Cognitive Automation Market Outlook:

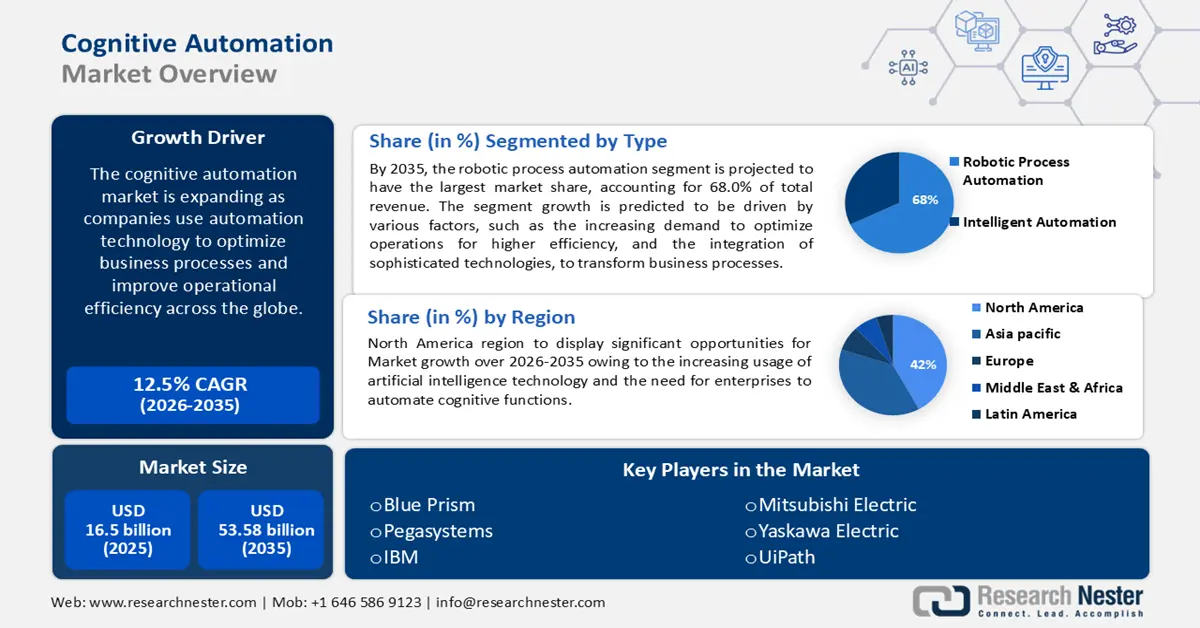

Cognitive Automation Market size was valued at USD 16.5 billion in 2025 and is likely to cross USD 53.58 billion by 2035, registering more than 12.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cognitive automation is assessed at USD 18.36 billion.

Partially or fully cognitive automated machines are gaining traction in electronics and automotive manufacturing, metal fabrication, food and beverage industry, warehousing, and logistics to improve productivity while relieving human workers from life-threatening or mundane tasks. Cognitive automation robots are primarily used in production lines for assembling basic components and metal-cutting activities. The commercial demand for smart and more interactive machines has led to the development of collaborative robots that work with humans in shared environments. Cognitive automation is projected to bridge the labor shortage in heavy-duty industries and commercial spaces.

Key Cognitive Automation Market Insights Summary:

Regional Highlights:

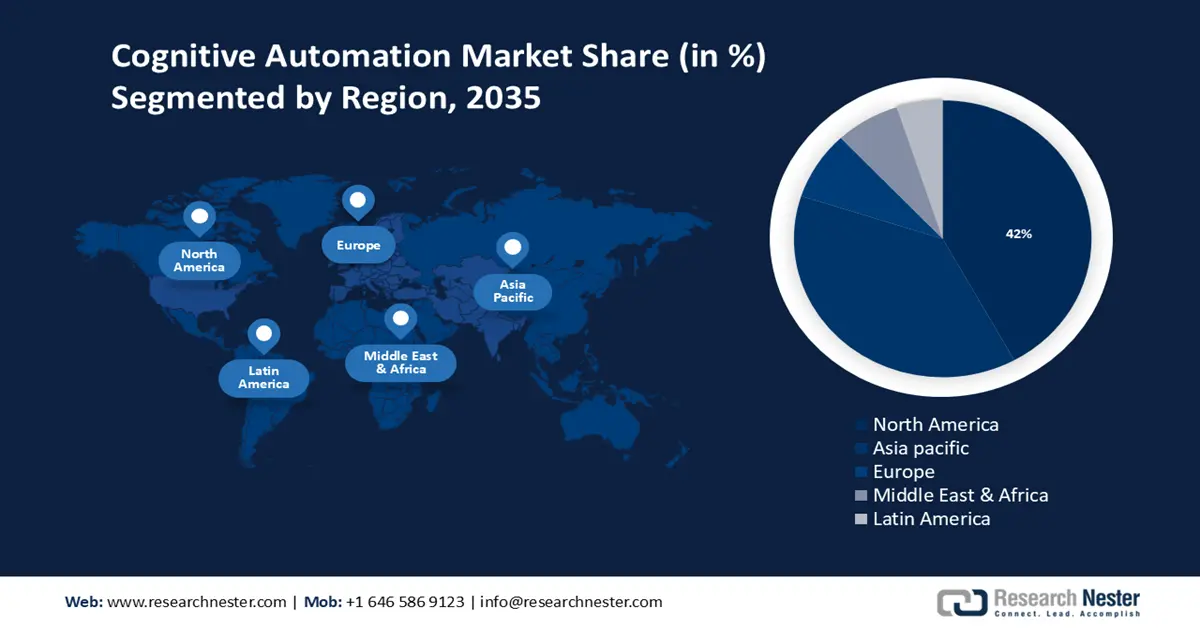

- The North America cognitive automation market will account for 42% share by 2035, driven by the increasing usage of artificial intelligence technology and the need for enterprises to automate cognitive functions.

- The Asia Pacific market will register significant growth during the forecast timeline, driven by rapid digitization and a surge in interest in automation and AI technology.

Segment Insights:

- The robotic process automation (rpa) segment in the cognitive automation market is forecasted to dominate with a 68% share by 2035, driven by increasing demand to optimize operations for higher efficiency and integrating advanced technologies.

- The machine learning segment in the cognitive automation market is anticipated to achieve significant growth till 2035, driven by efficient handling and extraction of valuable information from data using ML algorithms.

Key Growth Trends:

- Robotic Process Automation (RPA) adoption in business process automation

- Reconfiguration of insurance operation model

Major Challenges:

- Selecting the appropriate tools

- Resource allocation

Key Players: Blue Prism, Automation Anywhere, NICE Systems Ltd., Tungsten Automation, Pegasystems, EdgeVerve Systems Limited, FPT Software, IBM, WorkFusion, Yaskawa Electric, Mitsubishi Electric, Omron Robotics and Safety Technologies Inc.

Global Cognitive Automation Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 16.5 billion

- 2026 Market Size: USD 18.36 billion

- Projected Market Size: USD 53.58 billion by 2035

- Growth Forecasts: 12.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, United Kingdom, Japan

- Emerging Countries: China, India, Singapore, South Korea, Japan

Last updated on : 17 September, 2025

Cognitive Automation Market Growth Drivers and Challenges:

Growth Drivers

- Robotic Process Automation (RPA) adoption in business process automation: RPA or bots enable software to interact with applications and customers. Some early proponents of RPA include companies offering digitization software focused primarily on reading images through optical character recognition and delivering structured data into databases. Companies have been striving to diversify their digitization business portfolios using RPAs to include business process automation in daily tasks such as workflow management and operations.

Traditional proprietary programming creates a barrier to broader automation. However, RPA is easier to program as it uses graphical user interfaces (GUI) instead of writing codes. The development and deployment of RPA are affordable and faster than conventional counterparts. The RPAs are also pertinent to agencies seeking to digitize their records. In December 2022, the Office of Management and Budget (OMB) and the National Archives and Records Administration (NARA) jointly issued a Memorandum, M-19-21 for the transition to electronic records, advocating RPAs. - Reconfiguration of insurance operation model: Cognitive automation streamlines the healthcare claim processing using RPA, AI, and ML tools. Automated underwriting aids insurers in simplifying customer data, providing tailored packages for customers, assessing risks, and identifying areas of potential cost savings, unlike manual claim settlement that surges adjudication costs due to the poorly integrated data and delays in insurer claim review.

Key players have taken a significant leap forward in digital underwriting technology, providing insurers with a comprehensive and efficient solution for policy application processing. This advances their goal to reinvent the consumer's experience through innovative technology. For instance, in December 2023, Munich Re Automation Solutions launched the SARA interview screens module in Italy, Portugal, Spain, and Latin America. The new underwriting tool accelerates policy application and healthcare claim processes.

Furthermore, in June 2024, Appian and Swiss Re introduced Connected Underwriting Life Workbench in Europe, Asia Pacific, and the Middle East and Africa (MEA). It incorporates Magnum, Swiss Re’s automated health insurance underwriting solution, and consolidates scattered emails and lengthy documents while replacing outdated systems. Ongoing innovations refine underwriting processes while allowing agile adaptation to local regulations.

Traditional underwriting workbenches lack integration across internal partners and third-party systems, on cloud or on-premises. Typical life insurance requires underwriters to sign in to multiple systems for accessing information, assessing complex calculations, conducting risk analysis, and updating case information to underwrite every life insurance policy. Modern underwriters seek a unified system to orchestrate tasks, updates, and transactions seamlessly and effortlessly. Key plays are capitalizing on the existing gaps in the market.

Challenges

- Selecting the appropriate tools: There are numerous tools available that can handle large amounts of data. The selection of these tools should be based on the specific type of data and the business's data access requirements. Open-source tools that can be seamlessly integrated with most programs are highly recommended. However, selecting the most suitable solution from a wide range of open-source technologies can be a challenging task.

- Resource allocation - Cognitive automation achieves high success rates with the complete access to company data. However, the process of gathering all the necessary resources for task completion is complex. If any procedure fails to integrate, the entire cognitive automation process will fail. This requires rectification to construct an integrated automation solution utilizing cognitive automation systems.

Cognitive Automation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.5% |

|

Base Year Market Size (2025) |

USD 16.5 billion |

|

Forecast Year Market Size (2035) |

USD 53.58 billion |

|

Regional Scope |

|

Cognitive Automation Market Segmentation:

Type Segment Analysis

By 2035, the robotic process automation segment is projected to hold 68% of the global cognitive automation market share by 2035. The segment growth is predicted to be driven by various factors, such as the increasing demand to optimize operations for higher efficiency, and the integration of sophisticated technologies, to transform business processes. Robotic process automation (RPA) is highly efficient in automating monotonous, manual processes, such as data entry, form completion, validation, extraction, and simple computations. RPA bots replicate human interactions with user interfaces, allowing them to perform jobs with greater speed and precision.

In addition, enterprises can streamline intricate decision-making processes, analyze data, and manage unstructured data more efficiently by integrating RPA with cognitive capabilities. As an illustration, NASA has deployed an automated bot that generates procurement requests for the agency without requiring human intervention. This automates a monotonous and unproductive activity, enabling NASA procurement specialists to dedicate their attention to more significant tasks.

End use Segment Analysis

In the projected timeframe, the BFSI segment in the cognitive automation market is anticipated to account for 25% of the revenue share. Cognitive process automation in the Banking, financial services, and insurance sectors improves risk management and fraud detection. AI algorithms have the capability to analyze vast quantities of data, equipping them to identify patterns and notify consumers of possible scams. The BFSI sector presents substantial prospects for enhancing operational efficiency, and client experiences and reducing risks through cognitive process automation.

WorkFusion estimates that over 60% of the manual tasks involved in the customer onboarding process at a bank can be automated to some extent. Approximately half of the reduction in work can be achieved by incorporating machine learning, digitization, and analytics in addition to robotic process automation (RPA).

Application Segment Analysis

The machine learning segment is expected to hold 28% share of the global cognitive automation market by 2035. Cognitive process automation employs machine learning algorithms to efficiently handle, examine, and extract valuable information from both organized and unorganized data. This empowers businesses to expand their operations and make well-informed choices by utilizing data analysis.

Furthermore, intelligent document processing employs machine learning techniques to automate the retrieval and examination of information from unorganized documents such as financial accounts, contracts, and invoices. Several businesses are employing cognitive process automation to implement machine learning in several industries. In 2018, NARA introduced its chatbot intending to address inquiries from the public and achieve the agency's strategic aim of connecting with customers.

Our in-depth analysis of the cognitive automation market includes the following segments:

|

Type |

|

|

End use |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cognitive Automation Market Regional Analysis:

North America Market Insights

North America industry is expected to dominate majority revenue share of 42% by 2035. The North America cognitive process automation market is witnessing substantial growth as a result of the increasing usage of artificial intelligence technology and the need for enterprises to automate cognitive functions. Intelligent virtual assistants, such as those employed for customer care and sales assistance, are commonly utilized for interactions in North America. These virtual assistants utilize cognitive process automation to understand and address client inquiries, do activities, and improve customer experiences.

The U.S. in 2023, held the largest revenue share owing to the growth of the automobile sector. Furthermore, the presence of prominent players including Blue Prism, IBM, IPsoft, and Kryon Systems is fostering market growth in the U.S.

The Canada market is driven by the rapid scaling of robotics & cognitive automation (R&CA) capabilities and ongoing investment in exponential technologies such as ML and chatbots. For instance, in November 2022, Sanctuary Cognitive Systems received USD 30 million in SIF funding from the Government of Canada to support its mission of building automation to address labor shortages. It is expected to help position Canada in the global knowledge-based economy.

APAC Market Insights

Asia Pacific region is set to witness significant growth till 2035, owing to rapid digitization and a surge in interest in automation and artificial intelligence (AI) technology. Organizations are implementing cognitive process automation to enhance productivity, save expenses, and optimize operations. China, India, Japan, and South Korea, play a pivotal role by actively investing in AI research, development, and innovation support. As a result, the market for market is poised for significant growth.

The prominent players in the India cognitive automation market are keen on introducing intelligent process automation (IPA), digital process automation (DPA), intelligent business process automation, and hyper-automation to fill gaps between programming interface tools and RPA, in tandem with low-code applications. TCS’ Cognitive Automation Platform has widespread adoption in front- and back offices, particularly catering to the BFSI sector. The domestic launch of advanced solutions by leveraging pre-trained models and configurations is aiding to rapid market expansion.

Cognitive automation market in China held a significant revenue share in 2023. The number of new units of automated robots installed annually reached 290,258 in 2022. To cater to the ever-changing demands of this thriving market, both local and global manufacturers of robots have set up production facilities in China and consistently expanded their production capabilities. The average annual growth rate of robot installations from 2017 to 2022 is 13%.

The number of cognitive automated robot installations in Japan increased by 9% to reach 50,413 units, surpassing the pre-pandemic level of 49,908 units recorded in 2019. Japan holds the dominant position in the global robot manufacturing industry, accounting for 46% of the total global robot production.

Cognitive Automation Market Players:

- UiPath

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Blue Prism

- Appian

- Sanctuary Cognitive Systems

- Munich Re Automation Solutions

- Automation Anywhere

- NICE Systems Ltd.

- Tungsten Automation

- Pegasystems

- EdgeVerve Systems Limited

- FPT Software

- IBM

- WorkFusion

Automation is becoming increasingly prevalent in various fields, ranging from home automation to industrial automation, and even in the form of virtual assistants like "Alexa" and "Google Assistant". This trend indicates that automation will continue to shape the future. Moreover, the cognitive automation market is primarily dominated by prominent industry players who are gaining momentum in the marketplace via the implementation of various strategies, such as mergers and acquisitions.

Recent Developments

- In June 2024, Automation Anywhere introduced AI Agents with the new AI Agent Studio to manage complex cognitive business processes. It allows end users make informed decisions and speeds up processes by up to 90%. It is compatible with foundational model such as models Google Cloud, AWS, and Microsoft Azure OpenAI Service

- In June 2024, UiPath announced the widespread availability of UiPath Automation Cloud on Microsoft Azure in the United Kingdom. This move is in response to the significant demand from customers for local data residency and an increasing requirement for AI and automation solutions from UiPath. The expansion allows both private and public-sector customers to strategically place their infrastructure, apps, and data in order to ensure better compliance with local data residency regulations.

- Report ID: 6318

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cognitive Automation Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.