Colocation Edge Data Center Market Outlook:

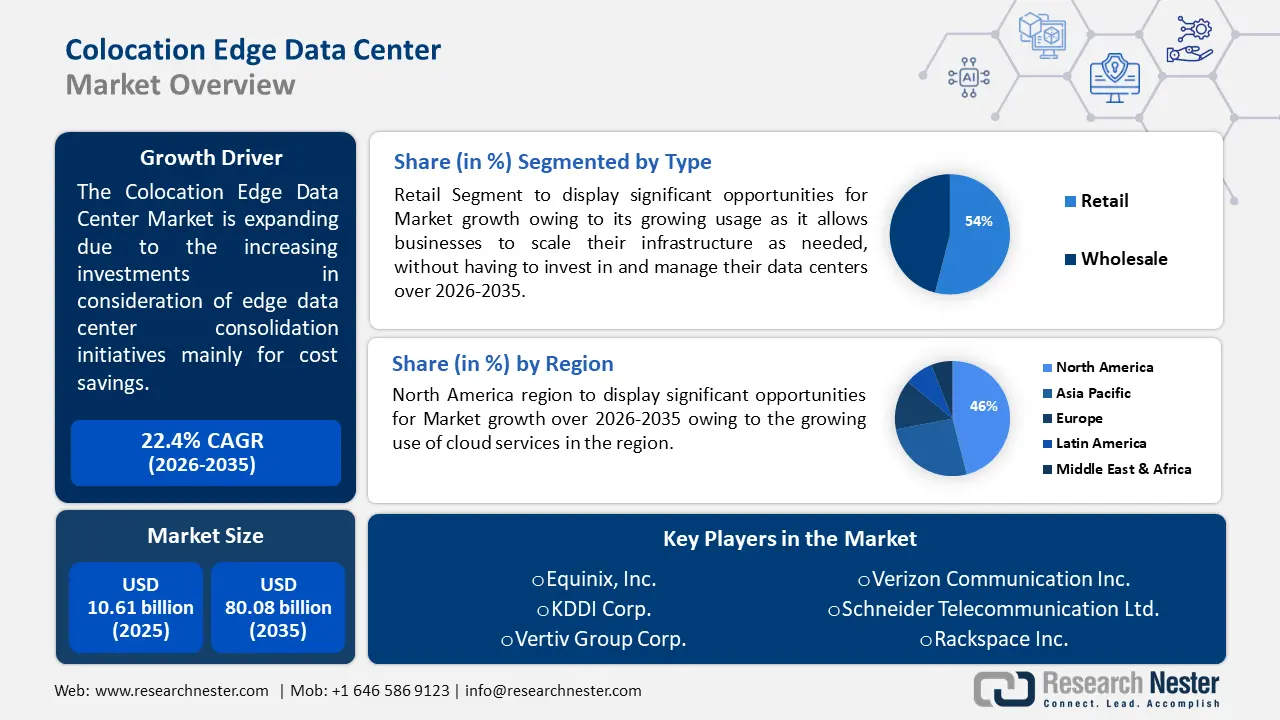

Colocation Edge Data Center Market size was over USD 10.61 billion in 2025 and is anticipated to cross USD 80.08 billion by 2035, growing at more than 22.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of colocation edge data center is assessed at USD 12.75 billion.

The market growth is due to the increasing investments in consideration of edge data center consolidation initiatives mainly for cost savings. According to a report, there are about 11,000 data centers worldwide as of Decemeber 2023. Furthermore, the increasing utilization of novel approaches such as server and storage virtualization and high-density storage solutions contributes to the expansion of market.

In addition, the spread of the healthcare sector is also propelling the growth of the colocation edge data center market. High investments in infrastructural expansion are catering to the changes in the pharmaceutical sector, as the healthcare sector generates about 30% of the world's data volume, and by 2025 it is expected that the compound annual growth rate of healthcare data will cross 36%. This is 11% faster than media & entertainment, 10% more than financial services, and 6% higher than manufacturing industries.

Key Colocation Edge Data Center Market Insights Summary:

Regional Highlights:

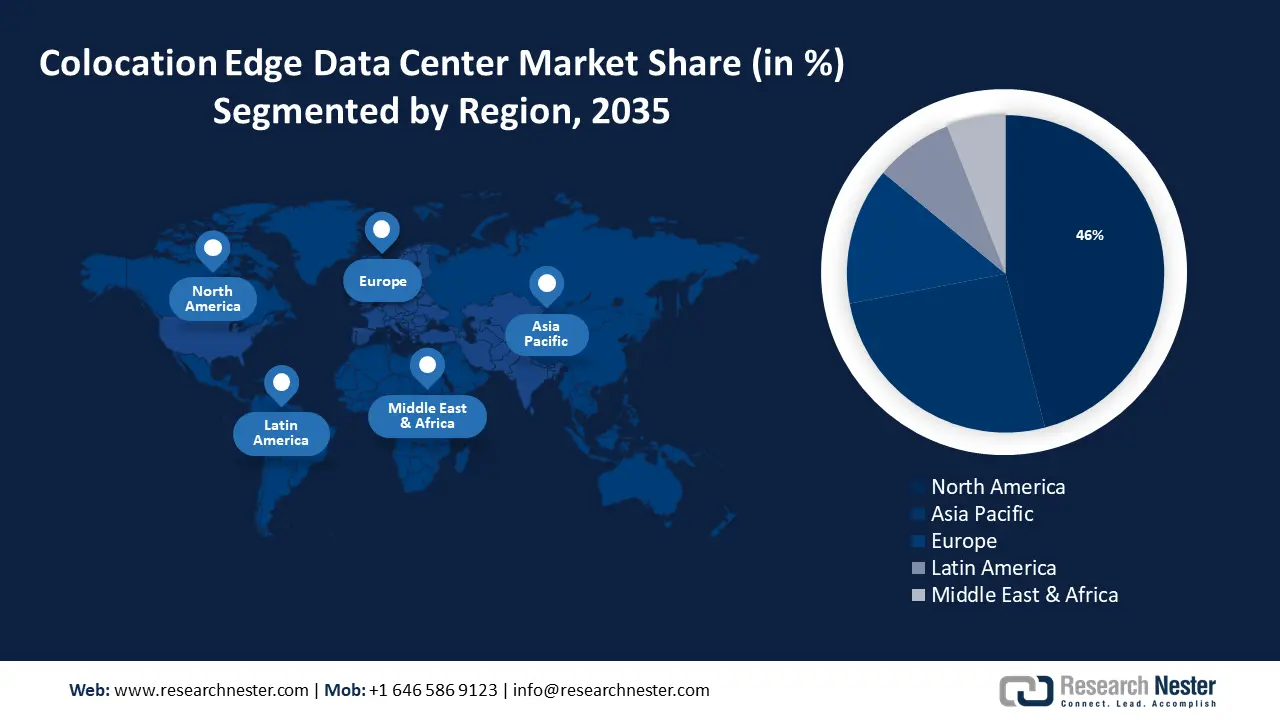

- North America’s colocation edge data center market dominates with a 46% share by 2035, driven by growing adoption of cloud services and data center development.

- Asia Pacific’s market will exhibit substantial growth during the forecast timeline, fueled by growing edge computing and 5G network deployment.

Segment Insights:

- The retail segment (colocation edge data center market) segment in the colocation edge data center market is expected to achieve a 54% share by 2035, attributed to its growing usage that allows businesses to scale infrastructure cost-effectively.

- The sme segment segment in the colocation edge data center market is projected to hold a notable revenue share by 2035, fueled by affordable IT outsourcing and technology leveling the playing field for SMEs.

Key Growth Trends:

- Growing adoption of 5g networks

- Growing adoption of advanced technologies

Major Challenges:

- Growing adoption of 5g networks

- Growing adoption of advanced technologies

Key Players: Hewlett-Packard, Eaton Corp. PLC, Digital Realty Trust, Inc, Emtel, Equinix, Inc., KDDI Corp., Vertiv Group Corp., Verizon Communication Inc., Schneider Telecommunication Ltd., Rackspace Inc.

Global Colocation Edge Data Center Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.61 billion

- 2026 Market Size: USD 12.75 billion

- Projected Market Size: USD 80.08 billion by 2035

- Growth Forecasts: 22.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, Singapore

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 16 September, 2025

Colocation Edge Data Center Market Growth Drivers and Challenges:

Growth Drivers

- Growing adoption of 5g networks - 5G technology requires low latency and higher bandwidth for delivering its full potential, as colocation edge data centers are essential for supporting several 5G applications, which can process data locally and reduce backhaul traffic. According to a report, the number of commercial 5G devices has increased by about 51.3% since March 2022. The integration of the next-generation wireless network and the colocation edge data center market is a symbiotic relationship that enhances the capabilities and potential of both technologies as they complement each other to address the demands of modern applications and services.

In addition, 5G technology’s ultra-wideband perfectly matches edge data centers; this combination allows quick data transfer from connected devices to nearby edge data centers, enabling real-time processing and responses.

- Growing adoption of advanced technologies - Over the past few years, the adoption of cutting-edge technologies like cloud computing and data analytics has increased demand for data center colocation services. Players in the colocation edge data center market are utilizing edge solutions to enhance customer support and data management. For instance, the cloud houses 60% of all corporate data worldwide. Global energy consumption is accounted for by cloud data centers at 3%.

The annual revenue from cloud infrastructure services is USD 178 Billion. 90% of major businesses have implemented a multi-cloud infrastructure. Therefore, the BFSI industry's growing integration of cloud-based solutions will increase demand for colocation edge data centers that guarantee quick and instantaneous data transfers.

Challenges

- High-speed network connection in remote areas - As edge data centers are situated close to end-users, data sources, and network access points, there is less distance for data to travel, which lowers the latency between the generation and processing of data. Nevertheless, the absence of a strong network infrastructure in rural areas makes it challenging to build fast connections. As a result, this element can restrict the market for colocation edge data centers' expansion.

- High start-up and maintenance costs may hamper the growth of the colocation edge data center market.

- Concerns over carbon emissions from data centers may hinder the growth of the market.

Colocation Edge Data Center Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

22.4% |

|

Base Year Market Size (2025) |

USD 10.61 billion |

|

Forecast Year Market Size (2035) |

USD 80.08 billion |

|

Regional Scope |

|

Colocation Edge Data Center Market Segmentation:

Type Segment Analysis

The retail segment in the colocation edge data center market is estimated to gain the a share of about 54% by 2035. The segment growth can be attributed to its growing usage as it allows businesses to scale their infrastructure as needed, without having to invest in and manage their data centers. According to a report, the spending on retail cloud infrastructure increased by 23% in 2023.

Moreover, retail colocation facilities are well-connected to various network providers, enabling businesses to access high-speed internet connectivity and interconnect with other organizations, increasing demand for scalable and flexible IT infrastructure solutions. For instance, with a 41% market share in 2022, Cisco maintained its position as one of the top manufacturers of enterprise network infrastructure.

Retail colocation allows businesses to rent space in a shared data center, allowing them to easily scale up or down as their needs change. Furthermore, the growth of retail colocation is highly cost-efficient, and by opting for retail colocation, businesses can also avoid such expenses and can instead pay for the space and services they need. Therefore, altogether these factors are propelling the growth of the segment.

End-user Segment Analysis

The SME segment in the colocation edge data center market is set to garner a notable share during the forecast period due to the availability of several affordable ways for outsourcing IT infrastructure, which lowers operating costs and also improves scalability. Additionally, the advancements in technology have also leveled the playing field for SMEs, which allows them to compete with larger companies. Digital tools, online platforms, and e-commerce have made it easier for SMEs to reach customers globally for marketing their products or services, and streamline their operations.

Moreover, the changing consumer preferences and demands have created opportunities for SMEs. Consumers are increasingly seeking personalized and niche products or services; which SMEs are often well-positioned to provide. Therefore, these factors are accelerating the growth of the segment.

Our in-depth analysis of the colocation edge data center market includes the following segments:

|

Type |

|

|

End-user |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Colocation Edge Data Center Market Regional Analysis:

North American Market Insights

The colocation edge data center market in the North America is anticipated to gain a share of about 46% by the end of 2035. The market growth in the region is expected on account of the growing use of cloud services by US and Canadian businesses in a variety of industries. According to a report, about 70% of businesses use cloud services in the U.S. which has increased the total spending on cloud services by 25%.

Cloud solutions from hyper-scale providers like AWS, Microsoft, and Oracle are being used by enterprises more frequently to meet their computing capacity requirements with the least amount of money. In addition to this, several data centers have already been developed by businesses in the region. Therefore, these factors are accelerating the growth of the colocation edge data center market in the region.

APAC Market Insights

Asia Pacific region is poised to witness substantial growth through 2035 and will hold the second position owing to a significant increase in the data centers and edge computing solutions in countries like China, India, and Singapore, which is escalating the growth of the market in the region. According to a report, there has been an increase of about 12% in Asia’s data center landscape.

Additionally, the influence of 5G networks in the region is expected to further drive the growth of colocation edge data centers, as they can support the low-latency requirements of emerging technologies like autonomous vehicles and smart cities.

Colocation Edge Data Center Market Players:

- Hewlett-Packard

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Eaton Corp. PLC

- Digital Realty Trust, Inc

- Emtel

- Equinix, Inc.

- KDDI Corp.

- Vertiv Group Corp.

- Verizon Communication Inc.

- Schneider Telecommunication Ltd.

- Rackspace Inc.

Recent Developments

- Dell- announced its Dell Private Wireless Program, which aims to secure enterprise connectivity for several edge locations.

- Flexential- announced the expansion of their FlexAnywhere Platform in 2023 with more than 110MW across GA, Hillsboro, and Atlanta.a

- Report ID: 5503

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Colocation Edge Data Center Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.