Commercial Gensets Market Outlook:

Commercial Gensets Market size was over USD 15 billion in 2025 and is projected to reach USD 29.51 billion by 2035, witnessing around 7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of commercial gensets is evaluated at USD 15.95 billion.

The report by the World Integrated Trade Solution (WITS) reveals that Mexico is the world’s largest exporter of generators and alternators. In 2023, around 13,165,500 generators and alternators were exported by Mexico to the world. The Observatory for Economic Complexity analysis estimates that the world trade for generators & alternators surpassed USD 5.5 billion in 2022 and held 1103rd rank in the product complexity index. In the same year, Mexico totaled USD 862 million in generator and alternator exports. These statistics highlight that the increasing trade of gensets also called generators is set to maximize the revenue growth of key players in the coming years.

The rapidly increasing urban and industrial activities across the world are propelling the high demand for commercial gensets. Mining, manufacturing, chemical production, and heavy equipment operations are power-intensive, and any electricity disturbance can affect the overall production cycle. Thus, to combat such situations, companies are widely investing in advanced and reliable gensets.

The growth in infrastructure projects in developing countries and infrastructural upgrades in developed economies are also fueling the use of commercial gensets. The robust urban infrastructures such as healthcare facilities, data centers, schools, and other public and private organizations are making strong use of commercial gensets to ensure power backup. For instance, the International Energy Agency (IEA) revealed that in 2022, the data centers and data transmission networks account for 1 t0 1.5% of the global electricity use.

Key Commercial Gensets Market Insights Summary:

Regional Highlights:

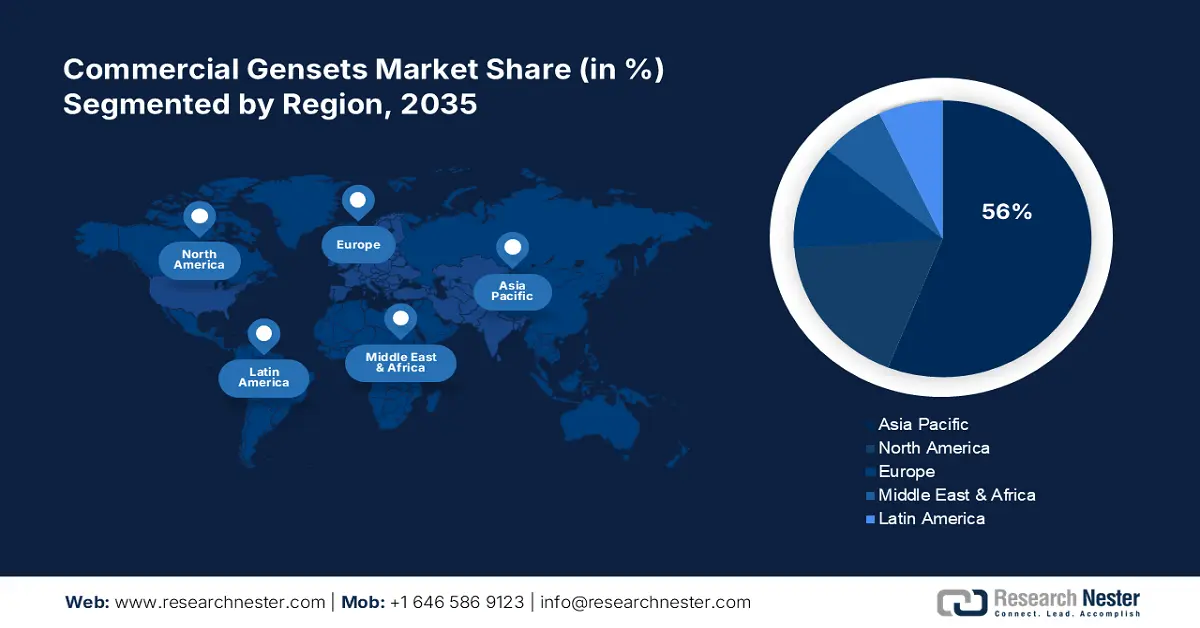

- Asia Pacific leads the Commercial Gensets Market with a 56% share, propelled by swift industrial and urban activities, growing smart tech adoption, and telecom/data center growth, ensuring robust growth through 2026–2035.

- North America’s commercial gensets market is expected to grow swiftly by 2035, attributed to strong data center presence, cleaner energy trends, and booming construction activities.

Segment Insights:

- The Diesel segment is projected to hold a 73.5% share by 2035, driven by the cost-effectiveness, durability, and high performance of diesel gensets.

- The ≤ 50 kVA segment of the Commercial Gensets Market is projected to hold an 18.80% share by 2035, driven by increasing adoption by SMEs seeking reliable and compact power solutions.

Key Growth Trends:

- Technological innovations

- High applications in aerospace and defense units

Major Challenges:

- High cost of advanced gensets

- Strict environmental regulations

- Key Players: Ashok Leyland Limited, Atlas Copco Group, Doosan Corporation, Caterpillar, Inc., Cummins, Inc., and FG Wilson.

Global Commercial Gensets Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 15 billion

- 2026 Market Size: USD 15.95 billion

- Projected Market Size: USD 29.51 billion by 2035

- Growth Forecasts: 7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (56% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 13 August, 2025

Commercial Gensets Market Growth Drivers and Challenges:

Growth Drivers

-

Technological innovations: Innovations in commercial gensets are set to significantly boost the revenue growth of the key market players in the coming years. Multifuel and hybrid generators are gaining traction owing to the clean energy trend. The integration of automation, artificial intelligence (AI), the Internet of Things (IoTs), and machine learning (ML) are enhancing the operational efficiency of commercial generator sets.

To meet the increasing demand for advanced gensets, manufacturers are also continuously investing in R&D to launch new models. For instance, in April 2024, Cummins, Inc. introduced 2 new advanced reliable generator models C2750D6E and C3000D6EB amplifying its commitment to innovation. These gensets with power output capacities of 2750kW and 3000kW, respectively are finding high applications in data centers, wastewater treatment plants, and healthcare facilities.

Following the innovation trend, and other marketing tactics Cummins, Inc. earned a revenue of USD 8.5 billion in the third quarter of FY24. Earnings before interest, taxes, depreciation, and amortization (EBITDA) were calculated at 16.4% of sales or USD 1.4 billion. The quarterly common stock cash dividend increased from USD 1.68 to USD 1.82 per share. The start of full production of the X15N natural gas engine at its Jamestown Engine Plant and its recognition as one of the 100 Best Companies by Seramount are some of the key highlights from the third quarter of FY24. - High applications in aerospace and defense units: The aerospace and defense facilities are majorly augmenting the sales of advanced commercial gensets as they require a reliable power source for mission-critical operations. Advanced gensets provide backup power for airbases, command centers, communication systems, and military vehicles ensuring uniform accessibility to power during field operations. Furthermore, to meet the rising demands from these sectors, manufacturers are introducing next-gen genset technologies.

In August 2024, LaunchPoint Electric Propulsion Solutions, Inc. announced the launch of a cutting-edge 250 kW starter/generator unit. With leading Size Weight and Power (SWaP) advantages, this genset meets the thorough demands of aerospace and defense units. The launch of this latest technology is aiding the company to boost its position in the power generation and electric propulsion segment.

Challenges

-

High cost of advanced gensets: The manufacturing of the genset is a complex process and requires high investments to meet the set standards. This complexity increases the overall product cost limiting its adoption to some extent. Small-scale companies and those running on tight budgets often hesitate to invest in these advanced technologies, hampering the overall commercial gensets market growth.

-

Strict environmental regulations: Strict emission standards, environmental regulations, and high fuel prices are hindering the use of commercial sets. The movement towards renewable energy adoption is challenging the sales of conventional gensets. Tax benefits and various supportive schemes are making cleaner energy adoption easier and cost-effective, leading to slow growth of the commercial gensets market.

Commercial Gensets Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7% |

|

Base Year Market Size (2025) |

USD 15 billion |

|

Forecast Year Market Size (2035) |

USD 29.51 billion |

|

Regional Scope |

|

Commercial Gensets Market Segmentation:

Fuel (Diesel, Gas, Hybrid)

By the end of 2035, diesel segment is likely to hold over 73.5% commercial gensets market share. The cost-effectiveness of diesel compared to other fuels is the main factor contributing to the segmental growth. The durability and high performance offered by the diesel commercial gensets are also driving their sales growth. Construction, telecom, and manufacturing are the major application areas of diesel commercial gensets as they require continuous power. Considering the increasing demands, manufacturers are employing new product launch strategies.

For instance, in August 2022, Caterpillar, Inc. announced the launch of 3 new standby diesel generator sets in North America. From 20 to 20 Kw capacity, these gensets are finding high applications in telecommunications and small industrial & commercial units. Such an additional option range is driving the high attention of end users, further contributing to Caterpillar’s revenue growth.

Power Rating (≤ 50 kVA, > 50 kVA - 125 kVA, > 125 kVA - 200 kVA, > 200 kVA - 330 kVA, > 330 kVA - 750 kVA, > 750 kVA)

In commercial gensets market, ≤ 50 kVA segment is poised to capture over 18.8% revenue share by 2035. Small and medium-sized enterprises are prime end users of ≤ 50 kVA gensets. These companies widely seek reliable, compact, cost-effective, and reliable power sources for their operations. Running on tight budgets, these enterprises invest in ≤ 50 kVA commercial gensets to meet their specific requirements.

The rise in the number of small-scale businesses and the increasing emergence of start-ups are augmenting the sales of ≤ 50 kVA generator sets. Furthermore, commercial properties such as small buildings, offices, shops, restaurants, and medical clinics highly invest in ≤ 50 kVA gensets to stay connected in power outage situations. Thus, easy-to-install, maintain and operate ≤ 50 kVA gensets are gaining high tractions around the globe.

Our in-depth analysis of the global commercial gensets market includes the following segments:

|

Fuel |

|

|

Power Rating |

|

|

End use |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Commercial Gensets Market Regional Analysis:

Asia Pacific Market Forecast

Asia Pacific in commercial gensets market is set to account for more than 56% revenue share by the end of 2035. The swift industrial and urban activities, growing adoption of smart technologies, and high expansion of telecommunications and data centers are fueling the sales of commercial gensets. India, China, Japan, and South Korea are some of the top marketplaces for commercial genset manufacturers.

In India, the high investments in infrastructure development projects and the rise in the manufacturing and telecommunications sector are increasing the demand for commercial gensets. For instance, the India Brand Equity Foundation (IBEF) reveals that in the union budget 2024-25, the government invested around USD13.98 billion in the telecommunications and IT sectors. Furthermore, the World Integrated Trade Solution (WITS) report estimated that around 1,148,380 generators & alternators were exported from India, in 2023.

China’s strong manufacturing companies and defense facilities are major users of commercial generator sets. Technological advancements and favorable regulatory policies are driving the production of commercial gensets in the country. The report by the Observatory of Economic Complexity elaborated that the export of Chinese generators and alternators totaled USD 631 million in 2022.

North America Market Statistics

The North America commercial gensets market is expected to increase at a swift pace during the anticipated period. The strong presence of data centers, cleaner energy trends, and booming construction activities are driving the sales of both conventional as well as hybrid commercial gensets. The existence of industry giants is also positively augmenting the market growth in the region.

In the U.S., the rising adoption of cloud-computing technologies by end use industries and the growth in e-commerce activities is fueling the adoption of commercial gensets. The swift expansion of residential and commercial structures is also augmenting the demand for compact and reliable generator sets. The World Integrated Trade Solution (WITS) analysis revealed that around 10,376,000 generators and alternators were exported from the U.S., in 2023.

In Canada, the mining sector is highly dominating the sales of commercial gensets, as the mining operations are dependent on high power capacities. Canada is the fourth largest producer of oil worldwide and over 5.1 million barrels of oil per day were produced in 2023. Thus, from these statistics, it can be understood that to carry out such big oil production activities uniform accessibility to power is necessary, and to avoid any disturbance the adoption of advanced commercial gensets is gaining a boom.

Key Commercial Gensets Market Players:

- Cummins, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Aggreko

- Ashok Leyland Limited

- Atlas Copco Group

- Doosan Corporation

- Caterpillar, Inc.

- FG Wilson

- Generac Holdings Inc.

- J C Bamford Excavators Ltd.

- Kirloskar Group

- Kohler Co.

- Mahindra Powerol

- Powerica Limited

- Rolls-Royce Holdings

- Supernova Gensets

- Wartsila

- LaunchPoint Electric Propulsion Solutions, Inc.

Key players in the commercial gensets market are employing several organic and inorganic marketing tactics such as new product launches, technological innovations, strategic collaborations & partnerships, mergers & acquisitions, and regional expansion to maximize their revenue growth. The introduction of new commercial gensets aids the company in attracting a wider consumer base. By forming partnerships with other players and collaborations with high-tech companies, the industry giants are developing advanced commercial gensets and boosting their market reach. Regional expansion tactics are also helping them to enter into untapped markets and grab high-earning opportunities.

Some of the key players include:

Recent Developments

- In November 2024, Cummins Inc. expanded its portfolio of Onan marine generator sets with the launch of the Marine Diesel Cummins (MDC) Turbo and Onan QSB7E ranges. These gensets were introduced at the Marine Equipment Trade Show (METS), a premium European showcase for professionals in the leisure marine industry.

- In February 2023, Caterpillar Inc. introduced the Cat XQ330 mobile diesel generator set that meets U.S. EPA Tier 4 Final emission standards. Powered by the efficient Cat C9.3B diesel engine, this new power solution is effective for standby and prime power applications

- Report ID: 6817

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Commercial Gensets Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.