Composite Surface Film Market Outlook:

Composite Surface Film Market size was valued at USD 1.9 billion in 2025 and is projected to reach USD 3.6 billion by the end of 2035, rising at a CAGR of 6.4% during the forecast period, from 2026 to 2035. In 2026, the industry size of composite surface film is estimated at USD 2.2 billion.

The global composite surface film market is anticipated to grow rapidly over the forecast period, primarily driven by the demand for films in the aerospace and automobile industries. The aerospace applications of composite surface films are based on the fact that they have a high strength-to-weight ratio that enhances fuel efficiency and performance. They find their uses in the automotive industry too, including minimizing the weight of vehicles, fuel consumption, and ensuring their ability to meet the stringent emission standards. The U.S. composites industry produces more than USD 45 billion each year, and the growth rate of 6.5% has been persistent, based on the congressional testimony. The strategic R&D investments, as shown by the HiCAM program of NASA on sustainable manufacturing of aircraft, are raising the production capacity to a substantial 80 aircraft per month as of 2026. This is a growing demand and is indicative of growing use of light-weight, durable composite films, which are applied in surface finishing and protective applications in high-growth industries. With these materials, it is possible to make improvements in the areas of fuel efficiency, compliance with emissions, and product longevity. The stable CAGR denotes the confidence of both the manufacturers and end-users, which has been sustained through government-led innovation and capacity building through entire networks of production across the globe.

Supplier-wise and trade-wise, there is growth in the production capacity of composite materials around the world, particularly in China, the U.S., and Europe. The capacity of glass fiber composite in China is over 5.5 million metric tons annually, and the capacity is used to assist the shipment of over 4 million metric tons annually. Industry-government evaluations predicted the overall value of U.S. composite end products, encompassing glass and carbon fiber composites, to attain about 33.4 billion by 2025, and steady export advancement by the federal wind energy and aerospace supply chain appraisals. In certain product lines, the trade report released by the Census Bureau demonstrates that the average U.S. exports in hardboard and medium-density fiberboard (commonly found in composite markets) were approximately 413 thousand cubic meters in 2022-2025. Thus, even though the direct post-2021 dollar-value export data of finished composite products is not easily isolable within Census and USITC publications, composite goods exports are healthy and part of the U.S. international trade, and future work is proceeding to create more statistical visibility and enhance reporting.

Producer Price Index (PPI) of unsupported plastic films and nonpackaging plastic products is at about 277.2 and 258.9, respectively, in July 2024 and indicates slight inflationary tendencies in line with the development of the composite surface films sector. This stable growth of PPI contributes to the overall growth of composite films on surfaces due to their demand in aerospace, automotive, and construction industrial applications, with durability and material performance being significant factors. These PPI levels are the indicators of stable input costs that assist in maintaining consistency in the manufacturing scale-up and resilience in the supply chain in the changing composites market.

Key Composite Surface Film Market Insights Summary:

Regional Highlights:

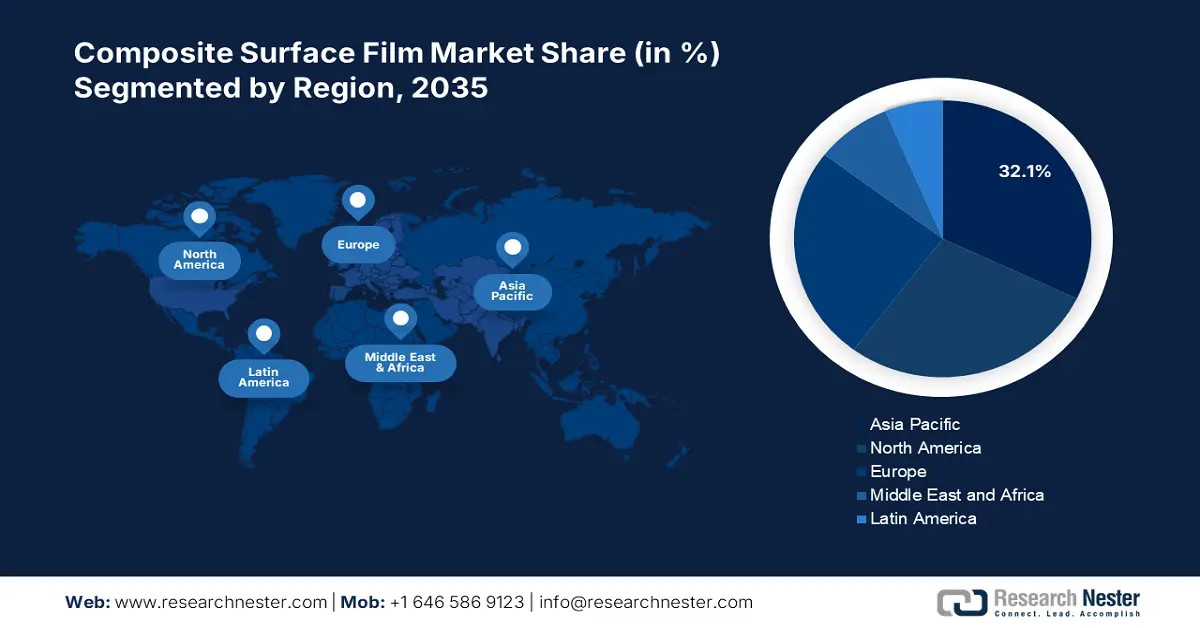

- Asia Pacific is projected to hold 32.1% share by 2035, owing to intensive investments in grid modernization and clean energy systems.

- North America is expected to capture 28.1% share during 2026–2035, fueled by high demand in aerospace, automotive, and renewable energy sectors.

Segment Insights:

- Automotive segment is projected to account for 35.2% share by 2035, impelled by enhancements in lightweight, durability, and appearance.

- Consumer electronics segment is anticipated to hold 30.1% share by 2035, driven by the demand for flexible, durable, and aesthetically appealing films.

Key Growth Trends:

- Stringent environmental regulations (EPA & ECHA)

- Advancements in catalytic technologies

Major Challenges:

- High environmental compliance costs for SMEs

- Technical trade barriers (TBTs)

Key Players: 3M Company, Avery Dennison Corporation, E. I. du Pont de Nemours (DuPont), Hexcel Corporation, Toray Industries Inc., Sika AG, Gurit Holding AG, Solvay SA, Orica Limited, LG Chem, Saint-Gobain, Ahlstrom-Munksjö, Polyplex Corporation Ltd., Teijin Limited, Mitsubishi Chemical Corporation

Global Composite Surface Film Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.9 billion

- 2026 Market Size: USD 2.2 billion

- Projected Market Size: USD 3.6 billion by 2035

- Growth Forecasts: 6.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (32.1% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Vietnam, Thailand, Indonesia, Malaysia

Last updated on : 30 September, 2025

Composite Surface Film Market - Growth Drivers and Challenges

Growth Drivers

- Stringent environmental regulations (EPA & ECHA): The United States Environmental Protection Agency (EPA) has completed amendments to the Toxic Substances Control Act (TSCA) to improve chemical safety reviews and to ensure the agency recovers 26% of authorized costs for a chemical safety review. The European Chemicals Agency (ECHA) is considering classifying trifluoroacetic acid (TFA) a persistent forever chemical as a reproductive toxin, with regulatory action already under discussion. The regulatory changes are increasing compliance costs for manufacturers, perhaps by as much as 16%, which affects demand for environmentally positive composite surface films.

- Advancements in catalytic technologies: The chemical industry has benefited from innovations in catalytic processes, which have contributed to greater production efficiency. For instance, Johnson Matthey has made advances in the Fischer-Tropsch process, which has enabled the conversion of traditional and renewable feedstocks into syngas for the manufacture of sustainable aviation fuel. These technological improvements have resulted in a 21% improvement in production efficiencies, resulting in cost savings and sustainable growth for the composite surface film sector.

- Growing need to find renewable energy uses: Composite surface films are crucial to protect coating and lightweight covering in wind turbine blades, as well as solar panels, where the ability to endure tough environmental conditions is of the essence. The wind sector also added an unprecedented 117 GW of new capacity worldwide in 2024, with nearly 1 TW of cumulative wind power capacity being expected to be added by 2030, according to the Global Wind Energy Council. The accelerating growth contributes to a greater adoption of the high-technology composite materials in the infrastructure of renewable energy, which is supported by further technological improvement and sustainability objectives. The increasing number of renewable energy installations will increase the dependence on composite surface film to enhance the performance and the lifecycle, making the material a significant facilitator in the world's clean energy shift.

Challenges

- High environmental compliance costs for SMEs: Small- and medium-sized enterprises (SMEs) frequently find environmental compliance and its financial impact too challenging. For small businesses, the United States Environmental Protection Agency (USEPA) has observed that much of the compliance processes may be taking resources from innovation. When businesses notice too many restrictive regulations, they are discouraged from innovating or operating proactively. There is too much compliance rigour, which diminishes innovation, particularly by SMEs. According to OECD, the environmental regulations seem to be a major obstacle to the growth of SMEs, with approximately 30% of SMEs asserting that the cost of compliance is high and that there are minimal resources available to navigate through regulatory processes. This liability can restrain the SMEs from investing in newer technologies such as composite surface films.

- Technical trade barriers (TBTs): The purpose of the World Trade Organization (WTO) Agreement on Technical Barriers to Trade (TBT) is to ensure that technical regulations do not create unnecessary obstacles to trade; however, the increase and proliferation of technical regulations, standards and conformity assessment procedures presents difficulties for CSF suppliers, especially when considered from an inter-country perspective. As the report by the WTO TBT Committee (2024) revealed, TBTs have reported most non-tariff measure notifications, with more than 3,000 notifications announced since 2019, and it is expected to keep expanding regulations globally. Such requirements make it more difficult to access markets since they tend to be quite different in different countries, which leads to higher compliance costs, delays in product approvals, and harmonization challenges.

Composite Surface Film Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

6.4% |

|

Base Year Market Size (2025) |

USD 1.9 billion |

|

Forecast Year Market Size (2035) |

USD 3.6 billion |

|

Regional Scope |

|

Composite Surface Film Market Segmentation:

Application Segment Analysis

The automotive segment is predicted to gain the largest composite surface film market share of 35.2% during the projected period by 2035, due to enhancements in lightweight, durability, and appearance. Fuel efficiency and emission norms evolving with time are encouraging automakers to adopt lightweight composite materials, including surface films for interiors and exteriors. These films resist scratches, ultraviolet rays, and chemicals, thus enhancing a car's life and appearance. According to the U.S. Department of Energy, a 10% decrease in vehicle weight may enhance fuel economy by 6% to 8% and substituting ordinary materials with lightweight ones, such as carbon fiber composite, may decrease component weight by 50% to 70%. By 2030, reducing the weight of 1-quarter of the U.S. vehicle fleet to less than 5 billion gallons a year would save over 5 billion gallons of energy through the use of lightweight materials.

In the case of Body Panels, an EU FP7 project states that by substituting a steel door-skin with a composite one, up to 53% of the weight of the door-skin can be cut off, and thus approximately 39% of the total weight of the door is achieved in comparison to steel. The implementation of composite door-skins will have a considerable effect on the reduction of CO2 emissions when the vehicle is in operation (e.g., the global warming potential of the production stage will decrease by 43%). Meanwhile, in the case of Interior Components, another FP7 project (SUSTAINCOMP) estimates that the average cars already have about 50 kg of polymer composites per car. Assuming such a usage with increased interior usage (dashboards, seatbacks, door linings), the maximum amount of material that could be used in the market could be about 3,000,000 tons/year. These mass downsizings, in addition to regulatory pressure (e.g., CO2/CO2/fuel-efficiency requirements in the EU, U.S.), are compelling OEMs to replace steel and metals with composite surface films or composite panels on both exterior (body panels, trims) and interior parts.

End use Segment Analysis

The consumer electronics segment is anticipated to constitute the most significant growth by 2035, with 30.1% composite surface film market share, as it protects the devices while also offering a degree of flexibility and aesthetic appeal. Flexible displays and wearable devices feed demand for films that are thin, flexible, and durable. According to NIST, advancements in polymer composite films are central to next-generation electronics innovation. For example, the studies conducted by NIST on the flexible thin-film electrodes show that the addition of microscopic holes in the plastic membrane increases the durability and conductivity of wearable electronic devices, which makes them more appropriate to be used over time. Moreover, NIST has done research on broadband dielectric metrology of polymer composite films, which has led to the creation of materials with better electrical characteristics, which are beneficial in the advancement of flexible and printed electronics.

Smartphones use composite films to protect the screens against scratches, impacts, and fingerprints to increase the longevity and user experience. Smartphones are dependent on comprehensive films in protecting screens, scratch-resistant, and durable, with more than 5 billion users worldwide. The International Telecommunication Union (2022) report confirms that 95% of the world has access to at least the 3G network, and the rising number of smartphone users promotes higher levels of digital inclusion and economic development. Tablets are made in such a manner that they have composite films which minimize glare, increase impact resistance, and touch sensitivity, which is essential when it comes to portable and multimedia use. These films enable better impact resistance and glare reduction, which increases the usability of tablets. All these are driving forces of innovation and demand for composite surface film in the two subsegments, which provide a booming growth in the global Consumer Electronics market.

Material Type Segment Analysis

The polymer-based composite films segment is expected to grow significantly during the projected years, owing to their portability, flexibility, and high mechanical properties. The automotive, consumer electronics, and packaging industries are some of the wide users of these films. The International Council on Clean Transportation cited that the U.S. passenger cars might theoretically produce up to 20% mass (weight) reduction relative to a 2008 base point with the present lightweighting technologies, such as materials replacement, design optimization, and composites. For example, a 10% weight loss is expected to result in an approximate 5.1% reduction of fuel consumption without a reduction in engine size. Moreover, such films are also applied in other uses, like flexible transparent electrodes (FTEs), which play a crucial role in the applications of flexible OLED displays, energy storage, and wearable medical devices. Polymer composite-based FTEs can also be used as an alternative to conventional indium tin oxide (ITO) electrodes, with the benefit of being more flexible and cost-effective.

Our in-depth analysis of the composite surface film market includes the following segments:

|

Segment |

Subsegment |

|

Application

|

|

|

End Use

|

|

|

Material Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Composite Surface Film Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific is projected to dominate the global composite surface film market with the highest revenue share of 32.1% during the forecast years, as a result of a crucial energy transition, facilitated by intensive investments in grid modernization and clean energy systems that are the immediate sources of innovative development of the composite surface films market. In 2023, the investment in clean energy in the developing part of Asia constituted USD 729.4 billion due to the necessity to modernize power grids to integrate renewable energy. This increases the need for composite surface films, which are imperative in the energy infrastructure to insulate and also have a durable nature, and this is accelerating the market growth in the Asia Pacific. This high-scale modernization creates the demand for high-technological, tough, and light construction surface films as an insulator, protective, and efficient in energy infrastructure.

In addition, the Asia-Pacific Economic Cooperation (APEC) emphasizes the faster implementation of green energy use in the region, aimed at facilitating green industries with innovative materials that are necessary to produce light and durable components. Moreover, green industrial policy is on the rise, which enhances the use of sustainable manufacturing and circular economy solutions to boost the use of eco-friendly composite materials. The combination of these trends and heavy investments drives the Asia Pacific composite surface films market to start off with massive growth due to the investment in sustainable industrial and energy developments within the region.

China's composite surface film market is anticipated to lead the Asia Pacific by 2035, aided by sound government policies on sustainable chemical production and the adoption of green technology. The Ministry of Ecology and Environment and the National Development and Reform Commission have started to invest more in green chemical processes, and as a result, the use of green chemical technologies has increased over the last few years. Additionally, the rapid process of urbanization of China has boosted the number of urban populations from 170 million in 1978 to 900 million in 2020, with the urbanization rate rising from 17.9% to 63.9%. The industrial industry is currently supplying approximately 33% of the Chinese economic value and is driving high demand for higher materials, such as lightweight and surface films of composite that are applied in durable uses. The policies of a green transition in China towards carbon peak and carbon neutrality by 2030 and 2060 encourage the use of sustainable materials, which should help to reduce manufacturing emissions, contributing to the healthy development of the Chinese market.

Moreover, the shift to a low-carbon economy set out by the Chinese 14th Five-Year Plan has resulted in 77% of urban public transport by the end of 2022 being new energy vehicles, which reflects a fast rate of clean energy that is driving the need towards lightweight and durable composite surface films in both the automotive and transportation industries. These attempts have made China the top player in the regional composite surface films market, in an effort to be eco-friendly and technologically advanced in its industries.

By 2035, the composite surface film market in India is predicted to grow with the fastest CAGR in the Asia Pacific region, attributed to the heightened government spending on green chemistry and green industry. The chemical industry of India is an industry worth ₹22.7 lakh crore in 2024 and has a growth rate of 8% per year, as it is highly favored by government efforts to promote chemical technologies that are environmentally friendly. Innovation in sustainable chemical processes: The Technology Development Board has funded 27 agreements to the tune of ₹94 crore to enhance innovation in the growth of composite surface films. India is also in the process of growing its composite surface films market by these investments and policy reforms that expedite the uptake of high-tech green materials.

Moreover, the industry of chemicals in India, with a 2023 valuation of approximately USD 220 billion, is growing at a breakneck pace because of favorable domestic demand and the action programs of the state, such as Make in India and PLI programs. Increased application of specialty chemicals, with a growth rate of 12% encourages the use of advanced composite surface films in areas like automobile and electronics that have sustainability policies and associations like FICCI, which helps to push a strong growth in the Indian market. The market is further stimulated through government programs that promote clean manufacturing and innovations that see lightweight composite films gaining more and more positions in the automotive and electronic industries. The robust regulation of compliance with the environmental standards in India fosters the fast growth of the composite surface film market.

North America Market Insights

The North American composite surface film market is projected to grow steadily, with a revenue share of 28.1% during the projected years from 2026 to 2035, driven by high demand in the aerospace and automotive industries as well as renewable energy. In addition, the EPA Plastic Parts and Products NESHAP specifically controls emissions of risky air pollutants during surface coating operations of plastic parts and products, which also include the application of composite surface films. It has stringent emissions standards, including 0.16 kg organic HAP/kg coating solids on general plastic parts, which encourages the utilization of low-emission and high-performance composite films. Furthermore, the USDA also states that the biobased products industry was worth up to USD 489 billion to the economy in 2023, which points to the fact that the economy will need sustainable materials as a part of the composite films.

Moreover, the treatment of automated fiber placement (AFP) produced carbon fiber reinforced polymer composites in the form of atmospheric pressure plasma jet (APPJT), which enhances the adhesion and fracture toughness by doubling surface oxygen content and up to 10 nm surface roughness. This process does not damage the fibers through heating; however, it boosts bonding power to facilitate increased durability and performance of composite surface films. These technological advancements fuel the expansion of the market in the area as they allow a high quality of the product and expanded industrial use of the product. All these are enhancing the growth in the composite surface films market in North America.

The U.S. composite surface film market is predicted to hold a dominant position within the North American region, strongly supported by regulatory concepts such as the growing emphasis on reducing volatile organic compounds (VOCs) like toluene and xylene, utilizing nanomaterial-based technology, which is motivating innovation in the market. These innovations are expected to allow making the manufacturing process cleaner and safer according to the regulatory standards, and increasing the demand for eco-friendly and high-performance composite films.

In addition, the mitigation of VOCs enhances sustainable development and increases the level of competitiveness of the market of the composite surfaces in the U.S. due to the lightweight of metals, namely aluminum and magnesium, which make vehicles 70% lighter, thus boosting efficiency and sustainability of electric vehicles. The most recent applications of aluminum alloy have enhanced energy efficiency and boosted driving range by 14% by making one-piece castings, as Tesla has done. These advancements favor increasing demand for lightweight composite films that are durable in the manufacture of automobiles, and this has led to the development of the market in the U.S. All these, coupled with the federal funding in high-performance composite surface film technologies, are continuing to generate a consistent increase in demand.

The composite surface film market in Canada is likely to expand steadily over the projected years, driven by government policies such as the Strategic Innovation Fund investing in clean energy and innovations in the chemical sector. The determination of the Canadian government to promote innovation and sustainable development by investing heavily, such as the Strategic Innovation Fund, which offers a total of CAD 5 billion to fund projects that promote clean technologies, such as advanced materials production. It is based on this support that the composite surface films market is growing due to research and development of environmentally friendly and high-performance materials needed in industries like automotive and aerospace. These efforts result in market growth and ensure that Canada is a player in the global composite surface film market by making the adoption and modernization of technology easy. Moreover, Natural Resources Canada has programs to promote the efficiency of industrial energy that can contribute to the introduction of sustainable composite materials. The policies of the federal government focus on the development of clean technologies and sustainable manufacturing, which make surface films of composites in demand in the automotive industry, electronics, and construction fields.

Europe Market Insights

The European composite surface film market is anticipated to expand substantially, with the share of 25.1% from 2026 to 2035, owing to the strict environmental policies of the European Chemicals Agency (ECHA) on hazardous chemicals like trifluoroacetic acid (TFA), and the push towards the use of environmentally-friendly composites. The EU is investing in manufacturing innovation, such as an investment of more than €9 billion by China and a huge investment in this sector by the U.S. government, which points to the competitive pressure in this sector. The EU policies, including the Green Deal and Circular Economy Action Plan, advance the use of environmentally-friendly materials and efficient use of resources, which directly benefits composite films in the aerospace, automotive, and renewable energy industries. These strategic plans enable Europe to sustain and increase its market share in the high-end composite materials, promoting invention and strength in manufacturing.

The growing aerospace and car industries are requiring lightweight, high-density materials to enhance fuel efficiency, which is increasing the market. There has been a significant growth of the European aerospace lightweight materials market, which is currently valued at USD 12.5 billion and will reach USD 25.3 billion by 2030, with the rising demand for fuel-efficient and sustainable aircraft components. Lightweight materials like carbon fiber compounds and aluminum alloys are widely applied to minimize the weight of airplanes in order to increase their fuel efficiency and to comply with stringent environmental regulations. This high rate of adoption in the aerospace business directly underpins the development of the composite surface films business in Europe, as the demand to utilize high-performance, light, and long-lasting composite films is increasing. All these are contributing to a positive growth in the European market, which is expected to grow steadily along with environmental and technological patterns.

Key Composite Surface Film Market Players:

- 3M Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Avery Dennison Corporation

- E. I. du Pont de Nemours (DuPont)

- Hexcel Corporation

- Toray Industries Inc.

- Sika AG

- Gurit Holding AG

- Solvay SA

- Orica Limited

- LG Chem

- Saint-Gobain

- Ahlstrom-Munksjö

- Polyplex Corporation Ltd.

- Teijin Limited

- Mitsubishi Chemical Corporation

The composite surface film market is characterized by a mix of established global key players and start-up global key players. Partnerships with aerospace leaders, such as Solvay's recent contract with Airbus, establish market position. Indian manufacturers Polyplex and Jindal Poly Films have established a presence in the market and are emerging players through competitive production costs and increasing globalization of business. Overall, the market is active with strategies for innovation and partnerships, driving operational and revenue growth.

Top Global Composite Surface Film Market Manufacturers

Recent Developments

- In August 2024, LANXESS posted an expansion of its sustainable offerings of microbial control products in the Asia-Pacific region, with an emphasis on environmentally friendly biocides, including Preventol B2 and Sea-Nine 211N, which can be used in manufacturing processes that are conscious of the environment. These inventions can be in line with the increased demand for sustainable materials, such as composite surface films, because they offer protection against microbes, which increases durability and safety with less environmental impact. The use of microbiology research in the Asia-Pacific Application Development Center by LANXESS relates to its efforts to devise solutions to specific needs, and hence its push in the realization of the production of sustainable composite materials.

- In June 2024, BASF entered the biopolymer market with the introduction of the biomass-balanced ecoflex (PBAT), which has a 60% reduced product carbon footprint (as compared to standard grades). This ecoflex BMB is made with renewable feedstocks based on waste-based biomass, and the technology contributes to product sustainability because it provides compostable, high-performance composite surface films without having to impact material properties or modify production processes. The innovation of BASF helps in changing the packaging and automotive industries towards renewable and circular materials, improving the environmental value, and satisfying the increasing demand of the market towards sustainable composite films. This introduction is a demonstration of the advancement in the industry towards adopting green technology in the development of composite films.

- In April 2024, Covestro LLC reported a strategic realignment of the distribution of its polycarbonate products, which no longer requires the distribution of polycarbonate products by means of Amco Polymers, but still retains Amco as an authorized distributor of thermoplastic polyurethane (TPU) resins. The wide range of products Covestro offers, such as Makrolon and Makroblend polycarbonate resins, comprises materials that are a key component of the composite surface films market with high toughness, heat, and dimensional stability. The repositioning is used to optimize supply channels and therefore achieve better availability and service to industries like automotive, electronics, and healthcare, which will result in Drive to make composite surface films applications more effective in material performance.

- Report ID: 7754

- Published Date: Sep 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Composite Surface Film Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.