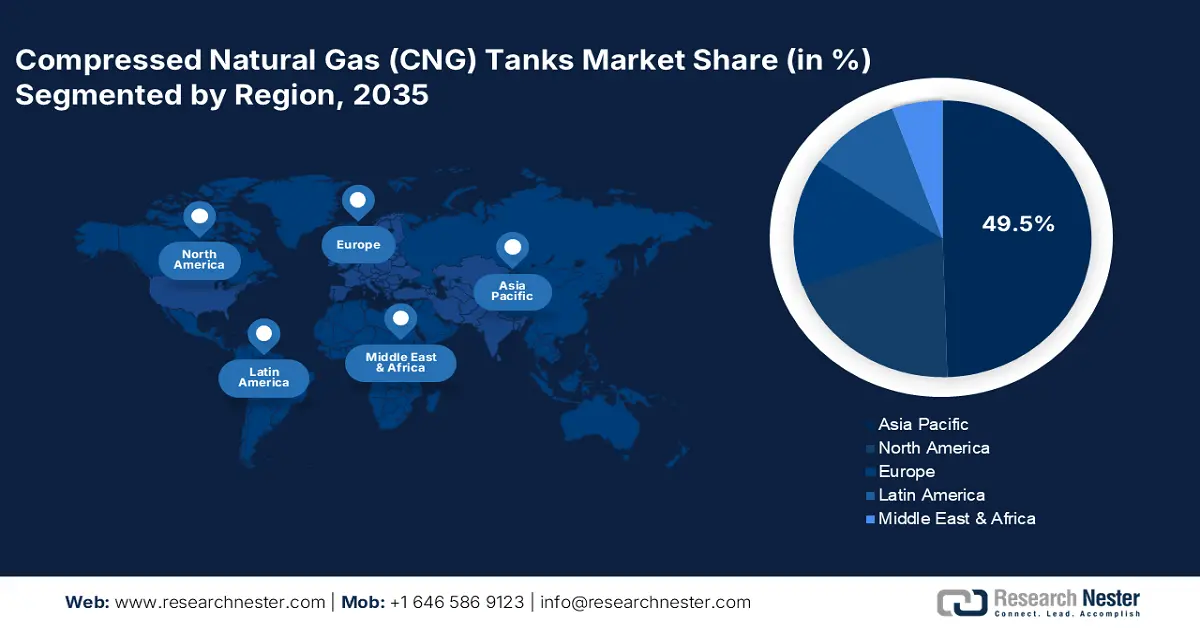

CNG Tank Market Regional Analysis:

APAC Market Insights

The Asia Pacific CNG tanks market is estimated to hold 49.5% of the global revenue share through 2035. The increasing awareness of natural gas is amplifying the sales of compressed natural gas tanks. The growth in public-private investments in renewable fuels is expected to augment the revenues of compressed natural gas storage solution manufacturers. China and India are set to offer high returns to the CNG tank investors during the projected timeframe. Japan and South Korea are anticipated to lead the innovations in compressed natural gas tanks during the same period.

The robust consumption of natural gas is increasing the demand for type 1 and 2 CNG storage solutions in China. The production and commercialization trade is set to propel the sales of larger CNG tanks. The U.S Energy Information Administration (EIA) estimates that China consumed natural gas of around 2.6 Bcf/d in 2023. The significant potential of maritime transport of natural gas is further creating high-earning opportunities for advanced CNG tank producers. The multiple applications of natural gas are likely to accelerate the production of CNG storage solutions in the coming years.

The innovations in both public and private refiners are foreseen to accelerate the demand for advanced compressed natural gas storage solutions in India. The Ministry of Petroleum and Natural Gas revealed that in 2024, the refining capacity of the country crossed 256.816 million metric tons per annum. The precise expansion of refineries across the country is expected to increase the installation of CNG tanks. Furthermore, the IEA study underscores that by 2030, the demand for natural gas in the country is estimated to increase by 60%. All the above statistics highlight that investing in India is likely to offer hefty gains to CNG tank producers during the foreseeable period.

North America Market Insights

The North America CNG tanks market is projected to increase at a robust rate between 2025 to 2035. The presence of dominant natural gas storage manufacturers is backing the overall sales growth. The increasing innovations and expansion of natural gas infrastructure are set to increase the demand for innovative and efficient tanks. The increasing production and export activities are also anticipated to propel the sales of compressed natural gas tanks. The U.S. and Canada are both expected to register high sales of CNG tanks due to their carbon neutrality goals.

The automotive and transportation sectors of the U.S. are likely to augment the sales of compressed natural gas tanks. According to the U.S. Department of Energy (DOE), there are over one lakh seventy-five thousand natural gas vehicles in the country. Such a boasting number highlights the CNG tank demand. The country’s move towards carbon neutrality is augmenting investments in the transformation of public transportation. In July 2024, the government funded USD 105 million in CNG bus transit. These moves are encouraging CNG tank companies to invest in the U.S.

The dominance of Canada in renewables is expected to propel the sales of natural gas storage solutions in the coming years. The production and commercialization trade represents profitable opportunities for compressed natural gas tank manufacturers. The report by the Canadian Energy Regulator underscores that the generation of natural gas in the country amounted to 17.9 billion Bcf/d. Alberta leads the country’s natural gas production, followed by Quebec and British Columbia. The increasing consumption of non-renewable natural fuels is likely to amplify the sales of natural gas storage tanks.