Commercial Scale Non-Metal Electrical Conduit Market Outlook:

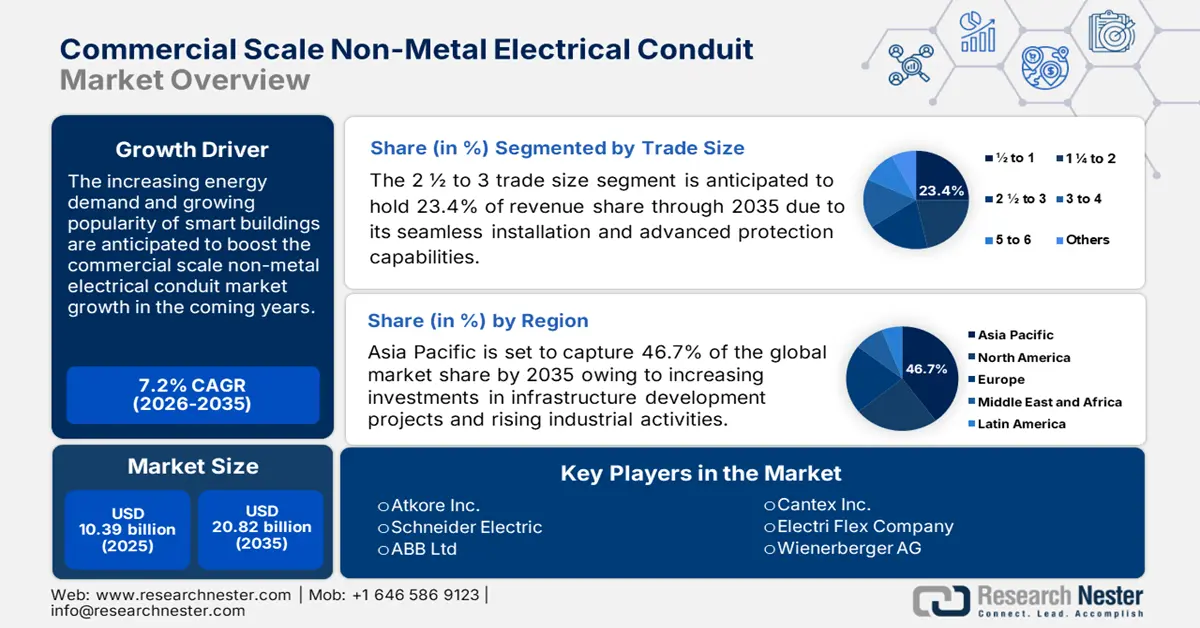

Commercial Scale Non-Metal Electrical Conduit Market size was valued at USD 10.39 billion in 2025 and is expected to reach USD 20.82 billion by 2035, expanding at around 7.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of commercial scale non-metal electrical conduit is evaluated at USD 11.06 billion.

The rising popularity of smart homes and buildings is likely to boost the demand for commercial scale non-metal electrical conduits in the next 12 years. The integration of advanced materials into buildings not only enhances their aesthetics but also complies with environmental regulations. For instance, as per the U.S. Department of Energy analysis, the integration of high-performance control solutions can mitigate HVAC energy use by 30% in commercial buildings.

The Western countries being early adopters of advanced technologies are contributing to the high demand for commercial scale non-metal electrical conduits. Rapid urbanization across the world and increasing demand for advanced home infrastructure are also pushing the overall market growth. According to a report by the Food and Agriculture Organization, around 70% of the global population is estimated to move to urban areas by 2050. Considering this urban trend the need for smart buildings and technologies such as commercial scale non-metal electrical conduits is anticipated to boom.

Key Commercial Scale Non-Metal Electrical Conduit Market Market Insights Summary:

Regional Highlights:

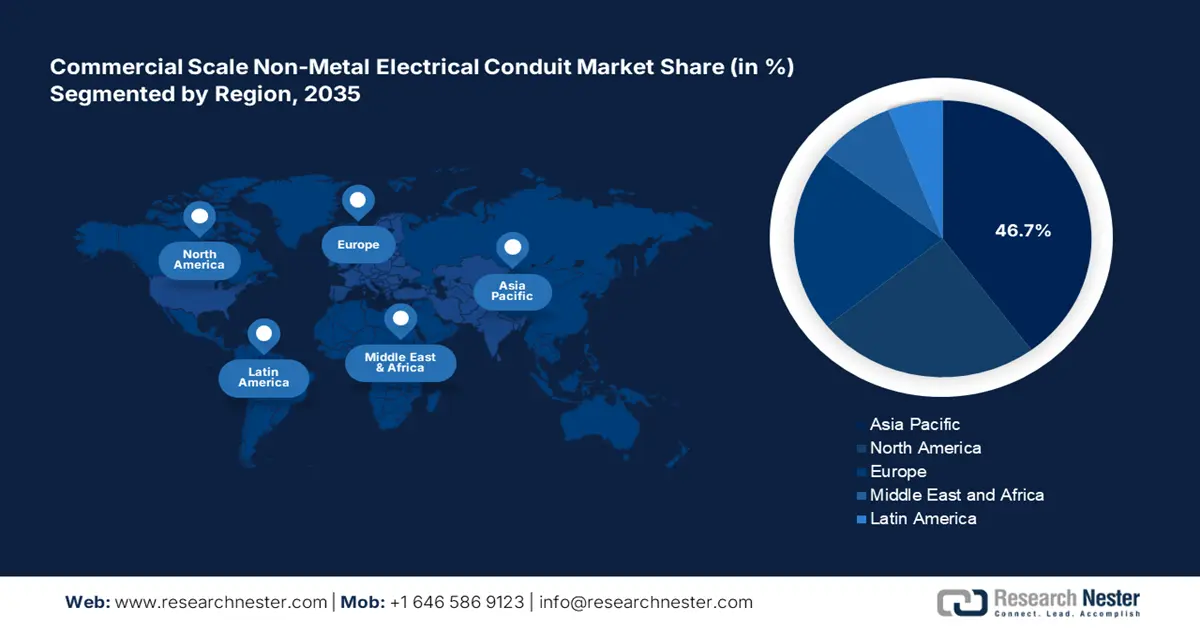

- Asia Pacific commercial scale non-metal electrical conduit market will account for 46.70% share by 2035, attributed to high industrial activities and robust infrastructure development projects.

Segment Insights:

- The polyvinyl chloride (pvc) segment in the commercial scale non-metal electrical conduit market is anticipated to achieve an 80.50% share by 2035, attributed to excellent insulation, cost-effectiveness, and manufacturing advancements.

- The 2½ to 3 trade size segment in the commercial scale non-metal electrical conduit market is expected to hold a 23.40% share by 2035, driven by rising commercial projects and supportive refurbishment policies increasing demand.

Key Growth Trends:

- Integration of advanced technologies and sustainable materials

- Infrastructure development initiatives

Major Challenges:

- High innovative product costs

- Easy accessibility of substitutes

Key Players: ABB Ltd, Atkore Inc., Cantex Inc., Astral Limited, Anamet Electrical, Inc., Legrand, and Schneider Electric.

Global Commercial Scale Non-Metal Electrical Conduit Market Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.39 billion

- 2026 Market Size: USD 11.06 billion

- Projected Market Size: USD 20.82 billion by 2035

- Growth Forecasts: 7.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (46.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Indonesia, Thailand, Brazil

Last updated on : 18 September, 2025

Commercial Scale Non-Metal Electrical Conduit Market Growth Drivers and Challenges:

Growth Drivers:

- Integration of advanced technologies and sustainable materials: The integration of advanced technologies and materials in commercial scale non-metal electrical conduit manufacturing is expected to boost their capabilities and features such as versatility, durability, and lightweight, offering more protection and strength to electrical wiring. The advanced design also offers flexibility for installation in irregular or premium spaces without compromising durability. Furthermore, the increasing demand for eco-friendly building materials is fueling the adoption of sustainable commercial scale non-metal electrical conduits. For instance, according to the U.S. Green Building Council compared to typical commercial buildings, LEED buildings account for 20% lower maintenance costs.

- Infrastructure development initiatives: The uplift in the infrastructure development projects is fueling the need for advanced electrical components including, commercial scale non-metal electrical conduits. The developed regions are witnessing several infrastructure upgrade projects and developing regions are set to witness new infrastructure construction initiatives. For instance, the World Bank reveals that the private sector invested around USD 86 billion in infrastructure development in high-potential economies in 2023.

Challenges

- High innovative product costs: The high installment cost of technologically advanced commercial scale non-metal electrical conduits can hamper the market growth to some extent. The small or budget constraint building projects often deter from adopting innovative electrical components including, non-metal electrical conduits due to their high prices.

- Easy accessibility of substitutes: The presence of alternatives such as tubing systems, raceways, and cable trays is a major challenge for commercial scale non-metal electrical conduit manufacturers. End users with limited budgets often opt for such cost-effective cable management systems, limiting the sales of innovative commercial scale non-metal electrical conduits.

Commercial Scale Non-Metal Electrical Conduit Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.2% |

|

Base Year Market Size (2025) |

USD 10.39 billion |

|

Forecast Year Market Size (2035) |

USD 20.82 billion |

|

Regional Scope |

|

Commercial Scale Non-Metal Electrical Conduit Market Segmentation:

Trade Size Segment Analysis

The 2 ½ to 3 segment is predicted to account for more than 23.4% commercial scale non-metal electrical conduit market share by the end of 2035. The rising commercial building projects coupled with supportive refurbishment policies for small-scale platforms are augmenting a high demand for these medium-sized non-metal electrical conduits. The 2 ½ to 3-sized non-metal electrical conduits offer seamless installation and advanced protection for electrical wiring, making them highly popular among commercial and industrial projects. Furthermore, with the growth in infrastructure modernization, the 2 ½ to 3-sized commercial scale non-metal electrical conduits are estimated to exhibit high demand.

Configuration Segment Analysis

By the end of 2035, polyvinyl chloride (PVC) segment is estimated to dominate around 80.5% commercial scale non-metal electrical conduit market share owing to its excellent electrical insulation characteristics. The cost-effectiveness compared to metal conduits is one of the prime reasons for boosting the sales of PVC electrical conduits. Many large-scale and small-scale projects make wide use of these affordable and durable polyvinyl chloride-based electrical conduits. The lightweight and high-strength features of PVC conduits offer easy installation and transport, leading to lower transport and labor costs. Furthermore, advancements in PVC conduit manufacturing techniques such as extrusion technology are driving high consistency and speed in the production cycle.

Our in-depth analysis of the market includes the following segments:

|

Trade Size

|

|

|

Configuration |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Commercial Scale Non-Metal Electrical Conduit Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific in commercial scale non-metal electrical conduit market is projected to dominate over 46.7% revenue share by 2035, owing to the high industrial activities and robust infrastructure development projects. The countries in the region are witnessing several construction initiatives such as healthcare infrastructure development, smart city projects, and the upgradation of aging infrastructure, which is generating lucrative opportunities for commercial-scale non-metal electrical conduit manufacturers.

India is witnessing several infrastructure development activities, which are pushing high demand for electrical components including, non-metal electrical conduits. For instance, in India’s union budget 2024-2025, USD 10.7 billion was allocated for the digitalization of healthcare infrastructure and to drive innovations in medical services. Such initiatives are directly pushing the demand for various electrical components including conduits.

China is the world’s biggest manufacturing hub and the rising industrial activities in the country are fuelling the sales of non-metal electrical conduits. According to the Trading Economics report, the industrial production in the country surged by 4.5% YoY in 2024. Considering these statistics, the manufacturers of commercial scale non-metal electrical conduits are expected to witness consistent profit earnings in the country.

North America Market Insights

North America is expected to witness a swift demand for commercial scale non-metal electrical conduits in the coming owing to the increasing need to upgrade the aging infrastructure and continuous technological advancements. The rapidly expanding transport, telecommunication, and energy sectors are also boosting the commercial scale non-metal electrical conduit market growth in North America.

In the U.S., strict environmental regulations, sustainable manufacturing practices, and rising demand for renewable energy sources are augmenting the demand for several electrical components including conduits. According to the American Clean Power Association, in the last 2 years, the U.S. has witnessed over USD 500 billion investment in clean energy projects and more than 160 new manufacturing facilities or facility expansions.

Commercial Scale Non-Metal Electrical Conduit Market Players:

- ABB Ltd

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Atkore Inc.

- Cantex Inc.

- Astral Limited

- Anamet Electrical, Inc.

- Legrand

- Schneider Electric

- Wienerberger AG

- Champion Fiberglass, Inc.

- Electri Flex Company

- HellermannTyton

- Hubbell

- Guangdong Ctube Industry Co., Ltd.

Key players in the market are employing several strategies such as new product launches, integration of advanced manufacturing technologies and materials, collaborations, partnerships, mergers & acquisitions, and regional expansions to earn high profits. Leading companies are collaborating with other players to introduce innovative commercial scale non-metal electrical conduits and increase their market presence. They are also entering into high-potential economies to tap emerging trends to boost their market reach.

Some of the key players include:

Recent Developments

- In May 2023, ABB Ltd announced an investment of USD 4 million to expand its distribution center in Pennsylvania. This investment is set to meet the increasing demand for electrical systems including conduits in the country.

- In November 2022, Atkore Inc. announced the acquisition of Elite Polymer Solutions a producer of HDPE conduit. According to Atkore Inc., the acquisition settled at USD 91.6 million.

- Report ID: 6603

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Commercial Scale Non-Metal Electrical Conduit Market Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.