Composite Coatings Market Outlook:

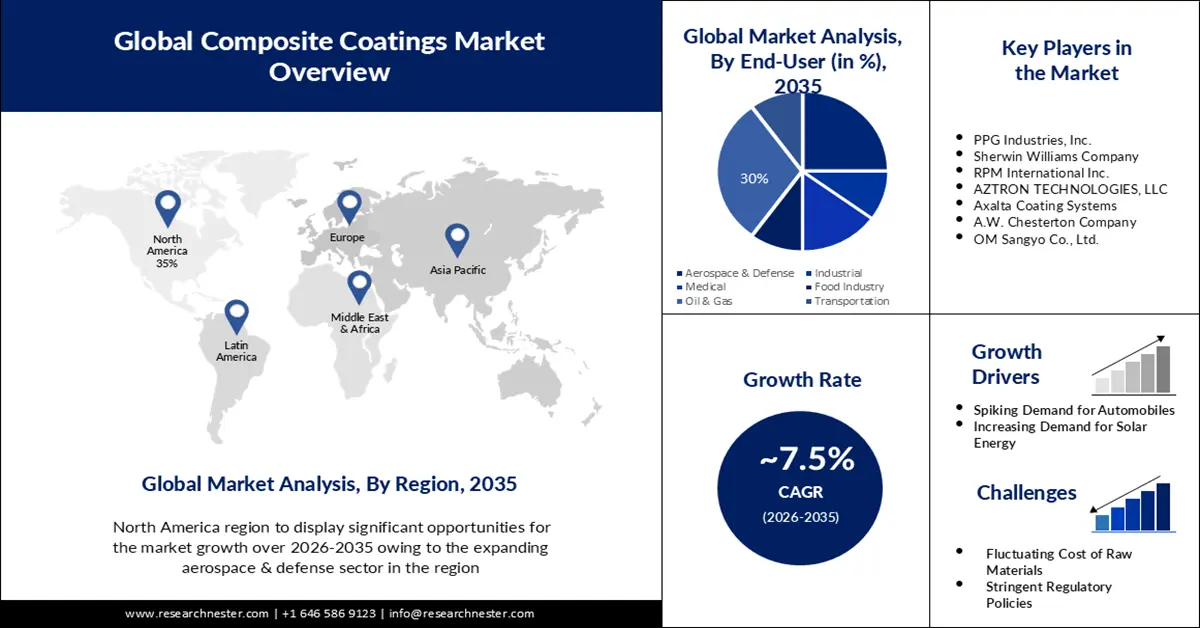

Composite Coatings Market size was valued at USD 1.8 Billion in 2025 and is set to exceed USD 3.71 Billion by 2035, registering over 7.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of composite coatings is estimated at USD 1.92 Billion.

The reason behind the growth is impelled by the increasing utilization of composite coatings in the packaging industry. Packaging is used in various industries including agriculture, healthcare, personal care, and industrial goods to protect the product from thermal and mechanical damage during manufacturing, transportation, and distribution.

To avoid this composite coatings are mostly used in the packaging industry for waterproofing and thermal barriers for safety since it comprises layers of protection that use paper, foil, or plastic additives to prevent damage.

The growing construction sector is believed to fuel the market growth. The anti-corrosive and self-lubricating advantages of composite coatings are expected to increase their utilization in construction infrastructures. In the building sector, they are commonly employed to stop corrosion on steel and they are also utilized on concrete and other materials as thermal and intumescent barriers.

According to estimates, the construction market was worth over USD 6 trillion in 2020, and it is anticipated to grow to more than USD 14 trillion by 2030.

Key Composite Coatings Market Insights Summary:

Regional Highlights:

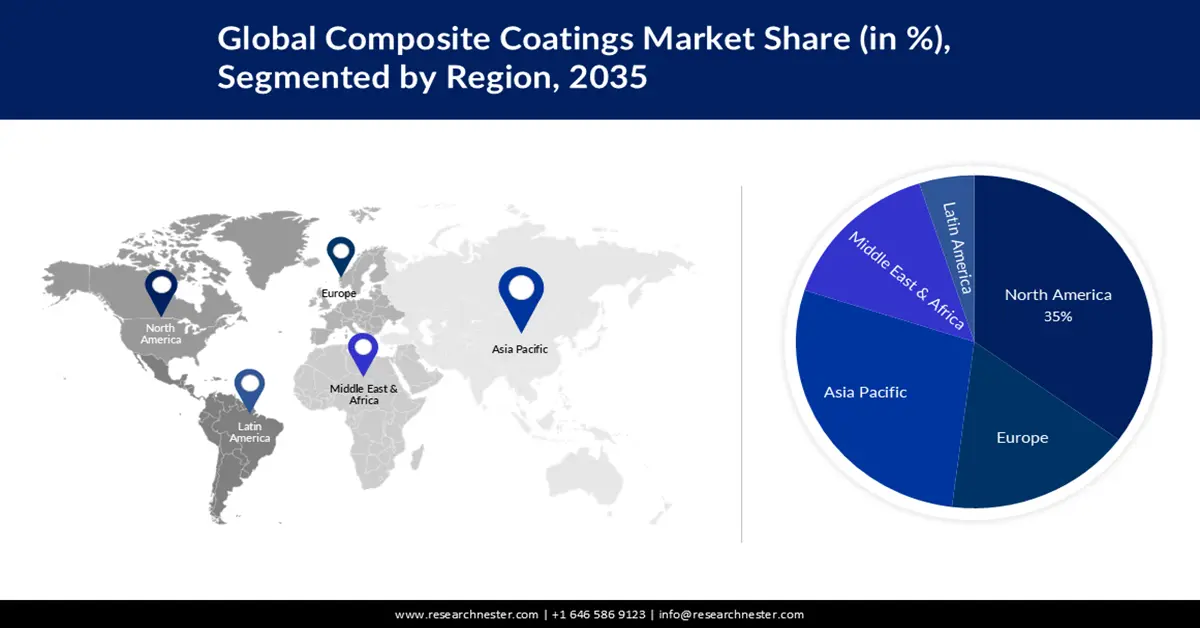

- North America composite coatings market is predicted to capture 35% share by 2035, driven by the expanding aerospace & defense sector, supported by rising funding and increased demand for composite coatings in the industry.

- Asia Pacific market will secure the second largest share by 2035, driven by rapid industrialization, particularly in emerging economies like India, driving the demand for composite coatings.

Segment Insights:

- The oil & gas segment in the composite coatings market market will capture a significant 30% share, driven by widespread use of composite coatings in protecting oil & gas infrastructure, forecast year 2035.

- The brazing (techniques) segment in the composite coatings market is expected to achieve a notable revenue share by 2035, influenced by brazing’s ability to enhance durability and resistance in lightweight composite coatings.

Key Growth Trends:

- Spiking Demand for Automobiles

- Increasing Demand for Solar Energy

Major Challenges:

- Fluctuating Cost of Raw Materials

- Stringent Regulatory Policies

Key Players: AkzoNobel, PPG Industries, Inc., Sherwin Williams Company, RPM International Inc., AZTRON TECHNOLOGIES, LLC, Axalta Coating Systems, A.W. Chesterton Company, OM Sangyo Co., Ltd., SURTECKARIYA Co., Ltd.

Global Composite Coatings Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.8 Billion

- 2026 Market Size: USD 1.92 Billion

- Projected Market Size: USD 3.71 Billion by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 9 September, 2025

Composite Coatings Market Growth Drivers and Challenges:

Growth Drivers

-

Spiking Demand for Automobiles– Rapid urbanization and rising disposable income across the globe has increased the demand for automobiles. This is expected to increase the demand for composite coatings in automobiles since vehicles are frequently exposed to harsh environments and temperatures.

Moreover, the use of composite coatings in the automotive industry has increased as these coatings provide more durability, and make the vehicles more appealing by meeting the need for an attractive exterior design and a high-quality gloss finish. As per data, in 2023, more than 68 million cars are expected to be sold worldwide. - Increasing Demand for Solar Energy- The growing population across the globe has increased the demand for solar energy to reduce the price of electricity while also lowering the carbon footprint. This has resulted in increasing demand for composite coatings as they play a crucial role in solar energy applications.

Challenges

-

Fluctuating Cost of Raw Materials– The high cost of raw materials and frequent price changes can cause disruptions in the supply chain which may make it difficult for the suppliers in sourcing these raw materials which as a result is expected to hinder the market growth.

-

Stringent Regulatory Policies

- Higher Costs associated with Manufacturing Process

Composite Coatings Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 1.8 Billion |

|

Forecast Year Market Size (2035) |

USD 3.71 Billion |

|

Regional Scope |

|

Composite Coatings Market Segmentation:

End- User Segment Analysis

The oil & gas segment in the composite coatings market is estimated to gain a robust revenue share of 30% in the coming years owing to the rising oil & gas sector. The composite coating is used as a protective coating to add shielding layers to increase the hardness and shelf time in equipment such as pipelines, vessels, and subsea equipment for proper functioning. These coatings are used in the oil & gas industry in various processes of exploration & production, transportation & storage, refining & petrochemical. According to data, the oil & gas industry is one of the largest sectors in the world, which generated over USD 4 trillion in 2022.

Techniques Segment Analysis

The brazing segment is set to garner a notable share shortly. This technique allows giving a tough and high resistance during the coating process compared to other techniques. The brazing method provides water resistance corrosion resistance to the surface. This is also believed to protect from damage caused by UV rays, scratches, heat, and fire. Further, owing to the light weight of composite coatings, the brazing techniques are applied in several sectors including aerospace, and automobile, among others to achieve the perfect result.

Our in-depth analysis of the global market includes the following segments:

|

Resin Type |

|

|

Application |

|

|

Techniques |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Composite Coatings Market Regional Analysis:

North American Market Insights

North America industry is likely to hold largest revenue share of 35% by 2035, impelled by the expanding aerospace & defense sector supported by rising funding in the aerospace & defense sector in the US. This as a result may rise the demand for composite coatings in the region as these coatings are used to create lightweight airframes, and are employed to protect, embellish, and serve a variety of purposes including erosion resistance, anti-static dissipation, and radar avoidance.

According to estimates, aerospace & defense industry exports increased by over 11% in 2021, reaching a total of more than USD 100 billion.

APAC Market Insights

The Asia Pacific composite coatings market is estimated to be the second largest, during the forecast timeframe led by rapid industrialization. In emerging economies such as India rising industrialization is known to be the major driver of the composite coatings market. For instance, these coatings are suitable for various industries as they protect the machinery, and other equipment from corrosion, and can be formulated with lower levels of volatile organic compounds (VOCs).

According to recent data, India's industrial production increased by over 6% in 2023.

Composite Coatings Market Players:

- AkzoNobel

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- PPG Industries, Inc.

- Sherwin Williams Company

- RPM International Inc.

- AZTRON TECHNOLOGIES, LLC

- Axalta Coating Systems

- A.W. Chesterton Company

- OM Sangyo Co., Ltd.

- SURTECKARIYA Co., Ltd.

Recent Developments

- AkzoNobel acquired Stahl’s powder activities to strengthen their position as a full-service provider of sustainable solutions for heat-sensitive substrates, and to build on a worldwide leading position by entering emerging market segments. Further, the acquisition enables the introduction of powder application to temperature-sensitive substrates such as MDF, plywood, thermoplastics, and composites.

- PPG Industries, Inc. acquired the powder coatings business of Arsonsisi, a top provider of specialty powder coatings for industrial and architectural applications to integrate metallic bonding, in its powder coatings portfolio in the Europe, Middle East, and Africa (EMEA) area to generate over 35% of revenues from sustainably superior products.

- Report ID: 4261

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Composite Coatings Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.