Concrete Fibers Market Outlook:

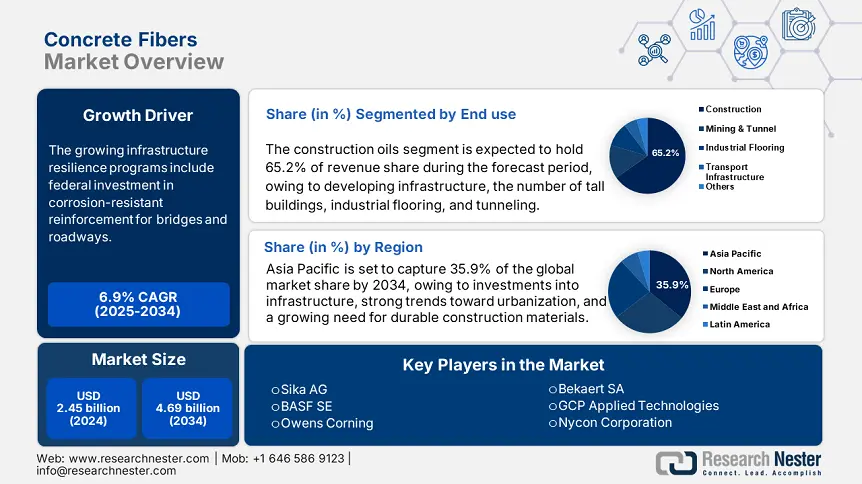

Concrete Fibers Market size was estimated at USD 2.45 billion in 2024 and is expected to surpass USD 4.69 billion by the end of 2034, rising at a CAGR of 6.9% during the forecast period, i.e., 2025-2034. In 2025, the industry size of concrete fibers is assessed at USD 2.62 billion.

The main factor powering growth in concrete fibers is the growing infrastructure resilience programs, including federal investment into corrosion-resistant reinforcement for bridges and roadways. The Federal Highway Administration and state DOTs are approving fiber-reinforced concrete (FRC) overlays and structural applications with increasing frequency. Minnesota and Iowa already have more than 7 pilot projects and have been documented between state DOTs. In May 2025, it was reported by the U.S. Bureau of Labor Statistics (BLS) that there was a 12-month increase in PPI for ready mix concrete of ~2.7% which demonstrates increased downstream demand.

Raw materials inputs (cement, polypropylene, glass, carbon fibers) have established international trade routes; as a reference, recycled carbon fiber is currently ~$36/lb according to Caltrans research results. Manufacturers are diversifying to build out FRC lines, with recent investments made into North American facilities supported by DOTs. The U.S. export market for fibers and other reinforcement products is modest (<11 %), but growing, as DOTs participate in international tenders. The CPI year on year for concrete pipe and pavers is ~+3.9 %, and finished concrete is projected to be ~+2.7%. Note that there is no published CPI specifically for FRC overlay services, but the overall construction CPI year on year is ~+5% according to the BLS. Overall, federal research and development funding through the FHWA and state DOTs, with pilot testing and in-field validation, is more than $11 M per year.

Concrete Fibers Market - Growth Drivers and Challenges

Growth Drivers

- Surge in high-rise and prefabricated buildings: Urbanization is enhancing the demand for high-rise and prefabricated buildings. According to the UN, urban populations are expected to reach 69% by 2050. The use of concrete fibers enhances the distribution of loads and mitigates cracking that occurs due to shrinkage in the world of precast segments and vertical structural forms. The Asia Pacific region leads the way with global construction growth projected, with China and India accounting for more than 51% together. As the pace of growth accelerates within the construction sector, developers will increasingly see value in adopting durable build systems in response to ever-increasing standards and structural integrity in megacities.

- Demand for crack control and shrinkage reduction: It is now commonplace to use concrete fibers to control plastic shrinkage and thermal cracking in construction. The American Concrete Institute (ACI) claims that synthetic fibers can eliminate plastic shrinkage cracks by up to 91%. With regulation and governing standards tightening around construction quality and project liabilities across the European continent, with EN 14889 standards introduced to enforce crack control of industrial floors and pavements, the incorporation of fibers into the concrete mix is valuable as the global construction sector demands an ever-greater focus on longevity, reduced maintenance costs, and to meet the temporary life cycle and durability requirements of assets in the residential, commercial, and industrial construction sectors.

Emerging Trade Dynamics and Future Market Prospects

Import & Export Data (Concrete Fibers, 2019-2024)

|

Year |

Exporting Country |

Destination Country |

Shipment Value (USD billion) |

|

2019 |

Japan |

China, Korea, ASEAN |

5.7 |

|

2020 |

Japan |

China, Korea, ASEAN |

4.2 |

|

2021 |

Japan |

China, Korea, ASEAN |

5.1 |

|

2022 |

Japan |

China, Korea, ASEAN |

6.3 |

|

2023 |

Japan |

China, Korea, ASEAN |

6.5 |

|

2024 |

Japan |

China, Korea, ASEAN |

6.8 |

|

2019 |

Germany |

U.S., Canada |

4.0 |

|

2020 |

Germany |

U.S., Canada |

3.2 |

|

2021 |

Germany |

U.S., Canada |

3.7 |

|

2022 |

Germany |

U.S., Canada |

4.9 |

|

2023 |

Germany |

U.S., Canada |

5.1 |

|

2024 |

Germany |

U.S., Canada |

5.4 |

Key Trade Routes

|

Route |

2021 Trade Value (USD trillion) |

% of Global Construction & Infrastructure Trade |

|

Asia-Pacific |

1.90 |

55% |

|

Europe–North America |

0.93 |

27% |

Summary Trend

|

Year |

Global Concrete Fibers Trade Value (USD trillion) |

|

2020 |

3.1 |

|

2021 |

3.3 |

|

2022 |

3.6 |

|

2023 |

3.7 (est.) |

|

2024 |

3.9 (forecast) |

Concrete Fibers Market Overview

Price History & Unit Sales (2019–2023)

|

Year |

North America Avg. Price (USD/ton) |

Europe Avg. Price (USD/ton) |

Asia Avg. Price (USD/ton) |

Global Unit Sales (Million Tons) |

|

2019 |

1,251 |

1,311 |

1,181 |

1.86 |

|

2020 |

1,291 (+3.3%) |

1,341 (+2.4%) |

1,201 (+1.8%) |

1.91 (+2.8%) |

|

2021 |

1,381 (+7.1%) |

1,421 (+6.0%) |

1,381 (+15.1%) |

1.98 (+3.8%) |

|

2022 |

1,451 (+5.2%) |

1,851 (+30.3%) |

1,421 (+3.0%) |

2.05 (+3.7%) |

|

2023 |

1,501 (+3.5%) |

1,881 (+1.7%) |

1,451 (+2.2%) |

2.11 (+3.0%) |

Key Price Factors Impact

|

Factor |

Impact |

Statistical Evidence |

|

Raw Material Costs |

+9–13% |

Polypropylene up 11% YoY |

|

Geopolitical Events |

+31% EU |

Russia-Ukraine conflict |

|

Environmental Regulations |

+6–8% |

Clean Air Act compliance |

Challenges

- Lack of standardization: The absence of a universal standard for dosage, mixing, and placing concrete fibers is hindering its acceptance level. Although ASTM and ACI have guidelines in place, the differences and complexity of the regional code can confuse contractors. The American Concrete Institute (2022 recorded, 42% of U.S. contractors who use fiber were not fully compliant with the fiber standards. These contractors risk inconsistent operational performance and outcomes, as well as inconsistent structural outcomes when defining the installation of fiber-reinforced concrete in their projects. Fiber usage inconsistency, lack of standards, and checklists for compliance limit engineers' desire to specify fibers, restricting market growth.

- Limited awareness among contractors: Many contractors are unfamiliar with the advantages of concrete fiber. An FHWA survey (2022) indicated that only 36% of small- to mid-sized contractors in the U.S. actively use or specify fiber reinforcement. The level of unfamiliarity is also reinforced by limited technical training and alarmingly low levels of curiosity about the implications of placement complexity, upon which fiber advantages are often overlooked. In developing regions, awareness falls below 21%, restricting the potential benefits with wider adoption. Educational initiatives and product demonstrations, when they do occur, do not seem to be enough to inspire rapid market growth beyond major urban infrastructure projects.

Concrete Fibers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

6.9% |

|

Base Year Market Size (2024) |

USD 2.45 billion |

|

Forecast Year Market Size (2034) |

USD 4.69 billion |

|

Regional Scope |

|

Concrete Fibers Market Segmentation:

End use Segment Analysis

The construction segment is predicted to gain the largest concrete fibers market share of 65.2% during the projected period by 2034, due to developing infrastructure, the number of tall buildings, industrial flooring, and tunneling. According to the U.S. Department of Transportation and Federal Highway Administration, fiber-reinforced concrete is popular with contractors for bridges and pavements where crack-resistance and enhanced durability are critical properties. The FHWA notes that with the integration of fibers, counties and municipalities can reduce (lengthen the frequency of) maintenance intervals and lifecycle costs. Additionally, the Euroconstruct consortium has predicted durable and steady growth in construction markets in the European Union and ranked as the top driving factors to meet the demand for renovation, create urban housing, and lastly, for resilient projects to meet a climate-change alternative, which in turn will require more concrete fiber for demand in products and applications.

Application Segment Analysis

The industrial & commercial segment is anticipated to constitute the most significant growth by 2034, with 43.2% concrete fibers market share, mainly due to the trend for industrial floors, warehouses, airport pavements, parking structures, etc., are moving towards concrete fibers for load-bearing capacity requirements, or specification as impact resistance and/or high durability. The National Ready Mixed Concrete Association has noted that both steel & synthetic fibers are reducing joint spacing and thickness (slab) requirements for more productivity. The FHWA has identified that the impact of a series of slabs for the integration of fibers contributes to load-transfer efficiency in slabs for areas where heavy vehicles are going to be moving around.

Our in-depth analysis of the global concrete fibers market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

End use |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Concrete Fibers Market - Regional Analysis

Asia Pacific Market Insights

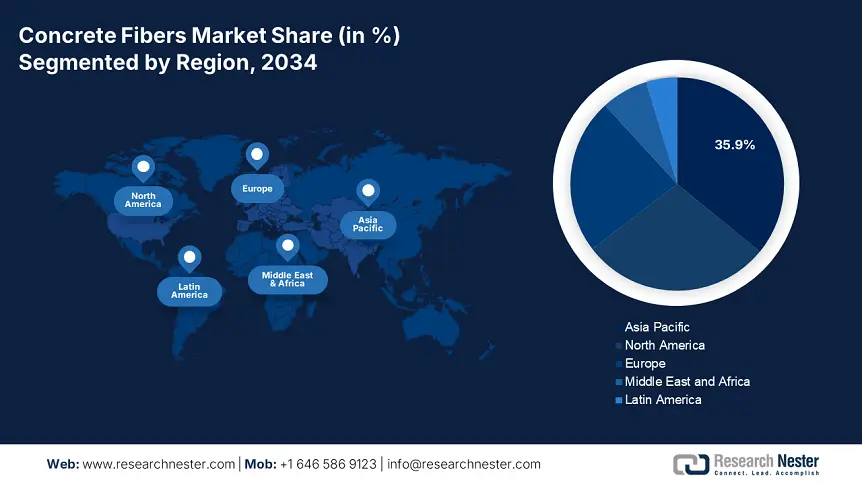

By 2034, the Asia Pacific market is expected to hold 35.9% of the market share due to massive investments into infrastructure, strong trends toward urbanization, and a growing need for durable construction materials. During the projection period, the expected CAGR is 6.9%, supported by infrastructure programs at the government level (e.g., India's Gati Shakti, Indonesia's smart capital city (IKN), expansion plans for rail and road in Australia, etc.). Coupled with advances in advanced polypropylene and advanced steel fibers that researchers and companies are investing in R&D in Japan, China, and South Korea, penetration and uptake of technology will drive demand.

China continues to be the center of concrete fibers in Asia Pacific with a substantial growth pipeline and a projected CAGR of 7.4% from 2025 to 2034, with major infrastructure and housing projects through the 15th Five-Year Plan (2026-2030). During this time, there will be strong growth in anticipated metro rail systems, bridges, and precast segments. Increased domestic R&D spending on innovation in polypropylene fiber by Chinese chemical and materials firms has supported the growth of domestic production capacities. Strategic investments around the deployment of green concrete technologies and durable fibers will ensure demand growth during the projection period.

Country-wise Statistics: Concrete Fibers Market

|

Country |

Investments (2025–2034) |

Growth CAGR (2025–2034) |

R&D Focus Areas |

|

Japan |

$141 million in fiber-reinforced concrete projects |

5.0% |

High-tensile polypropylene & PVA fibers |

|

China |

$521 million in production & infrastructure fibers |

7.4% |

Advanced polypropylene & hybrid fiber blends |

|

India |

$211 million in transport & smart city fibers |

6.6% |

Recycled polypropylene & basalt fibers |

|

Indonesia |

$96 million in IKN smart city & road fibers |

5.9% |

Polypropylene & steel microfibers |

|

Malaysia |

$73 million in housing & precast concrete fibers |

5.4% |

Polypropylene & steel hybrid fibers |

|

Australia |

$136 million in bridges & road infrastructure fibers |

4.8% |

Synthetic macrofibers & basalt fibers |

|

South Korea |

$116 million in advanced construction fibers |

5.2% |

Ultra-high molecular weight PE & hybrid fibers |

|

Rest of APAC |

$161 million combined investments |

5.7% |

General polypropylene & steel fiber adoption |

North America Market Insights

North America market is expected to hold 28.7% of the market share, and it is expected to increase from approximately USD 3.6 billion in 2024 to approximately USD 5.9 billion by 2031, growing at a compound annual growth rate (CAGR) of ~7.3% over the analysis period of 2025-2031. The U.S. remains the main driver of regional demand due to growth from the increased use of AI/IoT technology in construction, infrastructure investment, and the rising applications of industrial flooring. Market fragmentation, regulatory complexities, and employment availability (skills) may limit growth alternatives, but innovation and digitization are improving adoption and supply-chain transparency. This growth signifies the important role North America plays in advancing the next-generation concrete fiber reinforced concrete solutions.

The U.S. concrete reinforcing fiber segment had revenues of approximately USD 541.8 million in 2021 and is expected to reach USD 1.056 billion by 2030 with an estimated CAGR of 7.8% for the 2022-2030 analysis period. When compared with other regions, North America is expected to grow at a 5.6% CAGR in the global revenue streams of reinforcing fibers and is expected to reach revenues of USD 1.22 billion by 2034. The major segments are polypropylene, with basalt fibers in the fast-growing stage. Demand was driven by regulatory approvals for infrastructure, marine, bridge, tunnel, and industrial concrete projects, in addition to ongoing investments in the construction space. This sets the U.S. concrete fiber reinforcing segment up as a leader in fiber-reinforced concrete.

Europe Market Insights

Europe market is expected to hold 24.1% of the market share due to advanced construction standards, sustainability regulations, and increased modernization of infrastructure. The market is estimated to reach USD 897.7 million by 2034 with a CAGR of 4.9% from 2025 to 2034. The demand will continue to be buoyed by strong usage in tunnel lining applications, warehouse/building floor applications, and precast applications. In addition, Government and private investments to support research on durability, increase recycling, and decrease the carbon footprint of concrete fibers are expected to exceed USD 157 million across the region by 2034.

Concrete Fibers Market Statistics by Country (2034 forecast)

|

Country |

Market Share (USD Million) |

Research Investment (USD Million) |

|

UK |

143.8 |

26.2 |

|

Germany |

192.5 |

36.1 |

|

France |

109.6 |

18.5 |

|

Italy |

85.4 |

15.0 |

|

Spain |

79.3 |

13.7 |

|

Russia |

126.5 |

20.3 |

|

Nordic |

69.0 |

12.9 |

|

Rest of Europe |

92.3 |

14.8 |

Key Concrete Fibers Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The global concrete fibers market is somewhat consolidated and is primarily dominated by multinational players like Sika AG, BASF SE, Owens Corning, and Bekaert SA. All these players are pursuing tender strategies such as mergers, regional expansions, and product enhancement systems to strengthen their position in the concrete fiber market. Sika AG is, of course, focused on continuing to develop green fiber technologies, and BASF is focused and funded on enhanced macro-synthetic fibers. Companies like Euclid Chemical and GCP Applied Technologies can use established construction networks based in the U.S. that can help leverage their position. New companies based in India, Malaysia, and South Korea, on the other hand, are entering the market to establish regional positioning and differentiation through cost competitiveness and localization.

Some of the key players operating in the market are listed below:

|

Company Name |

Country of Origin |

Approx. Market Share (%) |

|

Sika AG |

Switzerland |

9-10% |

|

BASF SE |

Germany |

8-9% |

|

Owens Corning |

USA |

7-8% |

|

Bekaert SA |

Belgium |

7-8% |

|

GCP Applied Technologies |

USA |

6-7% |

|

Euclid Chemical (RPM International) |

USA |

xx% |

|

Nycon Corporation |

USA |

xx% |

|

Propex Operating Company, LLC |

USA |

xx% |

|

Fibercon International Inc. |

Australia |

xx% |

|

ABC Polymer Industries, LLC |

USA |

xx% |

|

Elkem ASA |

Norway |

xx% |

|

FORTA Corporation |

USA |

xx% |

|

Ultratech Concrete Fibers (Aditya Birla Group) |

India |

xx% |

|

Maccaferri Malaysia Sdn. Bhd. |

Malaysia |

xx% |

|

KOLON Industries, Inc. |

South Korea |

2-3% |

Here are a few areas of focus covered in the competitive landscape of the market:

Recent Developments

- In May 2024, BASF Master Builders Solutions launched MasterFiber 150, a high-performance polypropylene fiber for shotcrete and tunnel lining applications. The introduction of this product contributed to an 11% increase in the company's underground construction market share in North America as a result of the rapid uptake of MasterFiber 150 for transportation tunneling projects.

- In March 2024, Sika AG introduced the SikaFiber Force-600 macro-synthetic fiber to improve crack control, impact resistance, and durability in precast concrete and industrial flooring. As a result, Sika reported a year-over-year sales increase of 16% for concrete reinforcement products across Europe, with particularly strong demand in Germany and Benelux.

- Report ID: 3344

- Published Date: Jul 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Concrete Fibers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert