Cold Chain Logistics Market - Growth Drivers and Challenges

Growth Drivers

- Increasing demand for perishable and temperature-sensitive products: Global demand for fresh produce, exotic fruits, and temperature-sensitive pharmaceuticals is the main growth driver for the cold chain logistics market. Increasing consumer demand for healthier and more varied diets is driving demand for trustworthy cold chain capabilities to carry perishable products over long distances. Increased emphasis in the pharmaceutical sector on biologics and vaccines that need to be controlled at strict temperatures is another key contributor. For instance, DHL, in July 2025, declared a strategic investment of EUR 2 billion to upgrade its life sciences and healthcare logistics services, such as the installation of fresh pharma cold storage facilities globally. This massive investment signifies the sector's reaction to increased demand for specialized cold chain solutions. This development is hence driving the logistics providers to increase their capacity and implement more advanced technologies.

- Technology upgrades in monitoring and automation: Technological innovations are transforming the cold chain logistics sector, making it more efficient, transparent, and reliable. The use of Internet of Things (IoT) sensors, artificial intelligence (AI), and blockchain technology is offering unparalleled visibility of the supply chain, where temperature monitoring and product tracking in real-time are possible. Automation in cold storage warehouses is also enhancing operational efficiency and minimizing the possibility of human error. In July 2025, CtrlChain and NewCold further strengthened their strategic alliance to introduce a digitally integrated solution encompassing cold warehousing, brokerage, and transport. The solution offers end-to-end orchestration of supply chains in Europe and North America, demonstrating the potential of technology in establishing a more integrated and efficient cold chain. Such integration is redefining the operational excellence benchmark in the sector.

- Strict regulatory standards and quality control: More stringent regulations controlling the storage and transportation of temperature-sensitive goods are a major force driving the cold chain logistics industry. The emphasis on traceability and quality control is also influencing the take-up of solutions that are capable of recording a full audit trail of a product's movement along the supply chain. In June 2025, new advice on safe cold storage, traceability, and compliance with legislation was published by the UK Department for Environment, Food & Rural Affairs, covering the poultry and processed-food industries. This advice mirrors the increasing importance placed on regulatory compliance as a fundamental element of cold chain management. Consequently, those companies that are able to prove a commitment to such high levels of standards are reaping the benefits of a competitive edge.

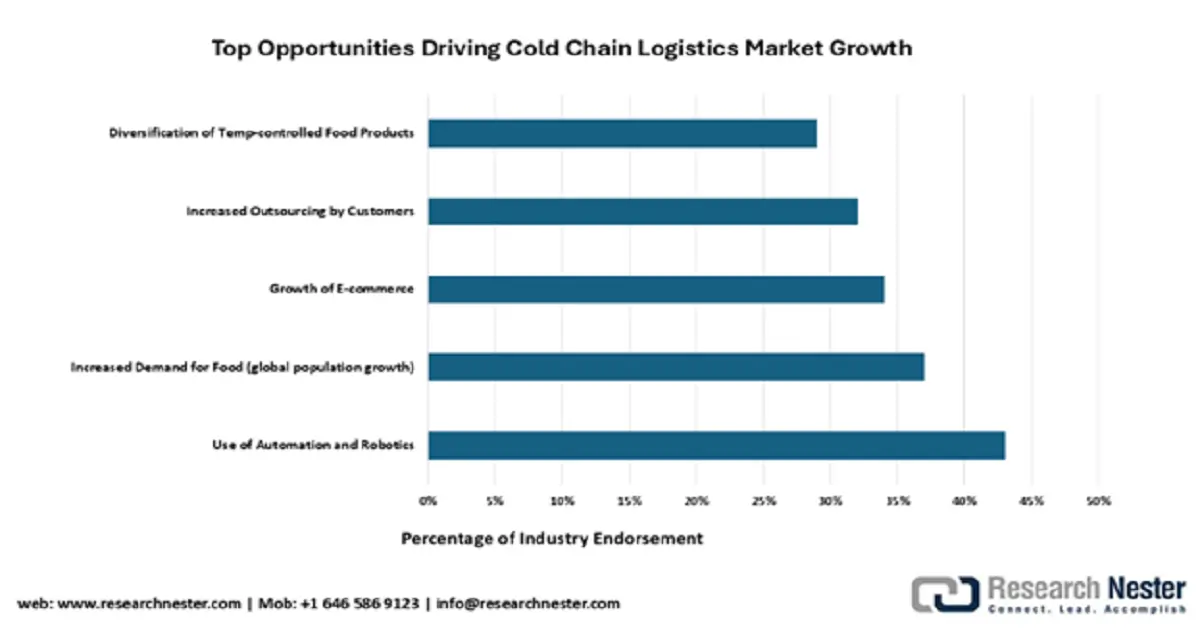

Opportunities Driving Cold Chain Logistics Market Growth

The cold chain logistics market is poised for significant transformation, led by automation and robotics which 43% of industry experts identify as the top opportunity to enhance efficiency and reduce spoilage. Growing global population demand and e-commerce expansion further drive need for scalable, temperature-controlled logistics solutions. These trends highlight a critical shift toward technology-driven, outsourced cold chain services to meet evolving consumer and regulatory demands for perishable goods integrity.

Source: GCCA

Challenges

- Cybersecurity risks to digitalized supply chains: As the cold chain logistics market continues to become digitalized, it thereby becomes exposed to cybersecurity risks. The dependence on interconnected systems to monitor and control the supply chain introduces novel points of entry for malicious individuals. A successful cyber attack would disrupt business, expose sensitive information, and even cause spoilage of temperature-controlled products, resulting in financial losses of considerable magnitude. The industry's complicated network of partners and suppliers adds to the dangers as well. In October 2024, the Canadian Centre for Cyber Security published its National Cyber Threat Assessment 2025–2026, which emphasized the necessity for new digital controls and traceability in temperature-sensitive supply chains. This assessment reinforces the increasing importance of cybersecurity as a key issue for the cold chain industry.

- Infrastructure and standardization gaps in emerging markets: As demand for cold chain logistics increases worldwide, however, most emerging markets lack the infrastructure and standardized procedures to accommodate a contemporary cold chain. Poor road systems, unstable power grids, and too few refrigerated storage facilities can pose major logistical challenges. Unclear standardized regulations and best practices among regions can also complicate cross-border trade and pose compliance issues. These infrastructure shortcomings could result in increased operational costs as well as more product wastage. In May 2025, the Ministry of Food Processing Industries of India published new national guidelines for Integrated Cold Chain and Value Addition Infrastructure. This move to encourage public-private investment in cold chains in refrigerated transport and storage recognizes the current infrastructure gaps and the imperative to come together to create a stronger cold chain ecosystem in the country.

Cold Chain Logistics Market Size and Forecast:

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

14% |

|

Base Year Market Size (2025) |

USD 385.6 billion |

|

Forecast Year Market Size (2035) |

USD 1,429.5 billion |

|

Regional Scope |

|