- Introduction

- Study Objective

- Scope of the report

- Market Taxonomy

- Study Assumptions and Abbreviations

- Research Methodology

- Secondary Research

- Primary Research

- SPSS Approach

- Data Triangulation

- Executive Summary

- Global Industry Overview

- Market Overview

- Regional Synopsis

- Industry Supply Chain Analysis

- DROTs

- Government Regulation: How They Would Aid The Business?

- Competitive Landscape

- ASHLAND INC.

- Collagen Solutions (US) LLC

- DARLING INGREDIENTS INC.

- dsm-firmenich.

- EVONIK INDUSTRIES AG

- GELITA AG

- Nitta Gelatin, Inc.

- Tessenderlo Group nv (PB Gelatins/PB Leiner)

- Vinh Hoan Corporation

- Weishardt

- Ongoing Technological Advancements

- Price Benchmarking

- SWOT Overview

- Patent Analysis

- Regulatory Approval Received by Key Players

- Startup Overview

- End User in Collagen Market

- Root Cause Analysis

- Porter’s Five Forces

- Collagen Utilization in Medical Devices Developed by iVascular

- Strategic Initiatives Adopted by Key Players

- Company Share in the Market

- Recent Developments Analysis

- Industry Risk Assessment

- Gobal Outlook and Projections

- Global Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Million), By

- Product, Value (USD Million)

- Gelatin

- Hydrolyzed Collagen

- Native Collagen

- Source, Value (USD Million)

- Bovine

- Porcine

- Poultry

- Marine

- Synthetic

- Application, Value (USD Million)

- Cosmetics & Personal Care

- Food & Beverages

- Medical Devices

- Nutritional Products

- Pharmaceutical Products

- Type, Value (USD Million)

- Type I

- Type II

- Type III

- Others

- Extraction Process, Value (USD Million)

- Chemical Hydrolysis

- Enzyme Hydrolysis

- Ultrasound

- Acid/Alkali Gelatin Hydrolysis

- Distribution Channel, Value (USD Million)

- Offline

- Pharmacies

- Supermarkets and Hypermarkets

- Specialty Stores

- Online

- Offline

- Regional Synopsis, Value (USD Million), 2024-2037

- North America, Value (USD Million)

- Europe, Value (USD Million)

- Asia Pacific, Value (USD Million)

- Latin America, Value (USD Million)

- Middle East and Africa, Value (USD Million)

- Product, Value (USD Million)

- Global Overview

- North America Market

- Global Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Million), By

- Product, Value (USD Million)

- Gelatin

- Hydrolyzed Collagen

- Native Collagen

- Source, Value (USD Million)

- Bovine

- Porcine

- Poultry

- Marine

- Synthetic

- Application, Value (USD Million)

- Cosmetics & Personal Care

- Food & Beverages

- Medical Devices

- Nutritional Products

- Pharmaceutical Products

- Type, Value (USD Million)

- Type I

- Type II

- Type III

- Others

- Extraction Process, Value (USD Million)

- Chemical Hydrolysis

- Enzyme Hydrolysis

- Ultrasound

- Acid/Alkali Gelatin Hydrolysis

- Distribution Channel, Value (USD Million)

- Offline

- Pharmacies

- Supermarkets and Hypermarkets

- Specialty Stores

- Online

- Offline

- Country Level Analysis, Value (USD Million)

- U.S.

- Canada

- Product, Value (USD Million)

- Global Overview

- Europe Market

- Global Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Million), By

- Product, Value (USD Million)

- Gelatin

- Hydrolyzed Collagen

- Native Collagen

- Source, Value (USD Million)

- Bovine

- Porcine

- Poultry

- Marine

- Synthetic

- Application, Value (USD Million)

- Cosmetics & Personal Care

- Food & Beverages

- Medical Devices

- Nutritional Products

- Pharmaceutical Products

- Type, Value (USD Million)

- Type I

- Type II

- Type III

- Others

- Extraction Process, Value (USD Million)

- Chemical Hydrolysis

- Enzyme Hydrolysis

- Ultrasound

- Acid/Alkali Gelatin Hydrolysis

- Distribution Channel, Value (USD Million)

- Offline

- Pharmacies

- Supermarkets and Hypermarkets

- Specialty Stores

- Online

- Offline

- Country Level Analysis, Value (USD Million)

- UK

- Germany

- France

- Italy

- Spain

- NORDIC

- Russia

- Rest of Europe

- Product, Value (USD Million)

- Global Overview

- Asia Pacific Market

- Global Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Million), By

- Product, Value (USD Million)

- Gelatin

- Hydrolyzed Collagen

- Native Collagen

- Source, Value (USD Million)

- Bovine

- Porcine

- Poultry

- Marine

- Synthetic

- Application, Value (USD Million)

- Cosmetics & Personal Care

- Food & Beverages

- Medical Devices

- Nutritional Products

- Pharmaceutical Products

- Type, Value (USD Million)

- Type I

- Type II

- Type III

- Others

- Extraction Process, Value (USD Million)

- Chemical Hydrolysis

- Enzyme Hydrolysis

- Ultrasound

- Acid/Alkali Gelatin Hydrolysis

- Distribution Channel, Value (USD Million)

- Offline

- Pharmacies

- Supermarkets and Hypermarkets

- Specialty Stores

- Online

- Offline

- Country Level Analysis, Value (USD Million)

- China

- Hong Kong

- Japan

- India

- Australia

- South Korea

- Vietnam

- Thailand

- Singapore

- Malaysia

- Rest of Asia Pacific

- China

- Product, Value (USD Million)

- Global Overview

- Latin America Market

- Global Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Million), By

- Product, Value (USD Million)

- Gelatin

- Hydrolyzed Collagen

- Native Collagen

- Source, Value (USD Million)

- Bovine

- Porcine

- Poultry

- Marine

- Synthetic

- Application, Value (USD Million)

- Cosmetics & Personal Care

- Food & Beverages

- Medical Devices

- Nutritional Products

- Pharmaceutical Products

- Type, Value (USD Million)

- Type I

- Type II

- Type III

- Others

- Extraction Process, Value (USD Million)

- Chemical Hydrolysis

- Enzyme Hydrolysis

- Ultrasound

- Acid/Alkali Gelatin Hydrolysis

- Distribution Channel, Value (USD Million)

- Offline

- Pharmacies

- Supermarkets and Hypermarkets

- Specialty Stores

- Online

- Offline

- Country Level Analysis, Value (USD Million)

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Product, Value (USD Million)

- Global Overview

- Middle East & Africa Market

- Global Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Million), By

- Product, Value (USD Million)

- Gelatin

- Hydrolyzed Collagen

- Native Collagen

- Source, Value (USD Million)

- Bovine

- Porcine

- Poultry

- Marine

- Synthetic

- Application, Value (USD Million)

- Cosmetics & Personal Care

- Food & Beverages

- Medical Devices

- Nutritional Products

- Pharmaceutical Products

- Type, Value (USD Million)

- Type I

- Type II

- Type III

- Others

- Extraction Process, Value (USD Million)

- Chemical Hydrolysis

- Enzyme Hydrolysis

- Ultrasound

- Acid/Alkali Gelatin Hydrolysis

- Distribution Channel, Value (USD Million)

- Offline

- Pharmacies

- Supermarkets and Hypermarkets

- Specialty Stores

- Online

- Offline

- Country Level Analysis, Value (USD Million)

- GCC

- Israel

- South Africa

- Rest of Middle East & Africa

- Product, Value (USD Million)

- Global Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

Collagen Market Outlook:

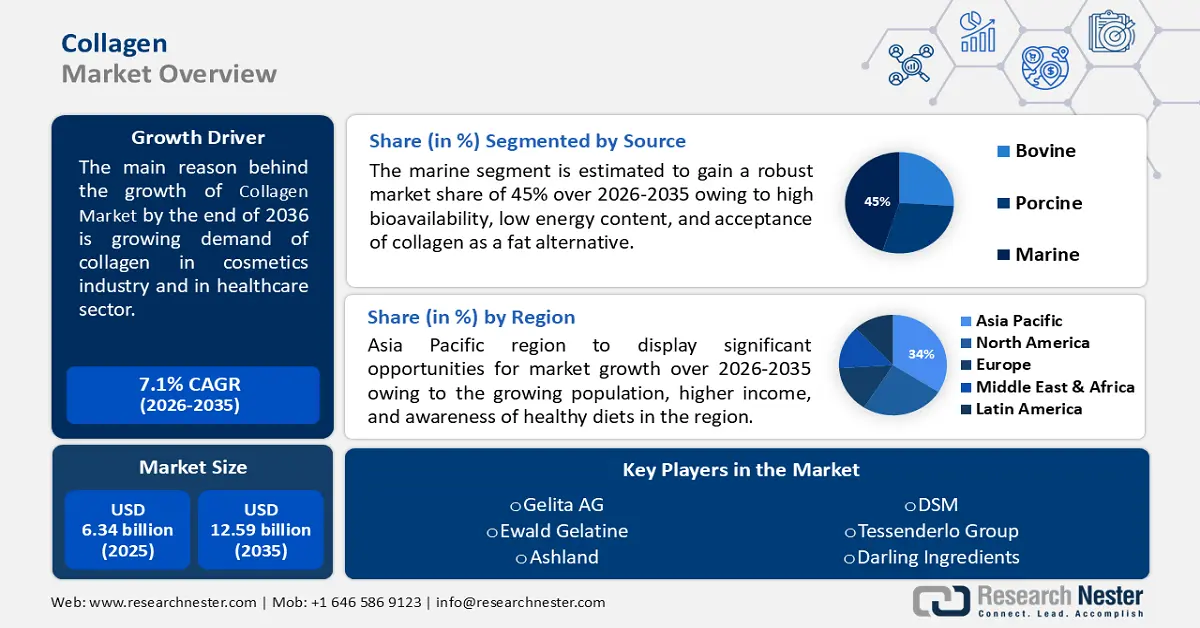

Collagen Market size was valued at USD 6.34 billion in 2025 and is set to exceed USD 12.59 billion by 2035, registering over 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of collagen is estimated at USD 6.75 billion.

The collagen market is witnessing a surge in growth globally due to growing applications across the healthcare, cosmetics, and food industries. Due to its multi-functionality, collagen is aligning well to become the key raw material for the formulation of several newly advanced products within the nutraceuticals, medical devices, and functional food industries. In October 2024, Nextida GC, Darling Ingredients' line of collagen peptides, which is aimed at limiting post-meal spikes in glucose. Such developments reflect the growing interest in healthy, natural options. Several players are focusing on sustainable production, which is likely to drive collagen market growth.

Governments and private institutions are making significant investments in R&D to introduce better collagen production and its uses. For instance, in November 2023, PB Leiner opened a fish collagen peptides production facility in Haihan, China, to cater to the growing demand worldwide for sustainable and quality collagen. Besides this, regulatory efforts to ensure that the quality of collagen is maintained at a high level in both pharmaceutical and cosmetic applications also drive innovation in the sector. This increasing focus on health and sustainability is likely to maintain the upward trend during the forecast period.

Key Collagen Market Insights Summary:

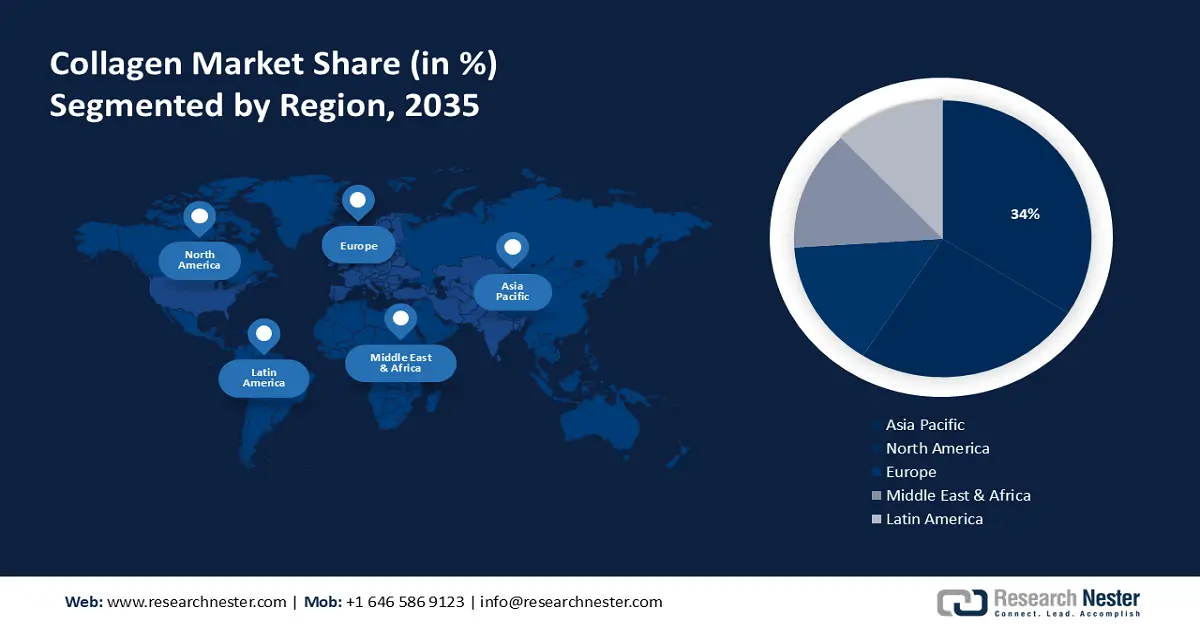

Regional Highlights:

- North America collagen market will hold more than 30% share by 2035, fueled by applications in nutraceuticals and healthcare, and regulatory support.

- Asia Pacific market will exhibit significant growth from 2026 to 2035, driven by rising demand in healthcare and beauty applications and economic growth.

Segment Insights:

- The gelatin segment in the collagen market is expected to achieve a 66.70% share by 2035, influenced by gelatin's multi-functional use in pharma, confectionery, and functional foods.

- The bovine segment in the collagen market is expected to see significant growth through 2035, driven by increasing demand for bovine-based collagen in medical-grade and functional food sectors.

Key Growth Trends:

- Healthcare applications

- Growing demand for functional foods and beverages

Major Challenges:

- Regulatory challenges in international markets

- Supply chain constraints in raw materials

Key Players: Collagen Solutions (US) LLC, DARLING INGREDIENTS INC., DSM-Firmenich., EVONIK INDUSTRIES AG, GELITA AG, Nitta Gelatin, Inc., Tessenderlo Group NV (PB Gelatins/PB Leiner), Vinh Hoan Corporation, Weishardt.

Global Collagen Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.34 billion

- 2026 Market Size: USD 6.75 billion

- Projected Market Size: USD 12.59 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (30% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, Japan, India, South Korea, Brazil

Last updated on : 17 September, 2025

Collagen Market Growth Drivers and Challenges:

Growth Drivers

-

Healthcare applications: Increasing medical applications are anticipated to drive growth in the demand for medical-grade collagen due to its adoption in regenerative medicine, wound healing, and surgery. For example, Nitta Gelatin finished constructing the Mirai-can facility in December 2022, offering biomedical-grade collagen solutions for advanced medicine. This corresponds to the increased prevalence of chronic diseases and growth in demand for new medical solutions worldwide, placing collagen as one of the vital raw materials within modern medical advancement.

-

Growing demand for functional foods and beverages: Another growth driver is the rising demand for functional foods and beverages incorporating collagen since it imparts health benefits related to skin elasticity and joint health. In September 2024, Vital Proteins launched an ad campaign featuring Jennifer Aniston for its collagen bars, positioning the product for wellness and beauty. Furthermore, this surge in demand reflects a wider consumer move toward health-focused, clean-label offerings that tap into a higher interest in preventive health and active lifestyles.

- Rising adoption in the cosmetics industry: A number of anti-aging and skin-rejuvenating properties have established collagen as an important material for the cosmetics industry. In March 2024, Evonik entered into a partnership with Jland Biotech in order to develop vegan collagen for personal care products, marking a paradigm shift toward environmental sustainability with plant-based alternatives. Such partnerships portray an uptick in focus on eco-friendly innovative solutions that can meet ethical consumer demand without reducing the high-performance expectations of beauty care.

Challenges

-

Regulatory challenges in international markets: Most collagen-based products face rigid regulatory barriers, particularly for medical and food applications. For instance, regulatory authorities often require a manufacturer to carry out extensive tests and provide voluminous documentation, which may delay product approval and increase the cost of development. Besides, these challenges slow market entry and make it difficult for small companies to compete effectively in such markets. Additionally, regional differences in regulations further add to complications in global market strategies, therefore making compliance with various regulations a very time-consuming and costly affair.

-

Supply chain constraints in raw materials: The collagen industry relies heavily on animal-derived sources such as bovine and porcine tissues, leading to supply chain challenges. Furthermore, these raw materials are subject to a lot of fluctuations based on various factors, such as outbreaks of diseases or changes in production levels of livestock. In addition, the diversity in sourcing has raised ethical concerns related to animal welfare and environmental sustainability. On the other hand, increasing demand for collagen raises pressures regarding the supply chains and prices.

Collagen Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 6.34 billion |

|

Forecast Year Market Size (2035) |

USD 12.59 billion |

|

Regional Scope |

|

Collagen Market Segmentation:

Product Segment Analysis

By the end of 2035, gelatin segment is estimated to account for collagen market share of more than 66.7%, due to its multi-applicability within pharmaceuticals, confectionery, and functional foods. Gelatin’s functionality for texture and stability improvement makes it a preferred ingredient in industries which has propelled the segment’s growth. In July 2023, GELITA launched CONFIXX-gelatin, which is a fast-setting gelatin specifically for fortified gummies with good texture and cost efficiency. This also aligns with the surge in demand within the health and wellness market for fortified and functional products. Furthermore, ongoing advancements in gelatin formulations are continuously widening its use in emerging applications, boosting the market prospects.

Source Segment Analysis

Bovine segment is set to capture over 36.7% collagen market share by 2035, due to the continuously growing demand for bovine-based products for medical-grade collagen and functional foods. Since bovine-derived collagen is biocompatible with human tissue, this segment has garnered considerable adoption in regenerative medicine and surgical applications. In June 2022, Collagen Solutions strengthened its position by acquiring TissX, a company dealing in bovine-based biomaterials for advanced medical use. The improvement in extraction techniques increases the quality and efficiency of extraction, further propelling growth within the segment. With increasing healthcare needs, alongside emphasis laid upon bioactive ingredients, the bovine segment remains a key driver for the collagen market expansion.

Our in-depth analysis of the collagen market includes the following segments:

|

Product |

|

|

Source |

|

|

Application |

|

|

Type |

|

|

Extraction Process |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Collagen Market Regional Analysis:

North America Market Insights

In collagen market, North America region is expected to capture around 30% revenue share by the end of 2035, owing to a wide range of applications in nutraceuticals and healthcare. The high emphasis on the region for trends in wellness and innovations in technology remains a strong driving force for market growth. Increasing consumer inclination towards health-enhancing products, further helped by advancements in collagen formulations, sustains the growth. A well-established supply chain and leading global players who drive innovation proactively add to this. Moreover, supporting regulatory frameworks for health-focused products gives an impetus to the opportunities for market development.

The U.S. holds the largest share of the collagen market in North America, driven by the presence of established key players who are pioneering newer ways of innovative marketing and product development strategies. For example, in September 2024, Vital Proteins launched a high-impact campaign promoting collagen bars that emphasize wellness benefits to boost consumer awareness and drive demand. The country's emphasis on active lifestyles and preventative health makes it a key market for collagen products. Using advanced technologies and partnerships, companies in the U.S. are expanding applications into nutraceuticals, cosmetics, and functional foods. Moreover, greater spending by consumers in support of premium wellness items further supports the market expansion in the U.S.

The collagen market in Canada is developing at a rapid pace, motivated by investments in research and development, along with sustainable production methods. The companies in Canada are working on superior formulations for functional foods and cosmetics, considering the people of this nation and moving toward clean-label products with an eco-friendly approach. Collaboration with academia and programs initiated by the government furthers innovation in the field of biopharmaceutical applications and hence propels business growth. The growing demand from health-conscious and aging populations increases the demand for collagen, thereby driving market growth.

Asia Pacific Market Insights

Asia Pacific region is likely to observe significant growth till 2035, driven by rising demand in healthcare and beauty applications throughout major countries such as China, India, and Japan. The increasing knowledge among consumers about the benefits of collagen, along with growing economic conditions and industrialization, creates huge opportunities for collagen market growth. The significant level of investment in sustainable production and innovative product development in the region is also an added advantage. With a vast and diverse consumer base, Asia Pacific presents potential opportunities for collagen manufacturers targeting multiple sectors.

China is one of the major collagen market drivers in Asia Pacific with major investments in sustainable and innovative production methods. In November 2023, PB Leiner opened its fish collagen peptides facility in Hainan to meet the increasing demand for marine collagen coming from food and healthcare applications. The strong e-commerce platform presents in China and rising awareness among consumers towards the health and beauty benefits of collagen further drive the growth of the market. Government support for biopharmaceuticals and efforts toward high-quality product development help China maintain a leading position in the regional market.

India collagen market is predicted to rise at a rapid pace owing to applications in pharmaceuticals and functional foods. The growth is underpinned by an increase in awareness of the health benefits of collagen, supported by government initiatives for biopharmaceutical R&D. Growing disposable incomes and rising interest in health and well-being also contribute to the increasing adoption of collagen-based products. Furthermore, India is becoming a manufacturing hub for collagen, driven by advances in biology for the extraction of collagen and the development of sustainable practices for production.

Collagen Market Players:

- ASHLAND INC.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Collagen Solutions (U.S.) LLC

- DARLING INGREDIENTS INC.

- dsm-firmenich

- EVONIK INDUSTRIES AG

- GELITA AG

- Nitta Gelatin, Inc.

- Tessenderlo Group nv (PB Gelatins/PB Leiner)

- Vinh Hoan Corporation

- Weishardt

The collagen market is extremely competitive, with key players such as Collagen Solutions LLC, Darling Ingredients Inc., DSM-Firmenich, Evonik Industries AG, GELITA AG, Nitta Gelatin Inc., Tessenderlo Group NV, Vinh Hoan Corporation, and Weishardt conducting innovation and growth in the sector. These companies invest significantly in sustainable business practices and product development to meet the increasing demand from nutraceuticals, healthcare, and cosmetics sectors.

In August 2023, Vinh Hoan Corporation expanded marine collagen peptide production capacity to meet steadily high demand from the cosmetics and healthcare sectors. This is in line with strategic investment by the industry into eco-friendly production lines while diversifying high-growth collagen markets. The competitive landscape has been further characterized by collaborations, technological advancements, and regional expansions that ensure continued growth with diversification within the collagen industry.

Here are some leading companies in the collagen market:

Recent Developments

- In May 2024, Rousselot partnered with Xolo to integrate X-Pure GelMA solution into bioinks. This collaboration supports advanced 3D printing applications in biomedical engineering. The project emphasizes Rousselot’s focus on innovative and sustainable solutions. It addresses growing demand for high-performance collagen in tissue engineering.

- In February 2024, Evonik launched Vecollage Fortify L, a vegan collagen for beauty applications. The product caters to the increasing demand for plant-based and sustainable skincare solutions. This launch reflects Evonik’s strategic focus on eco-friendly innovations. It also reinforces its position in the personal care market.

- In April 2023, Advanced Medical Solutions received MDR approval for its EZ Cure Resorbable Collagen Membrane. This product facilitates guided bone healing for dental and orthopedic procedures. MDR certification ensures compliance with European medical device regulations. The approval strengthens the company’s position in the regenerative medicine market.

- Report ID: 6013

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Collagen Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.