Coin Cell Batteries Market Outlook:

Coin Cell Batteries Market size was valued at USD 5.6 billion in 2025 and is expected to reach USD 11.12 billion by 2035, expanding at around 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of coin cell batteries is evaluated at USD 5.96 billion.

Batteries are vital component to run any devices and are gaining widespread demand across the world. Continuous innovations are augmenting the sales of compact batteries, such as coin-cell batteries. High performance, durability, and miniature design are prime factors fueling the sales of coin cell batteries. According to the analysis by the Observatory of Economic Complexity (OEC), batteries held the 401st position as the most traded product in 2022. The global batteries trade totaled USD 9.26 billion in 2022, highlighting China as the major exporter and the U.S. as the prime importer. Furthermore, the coin cell batteries market concentration analyzed using Shannon Entropy accounted for 3.99, underscoring the export dominance of 15 countries.

|

Country |

Battery Value in Exports (USD Million) |

Country |

Battery Value in Imports (USD Million) |

|

China |

2530 |

U.S. |

414 |

|

Singapore |

468 |

Mexico |

228 |

|

Indonesia |

458 |

Canada |

220 |

|

Japan |

197 |

Italy |

154 |

|

Israel |

101 |

U.K. |

136 |

Source: OEC World

VARTA AG one of the leading manufacturers of coin cell batteries revealed that it totaled USD 224.3 million in Q3 FY23, the revenue surpassed by 11.0% compared to the previous year. The company held a dominating position in the micro batteries segment, reflecting an adjusted EBITDA margin of 14.9%. Lithium-ion coin power segment accounted for stable sales in Q3 2023. The consumer batteries totaled a net sales worth USD 242.16 million, between 1 January 2023 to 30 September 2023.

Key Coin Cell Batteries Market Insights Summary:

Regional Highlights:

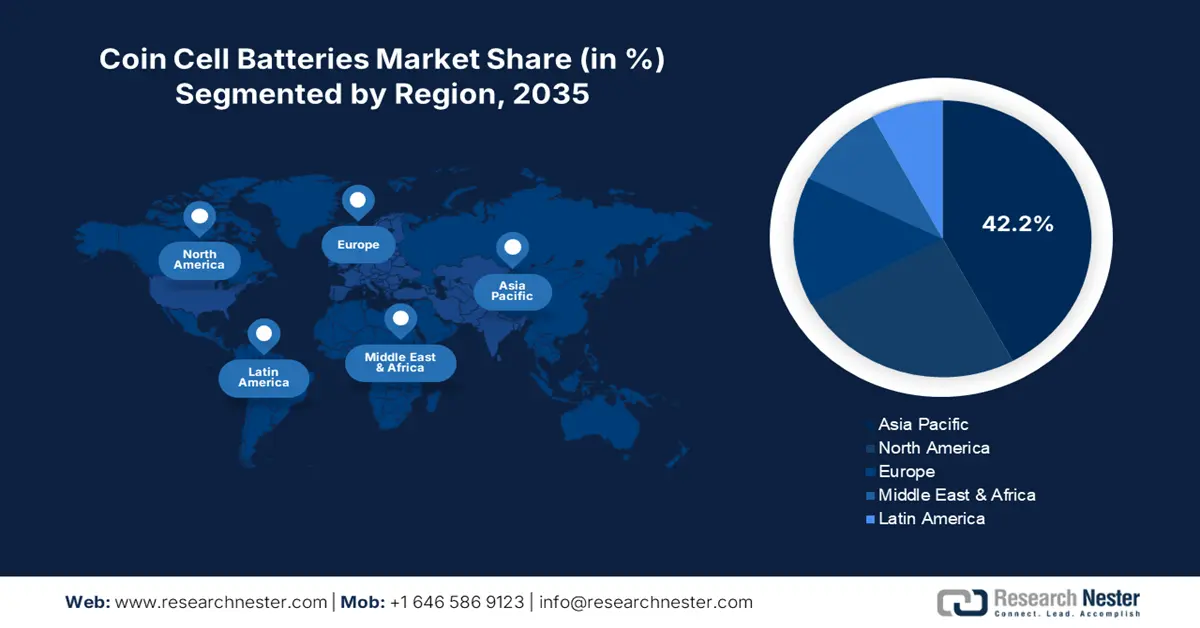

- Asia Pacific commands a 42.20% share in the Coin Cell Batteries Market, fueled by growth in consumer electronics and adoption of advanced vehicles and medical devices, ensuring strong growth by 2035.

- North America's coin cell batteries market expects the fastest growth by 2035, driven by the innovation in battery technologies and increasing demand for wearables and EVs.

Segment Insights:

- The Consumer Electronics segment is forecasted to achieve more than 46.8% market share by 2035, propelled by innovations in compact and reliable electronic products.

- The CR (Lithium) / Lithium Cell Batteries segment of the Coin Cell Batteries Market is projected to hold over 38.5% share by 2035, driven by the miniaturization trend and versatility of lithium.

Key Growth Trends:

- Advancements in medical wearable and monitoring technologies

- Technological advancements

Major Challenges:

- Competition from alternative technologies

- Environmental & disposal regulations

- Key Players: Duracell Inc., VARTA AG, Energizer Holdings, Inc., and Eveready Battery Company, Inc.

Global Coin Cell Batteries Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.6 billion

- 2026 Market Size: USD 5.96 billion

- Projected Market Size: USD 11.12 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, United States, Germany, South Korea

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 13 August, 2025

Coin Cell Batteries Market Growth Drivers and Challenges:

Growth Drivers

-

Advancements in medical wearable and monitoring technologies: The increasing innovations in medical monitoring devices and wearable technologies are generating profitable opportunities for coin cell batteries. The compact trend is driving high demand for small and long-lasting batteries in medical devices. The low self-discharge rate of coin cell batteries ensures reliability for medical applications such as pacemakers and glucose meters. For instance, in September 2023, Resonetics LLC announced the introduction of a Contego 200 mAh miniature D-shaped cell lithium/carbon monofluoride battery. This battery offers high performance in implantable devices. Key players are widely targeting the healthcare sector to introduce innovative coin cell batteries and earn high profits.

-

Technological advancements: The integration of advanced technologies such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) is aiding coin cell batteries market players in developing advanced components to enhance the performance of coin cell batteries. Coin cell battery manufacturers either solely or in collaboration with tech companies are concentrating on the introduction of innovative battery solutions. For instance, in January 2024, Ambient Scientific introduced an advanced AI Processor GPX-10 with 10 AI Cores. This innovative processor effectively aids cloud-free AI applications to run on portable battery-powered devices. GPX-10 manufactured using DigAn technology also drives fusion applications on c0in cell batteries.

Challenges

-

Competition from alternative technologies: Coin cell battery manufacturers are witnessing major challenges from the increasing emergence of alternative technologies. Supercapacitors, micro fuel cells, and advanced energy harvesting technologies are some of the other power sources hindering the sales of coin cell batteries. For instance, TDK Corporation to replace coin cell batteries recently developed an innovative CeraCharge-type material used in solid-state batteries, installed in wearable devices such as smartphones, hearing aids, and wireless earphones.

-

Environmental & disposal regulations: The coin cell batteries are integrated with hazardous materials such as mercury and cadmium, their improper disposal often creates environmental challenges. Thus, governments across the world are implementing stringent regulations on the disposal and recycling of batteries. These further increase the compliance costs and hamper the revenues of coin cell battery producers.

Coin Cell Batteries Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 5.6 billion |

|

Forecast Year Market Size (2035) |

USD 11.12 billion |

|

Regional Scope |

|

Coin Cell Batteries Market Segmentation:

Type (LR (Alkaline)/ Alkaline Watch Batteries, SR (Silver Oxide) / Silver Oxide Cell, CR (Lithium) / Lithium Cell Batteries, ZnAir / Zinc-air batteries, Others)

CR (lithium) / lithium cell batteries segment is predicted to dominate coin cell batteries market share of over 38.5% by 2035. The versatility and durability of lithium are majorly contributing to the segmental growth. The miniaturization trend is increasing the use of lithium coin cell batteries in advanced electronics. Continuous technological advancements are also increasing the applications of coin cell batteries. Furthermore, manufacturers are focused on developing lithium coin cell batteries with enhanced features and safety design. Lithium coin cell battery manufacturers are set to earn high profits in the coming years owing to their increasing applications in sectors such as automotive, medical, and consumer electronics. According to the analysis by the U.S. Geological Survey (USGS), the consumption of lithium worldwide totaled 180,000 tons in 2023, a 27% rise compared to the previous year.

Application (Consumer Electronics, Medical Devices, Industrial Devices, Others)

In coin cell batteries market, consumer electronics segment is expected to account for revenue share of more than 46.8% by the end of 2035. The increasing innovations in electronic products are driving the use of miniature batteries such as coin cell batteries. The compact design, durability, and reliability augment the use of coin cell batteries in electronic products. Furthermore, the rise in the sales of consumer electronics is set to double the profits of coin cell batteries.

Our in-depth analysis of the global coin cell batteries market includes the following segments:

|

Category |

|

|

Type |

|

|

Application |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Coin Cell Batteries Market Regional Analysis:

Asia Pacific Market Forecast

Asia Pacific coin cell batteries market is predicted to capture revenue share of over 42.2% by 2035. The expanding consumer electronics sector, continuous innovations in medical devices, and the adoption of advanced automobiles collectively contribute to the coin cell batteries market growth. India and China are estimated to offer high-earning opportunities for coin cell battery manufacturers in the coming years. The strong presence of key market players is substantially augmenting the sales of coin cell batteries in Japan and South Korea.

China is one of the largest producers of semiconductors across the world and this is significantly driving the coin cell batteries market growth. The Information Technology and Innovation Foundation (ITIF) reveals that between 2021 and 2022 nearly 55.0% of the semiconductor patent applications were registered in China. The increasing adoption of advanced vehicles is further fueling the demand for coin cell batteries. For instance, in August 2024, China’s State Council Information Office declared that around 16,000 licenses were issued for the testing of autonomous vehicles.

In India, rapid advancements in the medical device and consumer electronics sectors are propelling the demand for advanced coin cell batteries. The India Brand Equity Foundation (IBEF) report revealed that the approval of the National Medical Devices Policy 2023 is set to boost medical device sales to USD 50.0 million by 2030. Electronics system design & manufacturing (ESDM) is one of the swiftly expanding markets in India. The supportive government policies and foreign direct investments are also contributing to the coin cell batteries market growth. IBEF report states that around USD 1.06 billion were invested under the scheme for promotion of manufacturing of electronic components and semiconductors.

North America Market Statistics

The North America coin cell batteries market is set to expand at the fastest pace throughout the projected period. The rising lithium exploration, innovation in battery technologies, a boom in advanced automotive component manufacturing, and developments in consumer electronics are fueling the sales of coin cell batteries. Both, the U.S. and Canada are set to witness high coin cell battery trade activities owing to supportive government policies and investment flows.

In the U.S., innovations in wearable devices such as smartwatches, fitness trackers, and medical devices such as hearing aids and glucose monitors are significantly fueling the demand for coin cell batteries. The health & wellness trend and presence of tech-savvy consumers are driving sales of smart wearable devices, which further augment the profits of coin cell battery manufacturers.

In Canada, the strong presence of auto manufacturers and increasing innovations in autonomous vehicles are directly pushing the sales of coin cell batteries. The introduction of keyless entry systems and the shift towards electric vehicles are increasing the adoption of coin cell batteries.

Key Coin Cell Batteries Market Players:

- Duracell Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- VARTA AG

- Energizer Holdings, Inc.

- Eveready Battery Company, Inc.

- Seiko

- Camelion Batteries GmbH

- Renata AG SA

- EM Microelectronic

- Zeus Battery Products

- Nexperia

The coin cell batteries market is characterized by the presence of industry giants and the emergence of new companies. The leading companies are employing several marketing strategies such as new product launches, collaborations & partnerships, mergers & acquisitions, and global expansions to earn high profits and maximize their reach. Organic and inorganic strategies both play a vital role in uplifting the profits of key players. Collaborations with high-tech companies and partnerships with other players significantly boost the coin cell batteries market reach of the coin cell battery manufacturers. The new companies invest heavily in R&D activities to introduce innovative solutions and stand out in the crowd.

Some of the key players include:

Recent Developments

- In July 2023, Nexperia announced the launch of NBM7100 and NBM5100 an advanced type of ICs that life of non-rechargeable lithium coin cell batteries up to 10x. These next-gen ICs reduce the amount of battery waste in low-power IoT and portable applications.

- In May 2023, VARTA AG introduced its several battery products at the COMPUTEX 2023 trade fair in Taipei. The portfolio ranges from rechargeable lithium-ion coin cells to gas-generating cells and industrial pro batteries.

- Report ID: 6960

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Coin Cell Batteries Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.