Compounding Pharmacies Market Outlook:

Compounding Pharmacies Market size was valued at USD 9.42 billion in 2025 and is expected to reach USD 16.55 billion by 2035, registering around 5.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of compounding pharmacies is evaluated at USD 9.91 billion.

The growth of the market can be attributed to growing prevalence of chronic disease. Almost 59% of American adults in 2022 had at least one chronic illness. Moreover, dysphagia could be brought on by some chronic conditions, including Parkinson's disease, muscular dystrophy, and multiple sclerosis which could cause harm to the brain. The capacity to swallow may be impacted by sudden neurological damage, such as that caused by a stroke, brain injury, or spinal cord injury. Hence, the demand for compounding pharmacies is estimated to boost, which in turn is expected to boost the growth of the market. Moreover, pharmacy chains that specialize in compounding make it easier for patients to take their prescription medications. Given that they assemble the prescriptions for customers, they are able to create easier-to-take treatments including liquid suspension and chewable tablets.

Moreover, there has been a growing drug shortage and rise in drug failure all around the globe. Medication scarcity is a global problem that impacts high-, middle-, and low-income nations. Since, the problem is escalating and affecting the entire globe, many nations have produced a variety of solutions which also includes focusing more on compounding. All sorts of medications are susceptible to the shortage, including vital life-saving medications, cancer treatments, antimicrobial drugs, analgesics, opioids, cardiovascular medications, radiopharmaceuticals, and parenteral goods. However, the major factor contributing to the shortage of drugs is a regulatory issue. The approval of pharmacy drugs is one of the most time-consuming processes, and in the case of compounding medication, it doesn’t require any approval from the FDA and could be commercially distributed. Hence, the demand for compounding pharmacies is estimated to increase.

Key Compounding Pharmacies Market Insights Summary:

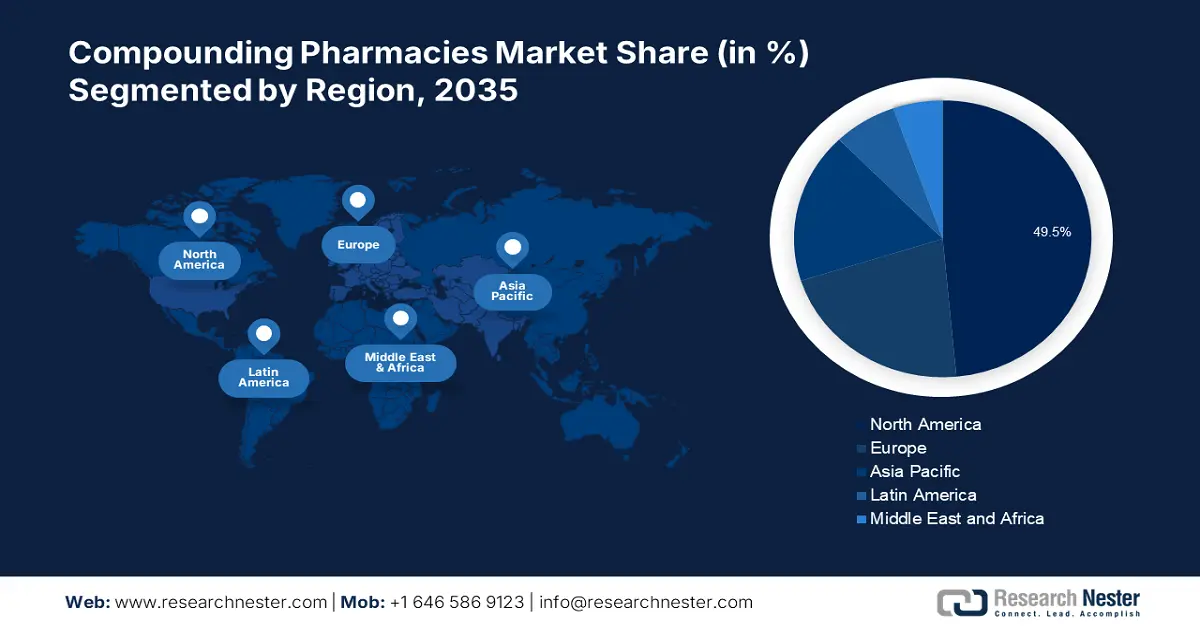

Regional Highlights:

- North America compounding pharmacies market will dominate more than 49.5% share by 2035, driven by growing shortage of drugs and surge in utilization of personalized medicines.

- Asia Pacific market records the highest CAGR during 2026-2035, attributed to growing drug shortages and the ageing population increasing hormone imbalance cases.

Segment Insights:

- The pain management segment in the compounding pharmacies market is expected to achieve the highest market share by 2035, driven by the growing prevalence of chronic pain among people.

- The oral segment in the compounding pharmacies market is anticipated to exhibit significant growth over 2026-2035, attributed to favorable aspects of oral drugs including less risk of acute medication reaction.

Key Growth Trends:

- Growing Geriatric Population

- Rise in Drug Failure

Major Challenges:

- Lack of Skilled Pharmacists

- Lack of Consumer Preference for Compounding Drugs

Key Players: B. Braun SE, Pharmacy Technician Certification Board, Institutional Pharmacy Solutions, LLC, Fagron, NewCo Pharma GmbH, Triangle Compounding, Advance Pharmaceuticals Inc., Athenex, Inc., Dougherty's Pharmacy, Nephron Pharmaceuticals Corporation.

Global Compounding Pharmacies Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.42 billion

- 2026 Market Size: USD 9.91 billion

- Projected Market Size: USD 16.55 billion by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (49.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Japan, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 10 September, 2025

Compounding Pharmacies Market Growth Drivers and Challenges:

Growth Drivers

- Growing Geriatric Population - According to the World Health Organization, one in six individuals on the planet would be 60 or older by 2030. By this point, there are projected to be 1.4 billion people over the age of 60, up from 1 billion in 2020. The number of persons in the globe who are 60 years or older would double (2.1 billion) by 2050. Hence, the demand for compounding medication is estimated to boost. Difficulty in swallowing and other oral problems such as dysphagia is very common in older people. A person's capacity to absorb particular drugs changes as they age. For instance, a slowing metabolism makes it more difficult for medications to be broken down. As a result, the medication's desired effectivity could not manifest as quickly as expected. Therefore, the preference for compounding drugs is growing further boosting the market growth.

- Rise in Drug Failure - A successful medicine takes 10 to 15 years and about 2 billion to produce. Despite, these enormous time and financial investments, approximately 89% of medication ideas in clinical trials are unsuccessful.

- Surge in Prescription for Compounded Medications - 1 to 3 percent of prescriptions written in the US are for compounded medications.

- Growth in Compounding Pharmacies - In the United States, there are about 55,000 community-based pharmacies, of which approximately 7,499 are compounding pharmacies.

- Upsurge in Dermatological Diseases - According to the World Health Organization, around 900 million people worldwide are currently afflicted with skin disorders, which are among the most prevalent illnesses affecting people's health. Hence, the market is estimated to grow. With dermatology compounding, the pharmacist could develop customized dermatological medications by fusing various ingredients to produce a drug that is catered to your unique requirements. Some chemicals, unneeded additives, and preservatives could be omitted from compounded drugs to accommodate the allergies or sensitivities of specific patients.

Challenges

- Lack of Skilled Pharmacists

- Growing Restrictions on Manufacturing of Compounding Medication - The development of the global market for compounding pharmacies is anticipated to be hampered by growing constraints on the production of complex formulas. Moreover, some difficulties are thought to be brought on by compounded medication. As a result, it prohibits compounding pharmacies from producing a number of different types of medications, including replicas of FDA-approved prescription drugs. Even, if they are listed on the FDA's shortage list, as well as complicated dosage forms such as extended release products, transdermal patches, liposomal products, and the majority of biologics.

- Lack of Consumer Preference for Compounding Drugs

Compounding Pharmacies Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 9.42 billion |

|

Forecast Year Market Size (2035) |

USD 16.55 billion |

|

Regional Scope |

|

Compounding Pharmacies Market Segmentation:

Therapeutic Area Segment Analysis

The global compounding pharmacies market is segmented and analyzed for demand and supply by therapeutic area into pain management, hormone replacement therapy, dermal disorders, and nutritional supplements. Out of which, the pain management segment is anticipated to garner the highest revenue by the end of 2035. The growth of the segment can be attributed to growing prevalence of chronic pain among people. Chronic pain is one of the most common among adults. For instance, the 2019 National Health Interview Survey (NHIS) data were utilized by the Centers for Disease Control and Prevention (CDC) to estimate that 50.2 million US adults suffer from chronic pain. Chronic pain is persistent pain that lasts longer than the typical healing time or coexists with a chronic health condition, such as arthritis. Chronic pain could be ongoing or intermittent. It leads to one inability to work and eat properly, or engage in physical activity. Hence, its treatment is necessary. Oral painkillers are frequently used to treat it, however not everyone may find these to be the most effective. People's experiences with chronic pain might differ greatly from one another, thus for some, the personalized approach provided by pain management compounding may be a preferable choice.

Route of Administration Segment Analysis

The global compounding pharmacies market is also segmented and analyzed for demand and supply by route of administration into oral and topical. Amongst which, the oral segment is anticipated to have a significant growth over the forecast period. Orally administered medications frequently pass through the liver and gut wall, which both have a number of enzymes that render them inactive. This procedure is referred to as "first-pass" or "pre-systemic" metabolism. This demonstrates that, after being administered, only a small percentage of the medicine really penetrates the systemic circulation. Moreover, there is less risk of an acute medication reaction since no sterile measures are required. These favorable aspects have increased the use of oral drugs over others, and even patients prefer them over other forms of treatment.

Our in-depth analysis of the global market includes the following segments:

|

By Therapeutic Area |

|

|

By Route of Administration |

|

|

By Sterility |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Compounding Pharmacies Market Regional Analysis:

North American Market Insights

North America region is projected to account for more than 49.5% market share by 2035, driven by growing shortage of drugs and surge in utilization of personalized medicines. Moreover, there has been growing demand for oral medication is this region which is also estimated to boost the growth of the market. Also, the prevalence of oral disease in high in this region. The two most common oral disorders in America continue to be tooth decay (which affects about 89% of persons aged 20 to 64) and gum disease (which affects roughly approximately 49% of adults aged 45 to 64). When compared to drugs that are taken systemically, compounded topical therapies that are locally absorbed and work only at the affected site may prove more effective while causing less systemic side effects for many disorders treated with oral medicine. Hence, its demand is growing in this region.

APAC Market Insights

The Asia Pacific compounding pharmacies market, amongst the market in all the other regions, is projected to grow with the highest CAGR during the forecast period. The growth of the market in this region can be attributed to growing drug shortages, particularly those for cancer treatments and other urgent medicines. Drug shortages have been linked to production delays as well as supply chain problems, including delays in getting raw materials, which further contributed to a limited supply of pharmaceuticals. Medication shortages increase the risk of medication errors, which could also harm patient outcomes and have an impact on healthcare finances as a result of higher healthcare costs. Hence, the demand for compounding pharmacies is estimated to boost in this region. Moreover, the ageing population and longer life expectancies have caused a rise in the number of patients with hormone imbalance, which is further estimated to boost the market growth.

Europe Market Insights

Additionally, the market in Europe region in estimated to have a significant growth over the forecast period, backed by growing geriatric population who are demanding testosterone therapy and high-quality dermatological products. Further, patients who are allergic to commercial treatments could use dermatology customized remedies. Depending on the patient's needs, compounded drugs could be created with or without specific preservatives, components, and additives, advancing the segment. A wide range of formulations, including solutions, gels, sprays, ointments, foams, and others, are available for dermatology compounding products to treat a number of skin conditions, including eczema, acne, psoriasis, and others. Thus, it is anticipated that the availability of a wide range of compounding formulations for dermatology applications would accelerate market expansion in this region

Compounding Pharmacies Market Players:

- B. Braun SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Pharmacy Technician Certification Board

- Institutional Pharmacy Solutions, LLC

- Fagron

- NewCo Pharma GmbH

- Triangle Compounding

- Advance Pharmaceuticals Inc.

- Athenex, Inc.

- Dougherty's Pharmacy

- Nephron Pharmaceuticals Corporation

Recent Developments

-

The PTCB Certified Compounded Sterile Preparation Technician (CSPT) Program was introduced by the Pharmacy Technician Certification Board. Since the establishment of the organisation in 1995 and the release of its Certified Pharmacy Technician (CPhT) Program, the PTCB has only offered the CSPTTM Program as a new certification programme. A crucial component in achieving PTCB's aim to promote pharmaceutical safety is the PTCB CSPT Program.

-

The top company in the world for pharmaceutical compounding, Fagron, purchased a 503B outsourcing facility in Boston from Fresenius Kabi. The acquisition included a supply agreement with Fresenius Kabi as well as all operational facets of the facility, including clients, vendors, and about 80 staff. In order to achieve our strategic goal of being the top global platform for sterile outsourced services, this purchase was a crucial step for them.

- Report ID: 4762

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Compounding Pharmacies Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.