Commercial Touch Display Market Outlook:

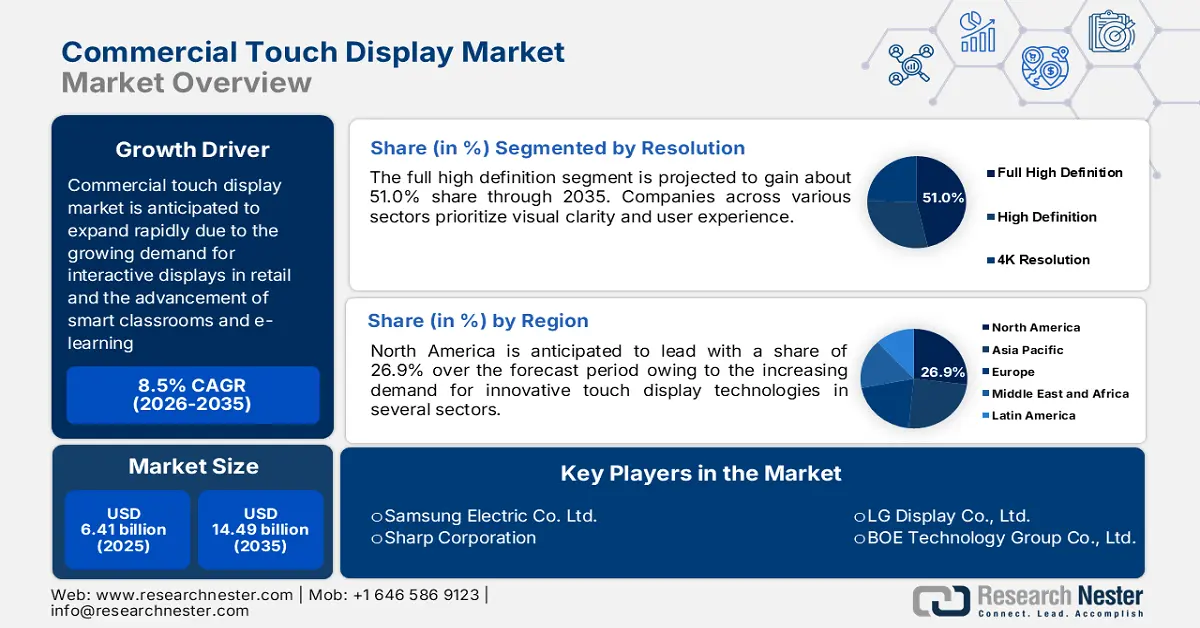

Commercial Touch Display Market size was valued at USD 6.41 billion in 2025 and is likely to cross USD 14.49 billion by 2035, registering more than 8.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of commercial touch display is estimated at USD 6.9 billion.

The demand for commercial touch displays is projected to rise rapidly over the forecast period due to technological development in display technologies, which enhances both performance and user experience across various industries. Innovations such as multi-touch capabilities allowing multiple points of contact are transforming how users interact with displays, particularly in collaborative environments such as education and corporate surroundings. In August 2024, pre-registration for C-TOUCH & DISPLAY SHENZHEN 2024 began, which showcased cutting-edge display and smart touch technologies. The event featured innovations focused on flexible displays, mini/micro-LED, and e-paper, highlighting developments in interactive and commercial display solutions.

The emergence of micro-LED and OLED displays is improving image quality with sharper contrast, faster response time, and higher brightness, mainly in healthcare and retail sectors where visual clarity is important. Moreover, progress in ruggedness and durability, such as displays with anti-glare and anti-scratch coatings, is making these systems more reliable for external and heavy-use environments. Furthermore, various technological advancements are propelling the widespread adoption of commercial touch displays in sectors such as corporate offices and research facilities where precision, durability, and clarity are important.

Key Commercial Touch Display Market Insights Summary:

Regional Highlights:

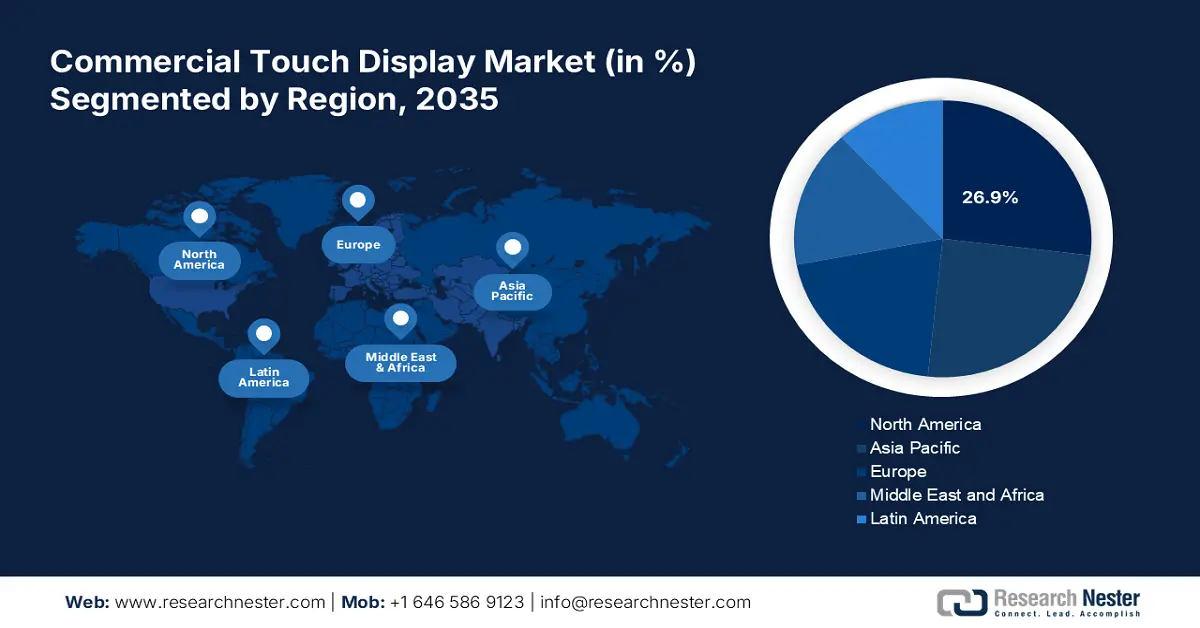

- North America holds a 26.9% share in the Commercial Touch Display Market, with adoption in key industries driving sustained growth through 2035.

- The Asia Pacific Commercial Touch Display Market is set for massive growth by 2035, fueled by rapid adoption of touch display technologies in retail and education.

Segment Insights:

- The Full High Definition segment is expected to exceed 51% market share by 2035, fueled by demand for sharp image quality in commercial displays.

- The Above 65 Inches segment is poised for lucrative growth from 2026 to 2035, driven by increasing adoption in large-scale digital environments.

Key Growth Trends:

- Increasing demand for interactive displays in retail

- Development of smart classrooms and e-learning

Major Challenges:

- Affordability and scalability challenges

- Heat dissipation issues

- Key Players: Samsung Electric Co. Ltd., Sharp Corporation, LG Display Co., Ltd., and BOE Technology Group Co., Ltd.

Global Commercial Touch Display Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.41 billion

- 2026 Market Size: USD 6.9 billion

- Projected Market Size: USD 14.49 billion by 2035

- Growth Forecasts: 8.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (26.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, South Korea, Germany

- Emerging Countries: China, India, South Korea, Brazil, Mexico

Last updated on : 14 August, 2025

Commercial Touch Display Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing demand for interactive displays in retail: As retailers progressively focus on producing more personalized, engaging, and immersive shopping experiences, touch displays have become essential tools for enhancing customer interaction and satisfaction. Interactive displays allow shoppers to be involved with digital content, make purchases, and discover product information all with a seamless interface. This not only improves the store experience but also offers retailers valuable data on consumer preferences and behavior it also allows them to customize offerings in real time.

For example, in June 2023, Samsung came up with the Samsung Kiosk, an all-in-one self-service solution that integrates card payment options, a high-definition touch display, and real-time product recommendations. Retailers can use this development to streamline checkout processes which encourage specific products and advance customer service efficiency. Furthermore, in June 2023, LG Electronics established advanced interactive digital signage solutions such as its 55-inch transparent OLED touch display which allows consumers to see digital content on physical products, improving the shopping experience by developing physical and virtual retail surroundings. -

Development of smart classrooms and e-learning: As educational institutions gradually adopt innovative technologies to boost teaching and learning experiences globally. With the rise of digital education, universities, schools, and training centers are integrating touch displays to foster more collaborative, engaging, and efficient learning settings. These interactive displays frequently combined with software for virtual teamwork allow students and teachers to work together in real time, either in person or remotely, thereby improving both understanding and retention of information.

In August 2022, Promethean Limited, a leading brand in interactive education technology announced its ActivPanel 9, providing multi-touch capabilities customizable interfaces, and innovative screen-sharing features that cater to hybrid learning models where students can take part in class and online simultaneously. The integration of cloud-based teamwork tools with touch technology permits real-time feedback and engagement, making the learning experience more interactive and student-centered.

Challenges

-

Affordability and scalability challenges: The increase in demand puts huge pressure on manufacturers to stay competitive by adopting cutting-edge technologies, which require significant investment. As these technologies offer improved performance, they also present challenges in terms of affordability and scalability for the broader commercial market. Companies face problems in adopting innovative features such as multi-touch capabilities, higher refresh rates, and integrated sensors (such as biometric or ambient light), which further increase research and development as well as production costs.

-

Heat dissipation issues: Effective and efficient heat management is critical for upholding the performance and longevity of displays. Touch screens are often placed in industrial environments and the public, they are ideally for prolonged use which generates significant heat. If not dissipated properly, this heat can damage components which later cause screen failures or decrease the display responsiveness and general lifespan. As demand for brighter and larger displays continues to grow across several sectors such as education, retail, and transportation challenges in managing heat effectively without cooperating on display performance or affordability are becoming progressively important for manufacturers in the commercial touch display market.

Commercial Touch Display Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.5% |

|

Base Year Market Size (2025) |

USD 6.41 billion |

|

Forecast Year Market Size (2035) |

USD 14.49 billion |

|

Regional Scope |

|

Commercial Touch Display Market Segmentation:

Screen Size (7 inches to 27 inches, 28 inches to 65 inches, Above 65 inches)

Above 65 inches segment in the commercial touch display market is expected to register lucrative growth till 2035. Different industries have variable needs based on the environment and application. Displays above 65 inches are being adopted in areas such as large-scale digital advertising, entertainment, and public spaces, where immersive and extremely visible touch screens are critical for delivering impactful content.

For example, in April 2023, ROHM Co., Ltd. advanced the 4ch/6ch LED driver for medium to large-size automotive displays in-car infotainment and instrument clusters. This low-power consumption technology reduces losses in LED driver current control circuits. As the demand for personalized, application-specific solutions rises across industries this segment allows manufacturers to address diverse commercial needs driving overall market growth.

Resolution (High Definition (HD), Full High Definition (FHD), 4K resolution)

Full high definition segment is expected to hold over 51% commercial touch display market share by the end of 2035. Businesses across numerous sectors prioritize visual clarity and user experience. The demand for full HD (1920 x 1080) displays is growing in environments where sharp image quality and clear visuals are important for tasks such as digital signage, interactive learning, and patient engagement systems. Full HD has become the standard for most commercial touch displays owing to its cost and balance of quality.

Our in-depth analysis of the global commercial touch display market includes the following segments:

|

Touch Technology |

|

|

Aspect Ratio |

|

|

Screen Size |

|

|

Resolution |

|

|

End use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Commercial Touch Display Market Regional Analysis:

North America Market Analysis

North America industry is anticipated to account for largest revenue share of 26.9% by 2035, due to further growth in the adoption demand from retail, health, and education industries. Touch display technologies are taken into use by companies with respect to improving consumer experience as well as work efficiency processes. The region gives high importance to technological innovations as well as digitalization for advanced touch solutions.

Companies in the U.S. are expanding product lines to capture high-traffic prospects such as schools, hospitals, and airports. For example, Elo Touch Solutions launched 5554L, a 55-inch 4K touchscreen display for hospitality and retail, in July 2024. The screen can support up to 40 simultaneous touches, thereby ensuring responsive and intuitive user interactions. The anti-friction glass increases durability, which makes it suitable for high-traffic environments. Such developments are anticipated to provide lucrative growth momentum in the U.S. commercial touch display industry.

The commercial touch display market in Canada is also rising at a steady pace due to the increasing adoption of these displays in retail and healthcare sectors. Furthermore, businesses in Canada are investing in touch display technologies to enhance customer experience and operational efficiency. The emphasis of the country on technological advancement and digital integration supports the growth of touch display solutions in different industries.

Asia Pacific Market Analysis

Asia Pacific commercial touch display market is set to exhibit massive CAGR till 2035, due to the presence of key players, such as LG, Sharp, Samsung, and BOE Technology. The rapid adoption of touch display technologies in the retail, education, and transportation sectors across the region also contributes to the expansion. Enhancement of user interaction and operational efficiency further supports the rising demand for touch display solutions. For example, in February 2023, Samsung displayed innovative signage solutions at Integrated Systems Europe (ISE) and showed the latest developments in signage technology to attract viewers and users.

China dominates Asia Pacific commercial touch display market in terms of innovative touch display products. The country put significant emphasis on developing a country with advanced technologies along with manufacturing capabilities that thus made it a potential player in the growth of the market in China. Additionally, due to digital transformation across most markets, touch display technology continues to gain adoption across China.

India commercial touch display market is also expanding due to growth in areas like retail and education, as more touch display technology is being utilized in such sectors. There is a great focus on digitalization and technology integration in India. Businesses in India are investing in touch display technology so that they can reach their customers better and seamlessly operate, which results in rapid expansion in the commercial touch display market.

Key Commercial Touch Display Market Players:

- Samsung Electric Co. Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- LG Display Co., Ltd.

- ViewSonic Corporation

- Promethean Limited

- BOE Technology Group Co., Ltd.

- Elo Touch Solutions, Inc.

- Hikvision

Among the leading commercial touch display manufacturers in the market are Samsung Electronics Co., Ltd., Sharp Corporation, LG Display Co., Ltd., and BOE Technology Group Co., Ltd. Companies involved in developing flexible, in-cell touch and OLED displays have improved their capabilities due to increased demand across different industries for commercial touch displays. Improving touch display technology enables the manufacture of more innovative products in the retail, healthcare, and educational sectors.

In January 2024, Samsung launched an S95D OLED TV, including a third-generation QD-OLED panel with a new anti-reflection coating as it eliminates glare and minimizes reflection to make it even brighter. This reflects the advancement of OLED technology from Samsung to suit consumer demands. Likewise, several other companies are also launching transparent TVs designed for various spaces, such as living rooms, making them visually appealing displays. These developments highlight the continuous efforts of industry leaders to push the boundaries of touch display technology.

Here are some leading players in the commercial touch display market:

Recent Developments

- In February 2024, Lenovo introduced its ThinkBook Transparent Display Laptop Concept at MWC 2024, featuring a 17.3-inch Micro-LED transparent screen. This innovation aligns with the growing trend in commercial touch displays, integrating advanced transparency and interactivity, and showcasing the future of high-tech, visually dynamic touch solutions.

- In June 2023, HIKVISION made substantial steps in Thailand commercial display market by showcasing developed audio-visual innovations at InfoComm Asia. The company announced its commercial display service center, interactive flat panels, emphasizing high-definition LED screens, and innovative commercial touch displays which are designed for hospitality and retail applications, the goal is to strengthen its position in government and corporate sectors.

- In April 2023, MicroTouch announced the launch of OF-270P-A1, a 27-inch open-frame touch monitor for hospitality and retail. Containing 10-point touch capabilities, FHD resolution, and an anti-glare surface, it also excels in bright environments. This invention supported the commercial touch display needs with greater optical performance and integration flexibility for several applications.

- Report ID: 6644

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Commercial Touch Display Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.