable, they are frequently employed in interior applications. For instance, with an approximate share of 33.97% in 2022, the industrial and institutional sector emerged as the biggest user of waterproofing membranes. Interestingly, by 2026, the US is predicted to invest an astounding USD 47.59 billion on new industrial structures.

Application Segment Analysis

In concrete repair system market, buildings segment is estimated to witness lucrative growth rate till 2035.The market is experiencing significant expansion due to the increasing global construction, restoration, and maintenance activities of buildings and parking lots. Personal and private buildings are exposed to different repair, maintenance, and renovation methods for either residential or commercial use in order to preserve and extend their building integrity and lifespan.

Moreover, there is a growing need for building infrastructure repair and maintenance because of the deterioration of materials and structures brought on by the interaction of loads and environmental factors. It is more affordable and practical to repair and upgrade a structure rather than demolish and replace it. The concrete repair system market for facilities management will expand by 1.3% in 2022.

Our in-depth analysis of the concrete repair system market includes the following segments:

|

Product Type |

|

|

Application |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Concrete Repair System Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is anticipated to account for largest revenue share of 32% by 2035. The market growth in the region is also projected on account of rapid urbanization and population expansion have been observed in region, placing a heavy burden on these nations' current infrastructure. As reported by UNFPA, the most populous countries in the world, China and India, are located in the Asia and Pacific region, which is home to 60% of the world's population, or 4.3 billion people.

The need for concrete repair mortars has surged because to the rapid growth of the construction industry in China, primarily in residential and non-residential building applications. With over 53 million workers, China's construction industry is the biggest in the world.

Advances in repair technology, a focus on sustainability, and heightened awareness of catastrophe preparedness have led to an increase in the use of concrete repair systems in Japan. Japan allocated around USD 74 million to disaster prevention in the fiscal year 2022. The budget was expected to be roughly USD 4.24 million for the fiscal year 2023.

In order to maintain the region's decaying infrastructure, including buildings, bridges, and other infrastructure, there is a growing need for concrete repair solutions in Korea.

European Market Insights

The European region will also encounter vast progress for the concrete repair system market during the forecast period and will hold the second position owing to the strict laws that support environmentally friendly building materials and a growing emphasis on green buildings. Many historic buildings, bridges, and other infrastructure in various European countries require ongoing maintenance and restoration. Approximately 75% of the buildings in the EU today are energy inefficient.

The need for concrete repair solutions is rising in major United Kingdom cities as a result of their aging urban infrastructure. The United Kingdom produced about 22.2 million metric tons of ready-mixed concrete in 2021.

In Germany, to improve adaptability, productivity, and user-friendliness on construction sites, Master Builders Solutions presents a customized, eco-friendly concrete repair system that eliminates the need for different, specialized solutions for every purpose. Eight percent of the CO2 emissions in the world are caused by the manufacture of cement.

In France, it is estimated that the development of patch repair mortar for road repairs will open up new growth prospects for the industry. The annual cost of maintaining the nation's network of Class A and state-run highways comes to about USD 1.660 billion.

Concrete Repair System Market Players:

- Sika AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- CMC

- Master Builders Solutions

- Fosroc, Inc.

- Saint-Gobain Group

- Mapei S.p.A.

- The Euclid Chemical Company

- The QUIKRETE Companies

- RPM International Inc.

- PPG Industries, Inc.

The market for Concrete Repair System is rather fragmented. The main participants are Sika AG, Flexcrete Technologies Ltd., MAPEI SpA, Saint-Gobain Weber, and Fosroc International Ltd., not in any specific order.

Recent Developments

- Commercial Metals Company acquired Tendon Systems, LLC, a top supplier of post-tensioning, barrier cable, and concrete restoration solutions to the Southeast. A wide range of construction types, including as multi-family residential, parking structures, industrial, and high-rise buildings, use Tendon's goods and services. In most projects, the company's main product, post-tension cable, is utilized in conjunction with rebar, giving CMC significant commercial synergy prospects. Tendon's revenue for the 2022 calendar year was roughly USD 60 million.

- Master Builders Solutions developed the MasterEmaco OneMix Concrete Repair System, provides construction projects with adaptability, effectiveness, and environmental friendliness. By adjusting the water requirement, this adaptable system with a single universal base material can be used for a variety of purposes. The business produced 120 distinct concrete repair products by fusing the base material with customized Power Paks, streamlining the repair procedure.

- Report ID: 6048

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Concrete Repair System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.