Commercial Aircraft Aftermarket Parts Market - Growth Drivers and Challenges

Growth Drivers

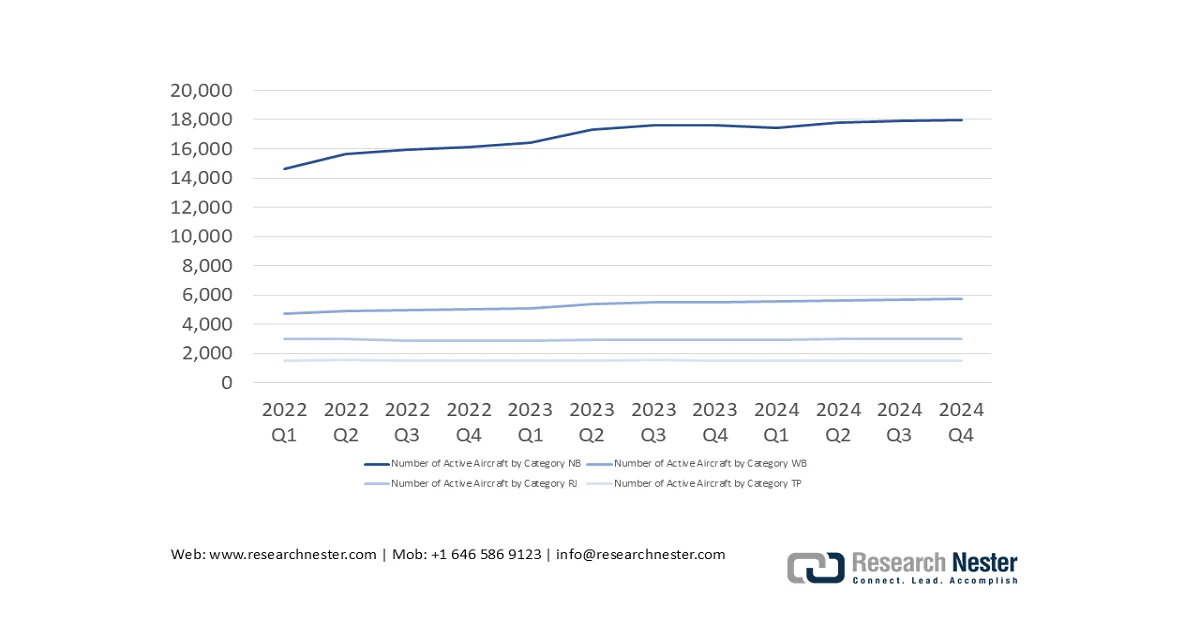

- Growth in active commercial aircraft fleet and utilization: The expansion and intensified use of the aircraft fleet are primary drivers for the commercial aircraft aftermarket parts market. According to the IATA 2024 data, the share of the global active aircraft remains steady at 85% in 2024, with the utilization rebounding strongly due to restored international routes and higher aircraft daily flight hours. Higher utilization directly stimulates the wear on engines, landing gear, avionics, and consumables, shortening the replacement cycles. Further, the report also indicates that the global revenue passenger kilometers is increasing by 8.0% annually, driving higher flight cycles per aircraft. For aftermarket suppliers, this translates into predictable demand growth tied to flight hour-based maintenance schedules rather than new aircraft deliveries.

Number of Active Aircraft by Category

Source: IATA 2024

- Aging fleet dynamics and expansion: The demand for the market is propelled by the growing installed base and increasing average age of aircraft. According to the IATA 2024 report, the global fleet in 2024 counted 33,271, which is set to increase by 1.9% every year, creating a large addressable market. besides a significant portion of the global fleet is aging, necessitating more intensive maintenance and heavier parts consumption for aging aircraft programs. This trend pushes the MRO providers and parts suppliers to stock legacy components while also integrating data analytics to predict the failure rates for older systems. Further, the surging need for structural repair and corrosion-related part replacements becomes a predictable demand stream for specific part categories.

- Growth in narrowbody fleets for short-haul and regional travel: The government reported traffic data shows a strong recovery in short-haul and domestic travel, driving the narrowbody aircraft utilization. Further, the ARSA 2022 to 2032 report depicts that the global commercial aircraft fleet is expected to be more than 28,000 aircraft, which is mainly driven by the narrowbody aircraft used on short and medium haul routes. Besides, the narrowbody aircraft have higher cycle counts, leading to faster replacement of brakes, wheels, avionics, and consumables. Additionally, the aviation authorities note that the higher takeoff and landing frequencies on short-haul routes stimulate fatigue wear, increasing the intervals and mandatory component replacement under the continuing airworthiness programs. Overall, the market demand is expected to grow faster for narrowbody platforms than for widebody aircraft over the medium term.

Narrowbody Fleet Summary

|

Region |

Fleet |

|

Africa |

430 |

|

Middle East |

505 |

|

APAC |

1,690 |

|

North America |

4,062 |

|

Europe |

3,931 |

Source: ARSA 2022 to 2032 report

Challenges

- OEM dominance and design rights: The original equipment manufacturers control the design data and intellectual property, often locking airlines into their parts ecosystems via restrictive contracts and power-by-the-hour agreements. This limits the addressable commercial aircraft aftermarket parts market for independents. A key battleground is the U.S. parts manufacturer approval process, which allows for alternative parts. Moreover, the active PMA demonstrates the ongoing efforts to boost competition. The modification and replacement parts association actively advocates for these rights, providing a collective voice for independent manufacturers against OEM dominance.

- High capital intensity and inventory costs: The parts market demands massive capital for inventory of slow moving high value parts to meet airline AOG service level agreements. This ties up finances and creates a significant risk. Top companies reduce this via advanced supply chain analytics and a vast global network, allowing them to optimize stock. Further, the top distributors hold inventory valued in the hundreds of millions of dollars, a barrier that prevents smaller players from competing on availability for a broad range of parts.

Commercial Aircraft Aftermarket Parts Market Size and Forecast:

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.9% |

|

Base Year Market Size (2025) |

USD 30.1 billion |

|

Forecast Year Market Size (2035) |

USD 58.6 billion |

|

Regional Scope |

|

Browse key industry insights with market data tables & charts from the report:

Frequently Asked Questions (FAQ)

In the year 2025, the industry size of the commercial aircraft aftermarket parts market was over USD 30.1 billion.

The market size for the commercial aircraft aftermarket parts market is projected to reach USD 58.6 billion by the end of 2035, expanding at a CAGR of 6.9% during the forecast period i.e., between 2026-2035.

The major players in the market are Boeing, Airbus, GE Aerospace, and others.

In terms of the end user segment, the commercial aviation sub-segment is anticipated to garner the largest market share of 75.6% by 2035 and display lucrative growth opportunities during 2026-2035.

The market in North America is projected to hold the largest market share of 34.5% by the end of 2035 and provide more business opportunities in the future.