Cogeneration Equipment Market Outlook:

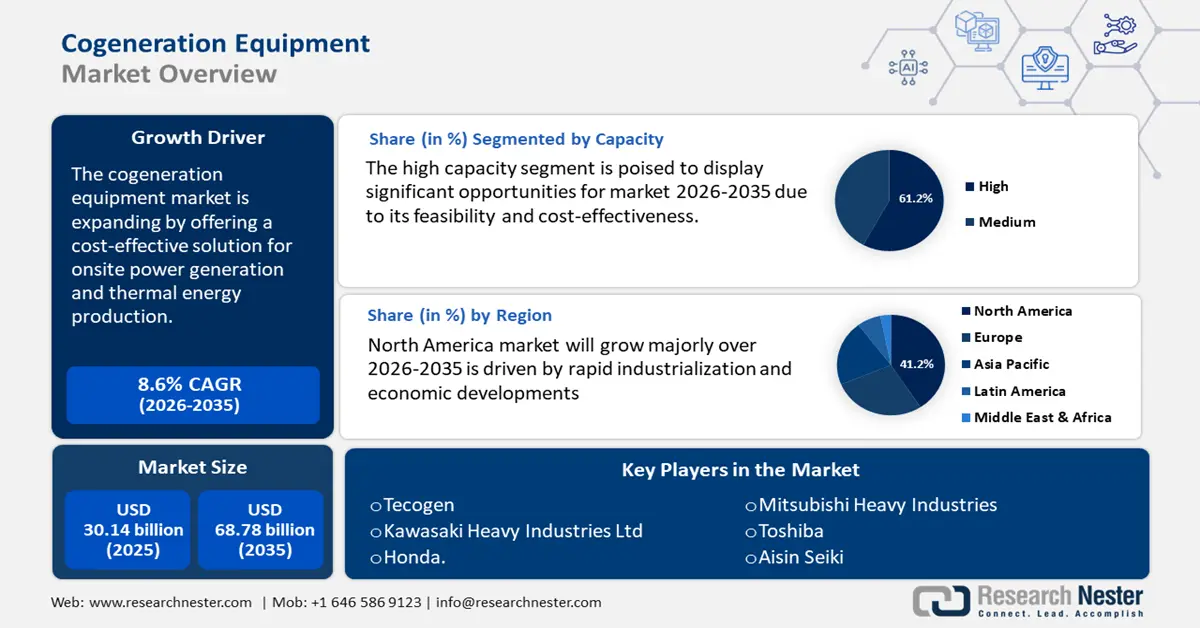

Cogeneration Equipment Market size was over USD 30.14 billion in 2025 and is poised to exceed USD 68.78 billion by 2035, growing at over 8.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cogeneration equipment is estimated at USD 32.47 billion.

The growing emphasis on sustainable development and energy resource recycling has significantly increased the demand for cogeneration equipment. The rapid expansion of global gas infrastructure has further fueled the need for this system, which optimizes energy production by generating multiple energy formats within a single plant, thereby enhancing efficiency and productivity.

Additionally, continuous research and development by key cogeneration equipment market players have led to technological advancements in cogeneration, enabling higher energy output through integrated systems. On the other hand, the increasing adoption of electric vehicles (EVs) has led to a significant rise in electricity demand, thereby boosting the need for cogeneration equipment to improve energy production and meet these new requirements.

Government initiatives offering incentives and schemes have significantly promoted the adoption of cogeneration equipment to meet escalating energy demands. For instance, the U.S. federal government provides a 10% ITC for qualified cogeneration systems. Under the Inflation Reduction Act, the section 48C program provides ITC of 30% for eligible cogeneration equipment projects, encouraging businesses to invest in this energy-efficient technology. Similarly, the European Commission has proposed measures to relax state aid regulations, enabling member countries to provide grants, tax advantages, and other financial incentives for clean technology projects including the CHP system. For instance, the European Commission approved a USD 3.50 billion Czech state aid scheme to support the production of electricity from new and modernized high-efficiency CHP plants.

This scheme is expected to offset emissions by approximately 9.3 million tons of CO2 per year, demonstrating the potential impact of such incentives on advancing energy efficiency and reducing greenhouse gas emissions. The pressing need to mitigate environmental degradation and reduce fossil fuel consumption has further accelerated the deployment of cogeneration systems, which produce multiple energy forms such as electricity and useful thermal energy from a single fuel source.

Common fuels utilized in these systems include natural gas, diesel, and biogas, while the energy outputs encompass thermal, solar wind, and electrical energy. Developed nations have notably transitioned towards renewable energy sources on a large scale to combat climate change and environmental pollution. All these factors collectively drive cogeneration equipment market growth, positioning cogeneration as a crucial solution for efficient and sustainable energy generation.

Typically, a single manufacturing plant generates electricity while recovering waste heat through steam turbines, followed by gas turbines, to maximize energy output. This approach optimizes space and equipment usage, leading to higher energy production and increased revenue over time. Cogeneration systems maximize their thermal efficiency up to 90%, with around 35-55% of the total energy converted into electricity and around 50% utilized as heat. The remaining 10% accounts for energy losses inherent in the process. This system is widely accepted due to conventional energy generation methods.

Furthermore, cogeneration improves energy security by maximizing utility and reliability, further boosting its need in the market. The rising global need for gas infrastructure has significantly driven the adoption of cogeneration technology, positioning it as a key factor in cogeneration equipment market growth.

Key Cogeneration Equipment Market Insights Summary:

Regional Highlights:

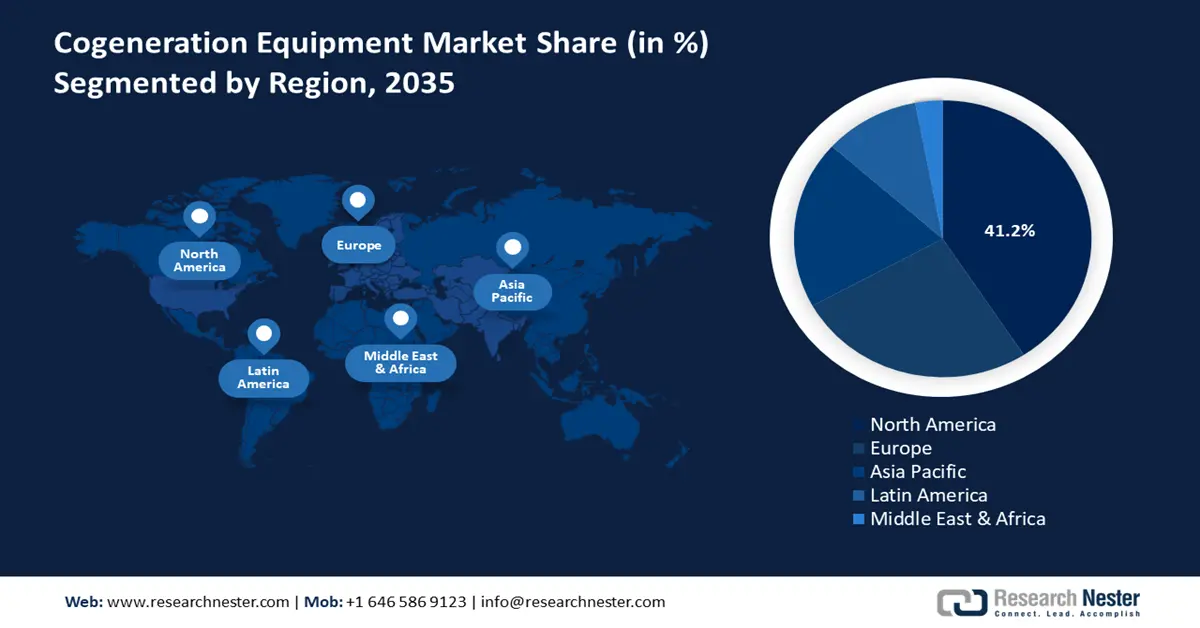

- North America leads the Cogeneration Equipment Market with a 41.2% share, propelled by rapid industrialization and economic development, sustaining strong growth through 2026–2035.

Segment Insights:

- High-capacity cogeneration equipment segment is expected to hold a 61.2% share by 2035, driven by its cost-effectiveness and ability to optimize fuel usage for enhanced productivity.

Key Growth Trends:

- Rising energy costs

- Technological advancements

Major Challenges:

- High initial investment cost

- Policy and regulatory obstacles

- Key Players: Tecogen, Kawasaki heavy industries Ltd, Robert BOSCH Gmbh, Siemens, General Electric, Clarke Energy, 2G Energy AG, Sundrop Fuels Inc., Mitsubishi heavy industries Ltd, A.B. HOLDING S.P.A..

Global Cogeneration Equipment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 30.14 billion

- 2026 Market Size: USD 32.47 billion

- Projected Market Size: USD 68.78 billion by 2035

- Growth Forecasts: 8.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 12 August, 2025

Cogeneration Equipment Market Growth Drivers and Challenges:

Growth Drivers

- Rising energy costs: The increasing cogeneration equipment market volatility and the increasing cost of energy increases the demand for cogeneration equipment systems. The cogeneration system offers a cost-effective solution for onsite power generation and thermal energy production. A cogeneration system generates electricity by simultaneous generation of electricity and capturing waste heat for heating or cooling. Furthermore, it helps businesses and institutions reduce their reliance on grid-supplied electricity, lowering overall energy costs and improving financial performance. According to the U.S. Environmental Protection Agency (EPA), cogeneration systems can achieve an overall energy efficiency of 65-90%, significantly higher than the around 36% efficiency of conventional fossil-fueled power plants. This increased efficiency translates into substantial cost savings for users.

Furthermore, the American Council for an Energy-Efficient Economy (ACEEE) reports that sophisticated energy efficiency systems in the commercial and industrial sectors can minimize energy usage by 20% or more, further contributing to cost reductions. Additionally, cogeneration projects present an attractive ROI, especially in regions with elevated electricity prices. For instance, in March 2024, the European countries of Poland, Italy, and the UK commercial electricity prices were the highest exceeding USD 0.40 per kWh. Similarly, household electricity prices in Europe have seen a significant increase, with Italy experiencing a 30% rise between September and October 2022, reaching USD 0.76 per kWh. A case study by the International Energy Agency (IEA) shows that investors often seek short payback periods of 2-4 years, favoring conversion plants with low capital costs. These factors underscore the economic visibility of cogeneration projects in high-cost energy markets.

Similarly, research conducted by Combined Heat and Power Alliance in the U.S. discovered that commercial and industrial cogeneration projects often achieve payback periods between 3 to 5 years, making them attractive investments for companies seeking long-term cost reductions. For instance, Thermal Energy International reposts typical net project paybacks ranging from 2 - 5 years for their combined heat and CHP solutions. Similarly, the ACEEE notes that a typical simple payback period for a CHP project is around 5 years. Consequently, with the potential for substantial cost savings and relatively short payback periods, cogeneration systems present a compelling option for mitigating rising energy costs and improving the long-term financial performance of users across various industries and regions.

- Technological advancements: Continuous enhancement in cogeneration technology increases the efficiency, reliability, and cost-effectiveness of the CHP system. The need to optimize fuel use and lower operational costs, strict environmental policies that aim to reduce greenhouse gas emissions, advancement in integrating cogeneration systems with renewable sources and smart grids, and the competitive energy market drive the need for more efficient and reliable energy solutions. According to the U.S. EPA, electricity vehicles produce no tailpipe emissions. EVs as a cleaner alternative to gasoline-powered cars. EVs powered by electricity from renewable sources such as solar or wind power produce zero emissions, significantly reducing reliance on fossil fuels.

Continuous enhancement in cogeneration technology enhances system performance, making them more attractive to a broader range of industries. Innovations such as microturbines, fuel cells, and CHP are expanding the application scope of cogeneration equipment, making them more accessible and attractive to a wide range of industries. For instance, micro-CHP systems, which are typically less than 5kWe, can be installed in homes or small businesses to generate electricity alongside heat, thereby enhancing energy efficiency. These technological enhancements are contributing to the growth of the cogeneration equipment market by providing more efficient and versatile energy solutions.

Challenges

- High initial investment cost: The widespread adoption of cogeneration equipment is often hindered by the substantial initial investment required for installation and commissioning. These systems involve significant infrastructure costs, including the procurement of prime movers such as gas turbines or engines, generators, heat recovery units, and enhanced control systems. For small and medium-sized enterprises (SMEs) and organizations with limited capital budgets, these high upfront expenses can present a financial barrier, restricting cogeneration equipment market adoption and slowing the deployment of cogeneration technology.

- Policy and regulatory obstacles: Regional variation was observed in regulatory issues. In some regions, the absence of supportive legislation or financial incentives hampers the implementation of these technologies. For instance, while the European Union CHP Directive aims to promote cogeneration by obligating member states to analyze and report on their CHP usage, the degree of support and implementation varies across countries.

Additionally, stringent environmental regulations and complex approval processes can lead to project delays and increased costs, further deterring potential adopters. In the U.S. the Public Utility Regulatory Policies Act encourages cogeneration by requiring utilities to purchase power from more efficient producers. However, the effectiveness of such policies can vary by state, leading to inconsistent support for cogeneration projects. These regulatory inconsistencies and procedural hurdles can significantly impede the growth and adoption of cogeneration systems.

Cogeneration Equipment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.6% |

|

Base Year Market Size (2025) |

USD 30.14 billion |

|

Forecast Year Market Size (2035) |

USD 68.78 billion |

|

Regional Scope |

|

Cogeneration Equipment Market Segmentation:

Capacity (High Capacity and Medium Capacity)

High-capacity segment is likely to hold more than 61.2% cogeneration equipment market share by 2035, due to its feasibility and cost-effectiveness. Maximizing productivity is a crucial factor in optimizing fuel or gas usage, thereby minimizing overall production costs. Cogeneration plants with high-capacity range offer significant power generation capabilities, supplying both electricity and thermal energy to diverse end users including industrial operations, district heating and cooling networks, and utility grids. These large-scale systems provide economies of scale, enhanced operational efficiency, and grid support services, contributing to greater energy security, improved grid stability, and increased environmental sustainability at regional and national levels.

Furthermore, cogeneration systems with a medium capacity are expected to gain traction during the projected period. They are well-suited to meet the energy demands of medium-sized industrial operations, large commercial complexes, and multi-building campuses. These systems offer substantial power generation capabilities, enabling comprehensive coverage of both electrical and thermal energy requirements within a single facility or across multiple interconnected sites.

Implementing cogeneration facilities of this scale improves energy reliability, resilience, and cost savings, making them attractive solutions for medium-sized enterprises aiming to optimize energy usage and reduce operational expenses. For example, the Fort Saskatchewan Cogeneration Plan in Alberta Canada, exemplifies a medium-scale cogeneration system. This can produce 118MW of electricity and 100 tons per hour of steam, supplying energy to Dow Chemical Canada operations. By integrating electricity and steam production, the plant improves energy efficiency and reliability for the industrial complex.

Fuel (Natural Gas, Biogas, Residential, and Coal)

Natural gas will hold a substantial share in the cogeneration equipment market during the forecast period, primarily due to its widespread availability, increasing demand for reliable and efficient power generation, coupled with growing availability & affordability of natural gas, cost-effectiveness, and environmental benefits over traditional fossil fuels. Its combustion results in lower carbon dioxide emissions compared to coal and oil, aligning with global efforts to minimize greenhouse gas emissions. For instance, the Grain Power Station in the UK operates a 1,275 MW combined cycle gas turbine (CCGT) plant that uses natural gas to achieve high efficiency and reduce emissions. Additionally, the effective mileage provided by natural gas improves operational efficiency, further solidifying its position as a preferred choice for cogeneration systems.

Moreover, government incentives and regulations encouraging the adoption of clean energy sources are further driving the need for natural gas-based cogeneration systems. On the other hand, diesel is anticipated to notice a steady growth rate during the forecast period, owing to its wide usage in remote areas and backup power generation applications. Biomass and biogas are also expected to hold a significant position, driven by the growing focus on renewable energy sources and waste utilization. Global gas consumption is projected to increase by 60%, driven by economic growth in Asia and efforts to cut emissions in heavy industry and transport.

Our in-depth analysis of the global cogeneration equipment market includes the following segments:

|

Capacity |

|

|

Fuel |

|

|

Technology |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cogeneration Equipment Market Regional Analysis:

North America Market Statistics

North America cogeneration equipment market is poised to capture revenue share of around 41.2% by the end of 2035, driven by rapid industrialization and economic development. Globally, North America stands as a pivotal producer and consumer of electricity. According to the U.S. Energy Information Administration (EIA), U.S. power consumption is projected to reach record levels in the upcoming years. Specifically, EIA forecasts that the U.S. electricity price will be 3% higher than that in 2024.

This anticipated increase is attributed to factors such as the expansion of data centers, manufacturing growth, and the electrification of transportation and buildings. On the other hand, the region's growing population has significantly increased the need for goods and services, thereby intensifying energy demands while mitigating environmental impact, industries are increasingly adopting cogeneration equipment. This technology enables the efficient generation of multiple energy sources within manufacturing units, allowing industries to optimize energy utilization, increase operational efficiency, and contribute to sustainability efforts aimed at reducing global warming.

Looking further ahead, the EIA's Annual Energy Outlook 2023 projects that the U.S. energy consumption will rise between 0% and 15% by 2050 influenced by economic and population growth, as well as increased travel, offsetting improvements in energy efficiency. On the other hand, Canada has been actively advancing the adoption and development of cogeneration equipment in various sectors including manufacturing, healthcare, oil & gas, and food processing to improve energy efficiency and reduce costs. These projections underscore the escalating need for electricity in the industrial sector, highlighting the critical need for efficient energy production and consumption strategies to meet future requirements.

Europe Market Analysis

Europe holds a substantial share of the cogeneration equipment market during the forecast period. The region is expected to witness the fastest growth due to the abundant availability of natural gas in key economies such as Russia and Germany. Russian Ministry of Economic Development says gas production is expected to reach 666.7 billion cubic meters in 2024 and 695.4 bcm in 2025. Germany produced approximately 3.8 bcm of natural gas. This abundant availability of natural gas plays a significant role in cogeneration equipment.

In urban areas, space and cost constraints, along with stringent environmental regulations, are anticipated to drive demand for cogeneration equipment. Despite Europe's substantial power generation capacity, some economies continue to account for a significant share of global electricity imports. While the region is actively integrating alternative energy sources, natural gas remains the primary fuel for power generation, reinforcing its role in Europe's energy landscape.

Additionally, government bodies, including the Organization for Economic Cooperation and Development (OECD), are implementing incentive programs to promote the adoption of natural energy sources in various regions. Several OECD member countries offer corporate income tax (CIT) incentives to support investments in renewable energy projects, including wind, solar, hydropower, and geothermal energy. FITs guarantee renewable energy producers a fixed payment for electricity they generate over a specified period.

Key Cogeneration Equipment Market Players:

- Robert BOSCH Gmbh

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens

- General Electric

- Clarke Energy

- 2G Energy AG

- Sundrop Fuels Inc.

- 2G Energy

- Cummins Inc.

- Ameresco

- GE Vernova

- Indeck Power Equipment Company

Leading players in the cogeneration equipment market are actively investing in product development to increase their market presence. Major companies are also pursuing strategic partnerships and acquisitions to expand their customer base and geographical reach.

Recent Developments

- In March 2025, the cogeneration industry urges EU policymakers to give priority to the European Commission's Energy Efficiency First principle, energy systems integration, and energy supply diversification as essential pillars of a comprehensive security of supply framework. COGEN Europe welcomes the Transport, Telecommunications and Energy Council (Energy)'s discussion of the EU's energy security architecture.

- In November 2024, Tecogen Inc., a clean energy company that provides ultra-efficient and clean on-site power, heating, and cooling equipment, announced orders for twelve cogeneration systems across several buildings. These orders were generated via Tecogen's project developer partnerships.

- Report ID: 7388

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cogeneration Equipment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.