Commercial Boiler Market Outlook:

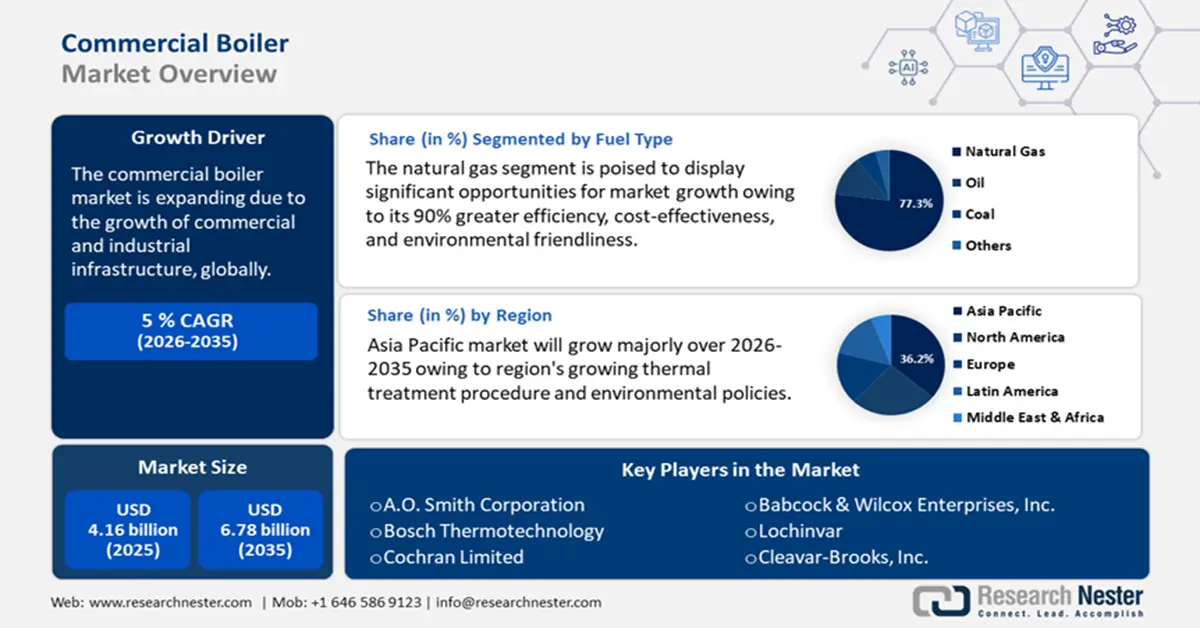

Commercial Boiler Market size was valued at USD 4.16 billion in 2025 and is expected to reach USD 6.78 billion by 2035, registering around 5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of commercial boiler is evaluated at USD 4.35 billion.

The global commercial boiler market is poised for substantial growth owing to the expansion of commercial and industrial infrastructure, which has significantly increased the demand for robust heating solutions, including advanced commercial boilers. As new construction projects are initiated and existing facilities undergo expansion or upgrades, there is an urgent requirement for efficient and reliable heating systems capable of supporting larger and more intricate environments.

This trend is particularly pronounced in sectors such as healthcare, education, and manufacturing, where dependable heating is essential. The ongoing development and growth in these sectors foster a consistent market for advanced commercial boilers specifically designed to meet the high demands of contemporary commercial and industrial applications.

Additionally, global infrastructure spending, driven by industrial expansion and government-backed sustainability initiatives, is significantly impacting the commercial boiler market. By 2025, global infrastructure spending is expected to have increased from USD 4 trillion annually in 2012 to over USD 9 trillion. Global spending is anticipated to reach over USD 78 trillion between 2014 and 2025. According to the World Economic Forum, for a dollar invested in capital, an economic return of 5% to 25% is produced by projects (in utilities, energy, transportation, waste management, flood defense, and telecommunications).

Furthermore, major manufacturers are investing heavily in R&D, production expansion, and acquisitions to enhance their market presence and offer cutting-edge solutions. Also, the growing push for sustainable product launches is aligning with global carbon reduction targets and government regulations, accelerating the shift toward low-emission and eco-friendly heating solutions. Bosch Thermotechnology reported sales of USD 4.68 billion in 2022, setting a new record. In the fiscal year 2022, sales revenues increased by nearly 13%, and the division experienced substantial double-digit growth across numerous markets. Furthermore, Bosch invested USD 728.21 million in electrification to expedite the adoption of heat pumps.

In November 2023, Vicinity Energy, a decarbonization leader with the nation's largest portfolio of district energy systems, announced the arrival of a 42MW industrial-scale electric boiler placed at its Kendall Square site in Cambridge, Massachusetts. Similarly, in July 2024, Viessmann Climate Solutions UK released a new range of high-efficiency, low-emission, commercial gas condensing boilers with the introduction of the new Vitocrossal 200 CI3. The new Vitocrossal 200 CI3 offers superior condensing technology on a 55% lower footprint for residential buildings, business enterprises, and local bodies.

Key Commercial Boiler Market Insights Summary:

Regional Highlights:

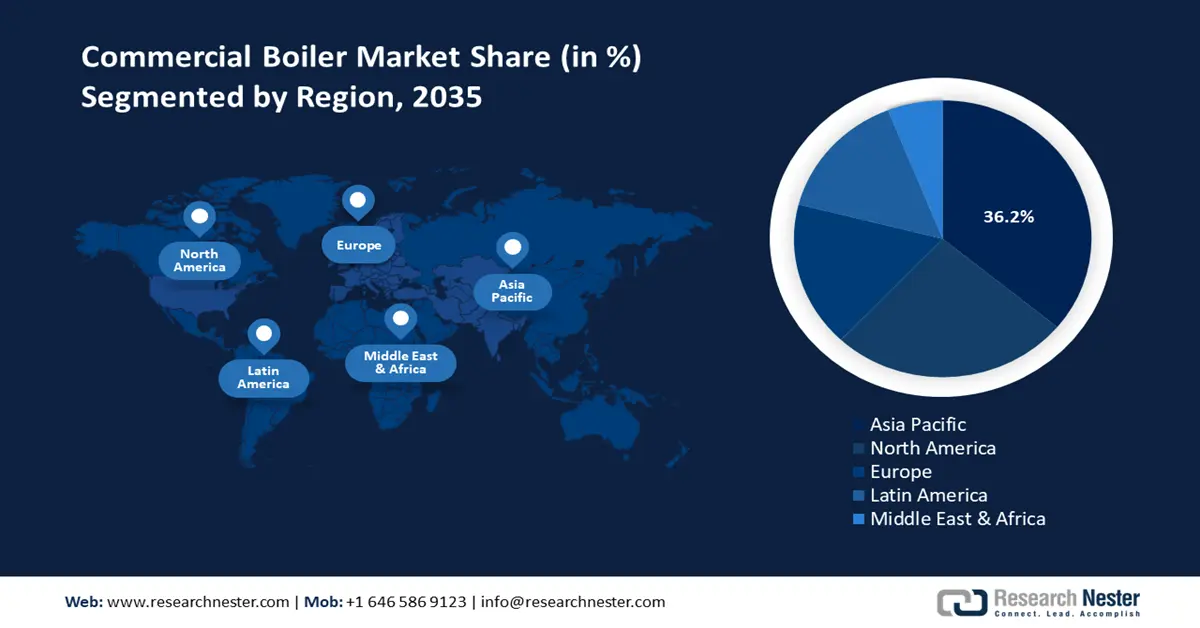

- Asia Pacific dominates the Commercial Boiler Market with a 36.2% share, fueled by growing thermal treatment procedures and environmental policies in the region, ensuring sustained growth through 2026–2035.

Segment Insights:

- The Natural Gas segment is expected to capture 77.3% market share by 2035, propelled by its efficiency, cost-effectiveness, and environmental friendliness.

Key Growth Trends:

- Widespread deployment of sustainable boilers

- Technological advancements in boiler technology

Major Challenges:

- High initial costs

- Intricate implementation and maintenance procedures

- Key Players: A.O. Smith Corporation, Bosch Thermotechnology, Cochran Limited, Babcock & Wilcox Enterprises, Inc., Lochinvar, Cleaver-Brooks, Inc., Fulton Boiler Works, Inc., Slant/Fin Corporation, Weil-McLain Solvay S.A, Vaillant Group.

Global Commercial Boiler Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.16 billion

- 2026 Market Size: USD 4.35 billion

- Projected Market Size: USD 6.78 billion by 2035

- Growth Forecasts: 5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, India, United States, Germany

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 13 August, 2025

Commercial Boiler Market Growth Drivers and Challenges:

Growth Drivers

- Widespread deployment of sustainable boilers: The trend toward green building certifications and sustainability programs is stirring the demand for commercial boilers. Many commercial facilities are implementing energy-efficient technologies to meet certification standards such as LEED (Leadership in Energy and Environmental Design) and BREEAM. Modern commercial boilers, with their higher energy efficiency and fewer emissions, are essential for these sustainable building solutions. Additionally, electric boilers in particular are gaining traction as a result of their reduced carbon impact and the growing availability of renewable energy sources.

The need for electric boilers in commercial buildings is anticipated to increase dramatically as governments worldwide encourage the use of renewable energy to satisfy climate targets. Similarly, business buildings seeking to lessen their dependency on fossil fuels are increasingly considering biomass boilers, which run on organic materials such as wood pellets and agricultural waste. Furthermore, favorable government rules and incentives that promote the use of energy-efficient heating systems are also helping the commercial boiler market worldwide.

Governments in many regions provide tax breaks, rebates, and subsidies to companies that purchase high-efficiency boilers, which propels the market's expansion. According to International Energy Agency (IEA) research, global sales of heat pumps increased by 11% in 2022, continuing the double-digit growth trend for the key technology in the worldwide shift to safe and sustainable heating. The financial incentives offered in more than 30 nations worldwide have increased sales of heat pumps. Together, these nations account for almost 70% of the world's building heating demand. In 2022, a number of these assistance programs were strengthened or introduced. The groundwork for the long-term deployment of heat pumps has been laid by the increase in subsidy levels in the US, Poland, Ireland, and Austria since the beginning of 2022.

- Technological advancements in boiler technology: A significant commercial boiler market trend that illustrates the broader shift toward intelligent infrastructure solutions is the incorporation of commercial boilers with the Internet of Things (IoT) and smart building systems. The integration of commercial boilers into the framework of smart building technologies is increasingly prevalent, facilitating the optimization of building operations through the deployment of advanced analytics and interconnected equipment.

Advanced automation features and control systems are becoming increasingly common in modern commercial boilers, greatly improving user convenience and operational efficiency. These advanced technologies optimize performance and energy consumption by enabling automated adjustments, remote monitoring, and exact temperature control. These boilers can adapt to changing demands in real-time by combining cutting-edge sensors and control technology, guaranteeing constant comfort and cutting down on energy waste. Modern commercial boilers are more appealing to businesses due to their ease of use and enhanced operational efficiency, which encourages their adoption and increases their commercial boiler market appeal.

The market for commercial boilers is expanding substantially as a result of market participants introducing new products to strengthen their positions. In June 2021, Lochinvar, a leading manufacturer of high-efficiency water heaters, introduced the CREST condensing boiler with Hellcat Combustion Technology and Real-Time O2 Trim. These boilers are suitable for large-scale commercial applications. The Hellcat Combustion Technology reduces monitoring and maintenance requirements while extending the boiler's life.

Challenges

-

High initial costs: The high initial cost of buying and installing sophisticated industrial boilers can be a major deterrent for some firms. Potential clients may be turned off by the high initial costs of commercial boilers, including equipment and installation costs. This is especially true for small and medium-sized businesses with limited budgets. Even while contemporary commercial boilers provide long-term advantages including lower operating costs and energy efficiency, adoption rates and commercial boiler market expansion may be hampered by the initial cost.

Significant initial cost reductions can be attained by upgrading oil-fired steam boilers using strategies such as improving combustion, boosting thermal efficiency, installing energy-saving equipment (such as heat recovery systems), and installing sophisticated control systems in effect. - Intricate implementation and maintenance procedures: Some consumers may be deterred by the complexity and specialized skills required for the installation and maintenance of commercial boilers. The intricacies involved in setting up these systems demand professional experience, particularly concerning precise calibration, integration with existing infrastructure, and compliance with safety regulations. Moreover, the operational complexity is heightened by the necessity of ongoing maintenance to ensure optimal performance and regulatory adherence. Organizations contemplating the acquisition of new commercial boilers may face challenges due to the need for qualified professionals and the potential for operational disruptions during the installation and maintenance processes, which could in turn affect commercial boiler market dynamics.

Commercial Boiler Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5% |

|

Base Year Market Size (2025) |

USD 4.16 billion |

|

Forecast Year Market Size (2035) |

USD 6.78 billion |

|

Regional Scope |

|

Commercial Boiler Market Segmentation:

Fuel Type (Natural Gas, Coal, Oil, Others)

Natural gas segment is predicted to account for commercial boiler market share of around 77.3% by 2035. In the commercial sector, natural gas is a highly economical and efficient heating fuel that is utilized for both steam and water facilities. The government's emphasis on natural gas as an environmental priority has increased its demand for commercial boilers. The main factors driving natural gas in the commercial boiler sector are its 90% greater efficiency, cost-effectiveness, and environmental friendliness. Additionally, the main drivers of the global market's growth are the rapid boiling system features and the fact that natural gas fuel is less disruptive than other fuels. In March 2024, the Gas Exporting Countries Forum (GECF) reported that by the latter half of the 2020s, natural gas will have surpassed coal as the second-largest energy source, growing at an average annual rate of 1% for the projected period.

Also, according to the World Bank Organization estimates the global natural gas supply, which grew by an estimated 1.6% in 2024, is predicted to grow by more than 2.3% in 2025 and 2026. A variety of regions, including Asia Pacific, Eurasia, the Middle East, and North America, are expected to contribute to the increase in 2025. Consequently, these statistics show that the market will develop as a result of rising supply and consumption of natural gas.

Technology (Condensing, Non-condensing)

The condensing segment in commercial boiler market is expected to hold a notable share during the estimated period. The segment is primarily expanding owing to the use of condensing boilers in the business sector. Condensing hot water boilers are made to reach a high degree of efficiency that conventional boilers cannot because of the constant low temperature of hot water loops in small business applications. The increasing need for space and water heating systems is a factor in the segment's growth. Global product penetration is increased by enacting advantageous government policies, such as tax incentives and refunds.

Our in-depth analysis of the global market includes the following segments:

|

Fuel Type |

|

|

Technology |

|

|

Product |

|

|

Capacity |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Commercial Boiler Market Regional Analysis:

APAC Market Statistics

Asia Pacific commercial boiler market is projected to hold revenue share of over 36.2% by the end of 2035. The market growth can be ascribed to the region's growing thermal treatment procedure and environmental policies. Furthermore, the expansion of commercial buildings, including offices and healthcare facilities due to the region's expanding foreign direct investment is significantly escalating the market growth. Energy supplies are strained by the expanding population, and commercial boilers are a more effective and sustainable way to produce heat and steam than conventional techniques. The development of commercial boilers is also receiving assistance from the governments of Asia Pacific nations. For instance, the government of China has established goals to increase the use of renewable energy, and commercial boilers are considered to be an important component of this endeavor.

The commercial boiler market is growing in China as a result of rapid urbanization, increasing industrialization, and rising demand for energy-efficient heating solutions. Government regulations promoting energy conservation and carbon reduction have pushed businesses to adopt advanced, eco-friendly boiler technologies. Furthermore, the nation is a leading producer and exporter of electric boilers, supplying a significant portion of the global market. Volza's Global Import statistics show that from March 2023 to February 2024, the world imported 5,466 cargoes of electric boilers from China. 1,272 Chinese exporters provided these imports to 1,268 global consumers, representing an 80% increase over the previous 12 months.

During this time, the world bought 129 shipments of electric boilers from China in February 2024 alone. This represents a sequential increase of 76% from January 2024 and a year-over-year growth of 60% from February 2023. Moreover, the shift towards cleaner energy sources, including natural gas and electric boilers, further boosts market growth as China works towards its carbon neutrality goals.

In India, industries such as food processing, pharmaceuticals, textiles, and chemicals require reliable steam and hot water systems, driving the adoption of commercial boilers. Additionally, government initiatives promoting energy efficiency and a shift towards eco-friendly fuel sources, such as natural gas and biofuels, are further boosting the market. The rise of smart cities, expanding hospitality and healthcare sectors, and advancements in boiler technology, including automation and improved efficiency are also contributing to the market growth. According to the India Brand Equity Foundation, by 2024, the Indian hospitality sector is expected to be worth around USD 24.61 billion, and by 2029, it is expected to grow to USD 31.01 billion. With forecasts showing a 7-9% revenue gain in 2025, the Indian hotel business is poised for exponential expansion.

North America Market Analysis

North America is projected to grow significantly for the commercial boiler market during the assessed period. The region's market will expand mainly as a result of shifting consumer preferences for modernizing or replacing outdated heating systems and advancements in boiler performance. The need to replace the region's current heating system with an energy-efficient one has been sparked by the high cost of operation and maintenance, growing fuel prices, and strict regulatory requirements.

Furthermore, in the U.S., the increasing demand for energy-efficient heating solutions across various industries, including healthcare, hospitality, education, and manufacturing. Stricter environmental regulations are pushing businesses to upgrade to high-efficiency, low-emission boilers, driving the market expansion. The Energy and Environmental Analysis Inc. reported that boilers serve 581,000, or 12%, of the 4.7 million commercial buildings in the U.S. Over half of all commercial boiler units and capacity are found in office buildings, medical facilities, and educational institutions. Although they make up 30% of boiler units, the boilers at educational institutions are tiny (3.6 MMBtu/hr on average) and only represent 11% of commercial boiler capacity. Healthcare facilities have boilers that are larger than average (20.9 versus 9.6 MMBtu/hr) and makeup 28% of commercial capacity, although being less in number than other groups. Warehouses, shops, public gathering places, hotels, and other facilities are among the additional building types that use boilers.

Furthermore, businesses in the nation are increasingly motivated to replace outdated, inefficient boilers with modern, energy-saving models to achieve substantial costs. Below is a table provided by the U.S. Department of Energy (DOE) comparing different types of commercial boiler purchases and calculating lifetime cost savings of energy-efficient models. According to Federal Energy Management Program calculations, a commercial gas-fired hot water boiler with a capacity of 3,000,000 Btu/h can achieve the necessary 96.0% combustion efficiency level. If Ec is priced no more than USD 59,703 higher than the base model, it saves money.

|

Performance |

Best Available |

Required Model |

Base Model |

|

Combustion Efficiency |

98.0% |

96.0% |

82.0% |

|

Annual Energy Use (therms/yr) |

35,143 |

35,875 |

42,000 |

|

Annual Energy Cost (USD/yr) |

USD 29,808 |

USD 30,429 |

USD 35,625 |

|

Lifetime Energy Cost (25 years) |

USD 342,552 |

USD 349,689 |

USD 409,392 |

|

Lifetime Energy Cost Savings |

USD 66,839 |

USD 59,703 |

------------- |

Source: DOE

This table highlights the positive environmental impact of efficient boilers, aligning sustainability goals and regulatory compliance. This transparency and financial insight accelerate the adoption of advanced commercial boilers, propelling market expansion.

Key Commercial Boiler Market Players:

- A.O. Smith Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bosch Thermotechnology

- Cochran Limited

- Babcock & Wilcox Enterprises, Inc.

- Lochinvar

- Cleaver-Brooks, Inc.

- Fulton Boiler Works, Inc.

- Slant/Fin Corporation

- Weil-McLain Solvay S.A.

- Vaillant Group

To meet end-user demand and increase their market share, the major companies in the commercial boiler market are focusing on technological improvements in boiler technologies. Additionally, some of the main tactics used by the competitors to become more competitive in the market include expanding R&D expenditures, strategic alliances, and partnerships.

Recent Developments

- In January 2025, Babcock & Wilcox announced that its B&W Thermal business segment has been awarded a contract worth about USD 13 million to retrofit boiler cleaning equipment at a power plant in Southeast Asia.

- In May 2024, Lochinvar, a leader in high-efficiency boilers and water heaters, introduced the LECTRUS Light Commercial Electric Boiler. This new solution gives clients flexibility while assisting the industry's shift to electrification and decarbonization.

- Report ID: 7168

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Commercial Boiler Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.