Compensation Software Market Outlook:

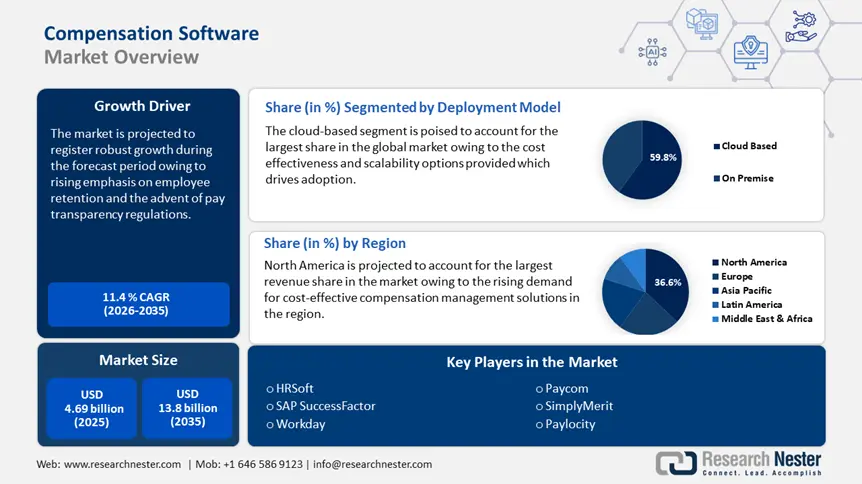

Compensation Software Market size was over USD 4.69 billion in 2025 and is poised to exceed USD 13.8 billion by 2035, witnessing over 11.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of compensation software is estimated at USD 5.17 billion.

A major driver of the compensation software market is the rapid digitization of human resource (HR) functions. Corporates across the world are investing in data-driven approaches to address critical aspects such as merit-based pay, and salary structuring to adhere to compliance frameworks. Furthermore, the demand for compensation software is projected to increase with the rising need for strategic pay management solutions.

The Society for Human Resource Management (SHRM) reported that employer costs for employee compensation have been on the rise as per the statistics released for the year 2023. The trends lay the framework for the increasing demand for compensation software that will assist in cost modeling, budget allocation, and forecasting future costs to help manage overall employer costs. The table below indicates key statistics on employers' spending on wages & benefits.

|

Comparative Data on Employer Spending on Wages & Benefits |

|

|

Employer Costs for Employee Compensation (December 2022 – March 2023) |

+1.4% |

|

Employer Costs for Employee Compensation (September 2023 – December 2023) |

+3.8% |

|

Total Employer Compensation Costs for Private-Industry Workers |

|

|

Wages & Salaries for Private-Industry Workers |

|

|

Benefits Costs for Private-Industry Workers |

|

Source: The U.S. Bureau of Labor Statistics

The statistics indicate a gradual increase in employer spending on employee wages and benefits, which is poised to drive the adoption of compensation software in businesses. Furthermore, the advent of machine learning and predictive analytics enables businesses to derive actionable insights from compensation data. Trends within human resource planning indicate the growing prevalence of long-term workforce planning, especially in corporate structures in knowledge-based economies, and compensation software tools are vital to realizing long-term workforce plans.

An indication of the competitiveness of the compensation software market is the recent launches of compensation management solutions, aimed at reducing reliance on manual work. For instance, in August 2024, Paycor HCM Inc. announced the release of Paycor Compensation Management which will be a collaborative solution purpose-built for leaders who want to streamline compensation planning while engaging and retaining employees. The solution is poised to significantly reduce time-consuming manual work and provide pay transparency to workers, which has remained a consistent demand within the employee circles. The key players in the compensation software market are expected to leverage favorable trends and maintain robust growth by the end of 2037.

Key Compensation Software Market Insights Summary:

Regional Highlights:

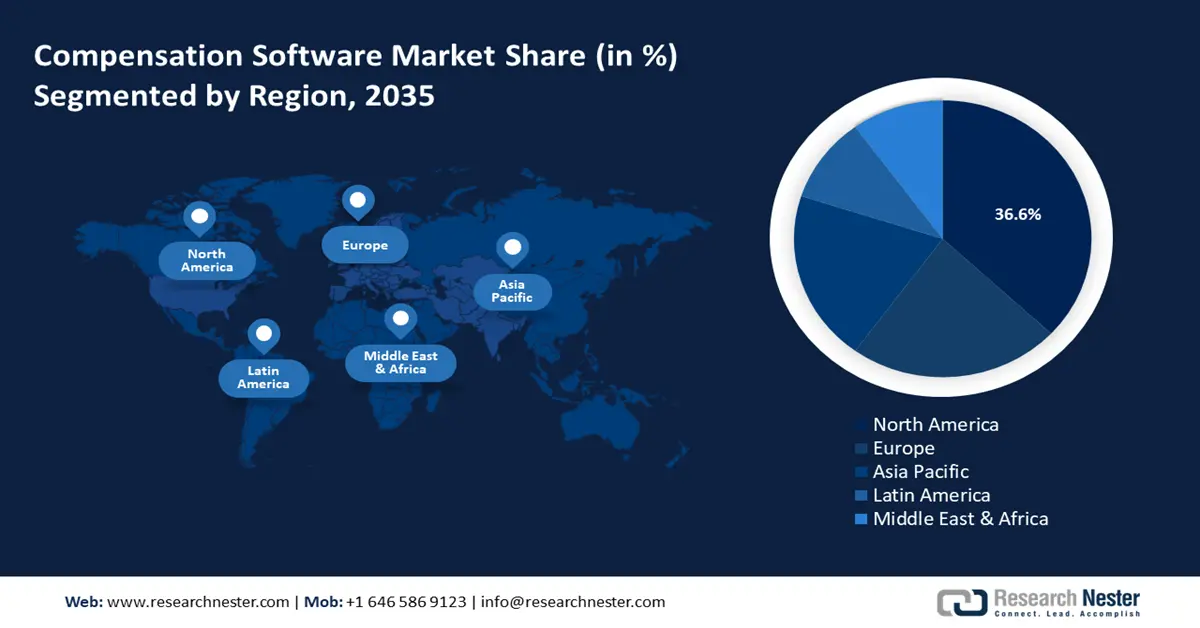

- North America's 36.6% share in the Compensation Software Market is driven by the presence of market-leading vendors and rapid proliferation of SaaS solutions, solidifying its leadership through 2026–2035.

- Europe’s compensation software market is set for rapid growth through 2026–2035, driven by rising calls for standardized compensation practices and regulatory directives like EU Pay Transparency.

Segment Insights:

- The cloud-based segment of the Compensation Software Market is expected to capture a 59.80% share by 2035, fueled by the cost-effectiveness and scalability of SaaS-based solutions.

Key Growth Trends:

- Rising emphasis on employee engagement and retention

- Growing adoption of total rewards strategies

Major Challenges:

- Limitations in software ROI

- Growing cost implications

- Key Players: HRSoft, SAP SuccessFactors, PayScale, HiBob, Paycom, Workday, Oracle HCM Cloud, Compport, SimplyMerit, Paylocity, Paycor HCM Inc. Deel, UKG.

Global Compensation Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.69 billion

- 2026 Market Size: USD 5.17 billion

- Projected Market Size: USD 13.8 billion by 2035

- Growth Forecasts: 11.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Japan, Canada

- Emerging Countries: China, India, Japan, Singapore, South Korea

Last updated on : 13 August, 2025

Compensation Software Market Growth Drivers and Challenges:

Growth Drivers

- Rising emphasis on employee engagement and retention: The HR trends globally indicate a rising emphasis on strengthening employee retention, which remains the hallmark of a well-functioning organization. The adoption of advanced compensation management solutions boosts employee engagement and the integration of AI and ML helps the creation of tailored compensation packages. Furthermore, companies offering salaries that are below market rates are expected to have higher turnover rates which can be detrimental in the long run. The table below indicates statistics on why fair compensation of employees is critical for retention.

Employee Replacement Costs

Estimated costs of replacing an employee

- 50% to 60% of the employee’s salary

- Overall costs ranging from 90% to 200%

Source: Small Business Association of Michigan

The statistics indicate that retaining an employee and helping them upskill is a cost-effective investment in comparison to replacements. The latter can drive the operational costs of an organization. To ensure that employee retention rates are high, the demand for compensation software to leverage market data on salaries and provide competitive pay. Additionally, the software assists in creating a performance-based pay structure that is rewarding for employee motivation. - Growing adoption of total rewards strategies: The rising adoption of total rewards strategies is expected to assist the growth of the compensation software market. Compensation management software plays a vital role in managing comprehensive reward packages, and by offering centralized dashboards, the systems assist HR teams in analyzing total reward offerings as per industry benchmarks. In April 2022, SHRM reported better compensation to account for 53% of new job searches within the U.S. and highlighted the requirement of total rewards for an organization to maintain a competitive advantage.

Revenue Report

Company Name

Details

HRSoft

- 58% year-over-year increase in revenue in Q2 2024.

- 100% net retention in FY 2023

- Record ARR growth (organic and inorganic) in 1H 2023, which represents a 198% increase YoY.

Paycor

- FY24 total revenue of USD 654.9 million, a 19% increase year-over-year while expanding operating margins.

- Fy25 revenue guidance of USD 722.0 million to USD 729.0 million, an increase of 11% year-over-year at the top end of the range.

Additionally, the revenue growth of key compensation management software solutions providers is an indication of the lucrative growth opportunities within the compensation software market. The table below highlights the revenue growth of two key players in the industry. - Rising demand for pay transparency initiatives: The increase in regulatory push for pay equity and transparency is a key factor in driving the adoption of compensation software. For instance, pay transparency laws are set to be adopted in 5 new U.S. states in 2025 which are Massachusetts, New Jersey, Vermont, Illinois, and Minnesota. Additionally, pay transparency is expected to be the norm for younger demographics of job seekers. The trends are expected to create sustained demand for compensation software to help organizations meet expectations via pay equity analytics.

Furthermore, the regulatory push has ensured that organizations require compensation management software that can assist in adhering to legal frameworks. The push for ethical compensation practices is a part of the broader trends in corporate responsibility and diversity, equity, and inclusion (DEI) initiatives. The table below highlights the list of companies that are successfully scaling up DEI initiatives as per the World Economic Forum (WEF) in 2024.

Diversity, Equity, and Inclusion Lighthouses Report 2024

Banco Pichincha

- The company closed the pay equity gap between men and women by 16% from December 2020 to May 2023.

Heineken

- 10% increase in the representation of women senior managers in sales from 2020 to 2022.

Source: WEF

The DEI initiatives are beneficial for the growth of a business in the current trends demanding greater accountability from corporations. With pay equity and pay transparency being key factors in DEI initiatives, the push to integrate compensation software solutions is expected to rise by the end of 2037.

Challenges

-

Limitations in software ROI: The Cambridge Personal Styles Questionnaire reported that the cost of poor software quality in the U.S. amounted to around USD 2 trillion in 2022. The maintenance costs and upgrades can affect the ROI of compensation software adoptions. Furthermore, failure to integrate with existing systems can degrade the value of software investments for an organization which can become a deterrent to the compensation software market’s growth.

- Growing cost implications: In December 2024, the U.S. Bureau of Labor Statistics released a report that indicated that employee compensations account for around 70% of operating costs. The financial burden can discourage some companies from investing in compensation software solutions. Additionally, complicated region-specific labor laws can remove the regulatory requirements to have a robust HR department which can negatively affect the adoption rates of compensation software.

Compensation Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.4% |

|

Base Year Market Size (2025) |

USD 4.69 billion |

|

Forecast Year Market Size (2035) |

USD 13.8 billion |

|

Regional Scope |

|

Compensation Software Market Segmentation:

Deployment Model (Cloud-Based, On-Premise)

The cloud-based segment is poised to capture over 59.8% compensation software market share by 2035. A major driver of the growth of the segment is the proliferation of SaaS services owing to their cost-effectiveness. Furthermore, cloud-based compensation software solutions offer scalability to organizations without incurring high maintenance costs making it lucrative for adoption. Key players operating in the sector that provide cloud-based compensation software solutions are investing in strategic acquisitions to expand their global footprints, and leverage the favorable trends in the compensation software market. For instance, in January 2022, Paylocity, a leading integration automation platform, announced the acquisition of Cloudsnap Inc., and the move is expected to assist HR and financial applications in automating data flows.

The on-premise segment of the compensation software market is poised to exhibit stable growth during the forecast period. A major driver of the segment is the sustained demand from public sector organizations that prioritize security and data control. With a rising number of public sector organizations establishing a dedicated HR department, the demand for on premise compensation software is poised to remain steady by the end of 2035. Companies that deal with sensitive data prefer to host the software within their own infrastructure. Despite the surging popularity of cloud-based deployment, businesses in the BFSI and healthcare sectors are poised to continue seeking on-premise deployment of compensation software solutions. Additionally, companies are seeking to release hybrid suites that merge compensation and performance management system, such as Version 8.5 of FocalReview Compensation and Performance Management Suite of Spira Links Corporation that can be deployed on-premises and via cloud.

Organization Size (Large Enterprises, Small and Medium-Sized Enterprises)

The large enterprises segment of the compensation software market is poised to account for a major revenue share during the forecast period. Large organizations require robust management of employee compensation, which makes them lucrative clients for companies offering compensation software solutions. Furthermore, large organizations offer opportunities for long-term adoption of compensation software. A key emerging driver of the segment is the rise of remote work and a globalized workforce.

The globalized workforce requires effective compensation management across regions and currencies, which drives demand for software management solutions to assist compliance with local regulations. SHRM’s report indicates that multinational corporations must focus on overseas employment costs to improve talent retention rates by adhering to fair compensation practices across countries. With pay gap concerns rising across countries, the demand for compensation software in large multinational enterprises is expected to rise during the forecast period.

Our in-depth analysis of the global compensation software market includes the following segments:

|

Deployment Model |

|

|

Organization Size |

|

|

Industry Vertical |

|

|

Compensation Practice |

|

|

Features |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Compensation Software Market Regional Analysis:

North America Market Forecast

North America in compensation software market is poised to account for around 36.6% revenue share by 2035. A major driver of the market is the presence of established market-leading vendors in the region and the rapid proliferation of SaaS solutions. Furthermore, the early adoption of advanced HR technologies in the U.S. and Canada benefits the market’s growth. The table below indicates the results of a survey on the integration of AI in HR-related activities in the U.S. which is poised to drive the adoption of compensation software solutions:

|

AI-Integration in HR Practices Trends |

|

|

Organizations that use AI to support HR-related tasks |

|

|

Industry-wise Organizations that use AI to support HR-related tasks |

|

|

Segmentation of HR-usage of AI |

|

Source: SHRM

The U.S. compensation software market accounts for the largest revenue share in North America. The market’s growth is driven by the rising complexity of compensation structures. In April 2024, the U.S. Department of Labor published the revisions for the Fair Labor Standards Act (FLSA) which increased the standard salary level and the annual compensation threshold of the highly compensated employee. The amendments in the regulations must be reflected in the compensation structure of private organizations, which is poised to drive demand for compensation management tools for efficient restructuring.

Additionally, companies offering compensation management solutions in the U.S. have reported an increase in revenue share which highlights the potential of the compensation software market. For instance, in October 2024, Paycom reported third-quarter revenues in FY2024 of USD 452 million, which is an 11% increase from the previous year. Sequoia, a key player in the U.S. compensation software market reported revenue worth USD 124.6 million, and net profit after tax worth USD 24 million.

The Canada compensation software market is poised to expand during the forecast period owing to the rapid proliferation of cloud-based solutions in the region. Furthermore, the proliferation of SaaS solutions in North America benefits the market in Canada. The Cloud Adoption Strategy of Canada pushes for the cloud to be the first choice in enterprises to help remediate technical debt and deliver business value. The trends indicate favorable opportunities to offer cloud-based compensation software solutions.

Additionally, an emerging trend in Canada is the rising demand for pay equity. For instance, in January 2025, Canada Nickel Company Inc. announced joining the federal government’s Equal by 30 campaign to improve career opportunities for women in the mining industry of the country. The Equal by 30 campaign strives towards pay-parity in public and private sectors, and with the evolving consumer trends demanding greater accountability from enterprises, the demand for compensation management tools is poised to increase to create structural plans to restore pay parity within organizations.

Europe Market Forecast

The Europe compensation software market is poised to register the fastest growth during the forecast period. The market’s growth is driven by the rising calls for standardized compensation practices across multinational organizations. Additionally, the diversity of compensation software markets in Europe provides lucrative opportunities for the adoption of compensation management software solutions. Furthermore, regulatory directives such as the EU directive on Pay Transparency are poised to drive the necessity for compensation software solutions. As per the new directive, companies operating in the EU must disclose salary information and take necessary action if the gender pay gap exceeds by 5%. Furthermore, the advent of cloud-based compensation software solutions integrated with performance management systems is poised to create lucrative opportunities in the compensation software market.

The Germany compensation software market is projected to expand during the forecast period owing to businesses in the country seeking to streamline their payroll system. Germany’s stringent labor laws necessitate compliant compensation software that can help a business navigate the regulatory directives in place. Germany has established manufacturing and automotive sectors where key players can offer compensation software solutions that can streamline the industry-specific benefits. The National Labor Law of Germany covers the compensation structure in the country, with foreign employees being subjected to its jurisdiction. The table below indicates wage growth in the country.

|

Wage Growth in Germany (2024) |

|

|

Wage Growth in 2024 |

2.90% increase in September 2024 compared to September 2023. |

|

Average Wage Growth from 1992 to 2024 |

0.30% growth from 1992 to 2024. |

Source: Federal Statistical Office

Furthermore, the new Minimum Wage Act of Germany will be effective from January 2025, which puts the minimum wage at USD 13.59 per hour, and the move is a part of the rising calls to ensure fair wages. The new directives must be reflected in the pay structure of the organizations operating in Germany, laying the groundwork for the adoption of integrated compensation software solutions.

The France compensation software market is poised to expand during the forecast period with the sector heavily shaped by complex labor laws. Companies in France must adhere to the Code du Travail that regulates wages. The intricate regulatory frameworks necessitate the adoption of compensation software tools to ensure efficiency in employee compensations. Additionally, the growing popularity of the Collective Performance Agreements (APC) which allows companies to adapt compensation policies to economic conditions, creating opportunities for customizable cloud-based software solutions. Additionally, France puts robust emphasis on pay equity, with businesses bound to report the annual gender pay gap, which drives demand for compensation software solutions that can provide advanced analytics to mitigate pay disparity.

Key Compensation Software Market Players:

- HRSoft

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SAP SuccessFactors

- PayScale

- HiBob

- Paycom

- Workday

- Oracle HCM Cloud

- Compport

- SimplyMerit

- Paylocity

- Paycor HCM Inc.

- Deel

- UKG

The compensation software market is poised to expand during the forecast period. Key players in the competitive sector are seeking to forge long-term relationships with multinational companies to expand revenue share. Furthermore, strategic acquisitions within the market bolster companies to increase the scope of their services to integrate advanced AI and ML in their compensation management software solutions. In June 2023, HRSoft, a major player in the market, announced the acquisition of CompTrak, to add CompTrak’s expertise in financial services firms globally to the existing product suite of HRSoft.

Here are some key players in the compensation software market:

Recent Developments

- In January 2025, Ludi Inc., announced the acquisition of MDComp’s wRVU calculator and dashboard tool. The acquisition Ludi’s commitment to addressing the complexities of physician compensation with efficient and reliable technology.

- In November 2024, Workday and Compa announced partnership to help organization effectively manage compensation with real-time data. This partnership will give joint customers access to Compa's real-time compensation data directly in the Workday platform, helping them make more informed, competitive job offers.

- Report ID: 6969

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Compensation Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.