Computer Vision in Healthcare Market Outlook:

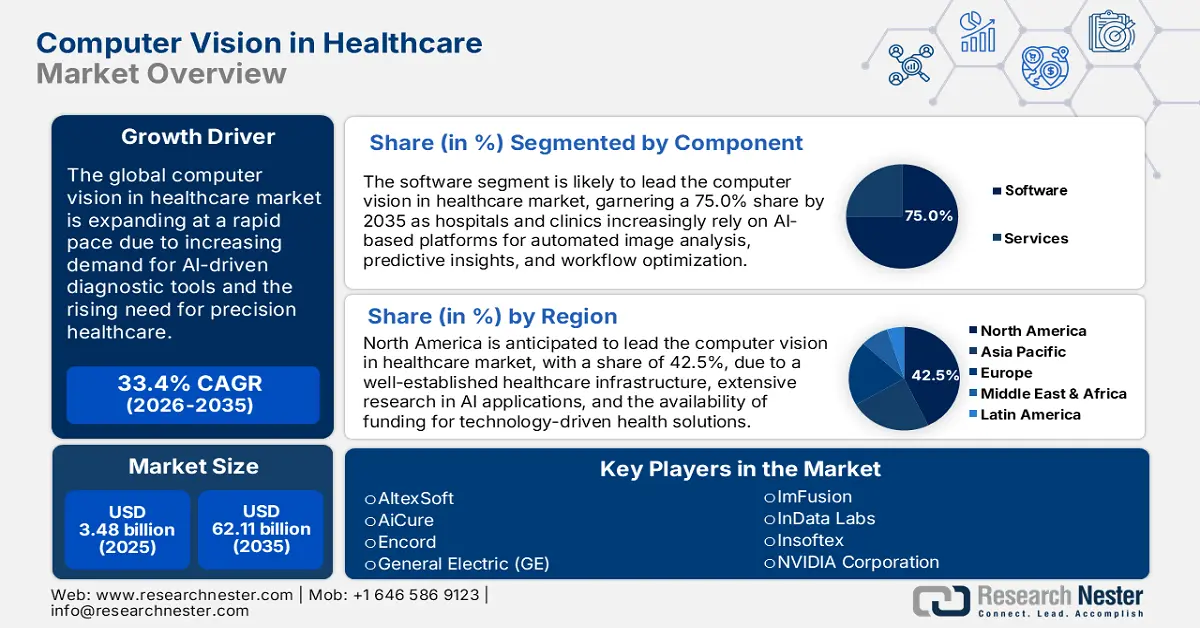

Computer Vision in Healthcare Market size was valued at USD 3.48 billion in 2025 and is set to exceed USD 62.11 billion by 2035, expanding at over 33.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of computer vision in healthcare is evaluated at USD 4.53 billion.

The computer vision in healthcare market is expanding at a rapid pace due to the increasing global demand for advanced diagnostic and monitoring tools. Computer vision technologies transform patient care through the enablement of precise, real-time analyses, from image diagnostics to surgery assistance. In April 2024, iCAD partnered with RAD-AID to deploy its ProFound AI Detection solution in low- and middle-income countries, starting with Guyana. Such initiatives that underline policymakers' belief in AI-driven computer vision tools for facilitating access to healthcare solutions because the requirement for diagnostic and therapeutic procedures is continuously on the rise across the world, especially in underserved areas.

Furthermore, the supportive policies and investments of governments in various parts of the world focus on the areas of accessibility and innovation for accelerated AI adoption in healthcare. A set of such policies includes encouraging the development of digital health infrastructure and funding research into AI technologies. Moreover, the funding associated with different AI-enabled projects in healthcare has apparently increased recently, especially in those regions where digital transformation in health is taken seriously. This governmental support is important, enhancing computer vision in health, which upgrades diagnostics, improves patient care, and routine operations for large-scale dissemination of AI-driven healthcare tools to larger masses.

Key Computer Vision in Healthcare Market Insights Summary:

Regional Highlights:

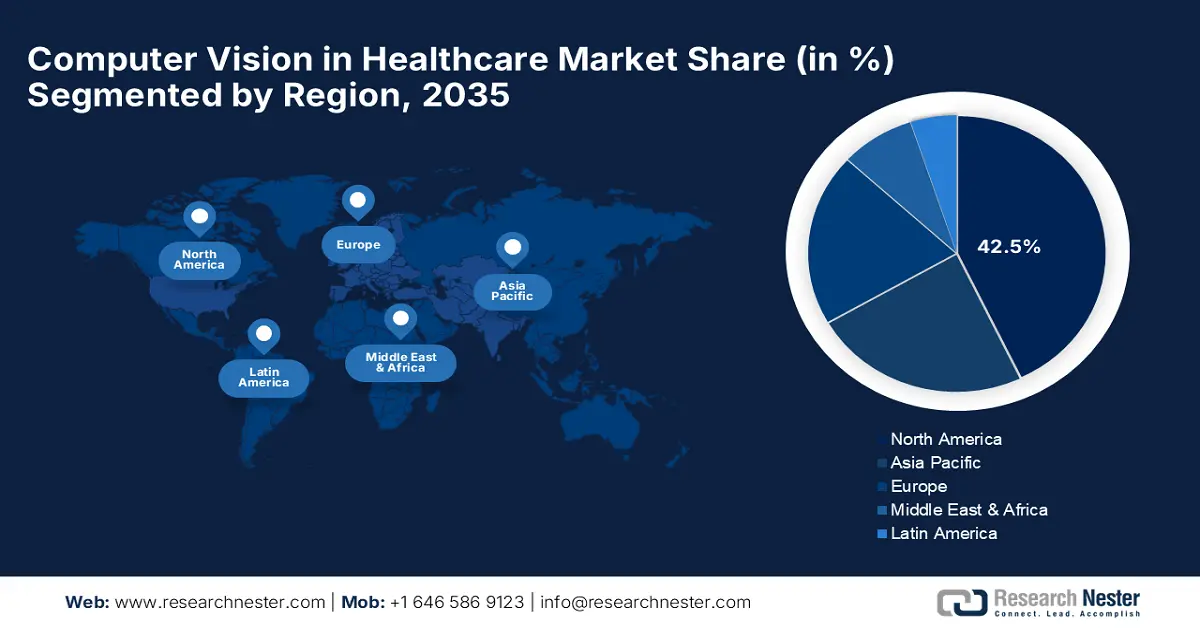

- North America leads the Computer Vision in Healthcare Market with a 42.5% share, propelled by federal initiatives and investments in AI for healthcare and higher healthcare spending, ensuring robust growth through 2026–2035.

- Asia Pacific’s computer vision in healthcare market anticipates lucrative growth through 2026–2035, attributed to increased technological advancements and investments in healthcare infrastructure.

Segment Insights:

- The Software segment is expected to dominate revenue share by 2035, fueled by demand for advanced diagnostic and image analysis solutions.

- The Medical Imaging and Diagnosis segment is projected to achieve over 40% share by 2035, propelled by rising demand for AI-enhanced diagnostic imaging solutions.

Key Growth Trends:

- AI adoption in diagnostics on the rise

- Growing demand for remote patient monitoring

Major Challenges:

- Data security and privacy

- Integration of computer vision with legacy systems

- Key Players: General Electric (GE), ImFusion, AltexSoft, AiCure, Encord, NVIDIA Corporation, InData Labs, Insoftex, Robovision BV., Shaip, Softengi, and Verkada Inc.

Global Computer Vision in Healthcare Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.48 billion

- 2026 Market Size: USD 4.53 billion

- Projected Market Size: USD 62.11 billion by 2035

- Growth Forecasts: 33.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, United Kingdom, Germany, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Computer Vision in Healthcare Market Growth Drivers and Challenges:

Growth Drivers

- AI adoption in diagnostics on the rise: AI-driven computer vision is revolutionizing healthcare by making the diagnosis of diseases more effective and agile. This can be assessed as healthcare providers are reposing increased confidence in AI for quicker and more authentic diagnostic insights. In November 2023, iCAD announced its collaboration with GE HealthCare, where ProFound AI was integrated into GE's MyBreastAI Suite to improve the quality of diagnosis in breast cancer. Such developments reflect the rising importance of AI in diagnostics and spur demand for computer vision technologies in healthcare.

- Growing demand for remote patient monitoring: The adoption of remote patient monitoring solutions has increased significantly, especially with the rising emphasis on accessible healthcare and patient safety. Computer vision-powered AI enables real-time monitoring, hence improving outcomes for patients while reducing hospital readmissions. In August 2024, Caregility Corporation announced the release of a native edge-based computer vision AI solution intended to advance real-time patient-monitoring capabilities without cloud-based processing. This development underlines the role of computer vision in ensuring progress in remote healthcare solutions and furthering computer vision in healthcare market growth.

- Increased precision medicine and personalized care: The rising focus on precision medicine demands the deployment of computer vision technologies that can offer more personalized diagnosis and treatment options. The effectiveness of personalized treatments is improved with computer vision through expanded medical imaging or patient data analysis. In September 2024, Exer AI partnered with Mayo Clinic in developing diagnostic Artificial Intelligence tools for movement disorders, further enhancing diagnostic accuracy for personalized care. This adoption of computer vision in healthcare is driven by a tailored patient solution focus.

Challenges

- Data security and privacy: Data privacy laws such as Europe GDPR and HIPAA in the United States will continue to be a challenge for the computer vision applications of healthcare as more patient data gets digitized and analyzed. Such rules require considerable investment and complicated deployment. Poorly handled patient data could lead to very costly fines and reputational damage to institutions. Additionally, organizations must implement robust security measures to protect sensitive information from unauthorized access and breaches.

- Integration of computer vision with legacy systems: Most healthcare providers are concerned about how computer vision technologies will be integrated with existing legacy systems. This limits the rate of adoption and is particularly faced by older hospitals or small clinics that have lesser budgets for digital upgrades. Seamless integration often requires specialized interfacing solutions, which can be complex and costly to implement. Furthermore, the integration of emerging technologies without hindering operational continuity requires careful planning and resources that most organizations find hard to manage.

Computer Vision in Healthcare Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

33.4% |

|

Base Year Market Size (2025) |

USD 3.48 billion |

|

Forecast Year Market Size (2035) |

USD 62.11 billion |

|

Regional Scope |

|

Computer Vision in Healthcare Market Segmentation:

Component (Software, Services)

Software segment is projected to account for around 75% computer vision in healthcare market share by 2035. This dominance is propelled by the growing reliance on various solutions for image analysis, diagnostic support, and patient monitoring. For example, Landing AI announced in September 2023 the launch of the Landing AI App Space, which is a development platform that has the capability to create custom computer vision applications for healthcare. This development marks the importance of software in meeting the growing needs of the sector and gives the leading position to the software segment in the computer vision in healthcare market.

Application (Medical Imaging & Diagnosis, Surgical Assistance, Patient Identification, Remote Patient Monitoring)

By the end of 2035, medical imaging and diagnosis segment is estimated to hold over 40% computer vision in healthcare market share. The factors behind this dominance include the high demand for accurate, AI-enhanced imaging solutions. Diagnostic applications using computer vision also boost speed and precision, two factors of vital importance in detecting diseases and treatment planning. In June 2023, the University of Michigan designed HiDisc, which is a machine-learning tool used in recognizing cancer characteristics through microscope images, thereby increasing the accuracy of diagnosis. Such diagnostic innovations underline the important role computer vision will play in the advancement of medical imaging and fuel segment growth.

Our in-depth analysis of the computer vision in healthcare market includes the following segments

|

Component |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Computer Vision in Healthcare Market Regional Analysis:

North America Market Analysis

North America industry is likely to hold largest revenue share of 42.5% by 2035. Federal initiatives and investments in AI for healthcare boost the usage of advanced computer vision solutions in diagnostic and patient monitoring applications. These factors, combined with supportive regulatory frameworks and relatively higher healthcare spending in the region, create an opportunistic computer vision in healthcare market for the players. As a result, these factors drive further adoption of applications involving computer vision in medical imaging, surgery, and patient monitoring.

The U.S. computer vision in healthcare market is driven by strong healthcare infrastructure and federal government support for AI-powered healthcare solutions. For example, AMD strengthened its AI and adaptive computing portfolio with the finalization of the acquisition of Xilinx in February 2022, further leveraging its position in the healthcare market. This acquisition represents some of the technological developments leading to the adoption of computer vision solutions in the U.S. healthcare sector, which in return propels growth in the computer vision in healthcare market.

Government initiatives to promote healthcare technology help boost the adoption of computer vision tools in Canada. Healthcare providers in the country are looking toward AI applications in patient diagnostics and monitoring. For example, in November 2023, Philips launched HealthSuite in Canada, which is a platform with computer vision algorithms to support diagnostics. The launch is well in line with the effort being set forth by Canada in innovative healthcare technologies, enough to ensure an enabling landscape for AI in healthcare.

Asia Pacific Market Analysis

Asia Pacific computer vision in healthcare market is anticipated to experience steady growth by 2035. This expansion is due to increased technological advancements and investments in the healthcare infrastructure during the forecast period. The region is adopting AI-driven computer vision applications in healthcare to meet the growing demand for effective diagnostic tools and personalized treatment. Developed and developing countries like Japan, China, and India are investing in digital healthcare transformation. Therefore, the region has become a lucrative market for computer vision technology in healthcare.

The computer vision in healthcare market in China is also developing at a rapid pace due to huge government support for AI in the healthcare sector and massive investment in the field of medical technology. The computer vision tools are becoming widely adopted in diagnostics and patient monitoring, addressing accessibility and accuracy in healthcare. In September 2023, Ever.Ag launched a computer vision system that uses edge computing to monitor animal health, reflecting the country's larger ambition of applying AI across all sectors. This innovative approach aligns with the set goals in China healthcare framework, where through advanced applications of AI, the country works toward achieving efficient healthcare.

In India, the healthcare market is adapting to computer vision to foster better diagnostics and patient care, backed by government policies that encourage digital solutions for healthcare. With the strong push towards AI-driven diagnostics, the adoption of tools such as computer vision for early detection of diseases and telemedicine is gaining traction in India. In July 2024, Fitterfly, a digital therapeutics company based in India, partnered with Google Cloud to introduce Fitterfly Klik. This AI-powered meal tracking feature allows users to track their meals for diabetes management. Such a strategic step reflects the country's commitment to integrating AI in improving patient outcomes and preventive care.

Key Computer Vision in Healthcare Market Players:

- AltexSoft

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AiCure

- Encord

- General Electric (GE)

- ImFusion

- InData Labs

- Insoftex

- NVIDIA Corporation

- Robovision BV.

- Shaip

- Softengi

Some of the key players in the computer vision in healthcare market are General Electric (GE), ImFusion, AltexSoft, AiCure, Encord, NVIDIA Corporation, InData Labs, Insoftex, Robovision BV., Shaip, Softengi, and Verkada Inc. These companies are well on the road to developing AI-driven solutions for improved diagnostics, surgical assistance, and patient monitoring. Major players rely on partnerships, acquisitions, and product launches as strategies to further their positions in the computer vision in healthcare market. The competitive dynamics place greater emphasis on technological innovation and the integration of AI, given that firms are keenly seeking continuous differentiation through superior capabilities and value additions to healthcare solutions.

In March 2024, Microsoft and NVIDIA announced the addition of NVIDIA's AI Enterprise software into Microsoft's Azure Machine Learning service. This launch reflects the recent trend where top firms are teaming up to offer scalable AI solutions for healthcare, targeting areas such as medical imaging and diagnostics. By combining their expertise, Microsoft and NVIDIA are addressing the healthcare industry's need for reliable and efficient AI-driven solutions that further heighten competition among the players in the computer vision in healthcare market.

Here are some leading players in the computer vision in healthcare market

Recent Developments

- In May 2024, Microsoft, in collaboration with the University of Washington and Providence Health Network, developed Prov-GigaPath, an AI model trained on over a billion pathology images. This initiative aims to enhance cancer diagnostics by addressing challenges in full-scale AI implementation, thereby improving diagnostic accuracy and efficiency.

- In March 2024, Siemens Healthineers launched the Cinematic Reality app for Apple Vision Pro, enabling users to view interactive holograms of the human body derived from medical scans. This application is designed to assist medical students, surgeons, and patients by providing immersive visualizations to enhance understanding and planning of medical procedures.

- Report ID: 6676

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.