Cognitive Robotics Market Outlook:

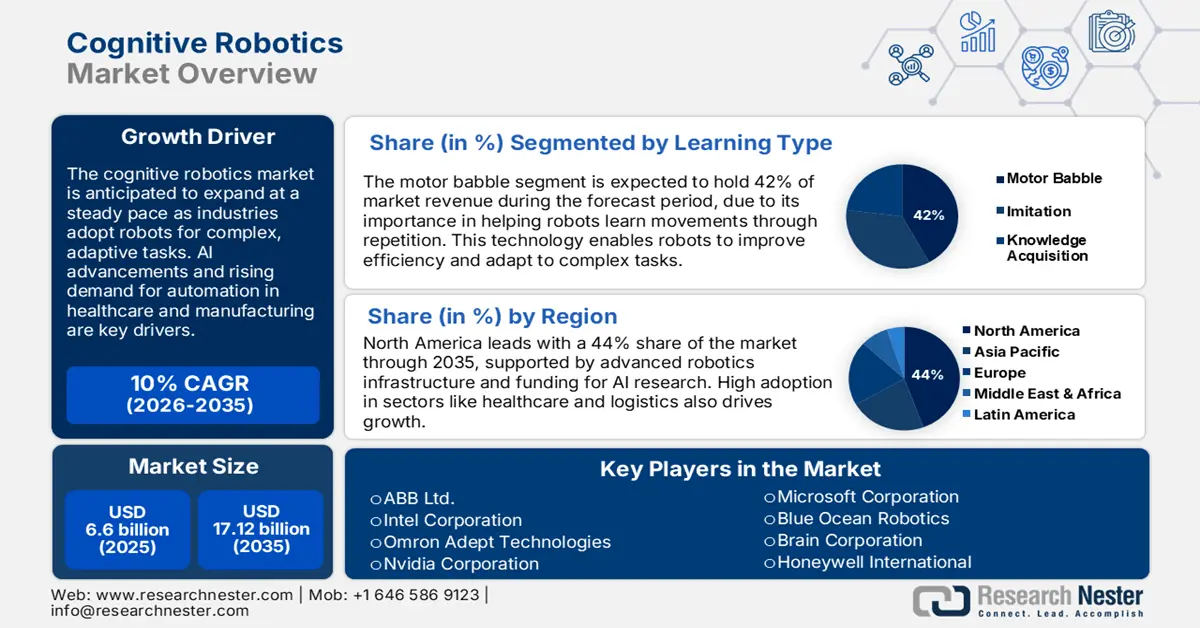

Cognitive Robotics Market size was valued at USD 6.6 billion in 2025 and is expected to reach USD 17.12 billion by 2035, registering around 10% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cognitive robotics is evaluated at USD 7.19 billion.

The demand for cognitive robotics is rising at a rapid pace as several industries are adopting AI-powered mechanisms for increasing automation, decreasing labor costs, and embracing efficiency in all fields. These robots combine the power of artificial intelligence, machine learning, and sensor integration to realize decision-making and adaptability in changing environments. Advancement in recent times has ensured their use right from health care and logistics to automotive and defense. For example, in June 2024, Thales launched OpenDrobotics, which is an open-source platform that accelerates global collaboration in cognitive robotics. The market is projected to expand as businesses integrate intelligent automation into their workflows.

Strategic funding and policy frameworks by governments across the world are key in propelling the cognitive robotics market growth. In March 2024, Dubai launched the RDI Grant Initiative to support advancements in the areas of AI, robotics, and life sciences. It also ignited startups and research organizations to address major challenges in automation. Such areas of focus align with the global drive to use robotics for solving the labor scarcity problem, ensuring productivity, and sustainability. While innovation and collaboration-driven initiatives drive the cognitive robotics market, the emergence of cobots is redefining automation and making it affordable, even for small and medium-scale enterprises.

Key Cognitive Robotics Market Insights Summary:

Regional Highlights:

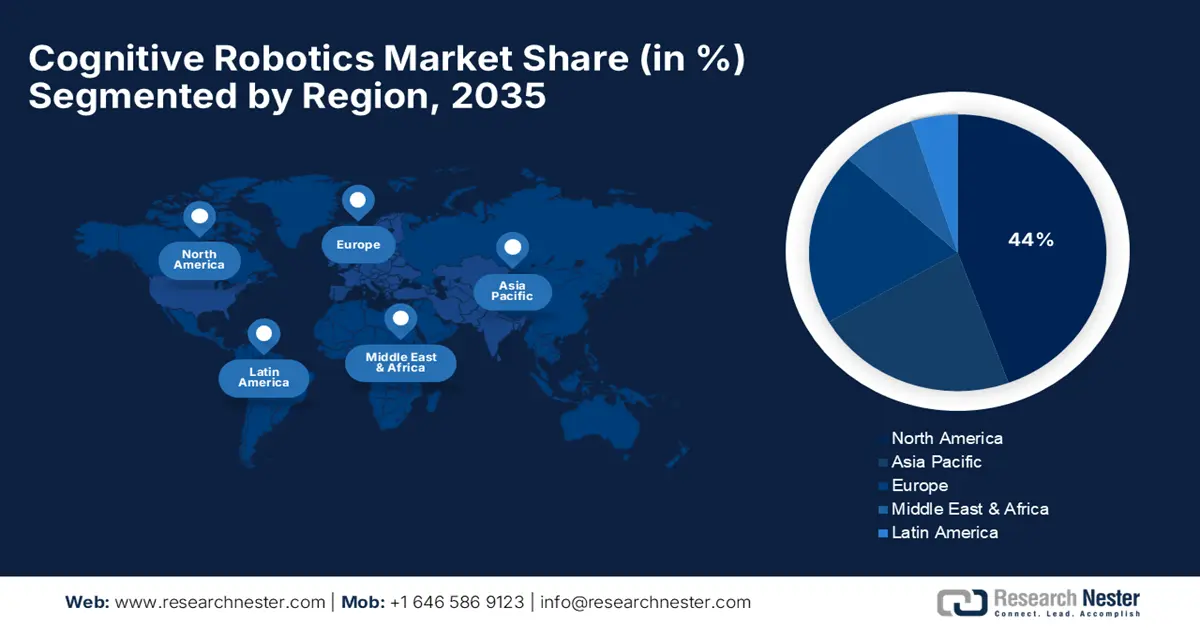

- North America is projected to secure over 44% revenue share by 2035 in the cognitive robotics market, owing to substantial R&D spending and strong early adoption of advanced technologies.

- Asia Pacific is expected to record around 8.8% growth during 2026–2035, supported by rapid industrialization and escalating automation investments.

Segment Insights:

- Motor babble segment is anticipated to capture over 42% share by 2035 in the cognitive robotics market, propelled by its essential function in enabling trial-and-error learning in dynamic robotic environments.

- Automotive segment is projected to command more than 31% share by 2035, supported by the sector’s expanding dependence on robotics for advanced assembly, inspection, and logistics operations.

Key Growth Trends:

- Increasing demand for cobots

- Improvements in machine learning and AI

Major Challenges:

- Integration complexity across industries

- Data security and privacy

Key Players: IBM Corporation, Intel Corporation, Omron Adept Technologies, Nvidia Corporation, ABB Ltd., CognitiveScale Inc., Kuka AG, Blue River Technology, Hanson Robotics Limited, and Microsoft Corporation.

Global Cognitive Robotics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.6 billion

- 2026 Market Size: USD 7.19 billion

- Projected Market Size: USD 17.12 billion by 2035

- Growth Forecasts: 10%

Key Regional Dynamics:

- Largest Region: North America (44% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Singapore, Canada, United Kingdom, Australia

Last updated on : 2 December, 2025

Cognitive Robotics Market - Growth Drivers and Challenges

Growth Drivers

-

Increasing demand for cobots: The demand for collaborative robots, also known as cobots, is on the rise due to their ability to interact perfectly with humans in an industrial environment. These robots are flexible and safe, hence suitable for tasks requiring precision and supervision. In May 2024, Techman Robot launched the TM30S cobot, which can handle heavy payloads with safety and advanced vision. Due to the increasing need for more efficient and safe automation solutions in manufacturing and logistics, the cognitive robotics market is expected to continue to expand.

-

Improvements in machine learning and AI: Advanced integration of machine learning and AI is changing the face of cognitive robotics by enhancing decision-making and adaptability. This allows robots to perform autonomously in an unstructured environment, raising their value proposition considerably across industries. In March 2024, Devin, an AI-based coding engineer who intended to accelerate system integration, developed several opportunities within the market, proving how AI inventions continue to drive further creation. Such progress in technologies keeps redefining the possibilities of cognitive robotics, making them valuable in complex environments.

- Increased investments in R&D: Large investments in R&D drive innovation in cognitive robotics, thus enabling companies to create next-generation solutions for industry vertical-specific applications. For example, NEURA Robotics raised EUR 15.1 million in June 2024 for further development of its offering in cognitive robotics and work on intuitive interaction and adaptive learning. These investments help players overcome rising challenges and fulfill the growing demand for intelligent automation systems, boosting cognitive robotics market growth.

Challenges

-

Integration complexity across industries: Implementation of cognitive robots generally requires highly complex integrations across industries for the robots to achieve complete compatibility with existing systems and workflows. This is due to the fact that most industries lack the modularity and flexibility necessary for seamless robotic implementation, especially those reliant on legacy infrastructure. For example, in manufacturing plants with decades-old machinery, there must be a major upgrade to achieve effective communication between robots and existing equipment.

-

Data security and privacy: Cognitive robots rely on real-time data processing and, therefore, raise significant concerns regarding data security and privacy. These robots often deal with sensitive information, ranging from highly sensitive personal health records in healthcare to confidential design information in manufacturing, and this raises some serious concerns about cybersecurity. A security breach in data integrity will result in operational disruption, financial loss, and possible legal consequences.

Cognitive Robotics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10% |

|

Base Year Market Size (2025) |

USD 6.6 billion |

|

Forecast Year Market Size (2035) |

USD 17.12 billion |

|

Regional Scope |

|

Cognitive Robotics Market Segmentation:

Learning Type Segment Analysis

Motor babble segment is expected to hold cognitive robotics market share of more than 42% by 2035 due to its crucial role in trial-and-error learning in robots. This type of learning is particularly important for those tasks where adaptation is needed in dynamic environments, for example, manufacturing and logistics. In May 2024, Vention launched AI-powered capabilities for its Manufacturing Automation Platform, emphasizing how AI makes motor babble intrinsic within making robots more adaptable. This would allow robots to have broad applications in industries where flexibility and precision are required.

Application Segment Analysis

In cognitive robotics market, automotive segment is set to dominate revenue share of over 31% by 2035, driven by the reliance of the industry on robotics for assembly, inspection, and logistics. With increasingly superior perception and decision-making capabilities, robots will continue to economize production lines by eliminating errors. For instance, in April 2024, Sanctuary AI partnered with Magna International to manufacture specific AI-driven robots that would meet the manufacturing demands and highlight why robotics is so crucial in automotive efficiency. Such developments ensure that the automotive industry remains one of the significant contributors to cognitive robotics market growth.

Our in-depth analysis of the cognitive robotics market includes the following segments:

|

Learning Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cognitive Robotics Market - Regional Analysis

North America Market Insights

North America cognitive robotics market is expected to hold revenue share of more than 44% by 2035, owing to strong R&D investments and early adoption of advanced technologies. Industries in this region, like healthcare, manufacturing, and defense, are looking to boost the adoption of automation to achieve efficiency and lower operation costs. This is constantly being reinforced by government funding and further venture capital investment, making the region a hotbed of innovation in robotics. North America leading position is consolidated with the growing emphasis on integrating AI with robotics to enable learning, decision making, and problem-solving capabilities.

Innovation-driven applications of cognitive robotics in defense, healthcare, and logistics sectors place the U.S. as a leading cognitive robotics market in North America. A notable milestone occurred in November 2023 when CynLr launched Cybernetics Hive, a cutting-edge research facility dedicated to advancing vision intelligence and robotics. This hub is set to drive breakthroughs in robotic manipulation and object recognition, paving the way for more adaptable and intelligent systems across logistics, automotive, and retail industries. Complementing these developments, government initiatives continue to promote the integration of AI and robotics, creating a fertile environment for growth.

Canada is also emerging as a lucrative market for cognitive robotics due to favorable government policy supporting AI and Automation. Collaboration of universities with private firms has led to advancements in areas like healthcare and manufacturing robotics. Examples include surgical robots and patient-assistive devices that are now coming into healthcare. This is further supported by government funding for R&D projects, along with other tax incentives, which act as a key driver to attract investment. With the focus of Canada being on sustainability and automation, it aligns with global trends, hence enabling the country to carve a niche in robotics tailored toward its economic sectors.

Asia Pacific Market Insights

Asia Pacific cognitive robotics market is anticipated to observe growth of around 8.8% between 2026 and 2035, owing to rapid industrialization and growing adoption of automation. In addition, industries are bound to invest in expensive robotics with rising labor costs and aging populations, especially in Japan and China. Many regional governments are actively promoting AI and robotics under key economic strategies, hence issuing grants and subsidies to spur the development of this industry. A large manufacturing base in countries like India and South Korea supports the large-scale adoption of cognitive robotics.

China is one of the largest cognitive robotics market in Asia Pacific due to its aggressive government funding and large-scale industrial adoption. The strategic focus of the country on robotics and AI technologies for self-reliance also aligns with the Made in China 2025 initiative of the country, emphasizing advanced manufacturing. In April 2024, Horizon Robotics launched SuperDrive, which is an autonomous system and cognitive technology breakthrough. These innovations underpin the country's commitment to infusing state-of-the-art solutions into industries such as automotive and smart logistics. Furthermore, the rise of robotics in emerging segments like e-commerce logistics and smart cities drives growth in China.

The cognitive robotics market is gaining momentum in India, majorly due to industrial automation and adoption in the healthcare industry. In February 2024, OMRON Automation launched the TM S Series Collaborative Robots in its robotics portfolio for the first time in India. Such developments support the focus of India to enhance productivity and ensure workplace safety by way of advanced robotics. Furthermore, initiatives such as Make in India and Digital India further boost growth momentum, attracting foreign investments and encouraging local manufacturing capabilities. With supportive government policies coupled with an increasing academic and industrial collaboration ecosystem, India is well on its way to becoming a key player in cognitive robotics.

Cognitive Robotics Market Players:

- IBM Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ABB Ltd.

- Intel Corporation

- Omron Adept Technologies

- Nvidia Corporation

- Microsoft Corporation

- Blue Ocean Robotics

- Brain Corporation

- Honeywell International

- Intuitive Surgical Operations

- iRobot

- Kuka AG

- Roborock

- Simbe Robotics

- CloudMinds Technology Inc.

The competition in the cognitive robotics market is fragmented, with leading players continuously making innovations to cater to various industries like healthcare, automotive, and manufacturing. Companies such as IBM Corporation, Intel Corporation, and ABB Ltd are focusing on investments in R&D to make robotic systems capable of adopting intelligence. Collaborative ventures and acquisitions in the firms to strengthen their technological edge and expand market reach constitute another prominent trend. Startups further promote dynamism with innovative solutions in niches to the demands of industries and create a frenzy of competition.

In June 2024, ABB Robotics launched OmniCore, an advanced automation platform that would guarantee increased precision and efficiency in industrial applications. This is a clear example of the growing trend toward ease of operating a robot and expansion in robotic solutions. Similarly, strategic partnerships of cognitive robotics companies with AI providers accelerate the development of AI-enabled robotics platforms. With the rise in competition, the key strategies toward cost reduction, increased adaptability, and integration of IoT and machine learning capabilities are likely to drive the growth in the cognitive robotics market.

Here are some leading players in the cognitive robotics market:

Recent Developments

- In September 2024, the Zhejiang Humanoid Robot Innovation Center, primarily funded by SUPCON, unveiled the NAVAI Navigator 2, a humanoid robot standing 1.65 meters tall and weighing 60 kilograms. With 41 degrees of freedom, it can perform complex tasks such as delivering speeches, making tea, and playing chess, demonstrating advanced motion mapping and execution capabilities. The robot's AI computing power enables 275 trillion operations per second, allowing rapid learning and precision in industrial scenarios.

- In May 2024, Cicada Innovations, Ai Group, and Robotics Australia Group collaborated to support the National Robotics Strategy. This partnership aims to foster growth and scalability within the robotics industry by providing resources and guidance to companies, promoting innovation, and enhancing position of Australia in the global robotics market.

- Report ID: 6721

- Published Date: Dec 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cognitive Robotics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.