Concrete Admixtures Market Outlook:

Concrete Admixtures Market size was valued at USD 20.4 billion in 2025 and is projected to reach USD 47.8 billion by the end of 2035, rising at a CAGR of 8.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of concrete admixtures is evaluated at USD 22.2 billion.

The global concrete admixtures market demand is closely tied to the construction activity, infrastructure renewal, and public capital expenditure patterns. The government data indicate the sustained structural demand for the concrete-intensive projects across transport, housing, energy, and water infrastructure. According to the U.S. Census Bureau January 2026 report the total construction spending in October 2025 reached USD 2,175.2 billion, driven by the public infrastructure and non-residential projects. Besides, the U.S. Department of Transport data in February 2023 indicates that USD 1.2 trillion is allocated for transport and infrastructure spending, with USD 550 billion allocated to new construction and rehabilitation of roads, bridges, ports, water systems, and public buildings, applications where admixture usage is standard practice to meet the performance specifications and durability.

U.S. Construction Spending

|

Category |

October 2025 (SAAR, USD billion) |

Change vs. Sep 2025 |

Change vs. Oct 2024 |

|

Total Construction |

2,175.2 |

+0.5% (±0.7%) |

-1.0% (±1.5%) |

|

YTD First 10 Months |

1,825.3 |

N/A |

-1.4% (±1.0%) |

|

Private Construction |

1,651.3 |

+0.6% (±0.5%) |

N/A |

|

- Residential |

913.9 |

+1.3% (±1.3%) |

N/A |

|

- Nonresidential |

737.4 |

-0.2% (±0.5%) |

N/A |

|

Public Construction |

524.0 |

+0.1% (±1.0%) |

N/A |

|

- Educational |

114.8 |

+0.7% (±1.3%) |

N/A |

|

- Highway |

141.6 |

+0.1% (±2.6%) |

N/A |

Source: U.S. Census Bureau, January 2026

Similarly, the U.S. Geological Survey's Mineral Commodity Summaries in January 2023 report states that the domestic cement production reached 92 million tons in 2022, reinforcing the scale of downstream concrete demand that directly supports the admixture volumes in ready mix and precast segments. The report also states that China is the leading producer of cement and produced 2,100,000 in 2022. The report further highlights that the cement production capacity utilization in the U.S. remained high due to the sustained public and private construction activity, indicating a stable demand condition for concrete inputs. Moreover, the scale of China’s cement output indicates the concentration of global concrete production in Asia, where large infrastructure and urban development programs continue to drive the significant consumption of admixtures in mass concrete and prefabricated construction.

Key Concrete Admixtures Market Insights Summary:

Regional Highlights:

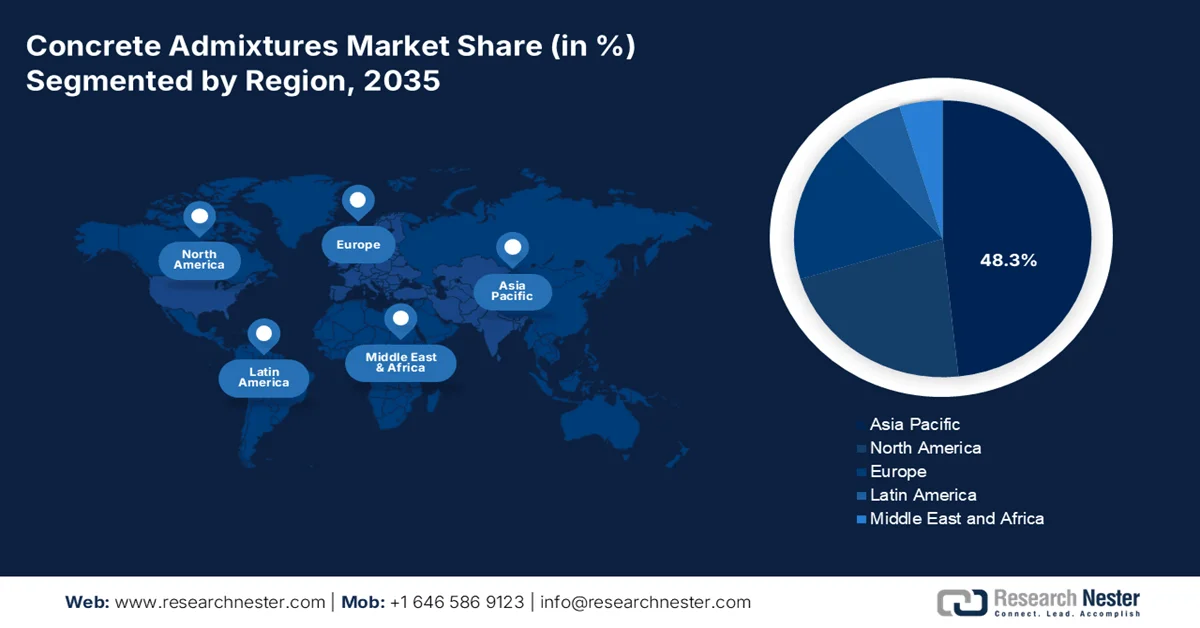

- In the concrete admixtures market, Asia Pacific is projected to account for a 48.3% regional revenue share by 2035, supported by rapid urbanization and large-scale public infrastructure investments, underpinned by national infrastructure modernization initiatives.

- North America is expected to be the fastest-growing region during 2026–2035 with a CAGR of 7.1%, reinforced by infrastructure renewal programs and sustainability mandates, accelerated through major public funding for low-carbon and high-performance concrete adoption.

Segment Insights:

- In the concrete admixtures market, the synthetic sub-segment within the material segment is anticipated to hold a 65.4% share by 2035, enabled by superior water-reduction efficiency and customizable polymer structures, stimulated by the construction industry’s emphasis on efficiency and sustainability.

- Within the application segment, ready-mix concrete is projected to maintain its leading position over 2026–2035, strengthened by the expansion of centralized batching plants and large-scale urban infrastructure projects, supported by the need for consistent quality-controlled concrete supply.

Key Growth Trends:

- Rising cement and concrete consumption volumes

- Government focus on infrastructure modernization

Major Challenges:

- High R&D and technical service costs

- Established brand loyalty and specification lock-in

Key Players: Sika AG, GCP Applied Technologies, BASF SE, Mapei S.p.A., Fosroc International Ltd., RPM International Inc. (MBCC Group), Arkema S.A., Pidilite Industries Limited, CEMEX S.A.B. de C.V., Dow Chemical Company, W. R. Grace & Co.

Global Concrete Admixtures Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 20.4 billion

- 2026 Market Size: USD 22.2 billion

- Projected Market Size: USD 47.8 billion by 2035

- Growth Forecasts: 8.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (48.3% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: India, Vietnam, Indonesia, Brazil, Mexico

Last updated on : 5 February, 2026

Concrete Admixtures Market - Growth Drivers and Challenges

Growth Drivers

- Rising cement and concrete consumption volumes: Cement production trends serve as leading indicators of downstream admixture demand. The U.S. Geological Survey, Mineral Commodity Summaries, January 2023, depicts that in 2022, the consumption of cement in the U.S. was nearly 900 million metric tons, and further, the states such as Texas, Missouri, California, and Florida produce approximately 43% of the cement in the U.S. This highlights the demand for the market. High-volume cement markets typically adopt admixtures to manage workability, setting time, and performance consistency at scale. In developing economies where the infrastructure and housing projects are executed under a compressed timeline, admixtures are increasingly specified to reduce the execution risks. This creates a volume-driven demand for the suppliers in APAC and North America.

U.S. Cement Consumption

|

Year |

Consumption |

|

2018 |

98,500 |

|

2019 |

102,000 |

|

2020 |

105,000 |

|

2021 |

110,000 |

|

2022 |

120,000 |

Source: USGS January 2023

- Government focus on infrastructure modernization: Government expenditure on transportation, energy, and water infrastructure is a significant and stable driver for the concrete admixture market. National multi-year plans create predictable, large-volume demand for high-performance concrete. According to the AASHTO IIJA Surface Reauthorization in May 2025 report, the IIJA allocates USD 110 billion for roads and bridges projects, which specify durable concrete requiring advanced admixtures for longevity and rapid construction. Further, the EU’s cohesion policy and national programs channel billions into concrete-intensive projects, mandating technical solutions that admixtures provide. Besides the government-led programs, further reinforce the sustained high volume admixture consumption by prioritizing time-bound concrete and large-scale construction across rail and highway utilities.

- Government led urbanization and housing programs: Public housing and urban development programs significantly influence admixture consumption mainly in the emerging nations. As per the WHO 2026 report, 55% of the global population lives in urban areas and is projected to grow significantly in the upcoming years. This increase requires a high sustained investment in residential and mixed-use construction. Governments in India, Southeast Asia, and Africa continue to prioritize affordable housing and urban infrastructure via centrally funded schemes. Large-scale residential construction relies on admixtures to maintain quality uniformity across high-volume pours and precast components. For admixtures manufacturers, alignment with public housing authorities and state contractors offers repeat demand and standardized specifications favoring suppliers with scalable production and regulatory compliance capabilities.

Challenges

- High R&D and technical service costs: Developing and proving next-gen admixtures, such as PCE-based superplasticizers, requires immense sustained R&D investment in the market. further the success is based on providing free, extensive technical service to specifiers and contractors, creating a significant cost barrier. The top players in the market consistently invest a certain percentage of their net sales in R&D to maintain their portfolio. New players struggle to match this commitment without established revenue streams, making product development and customer support financially prohibitive at scale.

- Established brand loyalty and specification lock-in: The major construction projects rely on engineer and architect specifications that often name trusted brands. This trusted brand or equal specification process favors the competitors with proven long-term performance data. The new brands in the market face a huge burden in getting specified, as contractors are risk-averse. Breaking into supply chains for mega projects is mainly difficult without a decades-long track record of successful large-scale applications.

Concrete Admixtures Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.9% |

|

Base Year Market Size (2025) |

USD 20.4 billion |

|

Forecast Year Market Size (2035) |

USD 47.8 billion |

|

Regional Scope |

|

Concrete Admixtures Market Segmentation:

Material Segment Analysis

In the concrete admixtures market, the synthetic sub-segments are leading the material segment and are poised to hold the share value of 65.4% by 2035. These advanced engineered polymers offer superior performance in reducing the water content and enhancing the workability at low dosages compared to the traditional natural lignosulfonates. Their molecular structure can be customized for specific concrete properties, making them indispensable for modern high-strength self-consolidating and sustainable concrete mixes that require low water-cement ratios and high durability. The shift is driven by the global construction industry’s demand for efficiency and sustainability, as its use directly enables significant reductions in cement content and related carbon emissions.

Application Segment Analysis

The ready-mix concrete is the dominating sub-segment in the market. The global shift toward the centralized batching plants that deliver precise quality-controlled concrete to construction sites is the major reason for their dominance. The admixtures are significant for ensuring this concrete maintains workability during transit, meets specified strength targets, and complies with project-specific requirements such as durability and set time. The growth of urban infrastructure and large-scale commercial projects that rely on consistent high-volume concrete supply strengthens this segment’s lead. The producer price index of ready mix concrete reached 399.849 in November 2025, based on the U.S. BLS 2025 report. In addition, the strict construction quality standards and increased adoption of high-performance and specialty admixtures reinforce the dominance of the ready mix concrete segment.

Producer Price Index of Ready-Mixed Concrete

|

Year |

2024 |

2025 |

|

Jan |

376.419 |

390.311 |

|

Feb |

380.370 |

389.524 |

|

Mar |

386.077 |

388.511 |

|

Apr |

383.503 |

386.098 |

|

May |

384.181 |

387.457 |

|

Jun |

382.036 |

387.394 |

|

Jul |

383.550 |

385.993 |

|

Aug |

386.394 |

386.359 |

|

Sep |

384.917 |

385.351 |

|

Oct |

385.351 |

386.267 |

|

Nov |

387.459 |

385.567 |

|

Dec |

385.931 |

384.802 |

|

Annual |

383.849 |

- |

Source: U.S. BLS

End use Segment Analysis

The residential construction is the leading sub-segment in the market. The leadership is fueled by the relentless global production growth, urbanization, and post pandemic recovery in housing starts. The admixtures are essential in residential projects for creating a durable foundation, crack-resistant slabs, and energy-efficient insulated concrete forms. Government policies promoting affordable housing and sustainable building codes further stimulate the demand as the admixtures allow for the use of alternative, greener cementitious materials and improve the overall building performance and resilience. According to the January 2025 U.S. Census Bureau report, the housing stats totaled nearly 1,499,000, illustrating a massive ongoing demand for residential construction materials, including advanced concrete admixtures.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Material |

|

|

Function |

|

|

Application |

|

|

End use |

|

|

Form |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Concrete Admixtures Market - Regional Analysis

APAC Market Insights

The Asia Pacific concrete admixtures market is the largest and the dominating market, poised to hold the regional revenue share of 48.3% by 2035. The dominance is due to the rising urbanization, massive public infrastructure investment, and growing focus on construction quality and sustainability. The primary demand driver is the national initiatives' active expansion and rising investment in infrastructure modernization. These investments are a multi trillion dollar programs and mandate for high volume of concrete. A significant trend is the rapid shift from basic to high-performance polycarboxylate ether-based superplasticizer admixtures, enabling easier construction and quicker. Moreover, the governments implement the green building codes, which increase the demand for admixtures that minimize the consumption of cement and water.

Large scale public infrastructure investment and rapid urban development supported by the central government programs are driving the India market. According to the IBEF October 2025 data, the cement production in India in 2024 was around 426.29 million tonnes. Higher cement output indicates the increased volumes of ready-mix, precast, and on-site concrete, where admixtures are routinely used to control workability, setting time, durability, and performance. Besides, the PIB February 2024 report shows the construction sector is growing significantly by 10.7%, indicating a rising demand and usage of concrete admixtures. Moreover, the RBSA December 2023 report depicts that the central government has allocated over USD 81 million for road construction, relying on ready mix and precast concrete. These data create a high volume demand for the concrete admixtures in India.

The China market is fundamentally driven by the scale and continuity of government-led infrastructure and urban construction programs. According to the NLM July 2025 study, concrete manufacturing relies on 4 billion tons of cement, and China is the largest cement producer with 1.9 billion metric tons in 2024, accounting for half of the global output, underscoring the volume base that supports the consumption. Besides the public investment, the infrastructure modernization grew by a significant percentage with the sustained funding directed towards transport networks, municipal utilities, water management, and more. Additionally, the improved quality control and durability in concrete construction are reinforcing the systematic admixture usage in precast and ready mix applications. This boosts the adoption across various applications, such as public housing, transportation, and municipal infrastructure projects in China.

North America Market Insights

The North America concrete admixtures market is the fastest growing and is expected to grow at a CAGR of 7.1% during the forecast period 2026 to 2035. The growth is driven by infrastructure renewal, stringent sustainability mandates, and advanced construction practices. The key drivers are the implementation of IIJA, which allocates a significant amount for infrastructure modernization, directly demanding for high performance concrete. Further, in Canada, the Invest in Canada plan supports the public infrastructure and low-carbon construction. A primary demand is the shift towards admixtures that facilitate low-carbon concrete mixes to meet ambitious embodied carbon targets such as the Buy Clean Initiative in the U.S. and Canada. The focus on repairing aging infrastructure over new builds also increases the demand for specialized repair and shotcrete admixtures.

The market in U.S. is strongly driven by the public sector procurement frameworks and the state-level infrastructure execution. The Illinois Department of Transportation Bureau of Materials report in January 2026 indicates the approved concrete admixtures list governs materials used in highway and bridge construction, reinforcing the role of the admixtures as the mandatory inputs rather than optional enhancements in federally and state-funded projects. This aligns with broader national spending trends. According to the U.S. Census Bureau report in January 2026, the public construction spending reached USD 524.0 billion, indicating a sustained concrete output. Further, the regulatory approvals and funding mechanisms create a predictable specification-driven demand for concrete admixtures across transportation, water, and civil infrastructure projects in the U.S.

IDOT Approved Concrete Admixtures

|

Company Name |

Brand Name |

Specification |

Material Code |

|

Chryso Inc |

Darex II AEA |

AIR ENTRAINING ADMIXTURES |

42138 |

|

DarCole Products, Inc. |

DNL 485 |

TYPE A, WATER REDUCING ADMIXTURES |

43958 |

|

Euclid Chemical Company |

Eucon Stasis |

TYPE B, RETARDING ADMIXTURES |

43949 |

|

Mapei |

Mapefast Super Set (Polychem Super Set) |

TYPE C, ACCELERATING ADMIXTURES |

43773 |

Source: Illinois Department of Transportation Bureau of Materials report January 2026

The Canada concrete admixtures market is closely related to the federally and provincially funded infrastructure and sustainability-focused construction programs. According to the Government of Canada's January 2026 report, the total investment in building construction reached USD 24.5 billion in November 2025, with public infrastructure accounting for a significant share of non-residential activity, supporting a steady demand for concrete and related admixtures. Moveover, the Housing Infrastructure and Communities of Canada report in September 2025 indicates that the nation continues to deploy funding under the Investing in Canada Plan, a long-term program of more than USD 180 billion supporting transportation, water, community infrastructure, and wastewater projects that rely on the performance specified concrete. These public investments are creating a stable and policy-driven demand for concrete admixture across Canada.

Europe Market Insights

The concrete admixture market in Europe is growing significantly and is driven by the stringent environmental regulations and major transnational infrastructure funding, balanced against a mature construction sector. The primary driver is the European Green Deal and its construction-specific directives, such as the Energy Performance of Buildings Directive recast and the proposed Construction Products Regulation, which mandate reductions in embodied carbon. This pushes the widespread adoption of admixtures that enable low clinker high performance concrete. On the other hand, the cohesion funds allocate significant billions for renovation and sustainable infrastructure, creating a direct demand. The key trend is the digitalization of construction, with admixture suppliers providing smart dosing systems and data services to optimize mix designs and ensure compliance.

The market in Germany is driven by the sustained public investment in transport and municipal infrastructure alongside strict regulatory standards governing construction quality and durability. According to the BAI August 2025 report, the highway railways, and energy infrastructure investment reached USD 400 billion, a significant portion of which is directed towards the maintenance and upgrading of existing assets, where the high-performance concrete and admixtures are specified. Besides, the Deutschland report in July 2025 indicates that in 2023 in 2023, nearly 300,000 houses and flats were built, and nearly 263,000 of these are new buildings, highlighting the rising consumption of the concrete admixtures and reflecting a strong demand in both the public and private sectors. These data reinforce consistent, specification-led demand for concrete admixtures across applications in the nation.

The UK concrete admixtures market is underpinned by the sustained public infrastructure investment and increasingly stringent performance and sustainability requirements in construction. As per the data from the Office of National Statistics in November 2025, the total construction new orders are expected to grow by 9.8%, nearly £1,078 million during Q3 2025, with the infrastructure accounting for a significant share of growth, mainly in transport utilities and public works. Besides, the Government of the UK report in February 2024 highlights that the National Infrastructure and Construction Pipeline outlines more than 660 projects with investments ranging from £700 to £775 billion over the next 10 years. These projects rely on durable high-performance concrete where admixtures are routinely specified. Further, these factors create a stable policy-driven demand environment for concrete admixtures in urban and commercial development projects in the UK.

Key Concrete Admixtures Market Players:

- Sika AG (Switzerland)

- GCP Applied Technologies (U.S.)

- BASF SE (Germany)

- Mapei S.p.A. (Italy)

- Fosroc International Ltd. (UK)

- RPM International Inc. (MBCC Group) (U.S.)

- Arkema S.A. (France)

- Pidilite Industries Limited (India)

- CEMEX S.A.B. de C.V. (Mexico)

- Dow Chemical Company (U.S.)

- W. R. Grace & Co. (U.S.)

- CHRYSO S.A.S. (France)

- Ashland Global Holdings Inc. (U.S.)

- Kao Corporation (Japan)

- Muhu Construction Materials Co., Ltd. (China)

- Cormix International Ltd. (UK)

- Ha-Be Betonchemie GmbH & Co. KG (Germany)

- The Euclid Chemical Company (U.S.)

- Selena FM S.A. (Poland)

- Henan Kingsun Chemical Co., Ltd. (China)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sika AG is a dominant player in the concrete admixture market and drives the growth via acquisition strategies, such as its landmark purchase of MBCC Group to expand its global footprint and comprehensive product portfolio. Their strategic initiatives heavily focus on innovation in high-performance admixtures for sustainable construction, including solutions for waterproofing concrete and reducing its carbon footprint. According to the 2024 annual report, the company has made a net sale of 11,763.1 CHF million.

- GCP Applied Technologies is a competitive player in the concrete admixtures market and distinguishes itself via its deep scientific expertise and a focus on advanced chemical technologies. Their strategic initiatives center on developing innovative admixtures that enhance the durability, sustainability, and efficiency of concrete.

- BASF SE is a global chemical leader in the concrete admixtures market and leads via its master builder solutions brand. Its key strategic initiatives are a massive investment in R&D to pioneer green admixture technologies such as MasterEase and MasterGlenium superplasticizers that enable the production of highly workable low carbon and resource-efficient concrete. The company has made sales of 18.2 million euros in North America.

- Mapei S.p.A.'s strength in the concrete admixtures market stems from its fully integrated, vertically controlled production chain and relentless focus on research. Their primary strategic initiatives involve creating highly specialized problem-solving admixture systems for complex applications, from self-compacting concrete to restoration projects backed by the global network of technical laboratories.

- Fosroc International Ltd competes in the global concrete admixtures market by positioning itself as a specialist solutions provider for the construction and mining industries. Their strategic initiatives emphasize developing high performance application specific admixture system that addresses the extreme durability challenges.

Here is a list of key players operating in the global market:

The global concrete admixtures market is defined by intense competition and consolidation, with the multinational chemical giants dominating the landscape. The key strategic initiatives include significant investments in R&D for the sustainable high-performance products expansion into the high-growth markets, and strategic mergers and acquisitions to broaden the product portfolios and geographic reach. Besides, in February 2025, Saint-Gobain acquired FOSROC, a leading player in construction chemicals in Asia and emerging markets, strengthening its global presence in the sector. The leading players are also focusing on providing technical support and customized solutions to major infrastructure projects, integrating digital tools for service, and advancing bio-based and low-carbon admixtures to meet the robust environmental regulations and the global push for green construction.

Corporate Landscape of the Concrete Admixtures Market:

Recent Developments

- In December 2025, SIKA has opened a new state-of-the-art plant in Haines City, Florida. The plant produces high-performance superplasticizers for concrete, serving customers across Florida and the Southeastern U.S., the highest requirements in demanding construction projects in the region.

- In October 2025, First Graphene has launched a new graphene-enhanced additive for cement and concrete in the South African market. The Company’s entrance into the South African construction materials market represents the rising prominence of the product and the range of benefits it provides to the global cement and concrete industry.

- In September 2025, MBT Construction Chemicals announced the inauguration of its new state-of-the-art manufacturing facility in Taloja, Navi Mumbai, India. The facility was inaugurated by Dr. Boris Gorella, CEO and Chairman of the Board of Management at Master Builders Solutions, accompanied by Dr. Karsten Eller, COO, and Himanshu Kapadia, Cluster Head Asia, Middle East & Turkey.

- Report ID: 3378

- Published Date: Feb 05, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Concrete Admixtures Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.