Commercial Smart Water Meter Market Outlook:

Commercial Smart Water Meter Market size was valued at USD 2.4 billion in 2025 and is expected to reach USD 12.46 billion by 2035, registering around 17.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of commercial smart water meter is assessed at USD 2.79 billion.

The commercial smart water meter market is expanding due to growing sustainability and water scarcity concerns. According to the UN Environment Program, 4 billion people, or at least half of the world's population, struggle with water shortages at least once a year. It is anticipated that 1.8 billion people will experience water scarcity by 2025. Smart meters help monitor real-time data on consumption, leaks, and inefficiencies, promoting more efficient water use in commercial settings. Furthermore, smart meters are now more precise, dependable, and economical due to technological improvements, which makes them a desirable investment for companies looking to lower operating expenses and enhance resource management.

Smart water meters help utilities and commercial entities reduce non-revenue water (NRW), which refers to water that is produced but not billed due to leaks, theft, or inaccurate meters. Real-time monitoring allows for better detection and reduction of water loss. Moreover, commercial customers benefit from accurate billing through smart water meters, ensuring that they are charged based on actual consumption rather than estimates. This eliminates disputes and helps utilities optimize revenue.

Key Commercial Smart Water Meter Market Insights Summary:

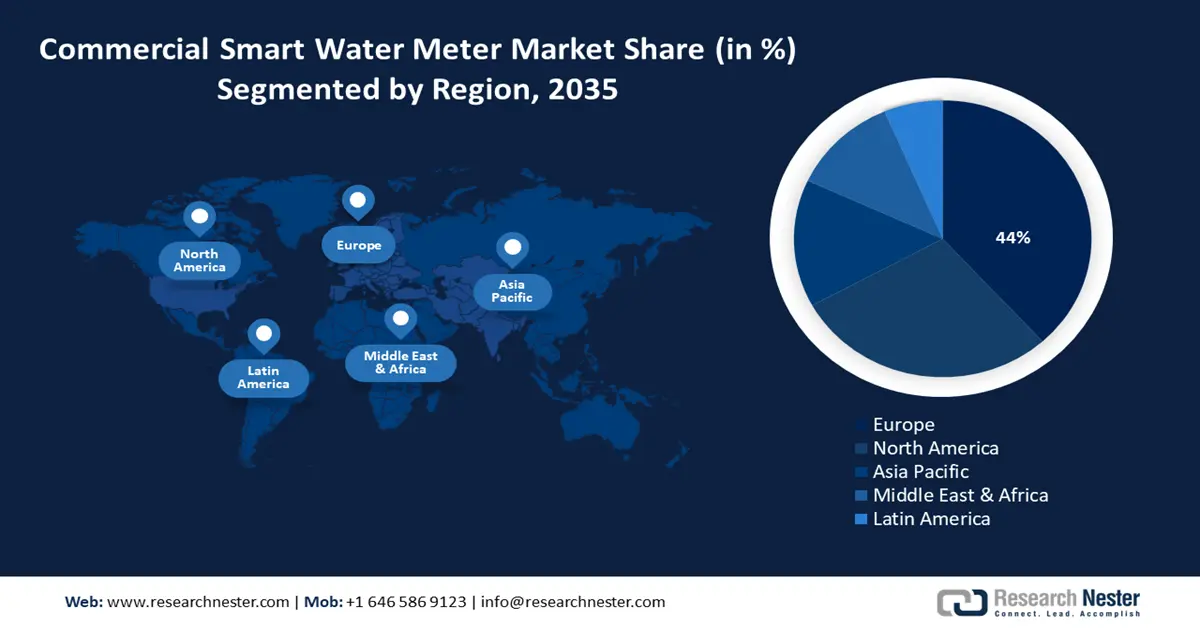

Regional Highlights:

- Europe’s 44% share in the commercial smart water meter market is driven by strong economic growth and technological developments, ensuring dominance through 2026–2035.

- North America is expected to hold a significant share of the Commercial Smart Water Meter Market from 2026 to 2035, driven by advanced water infrastructure and rising water conservation efforts by governments.

Segment Insights:

- The Cold Water Meter segment is projected to capture an 88.4% market share by 2035, driven by the need for accurate and efficient water usage monitoring in commercial facilities.

- The AMI segment of the Commercial Smart Water Meter Market is projected to hold a 54.50% share by 2035, driven by improved precision and real-time data gathering for better water management.

Key Growth Trends:

- Supportive government incentives

- Increased integration of advanced metering solutions

Major Challenges:

- Substantial upfront costs

- Lack of awareness

- Key Players: Aclara Technologies LLC, Avnet, Inc., SUEZ SA, Apator S.A., Arad Group, Badger Meter, Inc., Honeywell International Inc., Diehl Stiftung & Co. KG (Diehl Verwaltungs-Stiftung), Itron, Inc., Kamstrup.

Global Commercial Smart Water Meter Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.4 billion

- 2026 Market Size: USD 2.79 billion

- Projected Market Size: USD 12.46 billion by 2035

- Growth Forecasts: 17.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (44% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: Germany, United Kingdom, United States, China, Japan

- Emerging Countries: China, Japan, South Korea, India, Singapore

Last updated on : 14 August, 2025

Commercial Smart Water Meter Market Growth Drivers and Challenges:

Growth Drivers

- Supportive government incentives: As companies work to adhere to rules and take advantage of incentives, regulatory requirements and incentives promoting the use of commercial smart water meters propel market expansion. For instance, the Government of the UK has included smart metering initiatives in the updated draft plans as part of broader demand management efforts. Both the government and the Water Services Regulation Authority (Ofwat) have announced the accelerated installation of 462,000 smart meters as a part of a larger effort to expedite water infrastructure development. This move aims to promptly increase the adoption of smart metering. While most businesses are already metered, only around 8% currently have smart meters. Water companies are aiming to raise the percentage of smart meters in non-household properties to 48% by 2030, 63% by 2040, and 65% by 2050 in the UK.

- Increased integration of advanced metering solutions: IoT integration improves utility administration by enabling remote meter reading, leak detection, and real-time monitoring, increasing the demand for advanced metering solutions. There’s a heightened focus on data analytics and cloud-based systems to understand water consumption patterns and enable businesses to optimize usage and quickly identify abnormalities.

Moreover, elevation in sensor technology and communication protocols has improved the reliability and performance of these meters, increasing their adoption across diverse commercial industries.

Also, major key players are striving to introduce cost-effective and advanced metering solutions to promote the adoption of advanced metering infrastructure across various regions and sectors. For instance, in May 2023, Honeywell launched the Next Generation Cellular Module (NXCM), which enables Advanced Metering Infrastructure (AMI), an innovative system that converts old gas and water meters into smart meters without additional infrastructure. - Need to upgrade existing infrastructure: While there are still problems with water supply in developing nations, the water infrastructure constructed in industrialized countries throughout the early 20th century has the least potential for use. The water sector is confronted with the problem of aging infrastructure since the installed standard meters lack accuracy and have worn out. This has led to an increase in the adoption of smart water metering solutions across nations. For instance, in September 2022, Trilliant, a leading global provider of advanced metering infrastructure (AMI), smart grid, smart cities, and IIOT solutions, successfully implemented a wireless water metering system in Canada.

Challenges

- Substantial upfront costs: Large capital expenditures are needed for the installation of smart water meters. Installing smart water meters becomes challenging for water utilities and end consumers due to numerous components, including data management systems, control tools, real-time communication devices, and measuring and sensing devices, which are needed for the smart water metering infrastructure. Also, the lack of government funding for installing these meters and high installation costs may hinder the market from growing.

- Lack of awareness: Even with all of the benefits that smart water meters offer; a significant section of the global populace is ignorant of these services. The adoption rate of smart water metering is quite low in developed nations and very low in developing economies. This factor may impede market expansion during the forecast period.

Commercial Smart Water Meter Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

17.9% |

|

Base Year Market Size (2025) |

USD 2.4 billion |

|

Forecast Year Market Size (2035) |

USD 12.46 billion |

|

Regional Scope |

|

Commercial Smart Water Meter Market Segmentation:

Technology (AMI, AMR)

The AMI segment is expected to hold commercial smart water meter market share of over 54.5% by the end of 2035. The segment is growing due to its improved precision and real-time data gathering, which enables utilities to effectively track water usage and identify leaks, thus cutting down on water wastage and operational expenses. This technology allows meters and utilities to communicate in both directions, which makes remote monitoring and control essential for efficient water management. By offering actionable information and facilitating predictive maintenance, the integration of AMI with IoT and advanced data analytics further increases its attractiveness.

Product (Cold Water Meter, Hot Water Meter)

In commercial smart water meter market, cold-water meter segment is poised to capture revenue share of around 88.4% by the end of 2035. The segment growth can be attributed to the need for accurate and efficient water usage monitoring, driving the demand for advanced metering solutions. To ensure proper billing and minimize water wastage, cold-water meters are crucial for monitoring and controlling water consumption in commercial facilities. Modern smart metering technologies like real-time data analytics and IoT integration improve the performance and usefulness of cold-water meters. Better water management techniques, leak detection, and predictive maintenance are made possible by these advancements, which further fuel market expansion.

Our in-depth analysis of the commercial smart water meter market includes the following segments:

|

Technology |

|

|

Product |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Commercial Smart Water Meter Market Regional Analysis:

Europe Market Statistics

Europe industry is set to account for largest revenue share of 44% by 2035. Major factors expanding the market in the region are strong economic growth and technology developments in nations like Germany, the United Kingdom, Russia, Italy, and Sweden. The growing consumer market and developing digital economy greatly enhance the region’s economic growth. Exports, technical innovation, and strategic alliances contribute to the region's economy, as do Sweden and Italy with their robust industrial bases and innovation ecosystems.

In the UK, commercial smart water meters have gained traction as a potential remedy for the strains on the water infrastructure. Wetter winters and dryer summers due to climate change will put additional strain on UK waterways, which are already experiencing pollution and flooding. The local government stated that one in six residences in England, or about 5.2 million properties, are susceptible to floods. Therefore, smart water meters can be used to reduce water consumption and find leaks since they provide remote management of water usage.

Furthermore, in Germany, these commercial meters are becoming a top priority for governments and utilities to boost water conservation, reduce non-revenue water losses, and boost operational effectiveness. For instance, 45 million water meters were installed in Germany alone, and their combined production value in Europe is close to USD 1.09 billion.

North America Market Analysis

North America commercial smart water meter market is expected to hold a significant share during the forecast period. The market growth can be attributed to the existence of advanced water infrastructure and a rise in water conservation efforts by the government. For instance, with the America the Beautiful initiative, the government set a historic target to conserve 30% of the country's lands and waters by 2030.

The market is growing in the U.S. due to its extensive infrastructure, which encourages using smart water meters. The need for effective water management systems is also fueled by strict laws and a growing emphasis on water conservation. In addition, the essential role of the nation is reinforced by the existence of significant players and a favorable investment climate.

Key Commercial Smart Water Meter Market Players:

- Aclara Technologies LLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Avnet, Inc.

- SUEZ SA

- Apator S.A.

- Arad Group

- Badger Meter, Inc.

- Honeywell International Inc.

- Diehl Stiftung & Co. KG (Diehl Verwaltungs-Stiftung)

- Itron, Inc.

- Kamstrup

The leading companies in the commercial smart water meter market have a competitive advantage due to their vast experience and knowledge in smart technology and industrial automation. They also provide comprehensive solutions, such as enhanced metering capabilities, data analytics, and integration with existing infrastructure, specifically designed to meet the demands of commercial users.

Recent Developments

- In September 2024, Avnet, a leading international provider of technological solutions, had been contracted to provide South East Water's Digital Meters program with Huizhong's SCL61H-100 smart ultrasonic water meters. The implementation of Huizhong's smart water meters is aligned with the water utility's goal of drastically reducing water waste, which is important because non-revenue water—water lost to leaks and system bursts—represents both an environmental problem and a significant operational expense for water utilities.

- In April 2024, SUEZ, a pioneer in circular and digital solutions for water and waste services, and Vodafone, a world leader in communication technologies and services, a pioneer in circular and digital solutions for water and waste services, collaborated to quicken the worldwide roll-out of remote water meter reading using Narrowband IoT (NB-IoT1) communication networks. By 2030, more than 2 million NB-IoT meters are expected to be in use.

- Report ID: 6590

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Commercial Smart Water Meter Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.