Computer-assisted Coding Market Outlook:

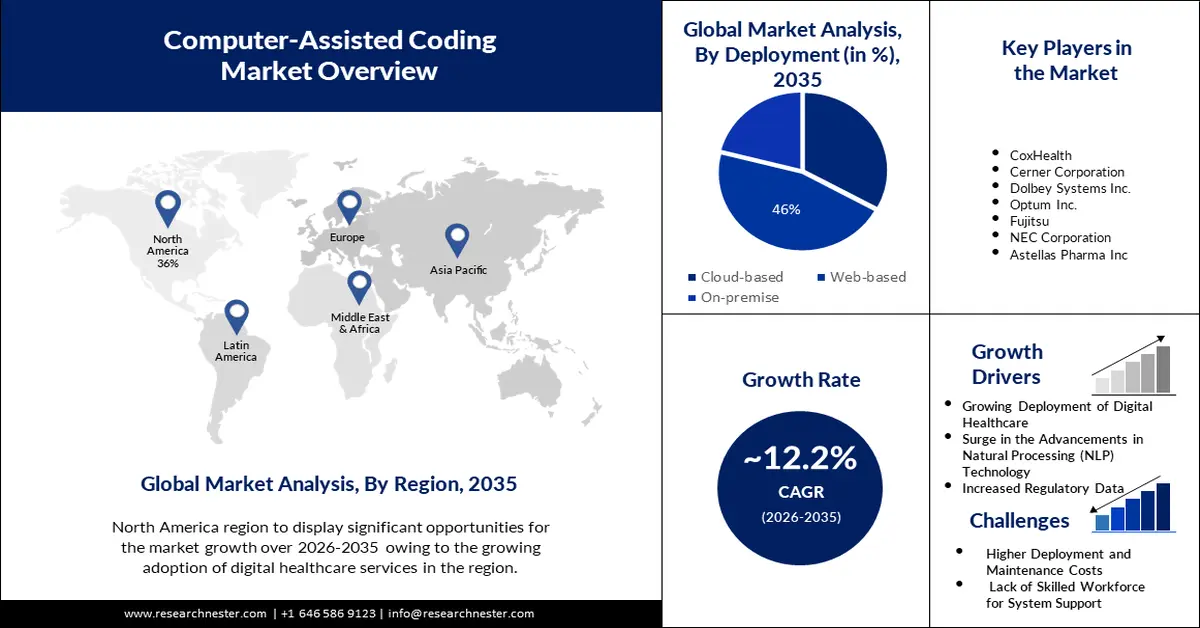

Computer-assisted Coding Market size was valued at USD 6.26 billion in 2025 and is set to exceed USD 19.79 billion by 2035, registering over 12.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of computer-assisted coding is estimated at USD 6.95 billion.

The need for computer-assisted coding software is being driven by the development of EHRs, which help healthcare organizations increase accuracy and streamline their coding procedures. For instance, by 2020, most clinicians in Europe were using electronic health records or EHRs. Over 80% of the European practitioners surveyed in this study reported using electronic health records. In 2020, almost all responders in Denmark and the Netherlands used electronic health records.

The need for remotely usable computer-assisted coding software is rising as remote work becomes more and more common, enabling programmers to work from any location in the world. Also, the need for computer-assisted coding software is being driven by regulatory compliance requirements, such as the International Classification of Diseases (ICD) and other coding standards since it assists healthcare institutions in remaining compliant and avoiding fines. Therefore, these factors are bolstering the computer-assisted coding market.

Key Computer-assisted Coding Market Insights Summary:

Regional Highlights:

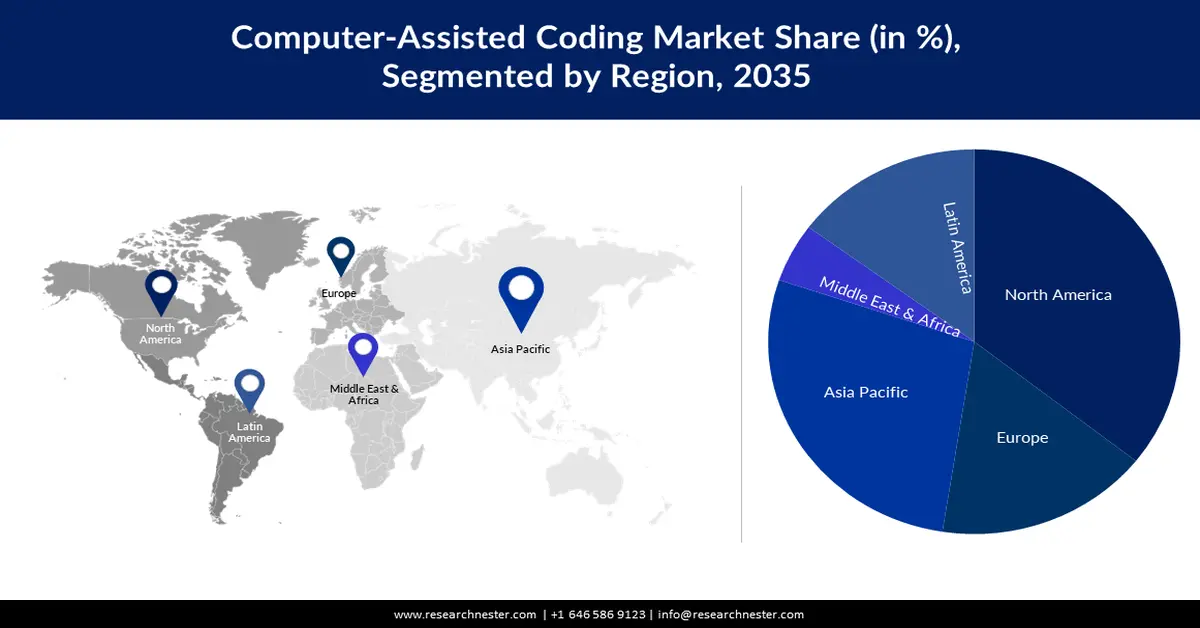

- North America computer-assisted coding market will dominate more than 36% share by 2035, driven by growing adoption of digital healthcare services and presence of major key players.

- Asia Pacific market will secure 28% share by 2035, attributed to government initiatives for digital healthcare and programs like Ayushman Bharat.

Segment Insights:

- The web-based segment segment in the computer-assisted coding market is forecasted to secure a 46% share by the forecast year 2035, fueled by the convenience and affordability of web-based software accessible anywhere.

- The hospitals segment in the computer-assisted coding market is projected to experience significant growth through 2035, driven by the increased efficiency and compliance computer-assisted coding provides.

Key Growth Trends:

- Growing Deployment of Digital Healthcare

- Surge in the Advancements in Natural Processing (NLP) Technology

Major Challenges:

- Higher Deployment and Maintenance Costs

- Lack of Skilled Workforce for System Support may Hinder the Growth of the Market

Key Players: Oracle, CoxHealth, Cerner Corporation, Dolbey Systems Inc., Optum Inc., Fujitsu, NEC Corporation, Astellas Pharma Inc., Otsuka Holdings Co Ltd, NTT DATA Group Corporation.

Global Computer-assisted Coding Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.26 billion

- 2026 Market Size: USD 6.95 billion

- Projected Market Size: USD 19.79 billion by 2035

- Growth Forecasts: 12.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 16 September, 2025

Computer-assisted Coding Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Deployment of Digital Healthcare - By lowering the need for manual coding and increasing coding accuracy, the use of coding software in healthcare organizations can save costs by preventing claim denials and guaranteeing proper reimbursement. Computer-assisted coding software is thereby satisfying the demand for accurate and efficient coding solutions, which has been brought about by the expanding digital healthcare initiatives. For instance, the Global Strategy on Digital Health 2020–2025 and other WHO norms and standards for Digital Health System Transformation are intended to be implemented more easily with the help of the Global Initiative on Digital Health (GIDH), a network of stakeholders administered by the World Health Organization. The Initiative will act as a platform for a broad global ecosystem to collaborate to enhance national capacity and fortify international collaboration in the field of digital health.

-

Surge in the Advancements in Natural Processing (NLP) Technology - The growing advancements in natural language processing (NLP) are expanding computer-assisted coding software because NLP enables the software to understand and interpret human language more effectively. This allows the software to analyze medical documentation, identify key information, and suggest appropriate codes accurately. For instance, NLP software for healthcare can more accurately give focused treatments or therapies than manual data processing by extracting important insights from clinical paperwork, such as medication dose or risk factors that may be pertinent to a specific patient's health. Therefore, the growing implementation of NLP in the healthcare industry is accelerating the growth of the market. According to a report in 2023, with an enormous 39% of the market, natural language processing (NLP) is the dominant player in the healthcare industry.

-

Increased Regulatory Requirements for the Management of Patient Data - The market for computer-assisted coding software is expanding due to the increasing regulatory requirements for patient data management, which call for precise and compliant coding techniques. The software's sophisticated features allow it to evaluate medical records, find pertinent codes, and highlight any possible compliance problems. This benefits healthcare businesses by helping them stay in compliance with regulations, avoid fines, and protect patient security and privacy. Regulations like the Healthcare Insurance Portability and Accountability Act (HIPAA) demand the security and privacy of patient data to be protected.

Challenges

-

Higher Deployment and Maintenance Costs - The expansion of the market will be hindered by high setup costs for on-site CAC support and a lack of domain expertise. In addition, the market for computer-assisted coding will be impacted by healthcare professionals' unwillingness to employ CAC systems in developing nations. Therefore, the high implementation costs may hamper the growth of computer-assisted coding market.

-

Lack of Skilled Workforce for System Support may Hinder the Growth of the Market

-

Disinclination to Adopt CAC Solutions Among Healthcare Providers in Emerging Markets may Impede the Growth of the Market

Computer-assisted Coding Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.2% |

|

Base Year Market Size (2025) |

USD 6.26 billion |

|

Forecast Year Market Size (2035) |

USD 19.79 billion |

|

Regional Scope |

|

Computer-assisted Coding Market Segmentation:

Deployment Segment Analysis

Computer-assisted coding market for the web-based segment is anticipated to hold a share of 46% during the forecast period. With web-based software, complicated installations or updates on particular devices are not necessary because healthcare companies may access the coding software via a web browser. Because they can access the program from any location with an internet connection, healthcare providers can now access it more conveniently and affordably. The market sector is driven by factors like the growing number of government initiatives to use computer-assisted coding, along with technological improvements and developments in healthcare organizations. For some health information systems adopting CAC, web-based services are a common choice, especially if there is an existing programming interface or other medical coding automation tools available. Coded records, including the CPT and ICD-10 codes required to submit a complete claim, along with code linkage, patient data, modifiers, and units, are the output of the workflow for healthcare coding software. Therefore, altogether these factors are contributing to the growth of the web-based segment.

End-user Segment Analysis

Hospitals segment in computer-assisted coding market is poised to hold a share of 43% during the projected period. The hospital segment is growing in the market because hospitals face unique challenges when it comes to coding and documentation. Hospitals handle a large volume of patient data and have complex coding needs due to the wide range of medical specialties and procedures they deal with. Computer-assisted coding helps hospitals streamline their coding processes, improving coding accuracy, and ensuring compliance with regulatory requirements. Also, one of the key reasons for the hospital segment's strong growth rate is the widespread and effective use of computer-assisted coding, which lowers healthcare delivery costs without sacrificing compliance. For instance, in a survey of US-based hospitals and health systems, nearly 70% of CAC adopters attested to the increased efficiency that came with computer support.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Deployment |

|

|

Application |

|

|

End-user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Computer-assisted Coding Market Regional Analysis:

North American Market Insights

North American computer-assisted coding market is anticipated to hold the largest share of 36% during the foreseen period. The growth can be accredited to the growing adoption of digital healthcare services in the region. Also, the presence of the major key players in the region is accelerating the growth of the market. For instance, in November 2023, John Muir Health (JMH) and Ambience Healthcare announced their partnership, introducing a generative AI platform that is completely connected with Epic's EHR. Furthermore, telemedicine is a rapidly expanding trend in North America's digital health business that enables people to get healthcare remotely. As per a survey, 52% of North American adults polled in 2022 said they had used telemedicine, which involved a live video conference with their doctor. This was a considerable growth over the years prior.

APAC Market Insights

Computer-assisted coding market in Asia Pacific is expected to hold a share of 28% by the end of 2035. The growth can be attributed to the growing demand for the reduction of the burden of the healthcare systems in the region. Also, governments in various countries are launching programs for implementing digital healthcare, which is positively impacting the growth of the market. For instance, one of the biggest health insurance programs in the world is Ayushman Bharat, generally referred to as the Pradhan Mantri Jan Arogya Yojana (PMJAY). The objective was to offer monetary safeguarding against unaffordable medical expenses. Also, China published a set of supporting policies for the construction of smart hospitals in 2022, based on the use of electronic medical records (EMRs) systems and other information systems, to optimize medical services and simplify diagnosis and treatment. Therefore, these factors are propelling the growth of the market in the region.

Computer-assisted Coding Market Players:

- Oracle

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- CoxHealth

- Cerner Corporation

- Dolbey Systems Inc.

- Optum Inc.

Recent Developments

- Oracle unveiled new features in its next-generation EHR platform, emphasizing how user-friendly, consumer-grade apps can enhance patient and provider experiences. The new Oracle Health EHR platform will offer practical self-service solutions that empower patients while lessening provider pressure and administrative responsibilities. It will have a contemporary UI and simple, guided workflows.

- With pride, CoxHealth announces that the whole organization will be using Epic for its Electronic Health Record (EHR). This is a significant technological investment that will enhance the way CoxHealth delivers care and how employees collaborate. CoxHealth selected Epic as a solution to enhance information sharing throughout the health system, standardize processes, and offer seamless integration for all-inclusive patient care. With Epic's large patient portal, CoxHealth will also be able to greatly enhance the patient experience.

- Report ID: 5622

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Computer-assisted Coding Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.