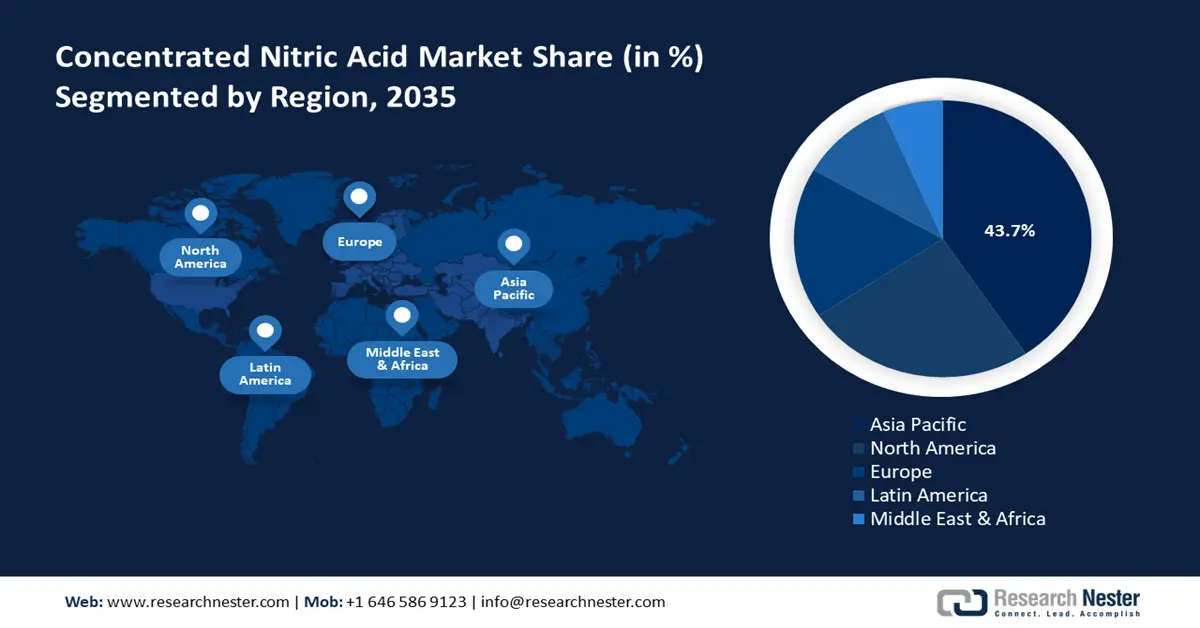

Concentrated Nitric Acid Market - Regional Analysis

Asia Pacific Market Insights

The Asia Pacific concentrated nitric acid sector is poised to hold a 43.7% share by the end of 2035. This dominance is primarily influenced by its significant agricultural sector. In the year 2022, Asia represented 55% of the worldwide total agricultural consumption of inorganic fertilizers, with China and India emerging as the top consumers. This preeminence is linked to the elevated demand for nitrogen-based fertilizers, such as ammonium nitrate, which are crucial for improving crop yields and securing food availability in the region.

China is expected to sustain the largest revenue share in the APAC concentrated nitric acid market by the year 2035. As the leading global consumer of inorganic fertilizers, China's vast agricultural operations require a considerable supply of concentrated nitric acid. The nation's dedication to enhancing fertilizer application to elevate crop yields further emphasizes its critical position in the regional market.

Top Exporter/Importer of China’s Nitric Acid (2024)

|

Region |

Exporter Value ($) |

Region |

Importer Value ($) |

|

Indonesia |

$4.36M |

South Korea |

$26.9M |

|

Vietnam |

$2.99M |

Chinese |

$1.46M |

|

China Taipei |

$2.58M |

Taipei |

$1.46M |

|

Singapore |

$998k |

Japan |

$617K |

|

Suriname |

$396k |

U.S. |

$588k |

|

UK |

4,407.23 |

Germany |

$259k |

Source: WITS

India is projected to capture a significant revenue share in the APAC concentrated nitric acid market by 2035. With a population surpassing 1 billion and an anticipated need for 300 million tonnes of food grains by 2025. This calls for an increase in fertilizer usage, particularly nitrogen-based fertilizers, to attain greater yields and ensure food security. A leading contributor to this growth is Deepak Fertilizers and Petrochemicals Corporation Ltd, one of India’s largest nitric acid producers. The company’s integrated production capabilities and focus on high-purity chemicals position it as a key player in the region’s evolving market landscape.

North America Market Insights

North America’s concentrated nitric acid market is expected to retain a substantial share of the global market during the forecast period, driven by advanced industrialization and strong demand across key sectors. Both countries have established manufacturing bases for polyurethane foams, explosives, fertilizers, and agrochemicals, which are significant consumers of concentrated nitric acid. The growing demand from different sectors is driving market growth. In the U.S., the chemical industry’s growing focus on polymers, particularly polyamides and polyurethanes, continues to drive nitric acid consumption in synthetic processes.

Meanwhile, Canada benefits from rising investments in agrochemical production and industrial chemicals, supporting regional market growth. Nutrien Ltd., a leading Canadian fertilizer company, plays a vital role in the region’s nitric acid supply chain. Through its extensive production and distribution network, Nutrien supports agricultural productivity and industrial applications, reinforcing the strategic importance of nitric acid in North America’s economic landscape. The U.S. leads in the production of nitric acid within North America, generating around 1.8 million tons each year, accounting for roughly 91% of the total output in the region. With the utilization of nitrogen in fertilizers reaching 11.5 million metric tons and ammonium nitrate making up 5%, the U.S. sustains a robust demand for nitric acid, bolstered by its extensive capacity for nitrogen fertilizer production.

Europe Market Insights

The market for concentrated nitric acid in Europe is witnessing consistent growth, primarily due to its crucial function in the production of fertilizers, especially ammonium nitrate. The focus on agricultural efficiency and sustainable methods in the region is propelling this demand. Germany, France, and the Netherlands stand out as significant producers and consumers, with Germany leading as the largest importer of nitric acid in Europe, having received more than 203 million kg in 2023.

The UK is expected to capture a considerable portion of the revenue in the European concentrated nitric acid market by the year 2035. In 2023, the UK imported around 496,897 kg of nitric acid from France. This level of import highlights the substantial demand for nitric acid within the UK, which is fueled by its agricultural and industrial sectors. The UK's dedication to improving agricultural efficiency and fostering industrial development establishes it as a significant contributor to the regional market.

Germany is projected to retain the largest revenue share in Europe's concentrated nitric acid market by the year 2035. This projection is supported by its extensive and technologically sophisticated chemical industry, which utilizes substantial amounts of nitric acid as a fundamental chemical for downstream applications. The robust agricultural sector of the country sustains a consistent demand for nitrogen-rich fertilizers. Furthermore, Germany's considerable industrial foundation in explosives for both mining and construction, coupled with its manufacturing of specialty chemicals and plastics, guarantees its ongoing leadership as the most significant and vital market for concentrated nitric acid within the region.