Combi Boiler Market Outlook:

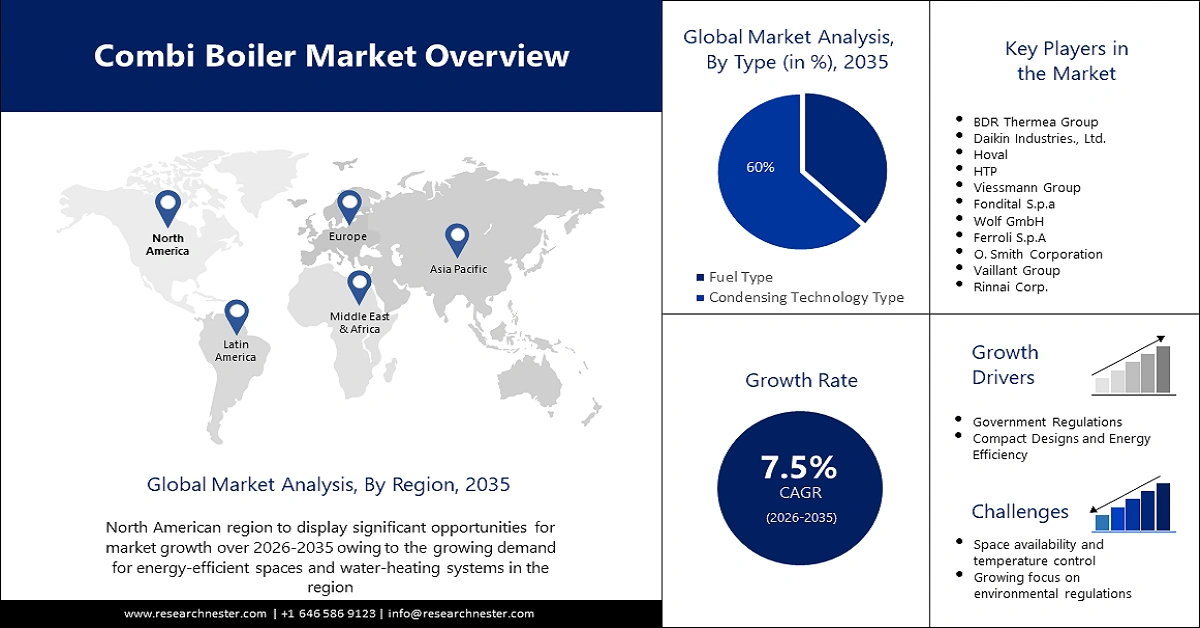

Combi Boiler Market size was over USD 37.1 billion in 2025 and is anticipated to cross USD 76.46 billion by 2035, witnessing more than 7.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of combi boiler is assessed at USD 39.6 billion.

The reason behind the growth is impelled by the growing demand for heating systems in urban residents, especially in temperate and tundra regions. According to estimates, more than 32% of households globally require both space heating and cooling.

Along with this, various favorable features of combi boilers, such as compact size, space-saving, and lower cost as compared to deploying two different systems for each function, are also projected to fuel the market growth.

The growing advancement in controlling technology is believed to fuel combi boiler market growth. Advancements such as connected controls, and remote and digital monitoring can aid in tracking and showing the boiler's water or steam pressure, and could potentially be used to encourage installers to configure the system properly.

Key Combi Boiler Market Insights Summary:

Regional Highlights:

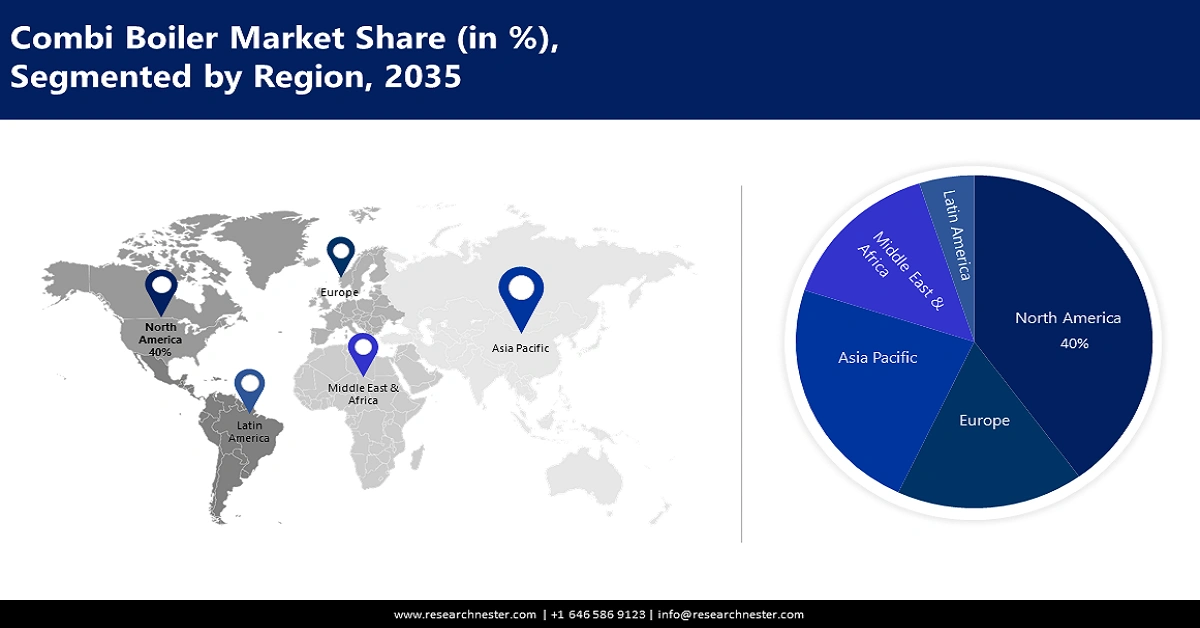

- North America combi boiler market will secure around 40% share by 2035, fueled by demand for efficient heating in cold regions.

Segment Insights:

- The condensing technology segment in the combi boiler market will experience substantial growth during 2026-2035, driven by energy efficiency and emission reduction.

- The central heating segment in the combi boiler market is projected to achieve notable revenue share by 2035, attributed to high efficiency and space-saving features suitable for home heating.

Key Growth Trends:

- Compact Designs and Energy Efficiency

- Government Regulations

Major Challenges:

- Compact Designs and Energy Efficiency

- Government Regulations

Key Players: BDR Thermea Group, Daikin Industries., Ltd., Hoval, HTP, Viessmann Group, Fondital S.p.a, Wolf GmbH, Ferroli S.p.A, O. Smith Corporation, Vaillant Group, Rinnai Corp.

Global Combi Boiler Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 37.1 billion

- 2026 Market Size: USD 39.6 billion

- Projected Market Size: USD 76.46 billion by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: Germany, United Kingdom, China, United States, Italy

- Emerging Countries: China, India, Brazil, Mexico, Russia

Last updated on : 9 September, 2025

Combi Boiler Market Growth Drivers and Challenges:

Growth Drivers

- Compact Designs and Energy Efficiency - Residential boilers and heaters consume over half of the users' yearly earnings. This clearly shows the need for cost-effective boilers all around the globe. At present, most of the new combi boilers that are installed in the United Kingdom, utilize less energy and provide the users with an impressive 90-94% efficiency. Combi boilers are now much smaller in size, unlike traditional boilers, which require a hot water cylinder, combi boilers have eliminated the need for any additional storage and hot water cylinder, which makes them perfect to use in compact spaces like a utility room, loft, or even a kitchen closet. Also, if the user decides to include a tank, they can enjoy a higher hot water flow rate.

- Government Regulations- All across the globe, governments are trying their best to save energy and are promoting sustainability as well. Combi boilers are known to be an energy-efficient solution, which is one of the reasons, users are switching to combi heaters. Additionally, there are several strict government regulations mainly for the control of greenhouse gas emissions, and this has also played a major role in increasing the growth of the combi boiler market.

Challenges

- Space availability and temperature control- Some combi boiler systems completely depend on the gravitation for functioning properly. For this purpose, the tank has to be placed as high as possible, and usually in the loft. The combi boiler, on the other hand, gets its water from the mains, and if the supply of the mains has low pressure, then the taps and showerheads will lack pressure. This can cause an issue in the system and would prevent it from functioning properly.

- The growing focus on environmental regulations worldwide, adds to the cost pressure challenging the profitability of the combi boiler market.

- A combi boiler is not able to work properly in a large house that has several bathrooms and taps, as while using the second tap, the first one has to be stopped. This is mainly because the combi boiler provides only a certain volume of hot water at a time.

Combi Boiler Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 37.1 billion |

|

Forecast Year Market Size (2035) |

USD 76.46 billion |

|

Regional Scope |

|

Combi Boiler Market Segmentation:

Device Type Segment Analysis

The condensing technology segment in the combi boiler market is estimated to gain a robust revenue share of 60% in the coming years. A condensing combi boiler is a heating system component that recovers water vapor and heat produced during gas combustion and is known to deliver both instantaneous hot water and central heating. Condensing boilers, use condensing technology to assist in lower heat loss and increase efficiency either by optimizing flow and return temperatures in the primary heat exchanger or by "capturing" the heat from the flue gases. These boilers are significantly greener than other boilers since they use less fuel, which aids in reducing harmful GHG emissions and also promotes low-emission technologies. For instance, condensing boilers, which make up the majority of new boilers, have an efficiency rating of more than 80%, while non-condensing boilers can only manage an efficiency rating of around 70%. Moreover, in residential structures, condensing combi boilers are typically used since they are wall-mounted and smaller.

Application Segment Analysis

The central heating segment in the combi boiler market is set to garner a notable share shortly. Central heating is essential for ensuring warmth during the winter. The major advantages of a combi boiler are its high efficiency, size, and its ability to provide hot water whenever required. These boilers can supply hot water and central heating by eliminating the requirement for the enormous storage tanks that traditional boilers require, and can usually last between 10-15 years taken care of along with annual servicing.

End-Use Segment Analysis

The residential segment in the combi boiler market is expected to witness a considerable growth. Combi-boilers, also known as combination boilers, compact, and single-unit water heaters, are a popular type of household heating system that can provide space heating and instantaneous household hot water. In addition, by combining space heating and domestic hot water (DHW) into one unit, a commercial combination boiler saves space and, oftentimes, money by using a plate heat exchanger to generate the hot water for several end-use industries.

Our in-depth analysis of the global combi boiler market includes the following segments:

|

Device Type |

|

|

End-Use |

|

|

Application |

|

|

Fuel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Combi Boiler Market Regional Analysis:

North American Market Insights

North America industry is likely to dominate majority revenue share of 40% by 2035. In addition, the region will also benefit from expanding demand for efficient heating systems in colder locations such as Canada and the United States, as well as increased public awareness of environmental issues. For instance, more than 55% of Americans reside in places that receive frequent winter snowfall. Moreover, the majority of Canadian homes are constructed to weather the winter, and in 2021, more than 90% of households said they had a primary heating system.

APAC Market Insights

The Asia Pacific combi boiler market is expected to rise steadily over the forecasted period, owing to the increasing adoption of combi-boilers in countries, such as Japan, China, and South Korea. These countries experience cold temperatures, especially during winter, which leads to a high demand for water heaters, as well as, central heaters. As the combi heater provides both functions in a single compact unit, its demand is growing in the region, which, in turn, is estimated to boost the market growth. Moreover, the high urban population in developing countries is further forecasted to fuel combi boiler market growth.

Combi Boiler Market Players:

- BDR Thermea Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Daikin Industries., Ltd.

- Hoval

- HTP

- Viessmann Group

- Fondital S.p.a

- Wolf GmbH

- Ferroli S.p.A

- O. Smith Corporation

- Vaillant Group

- Rinnai Corp.

Recent Developments

-

Vaillant, a manufacturer of combi boilers based in the UK, introduced a combination boiler that ranges between 24kW to 38 kW in power. This company also manufactures heating boilers, and their power ranges between 18 kW to 38 kW, which can be used for household purposes, along with solar power systems, hot water storage units, and heat pumps.

- A. O. Smith, Announced their first ProLine® XE Combi Boiler, which is their first dedicated combination-designed boiler especially for residential use from a single source.

- Report ID: 3861

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Combi Boiler Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.