Concentrating Solar Power Market Outlook:

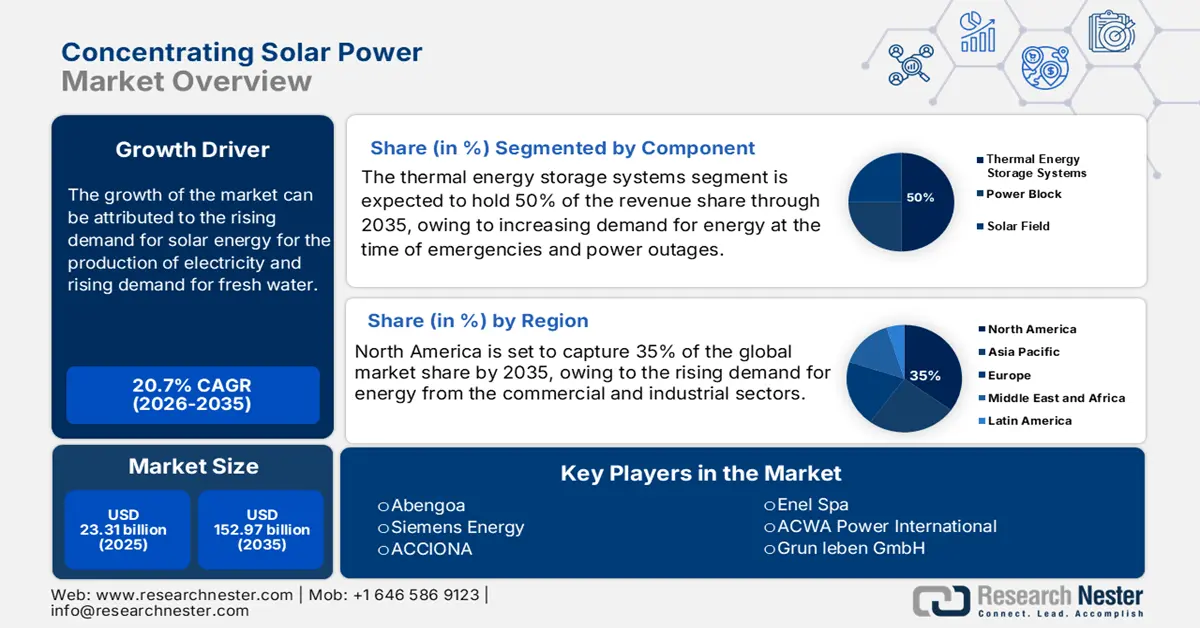

Concentrating Solar Power Market size was valued at USD 23.31 billion in 2025 and is expected to reach USD 152.97 billion by 2035, expanding at around 20.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of concentrating solar power is evaluated at USD 27.65 billion.

The growth of the market can be attributed to the rising demand for solar energy for the production of electricity. Solar PV is rapidly becoming the most cost-effective alternative for new electricity generation in most of the world, which is projected to drive investment in the next years. According to the International Energy Agency, global solar PV power generation climbed by a record 179 TWh in 2021, representing a 22% increase over 2020. Solar PV accounted for 3.6% of worldwide electricity generation in 2016, and it is still the third largest renewable energy technology after hydropower and wind.

In addition to these, factors that are believed to fuel the concentrating solar power market growth of concentrating solar power include the rising production of electricity by the use of solar energy and the low cost of solar-powered electricity. According to the statistics of IRENA, the global weighted average levelized cost of electricity (LCOE) of new utility-scale solar PV declined 13% year on year to USD 0.048/kWh. Furthermore, In Europe in 2021, the lifetime cost per kWh of new solar and wind power added was at least four to six times less than the marginal generating costs of fossil fuels in 2022. On the other hand, the growing burden on fossil fuel usage and the rising need to reduce carbon emission is also expected to augment the market growth.

Key Concentrating Solar Power (CSP) Market Insights Summary:

Regional Highlights:

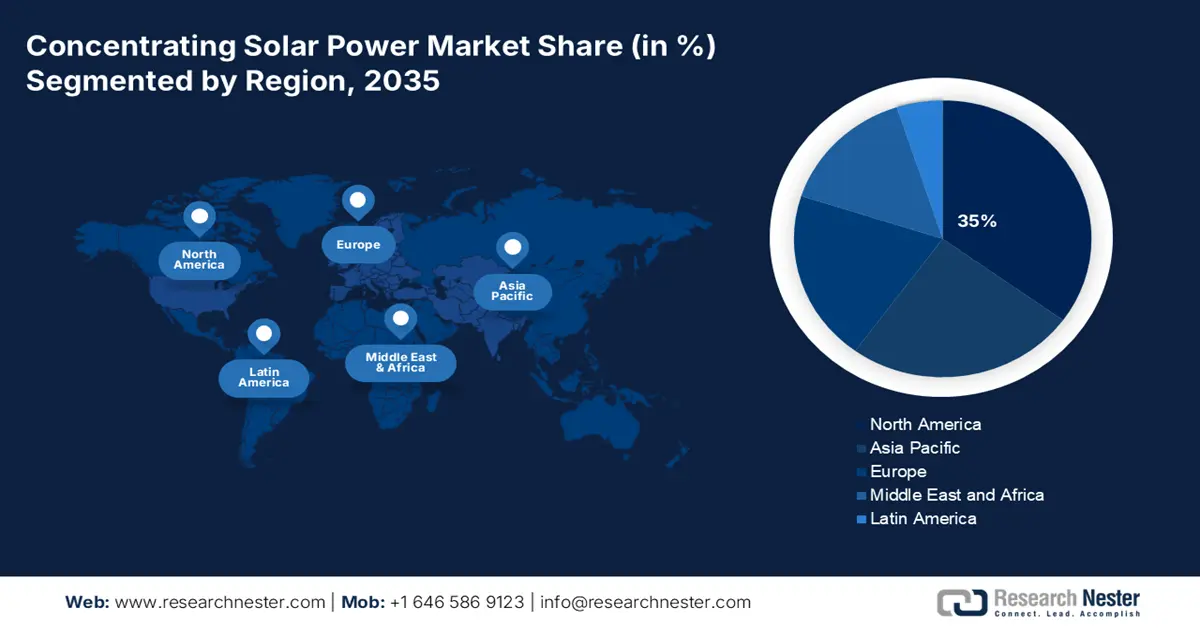

- North America concentrating solar power market will hold over 35% share by 2035, rising energy demand from industrial and commercial sectors and government support for renewable energy.

- Asia Pacific market will secure 25% share by 2035, rising renewable energy production and installation of solar PV systems in China and India.

Segment Insights:

- The non-residential segment in the concentrating solar power market is projected to secure a significant share by 2035, attributed to rising industrial energy demand and applications like desalination and food processing.

- The thermal energy storage systems segment in the concentrating solar power market is expected to hold the largest share by 2035, driven by energy needs during outages and rising investments in energy transition.

Key Growth Trends:

- Increasing Depletion of Fossil Fuels

- Rising Demand for Fresh Water

Major Challenges:

- The Setup of Solar Panels is Expensive

- Concentrated Solar Power Consumes a Lot of Water

Key Players: Abengoa, New BrightSource, Ltd., Siemens Energy, ACCIONA, Aalborg CSP A/S, ACWA Power International, Shouhang Hightech Energy Technology Co., Ltd., Enel Spa, Trivelli Energia s.r.l., Grün leben GmbH.

Global Concentrating Solar Power (CSP) Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 23.31 billion

- 2026 Market Size: USD 27.65 billion

- Projected Market Size: USD 152.97 billion by 2035

- Growth Forecasts: 20.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Spain, India

- Emerging Countries: China, India, Australia, Chile, Brazil

Last updated on : 10 September, 2025

Concentrating Solar Power Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Demand for Renewable Energy- On generating power with solar panels, no greenhouse gas emissions are sent into the atmosphere. Therefore, the need for concentrated solar power is becoming imperative in the polluted world. According to the International Renewable Energy Agency, the most capacity expansion of any renewable energy source happened in 2020 when new solar PV capacity increased by almost 125 GW globally.

-

Increasing Depletion of Fossil Fuels – The current global energy demand, fossil fuels cannot regenerate themselves quickly enough to fulfill these rising demands. The over-consumption of these non-renewable fuels has led to the need for more renewable energy to be developed. To avoid a potentially devastating rise in global temperatures, countries must limit their output of fossil fuels by 6% per year between 2020 and 2030, according to a United Nations-backed report.

- Rising Demand for Fresh Water – The Sun heats the saltwater in the desalination machine, turning it to water vapor The Sun heats the saltwater in the desalination machine, turning it to water vapor, and condenses back to liquid as fresh water in a separate collection container. Over 40% of water bodies were very polluted, according to a UN Environment Programme examination of 75,000 water bodies in 89 nations. Furthermore, 2.3 billion people globally live in water-stressed areas.

- Growing Extraction of Oil – Essential oil extraction by distillation requires heat in the medium temperature range, which can be supplied by a solar thermal system. Moreover, it is also used for enhanced oil recovery of the extracted oil. In 2020, the daily global demand for oil was around 91 barrels, but by 2021, it had risen to nearly 97 million barrels.

- Rising Government Efforts to Boost Renewable Energy –Proactive government initiatives are expected to boost the production of concentrated solar power in the world. In December 2022, the Government of India, Solar Energy Corporation of India Limited (SECI), and the World Bank signed agreements for a USD 150 million International Bank for Reconstruction and Development (IBRD) loan, a USD 28 million Clean Technology Fund (CTF) loan, and a USD 22 million CTF grant to help India increase its power generation capacity through cleaner, renewable energy sources.

Challenges

-

The Setup of Solar Panels is Expensive - CSP plants, such as solar PV and wind power, require a considerable amount of land to operate. CSP plants are only economically viable in sites with direct normal irradiation above 1800 kWh/m2/year, such as vast open fields and desert areas. Therefore, it makes concentrated solar panels costly in densely populated areas. Moreover, concentrated solar power makes extensive use of water to generate steam turbines and cool thermochemical reactors.

-

Concentrated Solar Power Consumes a Lot of Water

- Presence of Other Alternatives, such as Fission-Based Nuclear Power

Concentrating Solar Power Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

20.7% |

|

Base Year Market Size (2025) |

USD 23.31 billion |

|

Forecast Year Market Size (2035) |

USD 152.97 billion |

|

Regional Scope |

|

Concentrating Solar Power Market Segmentation:

Component Segment Analysis

The thermal energy storage systems segment is estimated to gain the largest market share in the year 2035. The growth of the segment can be attributed to the increasing demand for energy in the time of emergencies and power outages. Thermal energy storage has the ability to raise worldwide potential long-duration storage, or LDES, capacity from roughly 1 TW to 3 TW to between 2 TW and 8 TW by 2040. Furthermore, the rising investment to boost energy conversion is also expected to augment the segment growth. In 2022, the global investment in energy transition technologies, including energy efficiency, reached an all-time high of USD 1.3 trillion. To keep on track, the annual investment must be tripled.

Application Segment Analysis

The non-residential segment is expected to garner a significant concentrating solar power market share in the year 2035. Solar energy can be utilized to create heat for a wide range of industrial applications, such as water desalination, increased oil recovery, food processing, chemical production, and mineral processing. In addition to this, solar water desalination has the ability to treat extremely concentrated brines from seawater, underground aquifers, and industrial wastewaters, which would otherwise be difficult to clean for use in urban, agricultural, and industrial water sources. The growth of the segment is expected on the account of rising demand for energy from both the commercial and industrial sectors. Power consumption in the worldwide industrial sector has increased by 3% since 2000. Furthermore, the global industrial and commercial sectors consumed around 0.14 trillion kWh, or approximately 3% of overall energy consumption.

Our in-depth analysis of the global market includes the following segments:

|

By Technology |

|

|

By Component |

|

|

By Type |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Concentrating Solar Power Market Regional Analysis:

North American Market Insights

The concentrating solar power market in North America industry is set to hold largest revenue share of 35% by 2035. The growth of the market can be attributed majorly to the rising demand for energy from the commercial and industrial sectors. The industrial sector accounted for around 35% of total US end-use energy consumption and nearly 32% of overall US energy consumption in 2019. Developing solar technology for industrial processes contributes to the U.S. Department of Energy Solar Energy Technology Office's objective of creating a carbon-free energy sector by 2050. Moreover, the rising effort by the government to boost the production of renewable energy is also expected to drive market growth in the region. Green Power Partnership (GPP) is a volunteer program launched by the U.S. government that assists organizations in their green energy procurement by providing professional advice, technical support, tools, and resources.

APAC Market Insights

The Asia Pacific concentrating solar power market is estimated to be the second largest, registering a share of about 25% by the end of 2035. The growth of the market can be attributed majorly to the rising production of renewable energy. China and India both intend to grow installed renewable energy capacity to more than 50% by 2025 and 2030, respectively. India is the world's third-largest renewable energy generator, with non-fossil fuels accounting for 40% of installed electrical capacity. Moreover, China and India both intend to grow installed renewable energy capacity to more than 50% by 2025 and 2030, respectively. India is the world's third-largest renewable energy generator, with non-fossil fuels accounting for 40% of installed electrical capacity. Moreover, the rising installation of solar PV systems is also expected to boost the concentrating solar power market growth in the region. By July 2021, China's total installed residential PV capacity surpassed 30 GW, with around 2 million residential units hosting solar PV systems.

Europe Market Insights

Europe region is expected to observe significant growth till 2035. The growth of the market can be attributed majorly to the rising use of solar energy for the production of electricity. According to the European Commission, in 2020, the EU solar market grew by 18 GW, with solar energy accounting for 5.2% of total EU electricity generation. Solar energy is the fastest-increasing source of electricity in the EU. Besides this, solar power costs have dropped by 82% in the previous decade, making it the most cost-effective source of electricity in many parts of the EU.

Concentrating Solar Power Market Players:

- Abengoa

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- New BrightSource, Ltd.

- Siemens Energy

- ACCIONA

- Aalborg CSP A/S

- ACWA Power International

- Shouhang Hightech Energy Technology Co., Ltd.

- Enel Spa

- Trivelli Energia s.r.l.

- Grün leben GmbH

Recent Developments

-

Shouhang Hightech Energy Technology Co., Ltd. announced the investment agreement with Gansu Province for the Jinta for building the molten salt tower concentrating solar power project of 100 MW capacity.

-

ACCIONA announced the opening of Ceero Dominador concentrated solar power plant in Chile. It was built for EIG Global Energy Partner and has the capacity of 110 MW. The plant is located near the Chilean town of Mara Elena in the Atacama Desert, which has some of the world's highest amounts of solar radiation.

- Report ID: 4830

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.