Commercial Panel Mounted Disconnect Switch Market Outlook:

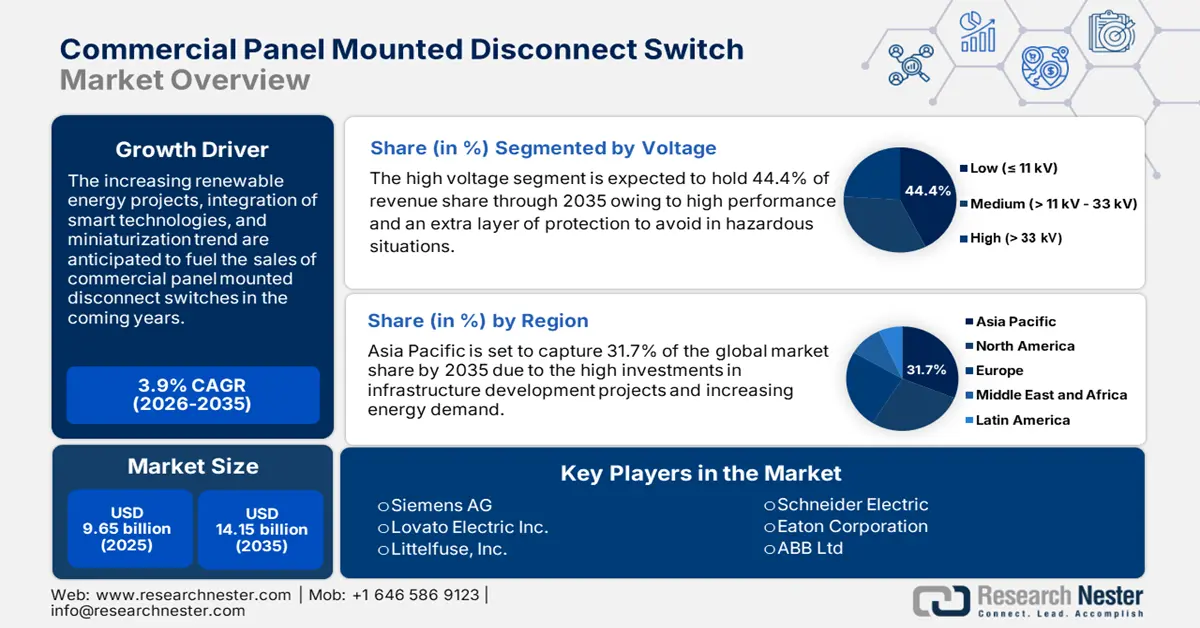

Commercial Panel Mounted Disconnect Switch Market size was valued at USD 9.65 billion in 2025 and is set to exceed USD 14.15 billion by 2035, expanding at over 3.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of commercial panel mounted disconnect switch is estimated at USD 9.99 billion.

The rapidly increasing industrialization activities and utilities are augmenting the sales of commercial panel mounted disconnect switches. Industries are investing heavily in advanced panel mounted switch technologies due to their high safety, reliability, and overall efficiency. In the utility sector, they aid in power stabilization and prevention of energy failure during high demand or load shedding respectively.

Industries such as automotive, food and beverages, electronics, and pharma are also adopting automated solutions including modern panel mounted disconnect switches, which is directly influencing the market growth. Furthermore, the boom in construction and infrastructure development projects worldwide is driving high demand for electrical components including disconnect switch technologies. For instance, the proposed Australia-Asia Power Link (AAPowerLink) project is set to drive high demand for panel mounted disconnect switches in the coming years. Such projects are generating lucrative opportunities for commercial panel mounted disconnect switch manufacturers to earn high profits.

Key Commercial Panel Mounted Disconnect Switch Market Insights Summary:

Regional Highlights:

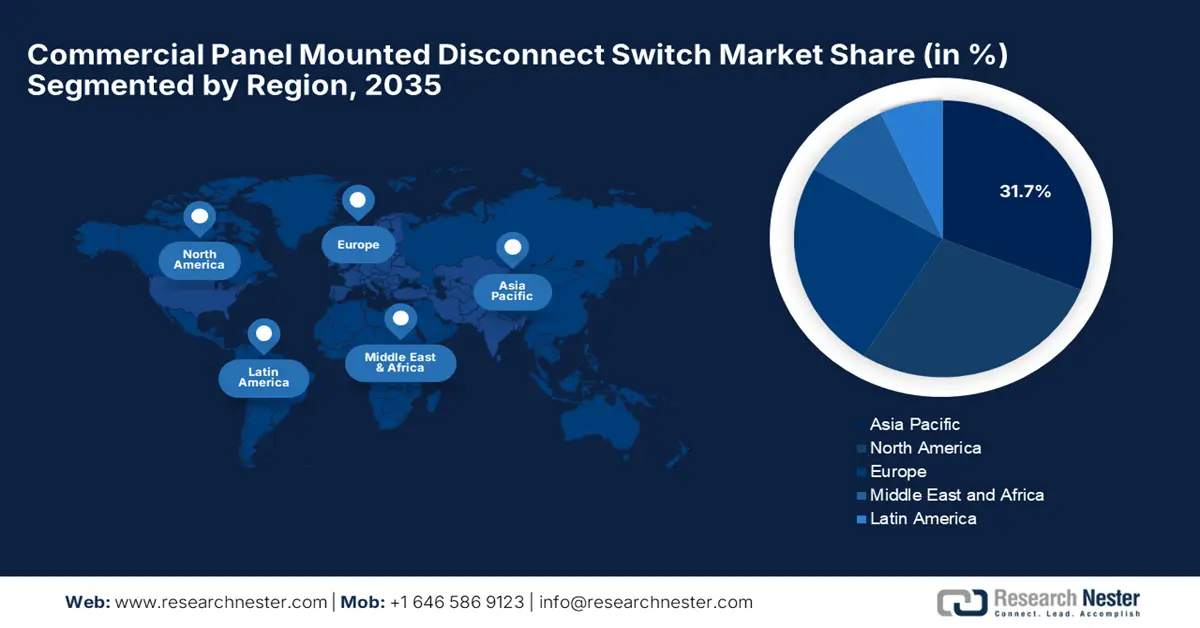

- Asia Pacific commercial panel mounted disconnect switch market will account for 31.70% share by 2035, attributed to rapid industrial activities and rising investments in renewable energy and infrastructure.

- North America market will exhibit the fastest growth during the forecast period 2026-2035, attributed to rapid digitalization and increasing R&D investments in electrical infrastructure.

Segment Insights:

- The non-fused segment in the commercial panel mounted disconnect switch market is expected to hold a 67.50% share by 2035, driven by ongoing technological advancements in non-fused switches.

- The high-voltage segment in the commercial panel mounted disconnect switch market is anticipated to experience robust growth till 2035, attributed to the adoption of renewable energy sources like solar and wind.

Key Growth Trends:

- Growing demand for smart load breaker/ disconnect switch technologies

- Compact safety switch technologies gaining traction

Major Challenges:

- Stringent regulations

- Market saturation

Key Players: ABB Ltd, Eaton Corporation, Emerson Electric Co., General Electric Company, Schneider Electric, and Siemens AG.

Global Commercial Panel Mounted Disconnect Switch Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.65 billion

- 2026 Market Size: USD 9.99 billion

- Projected Market Size: USD 14.15 billion by 2035

- Growth Forecasts: 3.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (31.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Brazil, South Korea, Singapore

Last updated on : 18 September, 2025

Commercial Panel Mounted Disconnect Switch Market Growth Drivers and Challenges:

Growth Drivers

- Growing demand for smart load breaker/ disconnect switch technologies: The increasing adoption of smart grid technologies by companies is pushing the demand for advanced panel mounted load break switches, which can be controlled and monitored remotely. For instance, the U.S. electric grid has more than 9, 200 electric generating units connecting over six lakh miles of transmission lines. The modern disconnect switches enabled with sensors and communication interfaces aid in tracking the status of electrical circuits in real-time, leading to quicker decision-making in the case of emergencies. Furthermore, the integration of the Internet of Things (IoT) also collectively allows for better predictive maintenance and safety.

- Compact safety switch technologies gaining traction: The miniaturization trend is anticipated to boost the revenues of commercial panel mounted disconnect switch producers in the coming years. In commercial settings, especially in urban areas where space is at premium, compact load breaker switches are exhibiting high demand. Compact disconnect or safety switches help in the efficient use of panel space, enabling more devices to be housed with a smaller footprint. The increasing adoption of advanced technologies in the telecommunications and renewable energy sectors is pushing the sales of compact disconnect switch solutions. For instance, in October 2023, Littelfuse, Inc. announced the launch of a compact Class J fuse disconnect switch.

Challenges:

- Stringent regulations: Strict safety and environmental regulations are expected to hamper the commercial panel mounted disconnect switch market growth to some extent during the forecasted period. Compliance with stringent regulations drives manufacturers to invest in advanced materials, technologies, and processes, which leads to high production costs, hampering small companies or new entrants from new opportunities due to low budgets.

- Market saturation: High competition among industry giants leads to price wars, which reduces profit margins and slows down investment in innovations. Established commercial panel mounted disconnect switch companies often saturate the market by introducing similar solutions, which hampers the differentiation marketing strategy. This also creates challenges for new and smaller companies to find a unique selling proposition to compete effectively.

Commercial Panel Mounted Disconnect Switch Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.9% |

|

Base Year Market Size (2025) |

USD 9.65 billion |

|

Forecast Year Market Size (2035) |

USD 14.15 billion |

|

Regional Scope |

|

Commercial Panel Mounted Disconnect Switch Market Segmentation:

Voltage

The high-voltage commercial panel mounted disconnect switch market is foreseen to capture 44.4% revenue share by 2035. The adoption of renewable energy sources such as solar and wind is leading to the increasing demand for robust electrical components including, disconnect switches to manage high-voltage connections. High voltage panel mounted disconnect switch systems are exhibiting high demand in solar lighting technologies as they aid in effectively preventing over-voltage situations that can hamper the system or lead to fire hazards. Advanced functionality, extra layer of protection, and high performance are fuelling the use of high voltage commercial panel mounted disconnect switches in the renewable energy sector.

Product

The non-fused commercial panel mounted disconnect switch market is estimated to hold 67.5% of revenue share by 2035. The non-fused commercial panel mounted disconnect switch systems offer a reliable means to isolate electrical circuits, leading to high safety during maintenance and servicing. Non-fused disconnect switches also comply with various electrical codes and standards, ensuring safe operations in commercial settings. The ongoing technological advancements are leading to the development of advanced, compact, and customizable non-fused commercial panel mounted disconnect switches.

Our in-depth analysis of the commercial panel mounted disconnect switch market includes the following segment

|

Voltage |

|

|

Product |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Commercial Panel Mounted Disconnect Switch Market Regional Analysis:

Asia Pacific Market Insights

The Asia Pacific commercial panel mounted disconnect switch market is anticipated to account for a revenue share of 31.7% through 2035 owing to rapid industrial activities and increasing adoption of renewable energy sources. The rising investments in infrastructure development and commercial construction projects are pushing the sales of advanced panel mounted disconnect switches. For instance, the Bhadla Solar Park located in India is the third biggest solar power plant project in the world as of 2024. Some of the high-growth marketplaces in Asia Pacific are China, India, Japan, and South Korea.

China’s consistent rise in industrial activities particularly in manufacturing and construction is driving high demand for efficient electrical systems including panel mounted disconnect switches. The country is witnessing high electricity demand in data center, transport, and residential sectors contributing to increasing sales of disconnect switches. For instance, according to the International Energy Agency, the electricity demand reached 6.4% in 2023.

In India, the rising urbanization and growing renewable energy projects are significantly influencing the sales of panel mounted disconnect switches. The India Brand Equity Foundation estimates that the country is the 3rd largest producer and consumer of power worldwide, with an installed capacity of 442.85 GW. According to the National Infrastructure Pipeline 2019-2025 estimations, energy projects account for 24% of the total capital expenditure. Furthermore, in the interim budget for 2024-2025, the solar power grid infrastructure development captured a fiscal allocation of USD 1.o2 billion.

North America Market Insights

The North America market is projected to expand at the fastest pace during the forecast period owing to rapid digitalization among several industries and the presence of key market players. The market players in North America are continuously investing in R&D to develop innovative commercial panel mounted disconnect switch technologies. The investments in upgrading electrical infrastructure in the region are also fuelling the sales of reliable electrical components including panel mounted disconnect systems.

In the U.S., the government’s investments in infrastructure and urban development projects are fuelling the demand for advanced electrical systems including disconnected switches. For instance, the Vogtle Electric Generating Plant located in Georgia has a power capacity of 4,536 megawatts and is one of the largest nuclear power plants and the source of low-carbon electricity in the country. Furthermore, strict safety and environmental regulations are also driving the adoption of advanced energy-efficient solutions such as safety or load breaker switches.

Commercial Panel Mounted Disconnect Switch Market Players:

- ABB Ltd

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Eaton Corporation

- Emerson Electric Co.

- EMSPEC

- B&J-USA Inc.

- c3controls

- Changan Group Co., Ltd.

- General Electric Company

- Salzer

- Schneider Electric

- Siemens AG

- SOCOMEC

- Lovato Electric Inc.

- Mersen EP

- Richards Manufacturing Co.

- Rockwell Automation

- Havells India Ltd.

- Honeywell International Inc.

- Littelfuse, Inc.

- WEG S.A

Key players in the commercial panel mounted disconnect switch market are employing several organic and inorganic strategies to earn high profits. The industry giants are investing in research and development activities to introduce smart panel mounted disconnect switches. They are also collaborating with other players and technology firms to enhance their product folio and expand market reach. Furthermore, leading companies are entering emerging markets to boost their customer base and sales.

Some of the key players include:

Recent Developments

- In August 2023, Lovato Electric Inc. revealed the expansion of its GL series of disconnect and changeover switches, covering applications up to 1000A. These solutions can be seamlessly integrated with other solutions owing to advanced actuation-switching technology.

- In January 2023, Schneider Electric announced the launch of its compact next-gen switch disconnectors. This innovation is aiding the company to attract a wider consumer base owing to its advanced design.

- Report ID: 6569

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Commercial Panel Mounted Disconnect Switch Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.