Cold Chain Market Outlook:

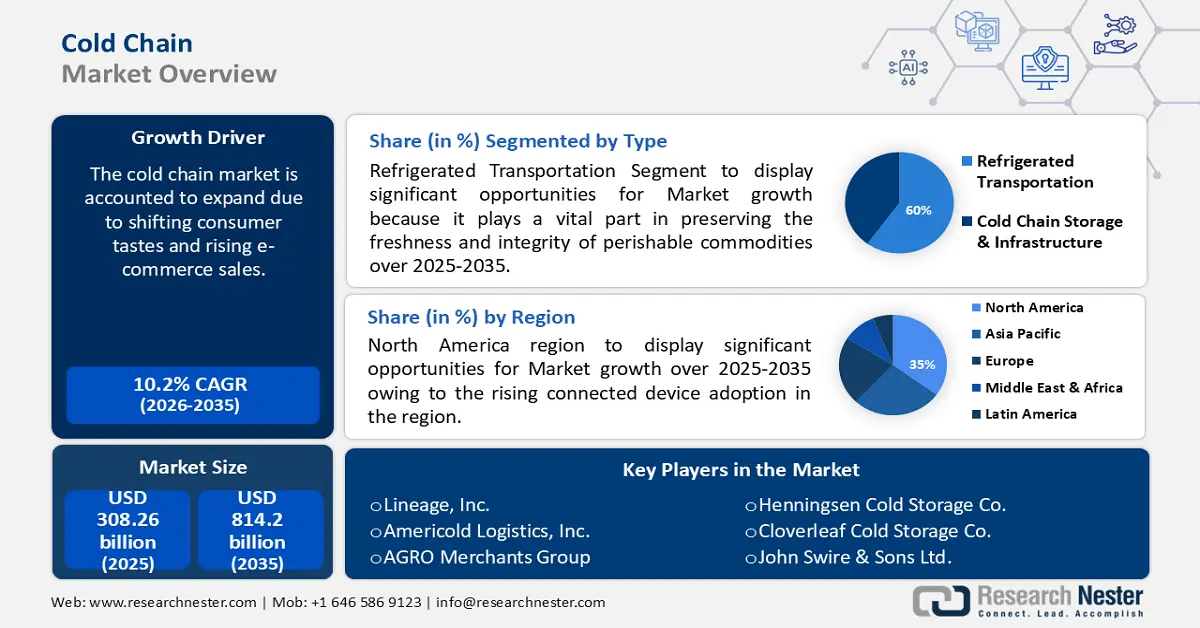

Cold Chain Market size was over USD 308.26 billion in 2025 and is projected to reach USD 814.2 billion by 2035, witnessing around 10.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cold chain is evaluated at USD 336.56 billion.

The cold chain market is accounted to expand due to shifting consumer tastes and rising e-commerce sales. Also, the need for cold chain solutions is rising as a result of the rise of organized retail outlets in developing nations. By 2025, 2.77 billion internet shoppers are anticipated.

Key Cold Chain Market Insights Summary:

Regional Highlights:

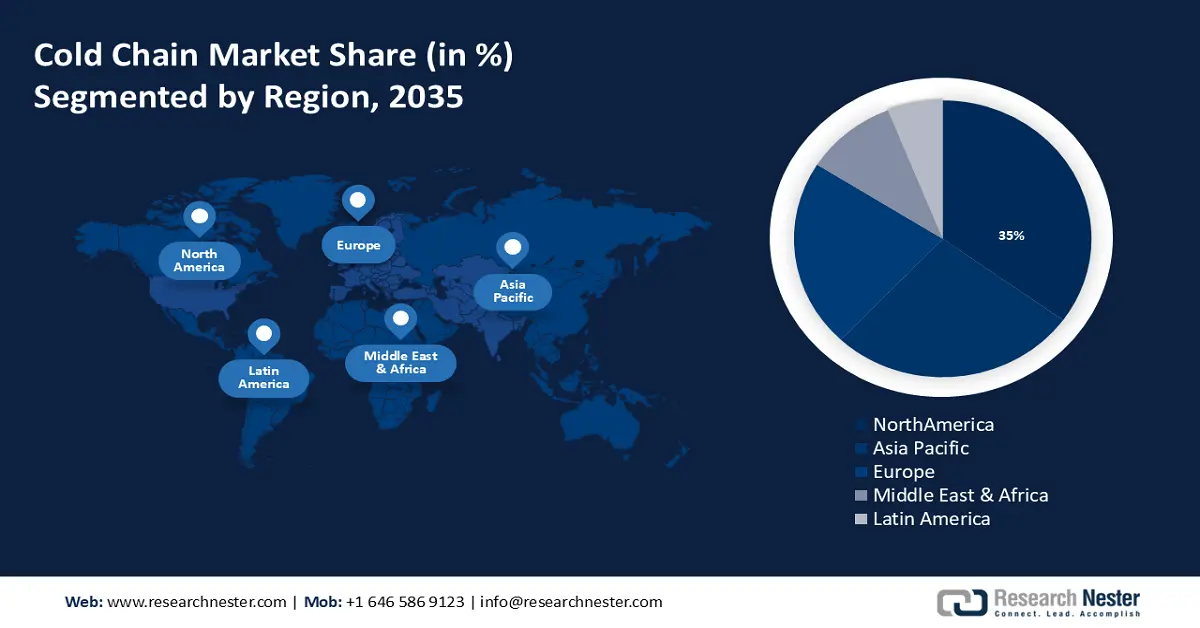

- North America cold chain market will hold more than 35% share by 2035, fueled by the integration of cutting-edge technologies such as blockchain and IoT.

- Asia Pacific market will achieve huge CAGR during 2026-2035, fueled by public spending on logistics infrastructure and WMS adoption.

Segment Insights:

- The refrigerated transportation segment in the cold chain market is anticipated to hold a 60% share by 2035, driven by its critical role in maintaining product integrity during transit.

- The food & beverages segment in the cold chain market is poised for lucrative growth over 2026-2035, driven by advancements in packaging and storage of processed and seafood products.

Key Growth Trends:

- Temperature regulation is becoming more and more important to avoid food loss and other health risks

- Multimodal transportation to save fuel expenses

Major Challenges:

- Preserving product quality while transporting perishable goods

- Fuel prices and efficient control of fuel consumption

Key Players: Hanson Logistics Ltd, Lineage, Inc., Americold Logistics, Inc., VersaCold Logistics Services, AGRO Merchants Group, Henningsen Cold Storage Co., Cloverleaf Cold Storage Co., John Swire & Sons Ltd., Interstate Cold Storage, Inc., Conestoga Cold Storage.

Global Cold Chain Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 308.26 billion

- 2026 Market Size: USD 336.56 billion

- Projected Market Size: USD 814.2 billion by 2035

- Growth Forecasts: 10.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, India

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 17 September, 2025

Cold Chain Market Growth Drivers and Challenges:

Growth Drivers

- Temperature regulation is becoming more and more important to avoid food loss and other health risks - Fresh vegetables, dairy products, and medications are among the perishable goods in high demand due to the world's population growth and increasing urbanization which will boost cold chain market demand. For instance, the United Nations reported that after an estimated 2.5 billion people in 1950, the world's population increased to 8.0 billion in mid-November 2022, with an additional 1 billion since 2010 and 2 billion since 1998.

Moreover, because of this rise, careful temperature control across the supply chain is required to ensure the safety and quality of the product. The complexity of today's supply chain, with its many distribution channels and long transit routes, makes temperature control even more crucial.

- Multimodal transportation to save fuel expenses - Because intermodal transport may optimize fuel costs better than any other method, it has become a key solution in the cold chain market. A careful balance between efficiency and temperature control is required in cold chain logistics.

In order to carry goods to their destination, intermodal transport effortlessly integrates several modes of transportation, including trucks, trains, and ships. This accomplishes this equilibrium. Through strategic combination of several forms of transportation, organizations can reduce fuel use by leveraging their respective capabilities and costs. The use of liquid fuels in the global transportation industry is increasing by 36 quadrillion Btu.

- Increasing technological advancements - Factors that are believed to fuel the cold chain market demand of cold chain owing to recent technological advancements that provide real-time visibility into internal temperature conditions and tracking of the location and status of products in transit. This makes cold chain transportation a viable option for the transportation of temperature-sensitive products. To further lessen the overall carbon footprint, companies in the cold chain packaging sector are aggressively innovating traditional packaging to achieve more recyclable and sustainable solutions. In this regard, New England Biolabs and Temperpack together unveiled a 100% recyclable cold chain shipping solution in April 2020.

Challenges

- Preserving product quality while transporting perishable goods - Fresh vegetables, seafood, and medications are examples of perishable items that are extremely sensitive to temperature changes. The quality and safety of the product might be jeopardized by even little departures from the specified temperature range, which can hasten rotting.

Sophisticated refrigeration systems and careful monitoring are needed to achieve and maintain the ideal temperature throughout the whole transportation process, from storage facilities to trucks, ships, or airplanes. Furthermore, keeping the cold chain in place frequently necessitates several handovers and means of transportation, raising the possibility of errors or delays. Every transition offers a chance for physical damage or temperature breaches, thus careful handling and packaging are required.

Fuel prices and efficient control of fuel consumption - The requirement for refrigerated trucks in cold chains has increased recently, especially in North America and Europe, therefore two other major problems for cold chain providers are fuel costs and efficient fuel usage management. On the other hand, running cold chains presents particular difficulties for emerging economies. Businesses in the cold chain incur significantly more in annual operational costs per cubic foot.

Cold Chain Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.2% |

|

Base Year Market Size (2025) |

USD 308.26 billion |

|

Forecast Year Market Size (2035) |

USD 814.2 billion |

|

Regional Scope |

|

Cold Chain Market Segmentation:

Type Segment Analysis

Refrigerated Transportation segment is projected to dominate over 60% cold chain market share by 2035. The segment growth can be expected because it plays a vital part in preserving the freshness and integrity of perishable commodities while they are in transit which will drive cold chain market. Refrigerated transportation guarantees constant temperature control from point of origin to point of destination, in contrast to warehouses, which primarily serve as storage facilities.

Furthermore, improvements in refrigeration technology have made it possible to remotely monitor and manage temperature precisely, improving product traceability and regulatory compliance. Moreover, through facilitating just-in-time delivery, lowering inventory spoilage, and cutting waste, maximizes supply chain efficiency. Its dominance in the market is further increased by its smooth integration with other means of transportation. In 2019, the size of the global cold chain market was estimated to be USD160.0 billion.

Application Segment Analysis

Food & Beverages segment in the cold chain market is poised to grow at lucrative CAGR till 2035. it is poised that technological advancements in the processing, packaging, and storage of seafood will accelerate and will lead to the expansion of cold chain market. However, because of ongoing advancements in packaging materials, processed food is expected to rise dramatically throughout the foreseeable years. Foods that are packaged more effectively have longer shelf lives.

Over the past few years, this has led to a surge in processed food sales. Twenty to sixty percent of the energy consumed by an individual each day comes from processed food, which includes packaged bread, baked goods, ready to eat food, and processed cheese products. Additionally, as per the data by CDC; the fast-food statistics 2021 report states that 34% of children between the ages of 2 and 19 eat fast food every day, 23% of adults in the US eat fast food three or more times a week, and 80% of Americans visit a fast-food restaurant at least once a month.

Our in-depth analysis of the cold chain market includes the following segments:

|

Technology |

|

|

Primary Packaging |

|

|

Secondary Packaging |

|

|

Usability |

|

|

Type |

|

|

Temperature Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cold Chain Market Regional Analysis:

North America Market Insights

North America cold chain market is poised to dominate revenue share of over 35% by 2035.The market expansion in the region is because the integration of cutting-edge technologies, such blockchain and Internet of Things (IoT) sensors, has improved cold chain visibility and traceability. North America is predictable to have 5.4 billion consumer and industrial Internet of Things (IoT) connections by 2025.

In United States, a number of factors, such as the growth of e-commerce and the growing need for temperature-controlled storage in the food and pharmaceutical industries, have contributed to the increase in demand for cold storage facilities. It was predicted that the US e-commerce market would generate a total of 668.5 billion US dollars in revenue between 2024 and 2029.

APAC Market Insights

The APAC region will also encounter huge growth for the cold chain market during the forecast period and will hold the second position owing to the growing public spending on the construction of logistics infrastructure and the adoption of warehouse management systems (WMS) in this region.

The transportation, infrastructure, and logistics sectors in Asia-Pacific have announced 36 stock offering deals, both completed and pending. The total value of these transactions exceeded USD 13,046.6 million.

The expansion of the seafood industry in China is credited to various sources, including technological developments in the areas of processing, packaging, and storage. 2023 saw China maintain its position as the world's leading seafood producer, with official estimates of 71 million metric tons (MMT), up 3.5 percent from 2022.

Modern technologies such as the internet of things are being used in Japan to improve cold chain operations and ensure that products are kept within the correct temperature range throughout the supply chain. In 2022, the expected value of Internet of Things (IoT) user expenditure in Japan was USD 6.8 billion.

In the Korean Peninsula, the cold chain market has grown throughout time as a result of the increasing popularity of e-commerce, the rise in customer demand for perishable goods, and the expansion of food retail chains by multinational corporations. Domestic internet sales increased from USD 168.5 billion in 2021 to USD 180.4 billion in 2022.

Cold Chain Market Players:

- Hanson Logistics Ltd

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Lineage, Inc.

- Americold Logistics, Inc.

- VersaCold Logistics Services

- AGRO Merchants Group

- Henningsen Cold Storage Co.

- Cloverleaf Cold Storage Co.

- John Swire & Sons Ltd.

- Interstate Cold Storage, Inc.

- Conestoga Cold Storage

To stay ahead of the competition and uphold efficiency, integrity, and safety, the major companies in the cold chain market are constantly advancing their technologies. In order to increase productivity with smaller shipments, vendors have adopted RFID technology and Hazard Analysis and Critical Control Points (HACCP).

Recent Developments

- Lineage Logistics Holding, LLC offers users in a range of industries warehousing and logistics solutions. The company's offerings include temperature-controlled public warehouses where a range of food items can be kept, such as fruits and vegetables, fish, ice creams, baked goods, pig, beef, and poultry. In order to service containerized markets and break bulk for its clients, the company also offers port-centric cold chain facilities on the East and West Coasts of the nation. The tailored operational solutions for Fortune 500 firms in different consumer and food industries are included in the third-party facility management services.

- Americold Logistics, Inc. offers temperature-controlled transportation and warehousing services to the food business. Producer solution services include automation, port facilities, public refrigerated warehouses, dedicated facilities, and integrated consolidation initiatives. Under the retailer solutions, system integration, automation, port facilities, network optimization studies, integrated consolidation programs, and i-3PL supply chain are among the services offered. It has made a mark on continents including the Americas and Asia Pacific.

- Report ID: 6047

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cold Chain Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.