Commercial Surge Protection Devices Market Outlook:

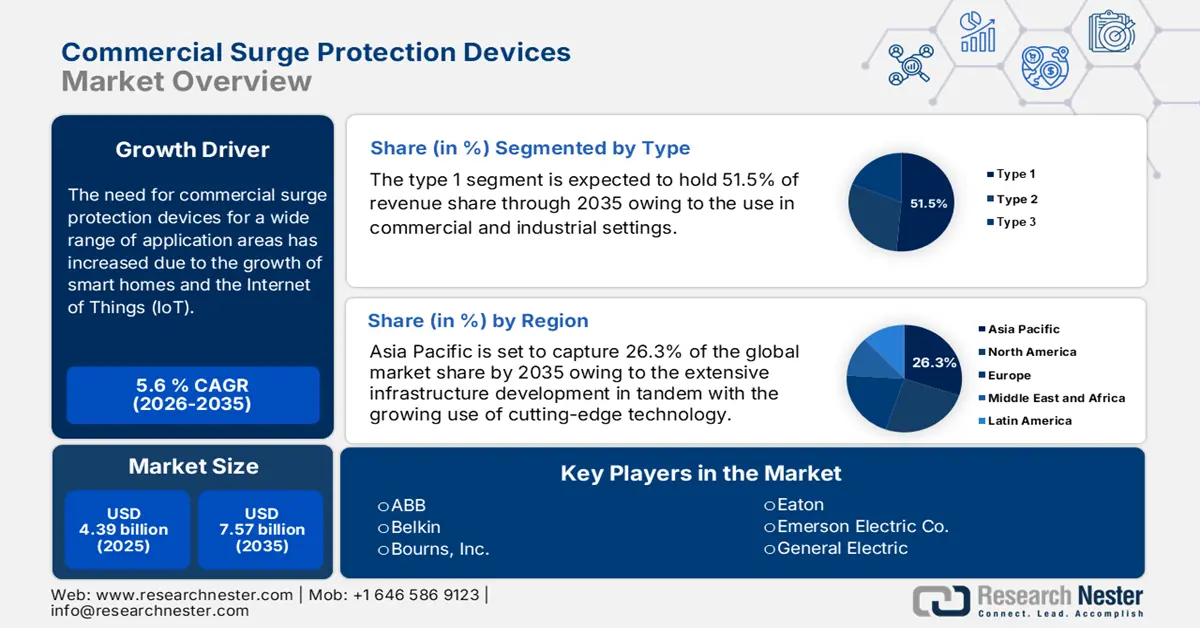

Commercial Surge Protection Devices Market size was valued at USD 4.39 billion in 2025 and is set to exceed USD 7.57 billion by 2035, expanding at over 5.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of commercial surge protection devices is evaluated at USD 4.61 billion.

The need for commercial surge protection devices across several applications has rapidly increased due to the growth of smart homes and the Internet of Things (IoT). These gadgets shield networked devices, entertainment systems, and smart appliances from power outages, expanding their use in various industrial contexts to safeguard automation equipment, control systems, and vital machinery. Surge protection solutions are becoming increasingly necessary as companies depend on automation and cutting-edge technology.

The increasing demand for smart power strips is an important factor driving the market's expansion. Due to its ability to automatically create timers and schedules and monitor energy consumption, various power strips are in high demand among consumers. Consequently, several businesses are working to offer power strips with Wi-Fi capabilities. For instance, in October 2020, Jasco, unveiled a new range of Enbrighten WiFi smart home devices that aim to connect the house from the inside out and make life easier.

Key Commercial Surge Protection Devices Market Insights Summary:

Regional Highlights:

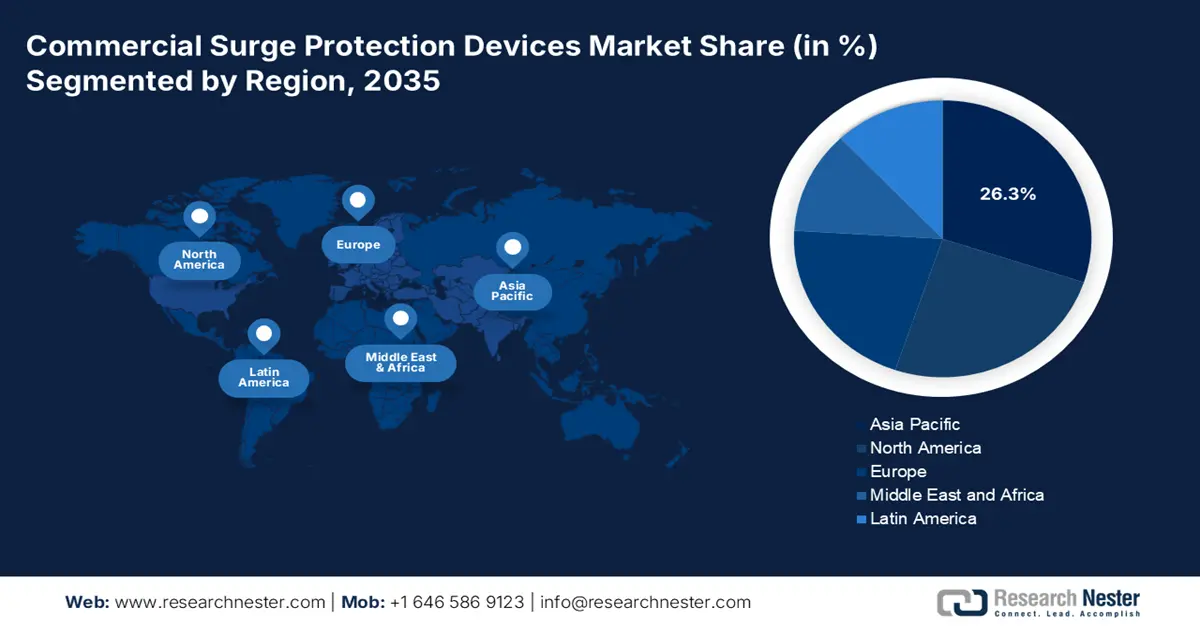

- Asia Pacific leads the Commercial Surge Protection Devices Market with a 26.3% share, propelled by infrastructure development and adoption of smart building technologies, fostering growth from 2026–2035.

- North America's commercial surge protection devices market is forecasted to maintain stable growth through 2026–2035, driven by adoption of cutting-edge technology and strict electrical safety regulations.

Segment Insights:

- The Line Cord segment is forecasted to see significant growth by 2035, propelled by stringent regulations and growing awareness of electrical surge risks.

- By 2035, the Type 1 segment is expected to secure a 51.5% share, driven by the need for surge protection in low-voltage installations against industrial surges and lightning strikes.

Key Growth Trends:

- Expanding market for building management and HVAC systems

- Rising number of data centers and telecommunication networks

Major Challenges:

- The availability of counterfeit goods

- High initial costs

- Key Players: ABB, Belkin, Bourns, Inc., CG Power and Industrial Solutions Limited, Eaton, Emerson Electric Co., General Electric, Raycap, GEYA Electrical Equipment Supply.

Global Commercial Surge Protection Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.39 billion

- 2026 Market Size: USD 4.61 billion

- Projected Market Size: USD 7.57 billion by 2035

- Growth Forecasts: 5.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (26.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 14 August, 2025

Commercial Surge Protection Devices Market Growth Drivers and Challenges:

Growth Drivers

- Expanding market for building management and HVAC systems: Complex controls, circuits, motors, and compressors used in HVAC systems are particularly vulnerable to electrical surges. To protect these from voltage anomalies HVAC equipment and building electrical service panels are being incorporated with hardwired and standalone protectors. The expansion of the HVAC and refrigeration industries led to greater use of electrical equipment, which calls for dependable surge protection to preserve system integrity and guarantee continuous operation.

- Rising number of data centers and telecommunication networks: Expansion in the data centers and telecommunications sector has resulted in an increasing need for SPDs. Advanced devices such as routers, switches, antennas, and controllers that are susceptible to electrical surges can interfere with signals and create outages in telecom networks. Over the upcoming years, it is anticipated that telecom providers worldwide will upgrade their networks to 5G and beyond. Surge protectors are necessary since 5G infrastructure mostly depends on tiny cell towers with delicate radio equipment. Additionally, as fiber optic networks grow to accommodate 5G, terminal boxes and cabling will require high-performance protection against transients.

Challenges

- The availability of counterfeit goods: The market is severely hampered by the rising availability of counterfeit surge prevention equipment. Premature failures result from subpar parts and defective designs that reduce their ability to handle surges. This key factor is expected to hamper overall market growth during the forecast period.

- High initial costs: Though commercial surge protection devices are rapidly gaining traction; the high costs can hamper the adoption between 2025 and 2037. Small to medium companies with limited budgets cannot afford to deploy advanced solutions. This along with low awareness about the importance of these devices can hamper global sales in the coming years.

Commercial Surge Protection Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.6% |

|

Base Year Market Size (2025) |

USD 4.39 billion |

|

Forecast Year Market Size (2035) |

USD 7.57 billion |

|

Regional Scope |

|

Commercial Surge Protection Devices Market Segmentation:

Type (Type 1, Type 2, Type 3)

Type 1 segment is expected to capture commercial surge protection devices market share of over 51.5% by 2035. The Type 1 commercial surge protector device line is made to safeguard low-voltage installations against industrial surges and lightning strikes. Alternating Current (AC) networks expose equipment to a variety of unwanted electrical phenomena that might interfere with its functionality, lead to malfunctions, reduce its lifespan, or even destroy it. For instance, in October 2023, Leviton unveiled a new range of Type 1 and Type 2 surge protection panels in the most popular voltage configurations, offering options for a range of uses, including commercial, industrial, and residential.

Product (Hard-Wired, Plug-In, Line Cord, Power Control Devices)

The line cord segment in commercial surge protection devices market is projected to gain a significant share during the forecast period. The use of these devices will be accelerated by stringent regulations and growing awareness of the possible harm that electrical surges can inflict. The business landscape is expected to improve as a result of growing recognition of the significance of lightning protection and the growing integration of these systems into automation and building management systems. By enabling remote control and real-time surge protection monitoring, this integration enhances system resilience overall and offers substantial prospects for industry growth. For instance, in June 2023, Littelfuse, Inc. introduced the Surge Protective Device (SPDN) series in the style of the National Electrical Manufacturers Association (NEMA) to shield equipment from brief overvoltage events that last only a few microseconds, thereby minimizing damage and downtime.

Our in-depth analysis of the commercial surge protection devices market includes the following segments:

|

Product |

|

|

Type |

|

|

Power Rating |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Commercial Surge Protection Devices Market Regional Analysis:

Asia Pacific Market Analysis

Asia Pacific industry is poised to account for largest revenue share of 26.3% by 2035. The market will expand as a result of extensive infrastructure development in tandem with the growing use of cutting-edge technology and the spread of delicate electronic equipment. The increasing demand for advanced surge protection in the region is partly a result of the expanding trend of smart buildings and the incorporation of renewable energy sources. For instance, in October 2019, Kasa Smart from TPLink, integrated with SmartThings, a pioneer in automation and straightforward production techniques for smart homes. Many of Kasa's most well-known smart home appliances are now certified under the Works with SmartThings program and are completely interoperable with SmartThings.

China's growing disposable income is also enabling people to purchase high-end consumer goods like refrigerators, washing machines, and LED TVs, among other things. The regional market is anticipated to increase during the forecast period due to the high customer emphasis on protecting these consumer gadgets.

The demand for commercial surge protection devices in the residential, commercial, and industrial sectors in India is being driven by rising tourism, smart city projects, and building activities. The emphasis on smart manufacturing techniques is a major trend affecting the industry under study. The Government of India set the ambitious goal of raising the manufacturing production contribution to 25% of GDP by 2025 according to IBEF data.

North America Market Analysis

North America commercial surge protection devices market is expected to experience a stable CAGR during the forecast period owing to the high rate of adoption of cutting-edge technology, stringent government laws about electrical safety, and the existence of major market participants. For instance, in April 2024, the Competitive Carriers Association, the leading organization for competitive wireless providers in the US, hosted CCA 2024, where Raycap, a global leader in infrastructure and power protection solutions for the telecom industry, showcased its array of surge protection and cabinet solutions.

The commercial surge protection devices market in the U.S. is expanding steadily due to the growing reliance on sophisticated electronic systems in a variety of industries. The need for these units is further highlighted by the deteriorating power infrastructure and the regularity of weather-related power outages.

The necessity to safeguard delicate electrical systems and equipment against voltage fluctuations has grown in Canada as a result of the country's rapid industrialization and automation technology adoption. Commercial surge protection devices are widely used in industries like manufacturing, chemicals, power, and oil and gas to reduce operational hazards and downtime brought on by surges. For example, to guarantee the efficient operation of motors, pumps, generators, and other vital equipment, oil rigs, refineries, and pipelines depend on hardwired and power control center surge protectors.

Key Commercial Surge Protection Devices Market Players:

- Littelfuse, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ABB

- Belkin

- Bourns, Inc.

- CG Power and Industrial Solutions Limited

- Eaton

- Emerson Electric Co.

- General Electric

- Raycap

Due to the existence of numerous well-known firms, the industry might be characterized as extremely competitive. The market participants' primary tactics include the creation of new products, capacity growth, mergers and acquisitions, strategic alliances, partnerships, and agreements, as well as funding for R&D. Businesses like General Electric Company are concentrating especially on offering surge protectors for wall taps and power strips. Key manufacturers are concentrating on expanding their product portfolios after realizing that product quality is the most important factor in the industry. The main focus of major businesses is on creating complex and inventive products that are the result of intensive research and development.

Here are some leading players in the commercial surge protection devices market:

Recent Developments

- In July 2023, Bourns, Inc., a prominent producer and supplier of electronic components for power, protection, and sensing systems, unveiled a high-performance DC Surge Protective Device (SPD) Series. A new series of DIN Rail general purpose SPDs with pluggable/replaceable modules, the Bourns Model 1420A Series SPDs may provide surge rates of up to 50 kA in various configurations.

- In July 2023, Raycap, a global producer of electrical components for monitoring systems, connection, surge protection, and surge protection solutions, is adding a new model of surge protection junction box for PV inverters to safeguard DC-side power. The ProTec PV Box 7Y, which is ready to attach, is a very small three-string solution that provides dependable protection against surge-related damage.

- Report ID: 6639

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Commercial Surge Protection Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.