Cold Storage Market Outlook:

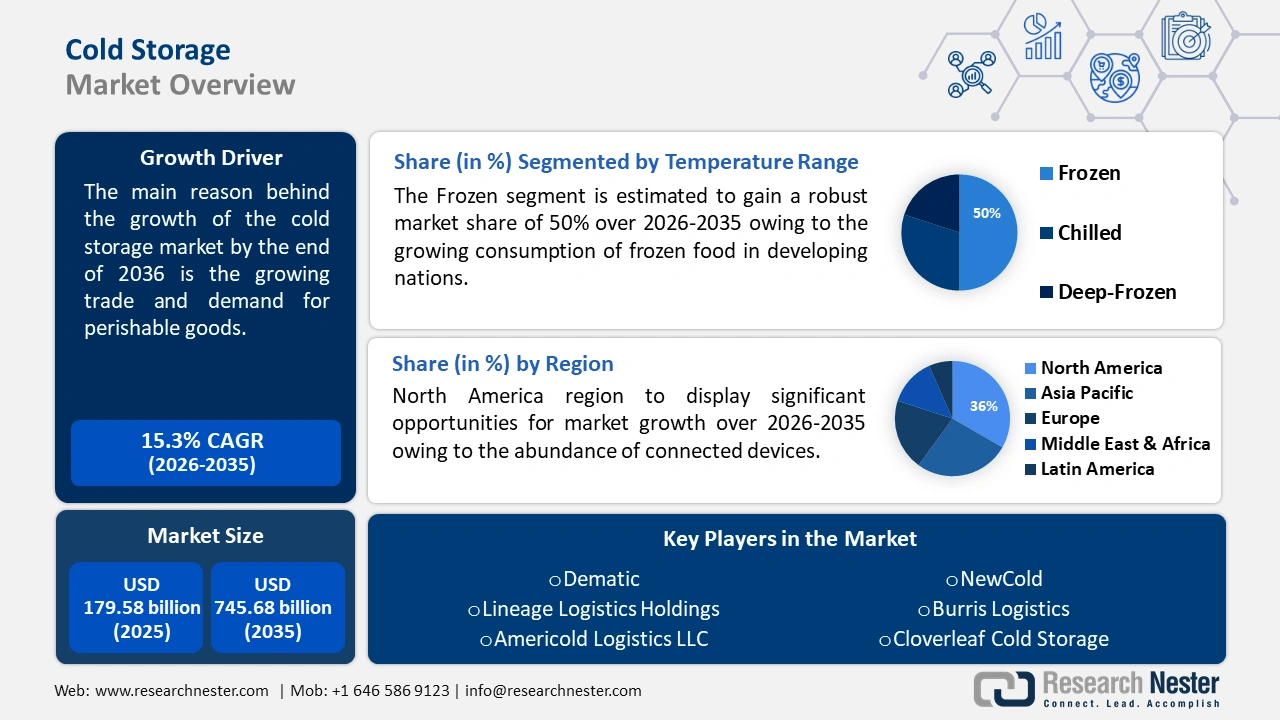

Cold Storage Market size was valued at USD 179.58 billion in 2025 and is set to exceed USD 745.68 billion by 2035, expanding at over 15.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cold storage is estimated at USD 204.31 billion.

The market growth can be attributed to the growing trade and demand for perishable goods. Perishable products, such as fruits and vegetables, dairy products, medicines, or other goods that have a short shelf life are those that break down quickly. According to the IATA Organization, perishables are a vital commodity in the air freight industry, making up approximately 15% of all air cargo worldwide in 2022.

Key Cold Storage Market Insights Summary:

Regional Highlights:

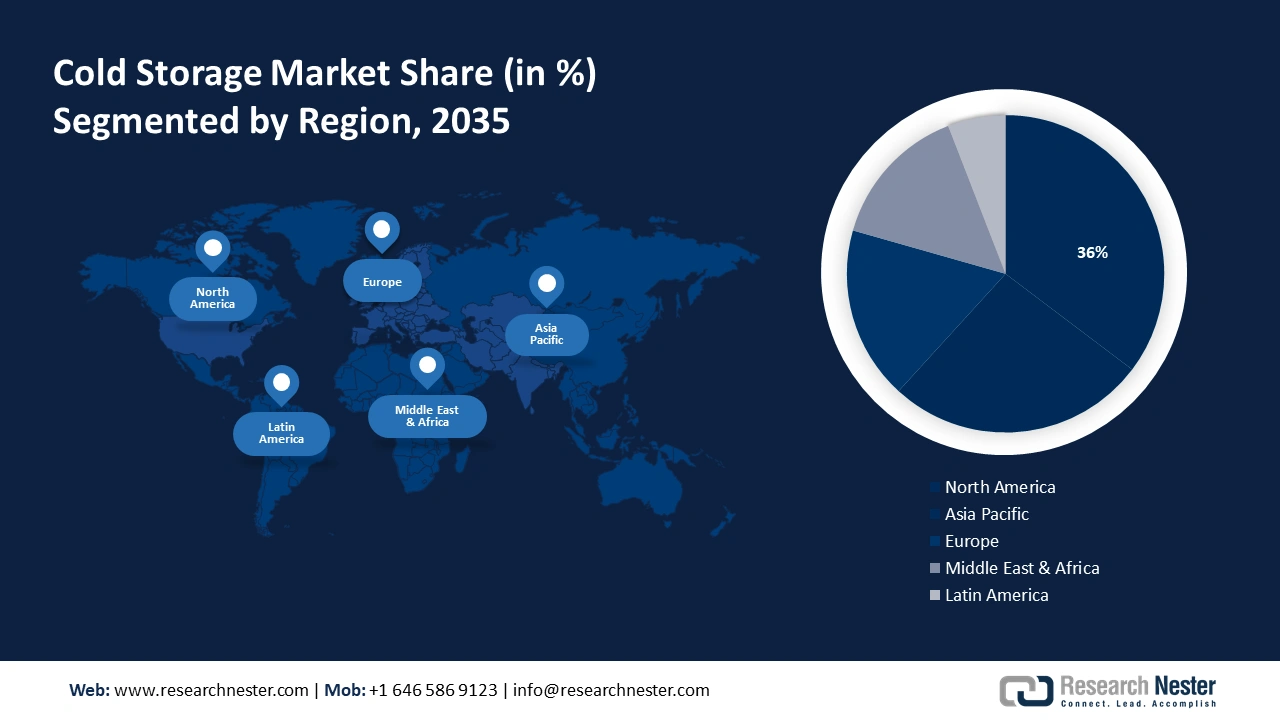

- North America cold storage market will secure over 36% share by 2035, driven by the abundance of connected devices and the popularity of cold chain logistics.

- Asia Pacific market will exhibit huge CAGR during 2026-2035, fueled by growing technological advancements in refrigerated transportation and warehouse management.

Segment Insights:

- The frozen segment in the cold storage market is projected to hold a 50% share by 2035, driven by the increasing consumption of frozen food in developing nations.

- The fish, meat & seafood segment in the cold storage market is expected to exhibit lucrative growth over 2026-2035, attributed to the rising demand for frozen meat and fish products.

Key Growth Trends:

- Growing awareness to reduce food waste

- Increased adoption of fuel cell-based technology

Major Challenges:

- Higher initial cost

- Electricity fluctuations

Key Players: Dematic, Lineage Logistics Holdings, Americold Logistics LLC, NewCold, CASA(S) Pte Ltd., Burris Logistics, Cloverleaf Cold Storage, Gulf Drug LLC, Kloosterboer, Nordic Logistics.

Global Cold Storage Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 179.58 billion

- 2026 Market Size: USD 204.31 billion

- Projected Market Size: USD 745.68 billion by 2035

- Growth Forecasts: 15.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 17 September, 2025

Cold Storage Market Growth Drivers and Challenges:

Growth Drivers

- Growing awareness to reduce food waste - 11% of food produced worldwide is wasted (in households, 5 percent in food service, and 2 percent in retail), while approximately 14% of food produced is lost globally between harvest and retail. Therefore, the growing awareness of reducing food waste is driving the market's growth rate in cold storage. All over the world, food waste is a major problem.

A lack of suitable storage facilities accounts for the majority of food waste. Perishable goods are typically transported through the supply chain at a variety of temperatures, which may result in food spoilage and waste.

- Increased adoption of fuel cell-based technology - The use of fuel cell technology can help warehouse managers save valuable warehouse space, which is often occupied by battery charging stations and batteries. For instance, the fuel cell infrastructure takes up more than 60% less space when compared to traditional energy and battery power infrastructures.

Also, by deploying fuel cell forklifts to increase the range of electric vehicles, warehouse productivity can be increased by up to 15% due to hydrogen fuel cell efficiency.

- Growing utilization of sustainable warehouses - Low carbon design and investment in environmental audits and innovative construction practices are being adopted by the players of the cold storage market. Sustainable and smart warehouses can be created by a low-carbon design, which reduces energy consumption.

Reducing energy costs and reducing the carbon footprint of these facilities can be achieved by using energy-efficient technologies, such as intelligent automation and control systems. For instance, along with DHL, Mars UK formally opened a brand-new, cutting-edge warehouse. The new facility, which is situated in the UK, completes Mars UK's new, "world-class" logistics operation, which is intended to further the business's environmental initiatives.

Challenges

- Higher initial cost - One of the main things impeding the cold storage industry's expansion is the large initial expenditure required to build a facility. Building a cold storage facility, installing the required equipment, and maintaining and repairing the infrastructure all demand large financial investments.

For businesses that are just entering the market, this cost may be particularly significant because they must make investments in superior insulation, refrigeration systems, and infrastructure to guarantee appropriate temperature control and energy efficiency.

- Electricity fluctuations - Power outages or electrical fluctuations can cause cooling systems to malfunction. Coolant failures and insufficient cooling circulation can negatively impact cold chain management, leading to increased maintenance costs. Excessive heat exposure can reduce the quality and competitiveness of perishable commodities, leading to significant waste.

Cold Storage Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

15.3% |

|

Base Year Market Size (2025) |

USD 179.58 billion |

|

Forecast Year Market Size (2035) |

USD 745.68 billion |

|

Regional Scope |

|

Cold Storage Market Segmentation:

Temperature Range Segment Analysis

Frozen segment is poised to capture around 50% cold storage market share by the end of 2035. The segment growth can be credited to the growing consumption of frozen food in developing nations. This category includes warehouses where frozen goods such as frozen fruits, vegetables, meat, fish, and seafood are kept.

The frozen (-18°C to -25°C) segment will rise as a result of shifting customer preferences and rising ready-to-cook meal consumption. For instance, in 2024, the market for ready-to-eat meals is projected to have an average volume per person of 11.1 kg. The need for these goods is also being propelled by the growth of organized retail chains, such as hypermarkets and supermarkets, in emerging economies.

Application Segment Analysis

Fish, meat & seafood segment in the cold storage market is estimated to grow at lucrative CAGR till 2035. The recent increase in demand for chilled beef is a result of increasing emphasis on health and nutrition in the food and beverage industry. Frozen processed meat is preferred by a large number of city dwellers, since it can be prepared more quickly and reduces the time needed for cutting. According to estimates, by 2028, manufacturing volume in the processed meat sector is evaluated to reach 40.99 billion kg.

The adoption of storage is set to increase and market growth will be driven by the meat and fish segment through 2035, due to increasing demand for frozen meat and fish. Furthermore, the growing need for convenient meals, safety concerns, and ever-changing lifestyles are the main factors driving the acceptance of frozen meat.

Our in-depth analysis of the global market includes the following segments:

|

Storage Type |

|

|

Construction Type |

|

|

Temperature Range |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cold Storage Market Regional Analysis:

North American Market Insights

North America industry is set to hold largest revenue share of 36% by 2035. The market growth in the region is also expected on account of the abundance of connected devices. For instance, it is anticipated that there will be 5.4 billion consumer and industrial Internet of Things (IoT) connections in North America by 2025.

The region's market has grown dramatically as cold chain logistics has become more popular in the organized retail sector. Also, the presence of major key players in the region including LINEAGE LOGISTICS HOLDING, LLC, Americold Logistics, Inc., and others is influencing the market growth in the region.

The US dominates the market in large part because of the size of the nation and the huge need for cold storage facilities. Also, the favorable business environment in this region is another factor impacting the market growth in the US.

APAC Market Insights

The APAC region will also encounter huge growth for the cold storage market through 2035 owing to the growing technological advancements in the region. Service providers can now tap into these growing markets by deploying innovative solutions that overcome transportation-related obstacles. This is made possible by advancements in refrigerated transportation and warehouse management, as well as government subsidies that have fueled the growth of the cold chain industry in the region.

Fresh food and products in China that are sensitive to temperature changes are in greater demand as the nation's population grows and becomes more urbanized. As a result, there is now more pressure on the supply chain to maintain product quality and safety as a result of this increase in demand, which increases the need for effective cold storage.

The cold storage market expansion in Korea can be due to the growing reliance on fruit and vegetable imports to meet its food needs, along with the growth of third-party logistics companies and the active involvement of the pharmaceutical sector.

People who support the selling of frozen goods frequently want to see a move to healthy life expectancy as the Japanese population matures. In hypermarkets, drugstores, and supermarkets, it also rose noticeably. Therefore, these factors are influencing the growth of the market in Japan.

Cold Storage Market Players:

- Dematic

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Lineage Logistics Holdings

- Americold Logistics LLC

- NewCold

- CASA(S) Pte Ltd.

- Burris Logistics

- Cloverleaf Cold Storage

- Gulf Drug LLC

- Kloosterboer

- Nordic Logistics

Major key players are making large investments in the integration of cutting-edge technologies for monitoring and optimization. Investor interest and support in original equipment manufacturing experience, monitoring, and pressure analysis in a cold storage have been growing.

Recent Developments

- Dematic, and Groupe Robert collaborated to launch a brand-new distribution facility in Quebec. The facility has one of the tallest third-party logistics (3PL) Dematic Automated Storage and Retrieval Systems (AS/RS) in Canada, complete with 130-foot-tall cranes to facilitate the fulfillment of frozen and fresh goods from high-density cold storage. Groupe Robert is now the first 3PL company in Quebec to have an automated warehouse for both frozen and fresh goods due to the solution.

- EF introduced the all-new EF Chest Freezers are the latest innovation in cold storage solutions. These freezers, which are built with cutting-edge technology and a dedication to quality, are poised to completely transform how people store and preserve their favorite foods. With the help of cutting-edge cooling technology, EF Chest Freezers guarantee quick and even freezing, keeping food fresh and nutrient-dense for longer.

- Report ID: 6071

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cold Storage Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.